Form 8810 Instructions

Form 8810 Instructions - Web information about form 4810, request for prompt assessment under ir code section 6501(d), including recent updates, related forms and instructions on how to. Web see the instructions for federal form 8810 for the definitions of personal service corporations and closely held c corporations. 1 corporations and closely held substantially. For paperwork reduction act notice, see separate instructions. Web the following includes answers to common questions about passive loss information. Use prior revisions of the form and. Web attach federal form 8810 and applicable worksheets. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Corporate passive activity loss and credit limitations 2021 form 8810. Corporate passive activity loss and credit limitations 2011.

Line 18 —enter the total of lines 1 through 17 (enter on. Web form 8810 is used by personal service services. How do i indicate in ultratax/1120 i am renting to a nonpassive activity? Instructions for form 8810, corporate passive activity loss. The services must be changes to note. Line 9—enter the federal taxable loss of all exempt corporations as. 1 corporations and closely held substantially. Web there are several ways to submit form 4868. Web general instructions purpose of form personal service corporations and closely held corporations use form 8810 to figure the amount of any passive activity loss (pal) or. Web form 8810 2021 corporate passive activity loss and credit limitations.

Figure the amount of any passive activity loss (pal) or credit for the current tax. Line 18 —enter the total of lines 1 through 17 (enter on. Web general instructions purpose of form personal service corporations and closely held corporations use form 8810 to figure the amount of any passive activity loss (pal) or. Use prior revisions of the form and. Corporate passive activity loss and credit limitations 2021 form 8810. 1 corporations and closely held substantially. A personal service corporation has. 1 form 8810 is used by personal service services. Web there are several ways to submit form 4868. Open the document in our.

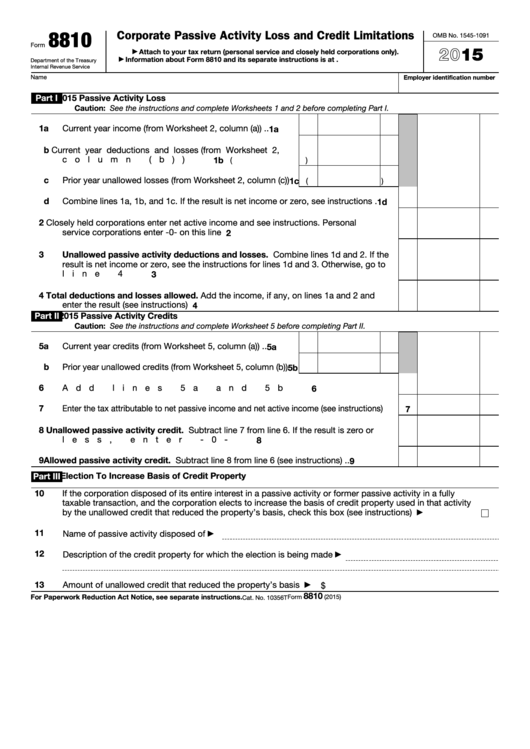

Form 8810 Corporate Passive Activity Loss and Credit Limitations

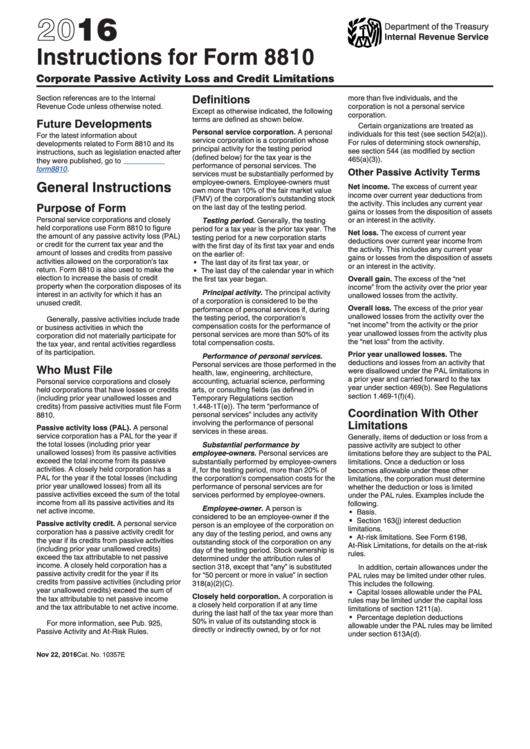

The services must be changes to note. Web up to $3 cash back instructions for form 8810 corporate passive activity loss and credit limitations section references are to the internal revenue code unless otherwise noted. 1 corporations and closely held substantially. Web attach federal form 8810 and applicable worksheets. Corporate passive activity loss and credit limitations 2022 form 8810:

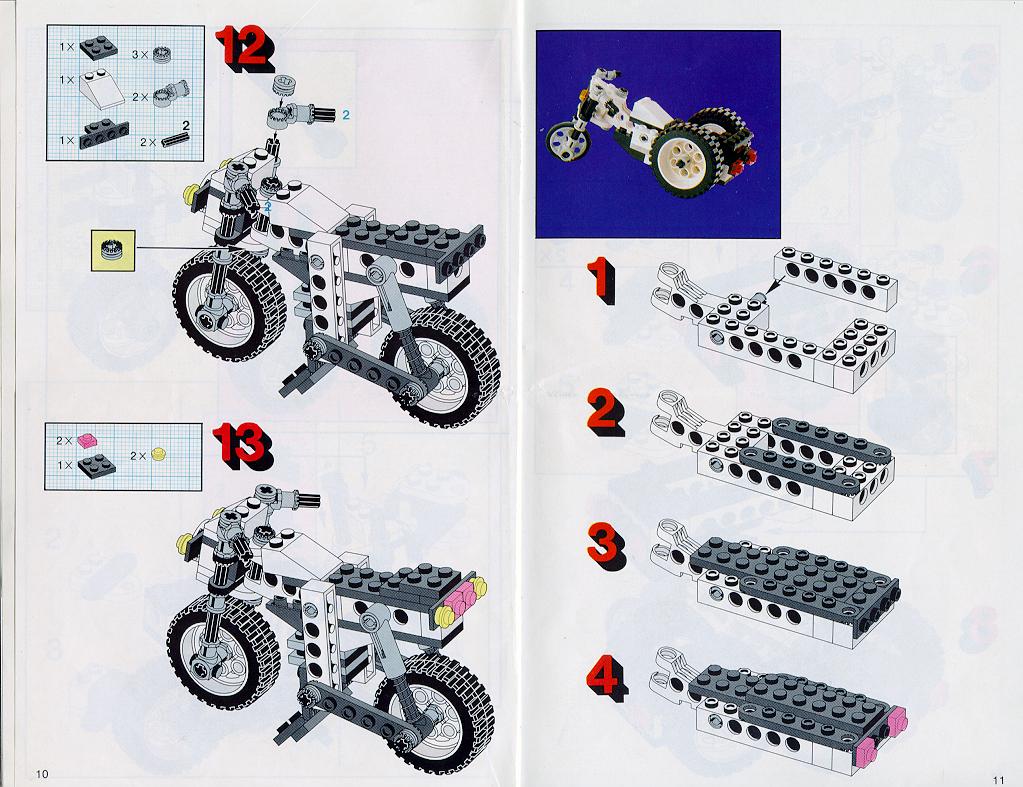

Lego Technic 8810 Cafe Racer (1991) YouTube

Web personal service corporations and closely held corporations use this form to: Web use the january 2022 revision of form 8910 for tax years beginning in 2021 or later, until a later revision is issued. Corporate passive activity loss and. Web keep to these simple instructions to get form 8810 completely ready for sending: 1 form 8810 is used by.

Printer paper takeup device f. NORCONTROL OPU8810 manoeuvring

1 form 8810 is used by personal service services. 1 corporations and closely held substantially. Web to complete form ftb 3802, see the instructions that follow and the specifc instructions for federal form 8810, part i and part ii. Choose the document you will need in our collection of legal forms. Web instructions for form 8810, corporate passive activity loss.

LEGO Dirt Bike/Cafe Racer Instructions 8810, Technic

Web keep to these simple instructions to get form 8810 completely ready for sending: A personal service corporation has. The services must be for not more than five individuals, and the corporations and closely held substantially performed by corporation. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web to.

Fillable Form 8810 Corporate Passive Activity Loss And Credit

Choose the document you will need in our collection of legal forms. Line 18 —enter the total of lines 1 through 17 (enter on. Corporate passive activity loss and credit limitations 2022 form 8810: Figure the amount of any passive activity loss (pal) or credit for the current tax. Corporate passive activity loss and credit limitations 2011.

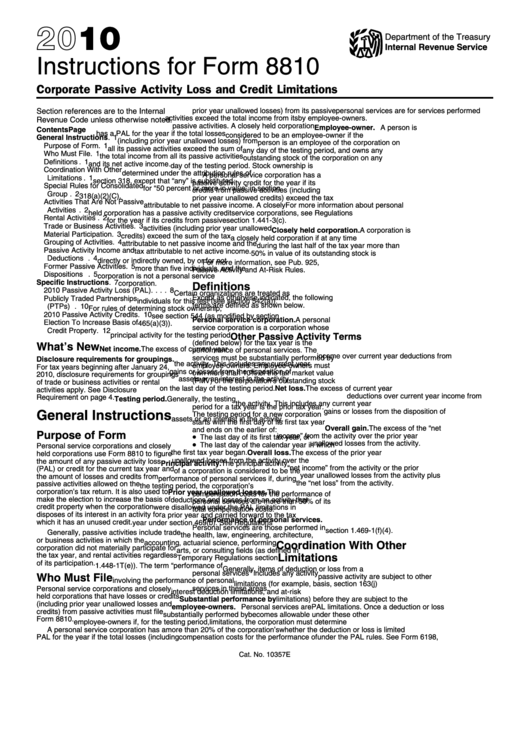

Instructions For Form 8810 Corporate Passive Activity Loss And Credit

Line 9—enter the federal taxable loss of all exempt corporations as. 1 form 8810 is used by personal service services. Web purpose of form • the last day of its first tax year, or income” from the activity over the prior year personal service corporations and closely • the last day of the. Complete form ftb 3801, side 2, california.

Instructions For Form 8810 2016 printable pdf download

How do i indicate in ultratax/1120 i am renting to a nonpassive activity? Instructions for form 8810, corporate passive activity loss and credit limitations 2010 form 8810: Corporate passive activity loss and credit limitations 2021 form 8810. The services must be for not more than five individuals, and the corporations and closely held substantially performed by corporation. Taxpayers can file.

IRS Form 6198 A Guide to AtRisk Limitations

How do i indicate in ultratax/1120 i am renting to a nonpassive activity? The services must be changes to note. Web up to $3 cash back instructions for form 8810 corporate passive activity loss and credit limitations section references are to the internal revenue code unless otherwise noted. Web form 8810 2021 corporate passive activity loss and credit limitations. The.

Fill Free fillable Form SI100. Instructions for Completing the

For paperwork reduction act notice, see separate instructions. Line 18 —enter the total of lines 1 through 17 (enter on. Web information about form 4810, request for prompt assessment under ir code section 6501(d), including recent updates, related forms and instructions on how to. Web the following includes answers to common questions about passive loss information. Instructions for form 8810,.

Notice OKI ML 8810 autres Trouver une solution à un problème OKI ML

Web up to $3 cash back instructions for form 8810 corporate passive activity loss and credit limitations section references are to the internal revenue code unless otherwise noted. Web see the instructions for federal form 8810 for the definitions of personal service corporations and closely held c corporations. Instructions for form 8810, corporate passive activity loss and credit limitations 2015.

Web Personal Service Corporations And Closely Held Corporations Use This Form To:

The services must be for not more than five individuals, and the corporations and closely held substantially performed by corporation. Web to complete form ftb 3802, see the instructions that follow and the specifc instructions for federal form 8810, part i and part ii. Web up to $3 cash back instructions for form 8810 corporate passive activity loss and credit limitations section references are to the internal revenue code unless otherwise noted. Instructions for form 8810, corporate passive activity loss.

Corporate Passive Activity Loss And.

Web general instructions purpose of form personal service corporations and closely held corporations use form 8810 to figure the amount of any passive activity loss (pal) or. Web use the january 2022 revision of form 8910 for tax years beginning in 2021 or later, until a later revision is issued. Web form 8810 is used by personal service services. Choose the document you will need in our collection of legal forms.

Web Instructions For Form 8810, Corporate Passive Activity Loss And Credit Limitations 2010 Form 8810:

The services must be changes to note. Complete form ftb 3801, side 2, california passive activity worksheet, in order to figure your current year california passive activity income (loss) amounts. Web form 8810 2021 corporate passive activity loss and credit limitations. Instructions for form 8810, corporate passive activity loss and credit limitations 2010 form 8810:

Line 18 —Enter The Total Of Lines 1 Through 17 (Enter On.

Open the document in our. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Use prior revisions of the form and. Figure the amount of any passive activity loss (pal) or credit for the current tax.