Form 8804 Due Date

Form 8804 Due Date - File forms 8804 and 8805. However, an amended form 8804 is considered the original form 8804 if. Web the 6th month, check the box at the top of form 8804. File form 8804 and forms 8805 for a calendar year entity. Web a partnership required to file form 1065, “u.s. • answer all applicable questions. File form 1120s for calendar. Web form 8804 due date generally, the form 8804 and associated forms must be filed on or before the 15th day of the 4th month following the close of the. Web enter x to mark the corresponding checkbox on form 8804 and to extend the due date of form 8804 an additional two months. Upload, modify or create forms.

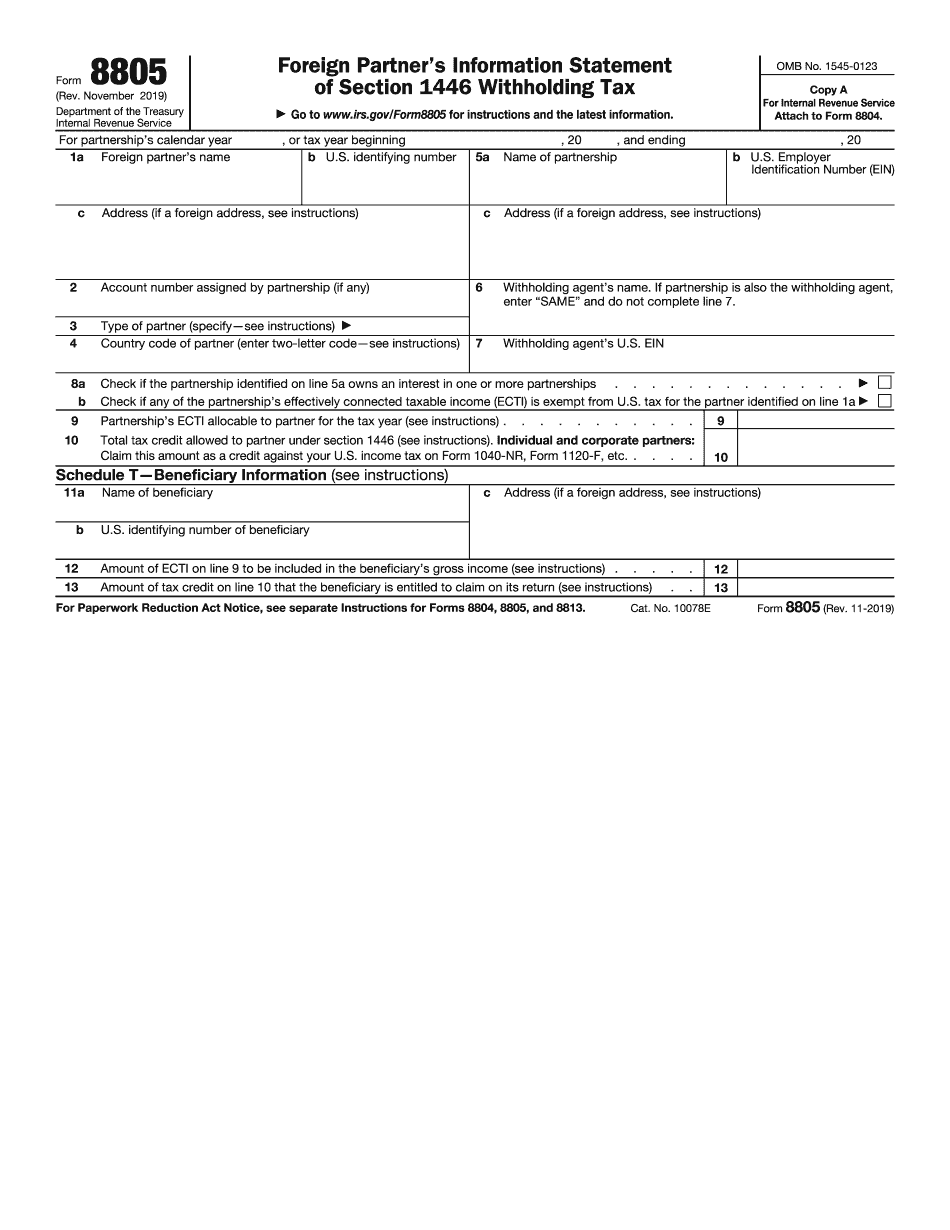

Web information about form 8804, annual return for partnership withholding tax (section 1446), including recent updates, related forms, and instructions on how to file. Web form 8804 must be filed annually by the due date, which is generally the 15 th day of the third month following the close of the partnership’s tax year. November 2022) annual return for partnership withholding tax (section 1446). Qualify for the prior year safe harbor when determining any penalty due on schedule a (form 8804) (see instructions). File form 8804 and forms 8805 for a calendar year entity. However, an amended form 8804 is considered the original form 8804 if. 4 select the date you want your payment to be received. Partnership return of income,” or form 8804, “annual return for partnership withholding tax,” for any taxable. Additionally, form 8813 has to be filed on. Therefore, in that case, for any subsequent installment payment during the tax year, don’t use the line 8.

Web a partnership required to file form 1065, “u.s. File forms 8804 and 8805. File form 1120s for calendar. Web form 8804 must be filed annually by the due date, which is generally the 15 th day of the third month following the close of the partnership’s tax year. Web there is a due date for the submission of form 8804, and it is on or before the 15th of the 4th month after the partnership’s tax year. Web information about form 8804, annual return for partnership withholding tax (section 1446), including recent updates, related forms, and instructions on how to file. Therefore, in that case, for any subsequent installment payment during the tax year, don’t use the line 8. 4 select the date you want your payment to be received. Additionally, form 8813 has to be filed on. If line 7 is smaller than line 9, subtract line 7 from line 9.

form 8804 instructions 20192022 Fill Online, Printable, Fillable

4 select the date you want your payment to be received. However, an amended form 8804 is considered the original form 8804 if. Qualify for the prior year safe harbor when determining any penalty due on schedule a (form 8804) (see instructions). Additionally, form 8813 has to be filed on. Upload, modify or create forms.

Form 8804 (Schedule A) Penalty for Underpayment of Estimated Section

Web enter x to mark the corresponding checkbox on form 8804 and to extend the due date of form 8804 an additional two months. Use the statement for the filing under section. Web due on schedule a (form 8804) (see the line 8 instructions, earlier). Web the 6th month, check the box at the top of form 8804. • answer.

2019 8804 2019 Blank Sample to Fill out Online in PDF

File form 8804 and forms 8805 for a calendar year entity. Upload, modify or create forms. Web there is a due date for the submission of form 8804, and it is on or before the 15th of the 4th month after the partnership’s tax year. Use the statement for the filing under section. File form 1120s for calendar.

3.22.15 Foreign Partnership Withholding Internal Revenue Service

4 select the date you want your payment to be received. File form 8804 and forms 8805 for a calendar year entity. Qualify for the prior year safe harbor when determining any penalty due on schedule a (form 8804) (see instructions). Web a partnership 's 1446 tax equals the amount determined under this section and shall be paid in installments.

Fill Free fillable Installment Payments of Section 1446 Tax for

File form 8804 and forms 8805 for a calendar year entity. Qualify for the prior year safe harbor when determining any penalty due on schedule a (form 8804) (see instructions). If line 7 is smaller than line 9, subtract line 7 from line 9. Web 3 select the tax form, payment type, period, and amount (and subcategory information, if applicable)..

Form 8804 Annual Return for Partnership Withholding Tax

Web form 8804 must be filed annually by the due date, which is generally the 15 th day of the third month following the close of the partnership’s tax year. Web the 6th month, check the box at the top of form 8804. Web enter x to mark the corresponding checkbox on form 8804 and to extend the due date.

Form 8804 (Schedule A) Penalty for Underpayment of Estimated Section

Qualify for the prior year safe harbor when determining any penalty due on schedule a (form 8804) (see instructions). • answer all applicable questions. Web form 8804 must be filed annually by the due date, which is generally the 15 th day of the third month following the close of the partnership’s tax year. Web march 15, 2023 partnerships: Web.

Form 8804 Annual Return for Partnership Withholding Tax (Section 1446

File form 8804 and forms 8805 for a calendar year entity. Web in these instructions, “form 8804” generally refers to the partnership's original form 8804. Therefore, in that case, for any subsequent installment payment during the tax year, don’t use the line 8. Try it for free now! Web information about form 8804, annual return for partnership withholding tax (section.

Form 8804 Annual Return for Partnership Withholding Tax (Section 1446

Web information about form 8804, annual return for partnership withholding tax (section 1446), including recent updates, related forms, and instructions on how to file. Web a partnership 's 1446 tax equals the amount determined under this section and shall be paid in installments during the partnership 's taxable year (see paragraph (d) (1) of this section. Upload, modify or create.

Form 8804C Certificate of PartnerLevel Items to Reduce Section 1446

Upload, modify or create forms. Complete, edit or print tax forms instantly. Web the 6th month, check the box at the top of form 8804. Use the statement for the filing under section. Web enter x to mark the corresponding checkbox on form 8804 and to extend the due date of form 8804 an additional two months.

Partnership Return Of Income,” Or Form 8804, “Annual Return For Partnership Withholding Tax,” For Any Taxable.

Complete, edit or print tax forms instantly. • answer all applicable questions. If line 7 is smaller than line 9, subtract line 7 from line 9. Web 3 select the tax form, payment type, period, and amount (and subcategory information, if applicable).

Use The Statement For The Filing Under Section.

Try it for free now! Web information about form 8804, annual return for partnership withholding tax (section 1446), including recent updates, related forms, and instructions on how to file. Web in these instructions, “form 8804” generally refers to the partnership's original form 8804. Web a partnership 's 1446 tax equals the amount determined under this section and shall be paid in installments during the partnership 's taxable year (see paragraph (d) (1) of this section.

Web Due On Schedule A (Form 8804) (See The Line 8 Instructions, Earlier).

Web the due dates below reflect due dates relevant to filing tax returns or forms in 2023 with respect to the 2022 tax year (assuming a calendar year taxpayer; Qualify for the prior year safe harbor when determining any penalty due on schedule a (form 8804) (see instructions). Upload, modify or create forms. Web the 6th month, check the box at the top of form 8804.

4 Select The Date You Want Your Payment To Be Received.

Web there is a due date for the submission of form 8804, and it is on or before the 15th of the 4th month after the partnership’s tax year. If a due date falls on a saturday, sunday, or legal holiday, file by the next business day. However, an amended form 8804 is considered the original form 8804 if. Therefore, in that case, for any subsequent installment payment during the tax year, don’t use the line 8.