Form 8453 Pe

Form 8453 Pe - @ladyalltheway if you attach a second one it should replace the first one as an attachment. Complete, edit or print tax forms instantly. Authenticate an electronic form 1065, u.s. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. What is 8453 pe form? Web we last updated the u.s. Web information about form 8453, u.s. If the form 1065 is being transmitted as part of a return of partnership income, i am a partner or member of the named partnership. Get ready for tax season deadlines by completing any required tax forms today. Web declare under penalties of perjury that:

Web use this form to: Web information about form 8453, u.s. If the form 1065 is being transmitted as part of a return of partnership income, i am a partner or member of the named partnership. Web to use the scanned form 8453 option, follow these steps. Meaning of 8453 pe form as a finance term. Information return information whole dollars only gross receipts or sales less returns and allowances form. What is 8453 pe form? Web form 8453 (with the required forms or supporting documents) must be mailed to the irs within three business days after receiving acknowledgement that the return was. Authenticate an electronic form 1065, u.s. Complete, edit or print tax forms instantly.

Web use this form to: What is 8453 pe form? Web to use the scanned form 8453 option, follow these steps. Information return information whole dollars only gross receipts or sales less returns and allowances form. Get ready for tax season deadlines by completing any required tax forms today. Authenticate an electronic form 1065, u.s. Web we last updated the u.s. Web form 8453 (with the required forms or supporting documents) must be mailed to the irs within three business days after receiving acknowledgement that the return was. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web declare under penalties of perjury that:

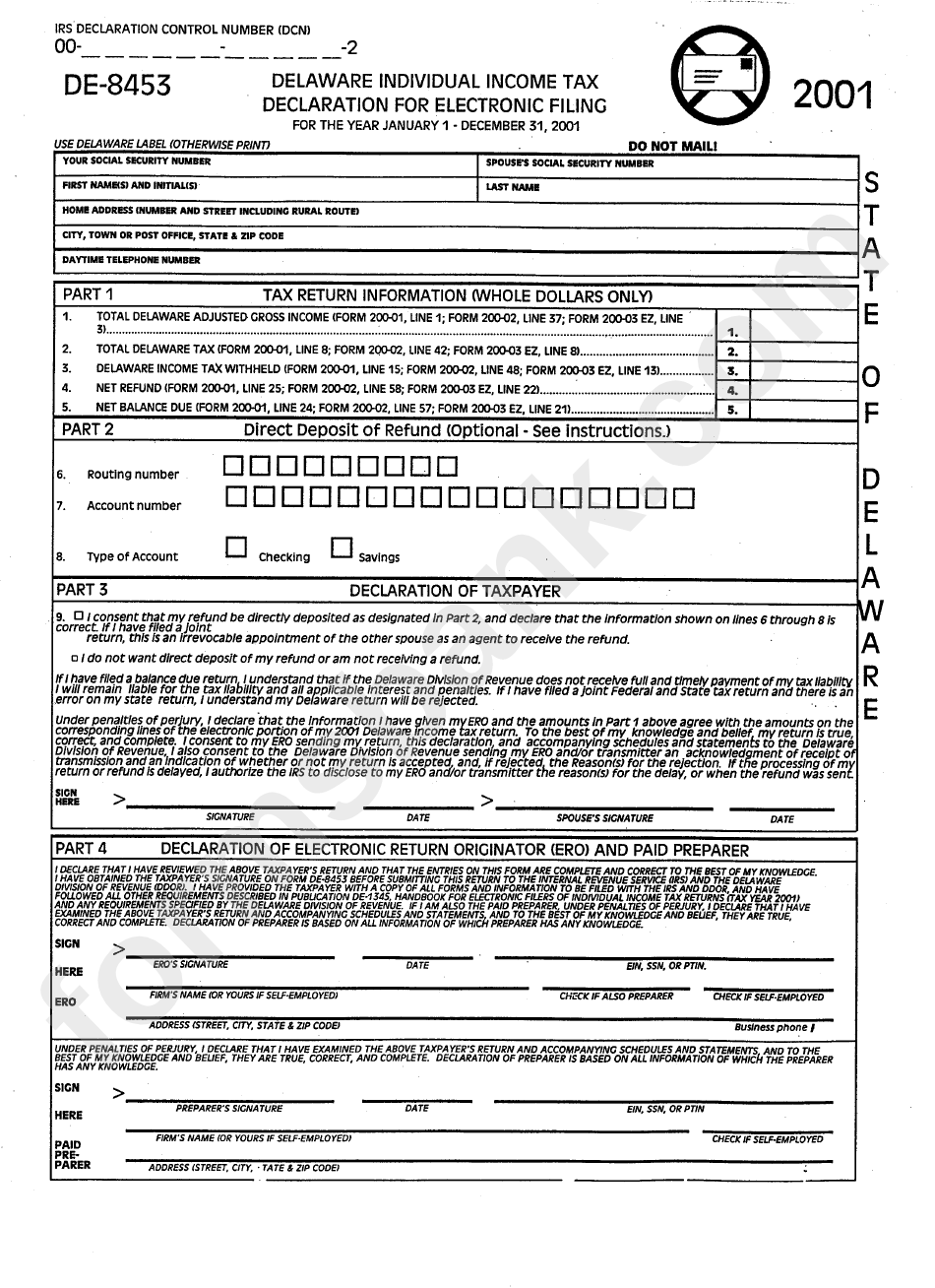

Fillable Form De8453 Delaware Individual Tax Declaration For

Authenticate an electronic form 1065, u.s. @ladyalltheway if you attach a second one it should replace the first one as an attachment. Information return information whole dollars only gross receipts or sales less returns and allowances form. Web form 8453 (with the required forms or supporting documents) must be mailed to the irs within three business days after receiving acknowledgement.

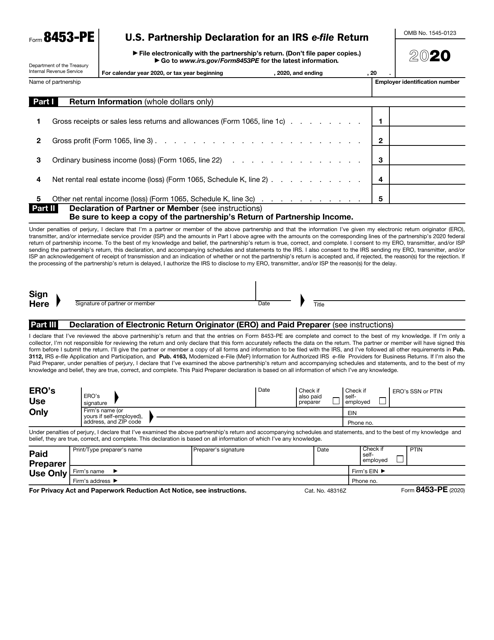

IRS Form 8453PE Download Fillable PDF or Fill Online U.S. Partnership

Web we last updated the u.s. Complete, edit or print tax forms instantly. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. What is 8453 pe form? Web declare under penalties of perjury that:

Form 8453PE U.S. Partnership Declaration for an IRS Efile Return

Web we last updated the u.s. Web declare under penalties of perjury that: Web to use the scanned form 8453 option, follow these steps. Authenticate an electronic form 1065, u.s. What is 8453 pe form?

File Tax Return! stock image. Image of page, date, records 35484223

Information return information whole dollars only gross receipts or sales less returns and allowances form. What is 8453 pe form? Complete, edit or print tax forms instantly. Web declare under penalties of perjury that: Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor.

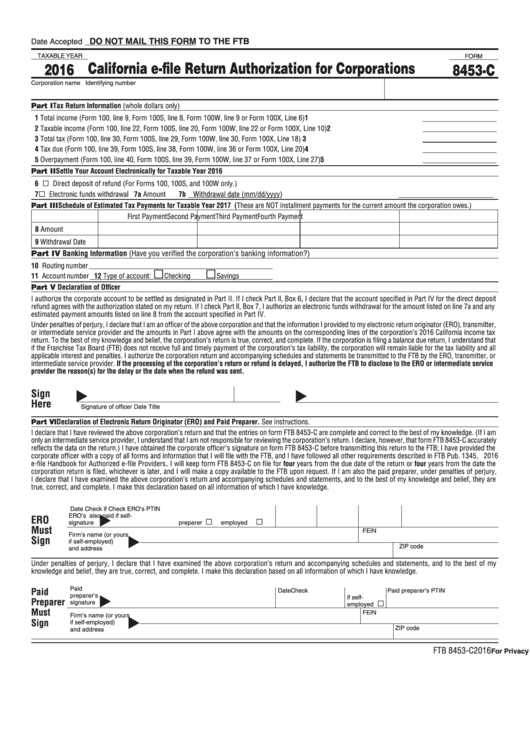

Fillable Form 8453C California EFile Return Authorization For

Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Authenticate an electronic form 1065, u.s. Web information about form 8453, u.s. Web form 8453 (with the required forms or supporting documents) must be mailed to the irs within three business days after receiving acknowledgement that the return was. Information return.

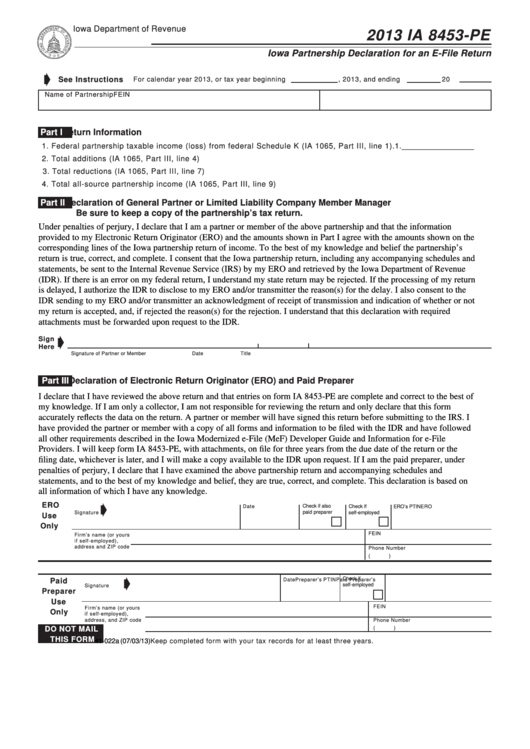

Form Ia 8453Pe Iowa Partnership Declaration For An EFile Return

Web form 8453 (with the required forms or supporting documents) must be mailed to the irs within three business days after receiving acknowledgement that the return was. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web we last updated the u.s. Authenticate an electronic form 1065, u.s. If the.

Form 8453PE U.S. Partnership Declaration for an IRS Efile Return

Web form 8453 (with the required forms or supporting documents) must be mailed to the irs within three business days after receiving acknowledgement that the return was. Web information about form 8453, u.s. Web declare under penalties of perjury that: Web to use the scanned form 8453 option, follow these steps. What is 8453 pe form?

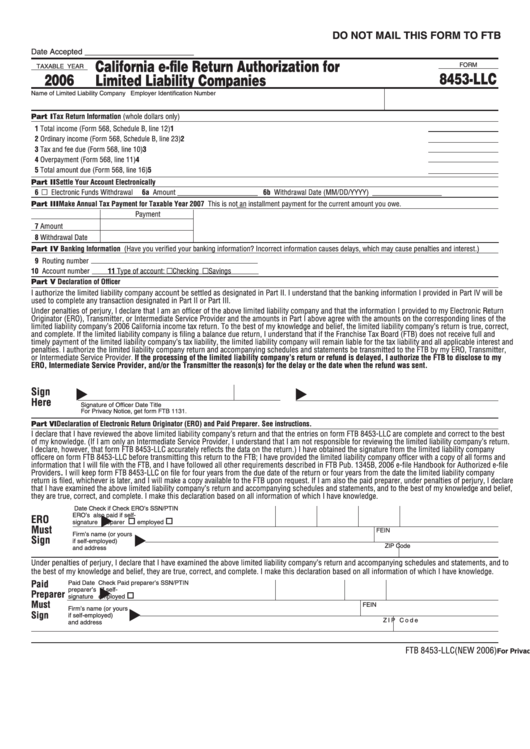

Form 8453Llc California EFile Return Authorization For Limited

Get ready for tax season deadlines by completing any required tax forms today. Authenticate an electronic form 1065, u.s. Web declare under penalties of perjury that: Complete, edit or print tax forms instantly. Web information about form 8453, u.s.

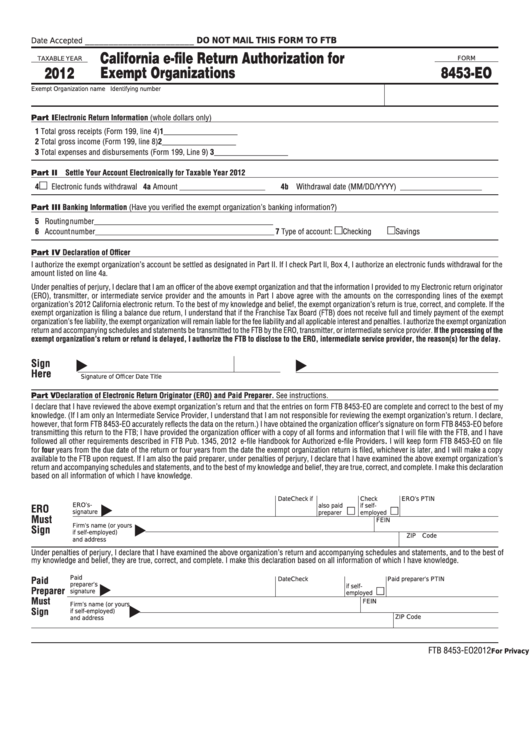

Fillable Form 8453Eo California EFile Return Authorization For

Information return information whole dollars only gross receipts or sales less returns and allowances form. Web use this form to: What is 8453 pe form? If the form 1065 is being transmitted as part of a return of partnership income, i am a partner or member of the named partnership. Web declare under penalties of perjury that:

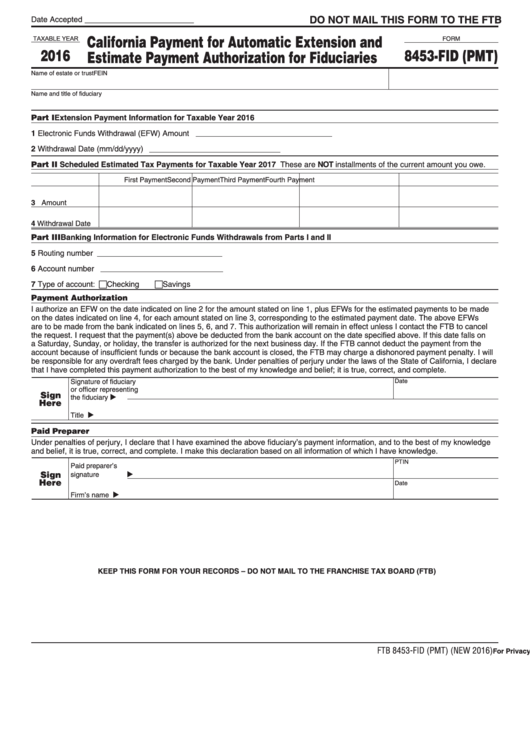

Form 8453Fid (Pmt) California Payment For Automatic Extension And

Web form 8453 (with the required forms or supporting documents) must be mailed to the irs within three business days after receiving acknowledgement that the return was. Get ready for tax season deadlines by completing any required tax forms today. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. What.

Web We Last Updated The U.s.

What is 8453 pe form? Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web to use the scanned form 8453 option, follow these steps. Web information about form 8453, u.s.

Information Return Information Whole Dollars Only Gross Receipts Or Sales Less Returns And Allowances Form.

Authenticate an electronic form 1065, u.s. If the form 1065 is being transmitted as part of a return of partnership income, i am a partner or member of the named partnership. Authenticate an electronic form 1065, u.s. @ladyalltheway if you attach a second one it should replace the first one as an attachment.

Web Declare Under Penalties Of Perjury That:

Complete, edit or print tax forms instantly. Web use this form to: Get ready for tax season deadlines by completing any required tax forms today. Meaning of 8453 pe form as a finance term.