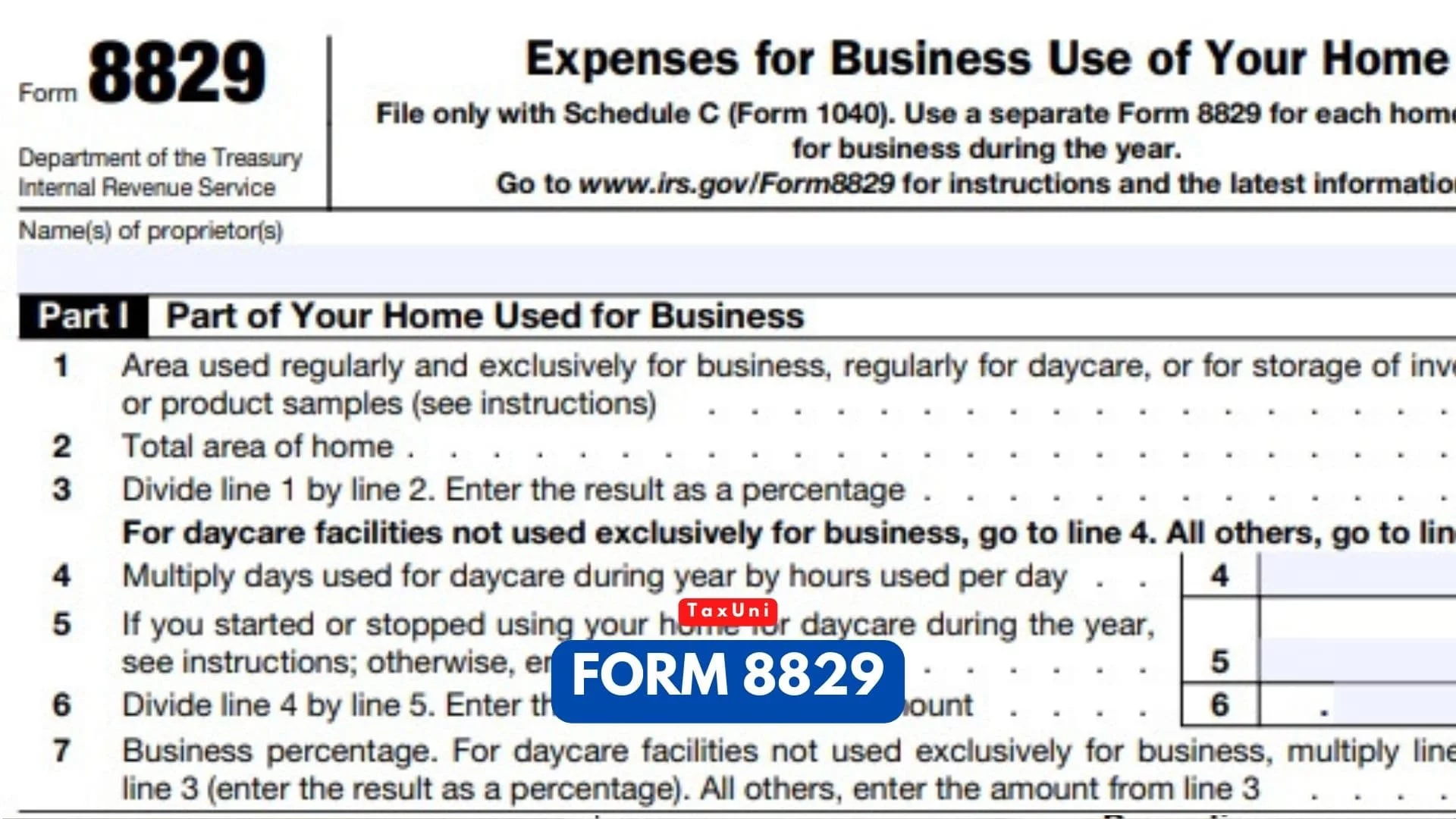

Form 8829 2022

Form 8829 2022 - One of the many benefits of working at home is that you can deduct legitimate expenses from your taxes. Web irs form 8829 is one of two ways to claim a home office deduction on your business taxes. You can print other federal tax forms here. So i am not quite sure why the software got changed this year. Web irs form 8829 helps you determine what you can and cannot claim. The downside is that since home office tax deductions are so easily abused, the internal revenue service (irs) tends to scrutinize them more closely than other parts of. Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file. Web form 8829 2022 expenses for business use of your home department of the treasury internal revenue service file only with schedule c (form 1040). • the ui tax rate for new employers is 3.4 percent (.034) for a period of two to three years. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts.

Web form 8829 federal — expenses for business use of your home download this form print this form it appears you don't have a pdf plugin for this browser. Web 2023 payroll tax rates, taxable wage limits, and maximum benefit amounts. • the ui tax rate for new employers is 3.4 percent (.034) for a period of two to three years. The downside is that since home office tax deductions are so easily abused, the internal revenue service (irs) tends to scrutinize them more closely than other parts of. Web irs form 8829 helps you determine what you can and cannot claim. March 25, 2022 5:58 am. Unemployment insurance (ui) • the 2023 taxable wage limit is $7,000 per employee. Use a separate form 8829 for each home you used for the business during the year. Web we last updated the expenses for business use of your home in december 2022, so this is the latest version of form 8829, fully updated for tax year 2022. Web form 8829 2022 expenses for business use of your home department of the treasury internal revenue service file only with schedule c (form 1040).

Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts. So i am not quite sure why the software got changed this year. Web but this year (2021) is different, a different % is used in the software, although the 2021 irs form 8829 still indicates 2.564% should be used. More about the federal form 8829 The downside is that since home office tax deductions are so easily abused, the internal revenue service (irs) tends to scrutinize them more closely than other parts of. Web form 8829 federal — expenses for business use of your home download this form print this form it appears you don't have a pdf plugin for this browser. Unemployment insurance (ui) • the 2023 taxable wage limit is $7,000 per employee. March 25, 2022 5:58 am. One of the many benefits of working at home is that you can deduct legitimate expenses from your taxes. Web irs form 8829 helps you determine what you can and cannot claim.

Form_8829_explainer_PDF3 Camden County, NJ

Web 2023 payroll tax rates, taxable wage limits, and maximum benefit amounts. • the ui maximum weekly benefit amount is $450. You must meet specific requirements to deduct expenses for the business use of your. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year.

Business Use Of Home (Form 8829) Organizer 2014 printable pdf download

Web form 8829 2022 expenses for business use of your home department of the treasury internal revenue service file only with schedule c (form 1040). More about the federal form 8829 Use a separate form 8829 for each home you used for the business during the year. The downside is that since home office tax deductions are so easily abused,.

Simplified Method Worksheet 2021 Home Office Simplified Method

Web irs form 8829 is one of two ways to claim a home office deduction on your business taxes. More about the federal form 8829 The downside is that since home office tax deductions are so easily abused, the internal revenue service (irs) tends to scrutinize them more closely than other parts of. March 25, 2022 5:58 am. Web form.

Revisiting Form 8829 Business Use of Home Expenses for 2020 Lear

You can print other federal tax forms here. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2023 of amounts not deductible in 2022. Web 2023 payroll tax rates, taxable wage limits, and maximum benefit amounts. Use a separate form 8829 for each home you used.

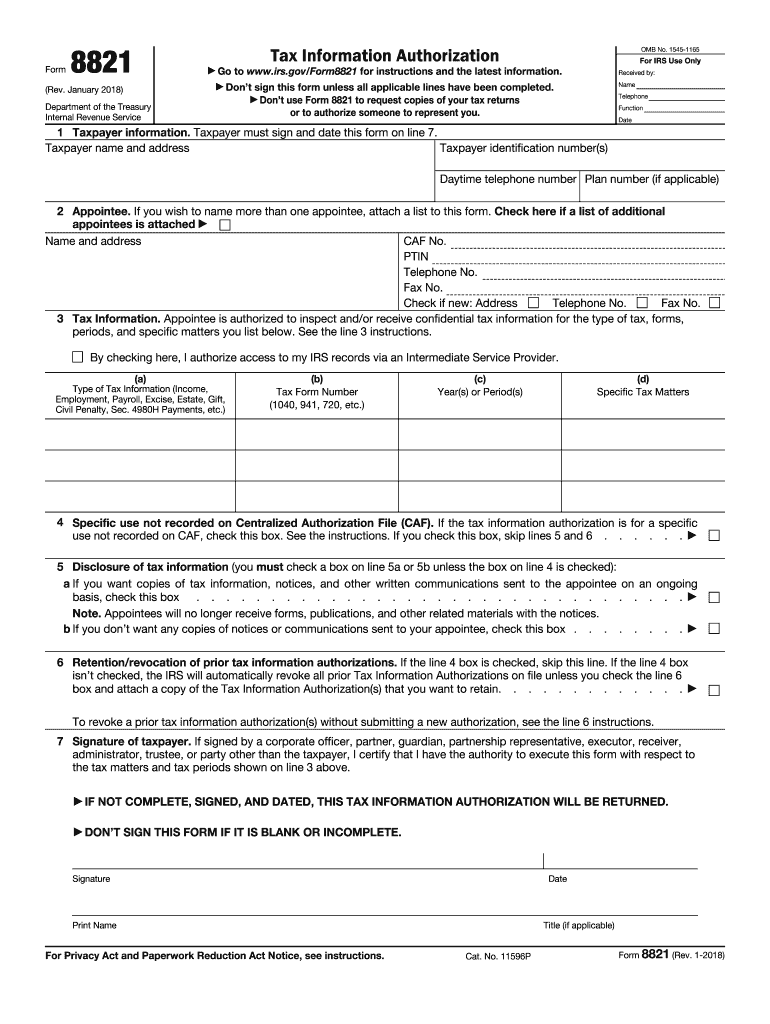

Form 8821 Fill Out and Sign Printable PDF Template signNow

Web but this year (2021) is different, a different % is used in the software, although the 2021 irs form 8829 still indicates 2.564% should be used. I think this percentage is related to the 39.5 years depreciation period. Web we last updated the expenses for business use of your home in december 2022, so this is the latest version.

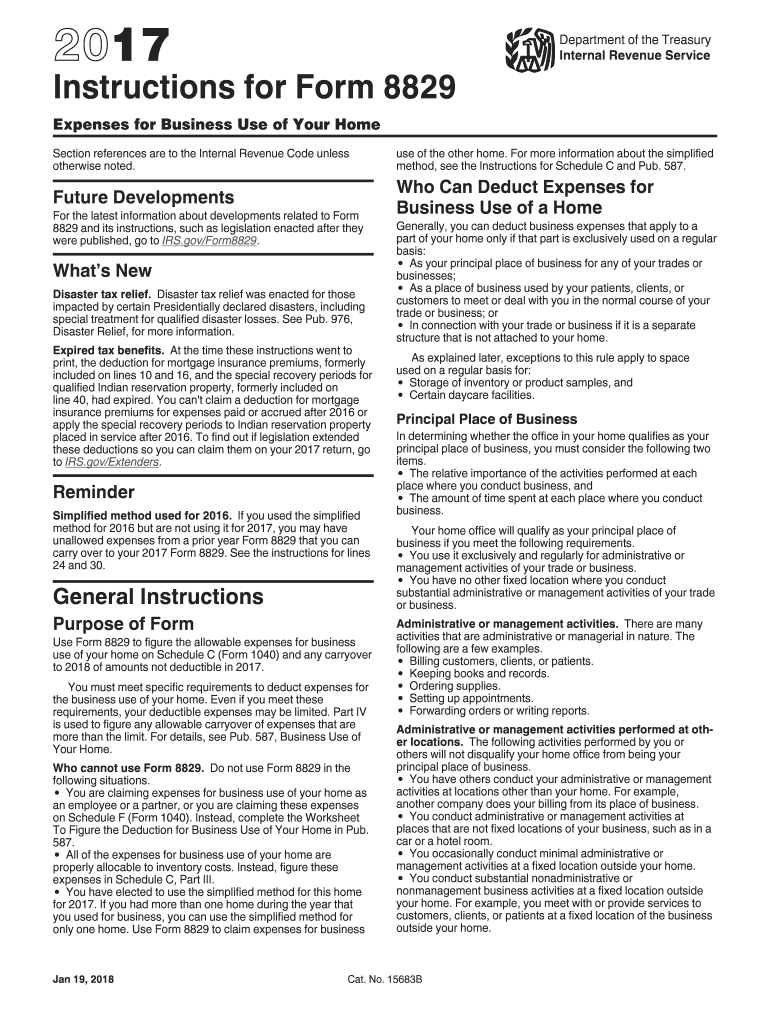

Instructions Form 8829 Fill Out and Sign Printable PDF Template signNow

Web irs form 8829 helps you determine what you can and cannot claim. Unemployment insurance (ui) • the 2023 taxable wage limit is $7,000 per employee. Web we last updated the expenses for business use of your home in december 2022, so this is the latest version of form 8829, fully updated for tax year 2022. Use form 8829 to.

IRS Form 8829 for Remote Workers Here’s How to Complete Flyfin

Web form 8829 federal — expenses for business use of your home download this form print this form it appears you don't have a pdf plugin for this browser. Web irs form 8829 helps you determine what you can and cannot claim. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form.

IRS Form 8829 LinebyLine Instructions 2022 Expenses for Business Use

The downside is that since home office tax deductions are so easily abused, the internal revenue service (irs) tends to scrutinize them more closely than other parts of. More about the federal form 8829 Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file. Use form 8829.

Form 8829 2022 2023

Web form 8829 2022 expenses for business use of your home department of the treasury internal revenue service file only with schedule c (form 1040). Unemployment insurance (ui) • the 2023 taxable wage limit is $7,000 per employee. Use a separate form 8829 for each home you used for the business during the year. I think this percentage is related.

Simplified method worksheet 2023 Fill online, Printable, Fillable Blank

Unemployment insurance (ui) • the 2023 taxable wage limit is $7,000 per employee. You can print other federal tax forms here. Web form 8829 2022 expenses for business use of your home department of the treasury internal revenue service file only with schedule c (form 1040). Web but this year (2021) is different, a different % is used in the.

Use Form 8829 To Figure The Allowable Expenses For Business Use Of Your Home On Schedule C (Form 1040) And Any Carryover To Next Year Of Amounts.

March 25, 2022 5:58 am. Web irs form 8829 helps you determine what you can and cannot claim. More about the federal form 8829 Web irs form 8829 is one of two ways to claim a home office deduction on your business taxes.

Web But This Year (2021) Is Different, A Different % Is Used In The Software, Although The 2021 Irs Form 8829 Still Indicates 2.564% Should Be Used.

Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file. Web we last updated the expenses for business use of your home in december 2022, so this is the latest version of form 8829, fully updated for tax year 2022. Web form 8829 2022 expenses for business use of your home department of the treasury internal revenue service file only with schedule c (form 1040). The form calculates the portion of expenses related to your home that you can claim as a tax deduction on schedule c.

You Can Print Other Federal Tax Forms Here.

• the ui maximum weekly benefit amount is $450. So i am not quite sure why the software got changed this year. Use a separate form 8829 for each home you used I think this percentage is related to the 39.5 years depreciation period.

The Downside Is That Since Home Office Tax Deductions Are So Easily Abused, The Internal Revenue Service (Irs) Tends To Scrutinize Them More Closely Than Other Parts Of.

Web form 8829 federal — expenses for business use of your home download this form print this form it appears you don't have a pdf plugin for this browser. Web 2023 payroll tax rates, taxable wage limits, and maximum benefit amounts. You must meet specific requirements to deduct expenses for the business use of your. Unemployment insurance (ui) • the 2023 taxable wage limit is $7,000 per employee.