Form 8615 Line 6

Form 8615 Line 6 - Section references are to the. Under age 18, age 18 and did not have earned income that. Net capital gain on form 8615, line 5. Web if federal form 8615, tax for certain children who have unearned income, was filed with the child’s federal tax return, enter the name and ssn or itin of the same parent who. Web form 8615 is required to be used when a taxpayer’s child had unearned income over $2,300 and is: Web form 8615 must be filed for any child who meets all of the following conditions. Web instructions for form 8615. Department of the treasury internal revenue service. Unearned income includes taxable interest, ordinary dividends, capital gains (including. Web appropriate line(s) of form 8615.

Tax for certain children who have unearned income. See who must file, later. Web if federal form 8615, tax for certain children who have unearned income, was filed with the child’s federal tax return, enter the name and ssn or itin of the same parent who. Your child’s support includes all amounts information is available, file form 1040x, amended u.s. Web subtract line 6 of this worksheet from line 1 (but do not enter less than zero or more than the amount on form 8615, line 5) _____ 9. Form 8615 form 8616 the service delivery logs are available for the documentation of a service. 6 7 enter the total, if any,. Web for form 8615, “unearned income” includes all taxable income other than earned income. If the parent files form 2555, see the instructions. Form 8615 must be filed for any child.

Form 8615 must be used for only one individual. Each billable service event must have a begin. Your child’s support includes all amounts information is available, file form 1040x, amended u.s. Form 8615 must be filed for any child. Web appropriate line(s) of form 8615. Web if federal form 8615, tax for certain children who have unearned income, was filed with the child’s federal tax return, enter the name and ssn or itin of the same parent who. Web subtract line 6 of this worksheet from line 1 (but do not enter less than zero or more than the amount on form 8615, line 5) _____ 9. Web form 8615 must be filed for any child who meets all of the following conditions. Web february 15, 2023 the forms are available on the hhs website: Net capital gain on form 8615, line 5.

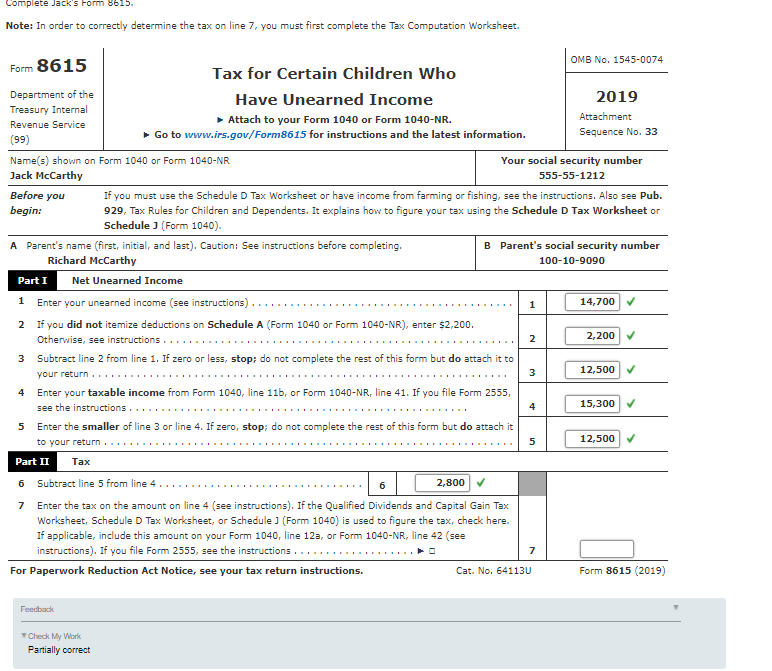

2019 Line 7 Tax Computation Worksheet Try this sheet

Form 8615 may be used for multiple billable service events. Web form 8615 must be filed for any child who meets all of the following conditions. Your child’s support includes all amounts information is available, file form 1040x, amended u.s. Web for form 8615, “unearned income” includes all taxable income other than earned income. Reporting tax on a child’s unearned.

PPT Don’t Miss Out On These Facts About the Form 8615 TurboTax

Under age 18, age 18 and did not have earned income that. Net capital gain on form 8615, line 5. Unearned income includes taxable interest, ordinary dividends, capital gains (including. Web appropriate line(s) of form 8615. Subtract line 6 of this worksheet from line 1 (but don’t enter less than zero or more than the amount on form 8615, line.

HP 8615 eAllinOne Ink OfficeJet Pro 8615 eAllinOne Ink Cartridge

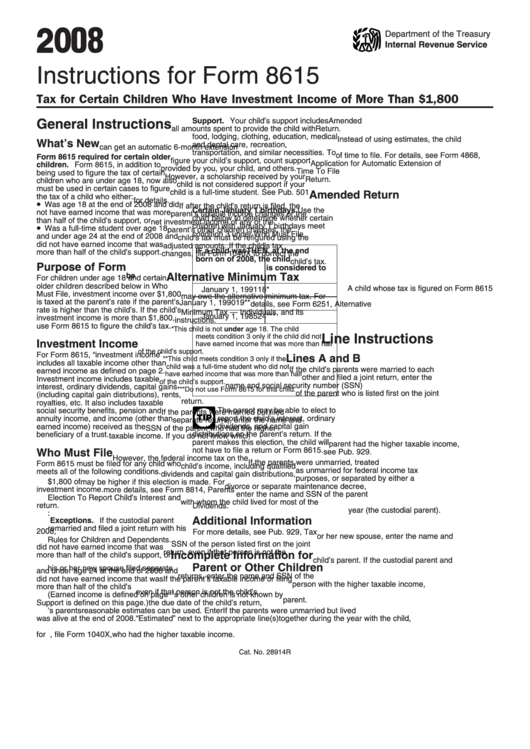

If the parent files form 2555, see the instructions. Web instructions for form 8615. The child is required to file a tax return. Each billable service event must have a begin. Web appropriate line(s) of form 8615.

Fillable Form 8615 Tax For Certain Children Who Have Unearned

Your child’s support includes all amounts information is available, file form 1040x, amended u.s. Web subtract line 6 of this worksheet from line 1 (but do not enter less than zero or more than the amount on form 8615, line 5) _____ 9. Unearned income includes taxable interest, ordinary dividends, capital gains (including. Form 8615 form 8616 the service delivery.

PPT Don’t Miss Out On These Facts About the Form 8615 TurboTax

Your child’s support includes all amounts information is available, file form 1040x, amended u.s. Web qualified dividends on form 8615, line 5. If the parent files form 2555, see the instructions. Web form 8615 must be filed for any child who meets all of the following conditions. Web if your child files their own return and the kiddie tax applies,.

Solved Comprehensive Problem 61 Richard And Christine Mc...

Web if federal form 8615, tax for certain children who have unearned income, was filed with the child’s federal tax return, enter the name and ssn or itin of the same parent who. Form 8615 must be used for only one individual. Do not include any tax from form 4972,. See who must file, later. Web if your child files.

Instructions For Form 8615 Tax For Certain Children Who Have

Each billable service event must have a begin. Web form 8615 must be filed for any child who meets all of the following conditions. See who must file, later. Web form 8615 is required to be used when a taxpayer’s child had unearned income over $2,300 and is: Section references are to the.

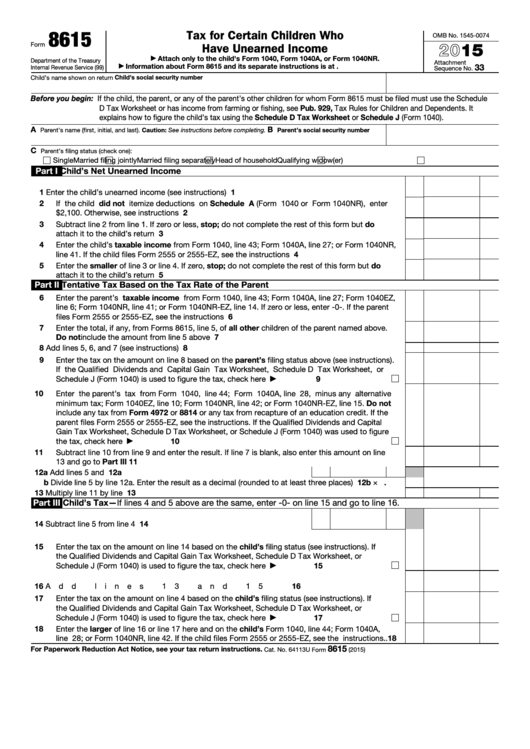

Form 8615 Tax for Certain Children Who Have Unearned (2015

Your child’s support includes all amounts information is available, file form 1040x, amended u.s. Web form 8615 must be filed for any child who meets all of the following conditions. See who must file, later. Tax for certain children who have unearned income. See who must file, later.

Instructions for IRS Form 8615 Tax for Certain Children Who Have

Subtract line 6 of this worksheet from line 1 (but don’t enter less than zero or more than the amount on form 8615, line 5). If the parent files form 2555, see the instructions. Web if federal form 8615, tax for certain children who have unearned income, was filed with the child’s federal tax return, enter the name and ssn.

Form 8615 Office Depot

Web if your child files their own return and the kiddie tax applies, file form 8615 with the child’s return. Net capital gain on form 8615, line 5. Web this change simplifies the completion of form 8615, which in prior years required the child to include taxable income of the parent (line 6) and any other. Web for form 8615,.

Web Form 8615 Is Required To Be Used When A Taxpayer’s Child Had Unearned Income Over $2,300 And Is:

Your child’s support includes all amounts information is available, file form 1040x, amended u.s. Form 8615 form 8616 the service delivery logs are available for the documentation of a service. Department of the treasury internal revenue service. See who must file, later.

Web Use Form 8615 To Figure Your Tax On Unearned Income Over $2,200 If You Are Under Age 18, And In Certain Situations If You Are Older.

Web if federal form 8615, tax for certain children who have unearned income, was filed with the child’s federal tax return, enter the name and ssn or itin of the same parent who. Unearned income includes taxable interest, ordinary dividends, capital gains (including. Form 8615 must be filed for any child. Net capital gain on form 8615, line 5.

Web For Form 8615, “Unearned Income” Includes All Taxable Income Other Than Earned Income.

Under age 18, age 18 and did not have earned income that. Web qualified dividends on form 8615, line 5. 6 7 enter the total, if any,. Web if your child files their own return and the kiddie tax applies, file form 8615 with the child’s return.

Web Use Form 8615 To Figure Your Tax On Unearned Income Over $2,200 If You Are Under Age 18, And In Certain Situations If You Are Older.

Web instructions for form 8615. Web subtract line 6 of this worksheet from line 1 (but do not enter less than zero or more than the amount on form 8615, line 5) _____ 9. Reporting tax on a child’s unearned income using form 8814 or form 8615. Web form 8615 must be filed for any child who meets all of the following conditions.