Form 8332 Vs Divorce Decree

Form 8332 Vs Divorce Decree - Web divorce decree or separation agreement that went into effect after 1984 and before 2009. If you are the custodial parent, you can use form 8332 to do the. Web a divorce decree is the court’s final decision that ends a marriage. Web additional child tax credit credit for other dependents however, form 8332 doesn’t apply to other tax benefits, such as the: If she is amenable to allowing you to claim the. Do i need to file an 8332 revoke form if divorce decree states that i can claim our child now? How to get a copy. It may be all you need to: Web a divorce certificate is a completely different document from a divorce decree. A certificate is not prepared by a court.

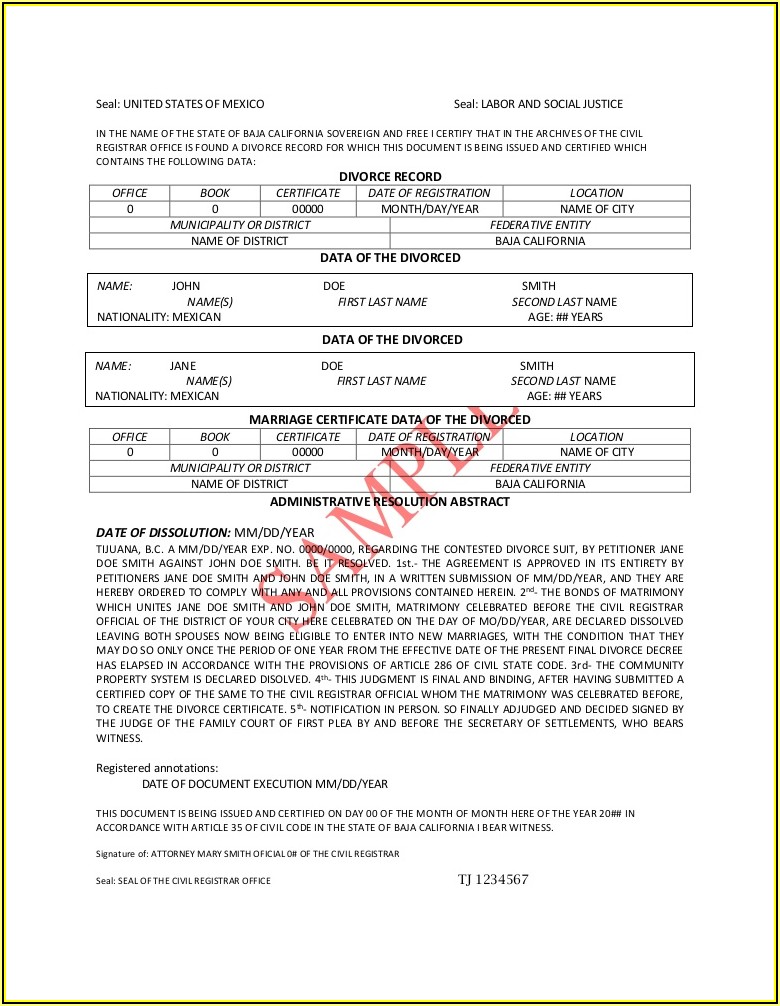

Earned income credit (eic) child and dependent care. Web additional child tax credit credit for other dependents however, form 8332 doesn’t apply to other tax benefits, such as the: A certificate is not prepared by a court. In order for the irs to honor this. Web the divorce certificate gives both people’s names and the location and date of the divorce. If the divorce decree or separation agreement went into effect after 1984 and before 2009,. How to get a copy. It may be all you need to: If you are a custodial parent, you can use this form to release your claim to a dependency exemption for your child. Web the appellate court may uphold the trial court's decision or send the case back (remand) to the trial court to modify the judgment or conduct a new trial.

In order for the irs to honor this. A certificate is not prepared by a court. Web the divorce certificate gives both people’s names and the location and date of the divorce. May either spouse claim the children for the eitc? It may be all you need to: Earned income credit (eic) child and dependent care. The release of the dependency exemption will. Web divorce decree or separation agreement that went into effect after 1984 and before 2009. If you are the custodial parent, you can use form 8332 to do the. Web a divorce decree is the court’s final decision that ends a marriage.

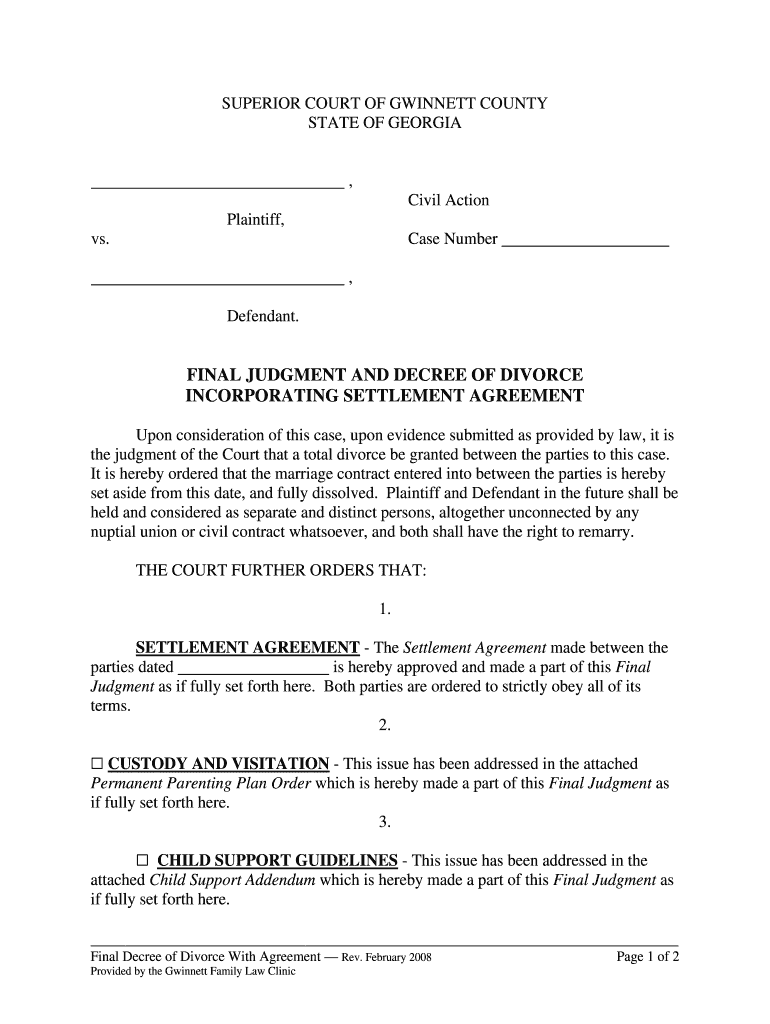

Final Divorce Decree Fill Out and Sign Printable PDF Template

Earned income credit (eic) child and dependent care. Web the divorce certificate gives both people’s names and the location and date of the divorce. Web additional child tax credit credit for other dependents however, form 8332 doesn’t apply to other tax benefits, such as the: It may be all you need to: Web the appellate court may uphold the trial.

Decree Of Divorce Form Michigan Form Resume Examples XnDErPz5Wl

The release of the dependency exemption will. Web form 8332 is a tax document that allows a custodial parent to pass the tax exemption for a dependent child to the noncustodial parent. If you are the custodial parent, you can use form 8332 to do the. How to get a copy. Web since you released your right to claim that.

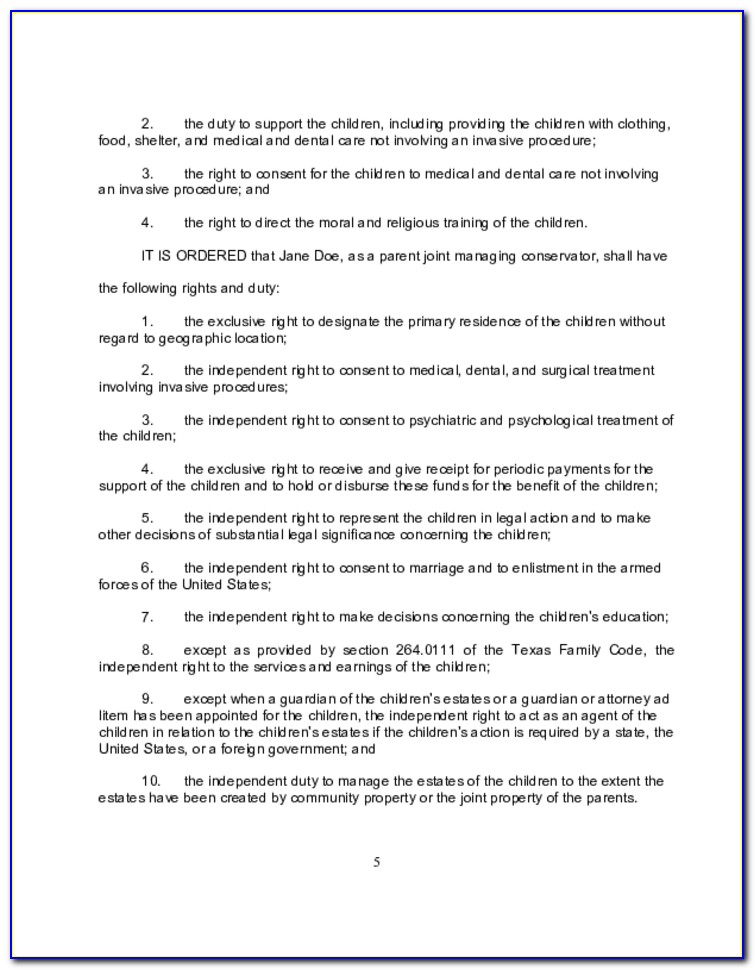

Final Decree Of Divorce Form Virginia Form Resume Examples wRYPK8P94a

Web divorce decree or separation agreement that went into effect after 1984 and before 2009. Web since you released your right to claim that child using the 8332 after the divorce decree, the 8332 would override the divorce decree. If she is amenable to allowing you to claim the. The release of the dependency exemption will. The separation is not.

Boost Efficiency With Our PDF Converter For IRS Form 8332

Web a divorce certificate is a completely different document from a divorce decree. It may be all you need to: If you are the custodial parent, you can use form 8332 to do the. The separation is not a legal separation under state law. The release of the dependency exemption will.

FREE 7+ Sample Divorce Forms in MS Word PDF

It may be all you need to: Earned income credit (eic) child and dependent care. If the divorce decree or separation agreement went into effect after 1984 and before 2009,. If you are the custodial parent, you can use form 8332 to do the. May either spouse claim the children for the eitc?

Decree of Divorce Form Wyoming Free Download

Earned income credit (eic) child and dependent care. Web the appellate court may uphold the trial court's decision or send the case back (remand) to the trial court to modify the judgment or conduct a new trial. May either spouse claim the children for the eitc? Web form 8332 is a tax document that allows a custodial parent to pass.

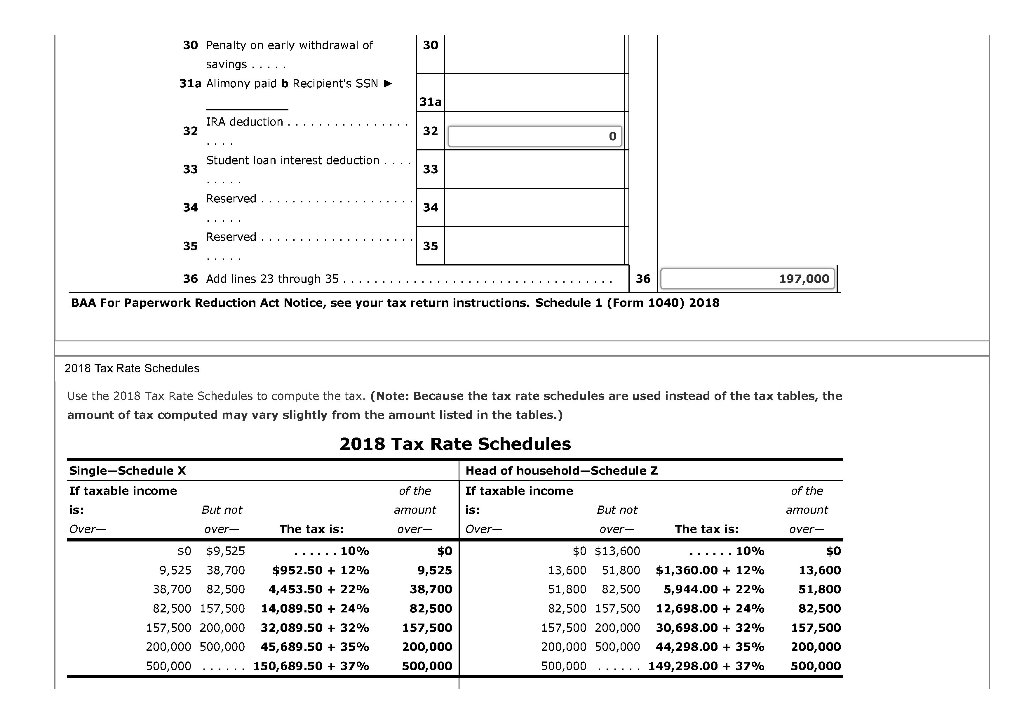

Solved Instructions Note This problem is for the 2018 tax

If you are a custodial parent, you can use this form to release your claim to a dependency exemption for your child. Web form 8332 is a tax document that allows a custodial parent to pass the tax exemption for a dependent child to the noncustodial parent. The separation is not a legal separation under state law. Web since you.

Final Decree of Divorce Virginia Free Download

Web divorce decree or separation agreement that went into effect after 1984 and before 2009. If you are the custodial parent, you can use form 8332 to do the. Instead, your state's health department or. A certificate is not prepared by a court. Web form 8332 is a tax document that allows a custodial parent to pass the tax exemption.

Divorce Certificate vs Divorce Decree What is the Difference? CLG

Web additional child tax credit credit for other dependents however, form 8332 doesn’t apply to other tax benefits, such as the: Web form 8332 is a tax document that allows a custodial parent to pass the tax exemption for a dependent child to the noncustodial parent. Web form 8332 is used by custodial parents to release their claim to their.

Final Decree of Divorce Virginia Free Download

Earned income credit (eic) child and dependent care. Web form 8332 is a tax document that allows a custodial parent to pass the tax exemption for a dependent child to the noncustodial parent. If you are a custodial parent, you can use this form to release your claim to a dependency exemption for your child. Web one spouse moves out.

Web A Divorce Decree Is The Court’s Final Decision That Ends A Marriage.

If she is amenable to allowing you to claim the. Web one spouse moves out and takes the children. It may be all you need to: The separation is not a legal separation under state law.

In General, A Divorce Decree Summarizes The Rights And Responsibilities Of Each Party.

Instead, your state's health department or. Web form 8332 is used by custodial parents to release their claim to their child's exemption. Web a divorce certificate is a completely different document from a divorce decree. Web additional child tax credit credit for other dependents however, form 8332 doesn’t apply to other tax benefits, such as the:

The Release Of The Dependency Exemption Will.

If you are a custodial parent, you can use this form to release your claim to a dependency exemption for your child. Web the divorce certificate gives both people’s names and the location and date of the divorce. Web form 8332 is a tax document that allows a custodial parent to pass the tax exemption for a dependent child to the noncustodial parent. Do i need to file an 8332 revoke form if divorce decree states that i can claim our child now?

Earned Income Credit (Eic) Child And Dependent Care.

A certificate is not prepared by a court. May either spouse claim the children for the eitc? If the divorce decree or separation agreement went into effect after 1984 and before 2009,. In order for the irs to honor this.