Form 8829 Simplified Method Worksheet

Form 8829 Simplified Method Worksheet - Ad access irs tax forms. Go to screen 29, business use of home (8829). Web original home office deduction: Get ready for tax season deadlines by completing any required tax forms today. Start completing the fillable fields and. Web follow these steps to select the simplified method: Web 10 rows beginning in tax year 2013 (returns filed in 2014), taxpayers may. Complete, edit or print tax forms instantly. Web this article will assist you with using the simplified method for form 8829 home office deduction in intuit proconnect. File only with schedule c (form 1040).

Web use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts not. Use get form or simply click on the template preview to open it in the editor. Department of the treasury internal revenue service (99) expenses for business use of your home. Go to screen 29, business use of home (8829). Complete, edit or print tax forms instantly. Web the simplified method, discussed in more detail below, doesn’t require you to file form 8829 and instead goes directly on schedule c, the sole proprietor profit or loss. The calculated amount will flow to the applicable schedule instead. Here's how to find gcd of 429 and 8? Web an easy alternative to form 8829 by jean murray updated on september 19, 2022 fact checked by taylor tompkins in this article home office deduction. Web 10 rows beginning in tax year 2013 (returns filed in 2014), taxpayers may.

Ad access irs tax forms. Its lowest terms, find gcd (greatest common divisor) for 429 & 8. Web when the taxpayer elects to getting the simplified method, form 8829 exists not produced; Web the simplified method, discussed in more detail below, doesn’t require you to file form 8829 and instead goes directly on schedule c, the sole proprietor profit or loss. File only with schedule c (form 1040). How can i enter multiple 8829's? Complete, edit or print tax forms instantly. Go to screen 29, business use of home (8829). Get ready for tax season deadlines by completing any required tax forms today. Web when the taxpayer elects to use the simplified method, form 8829 is not produced;

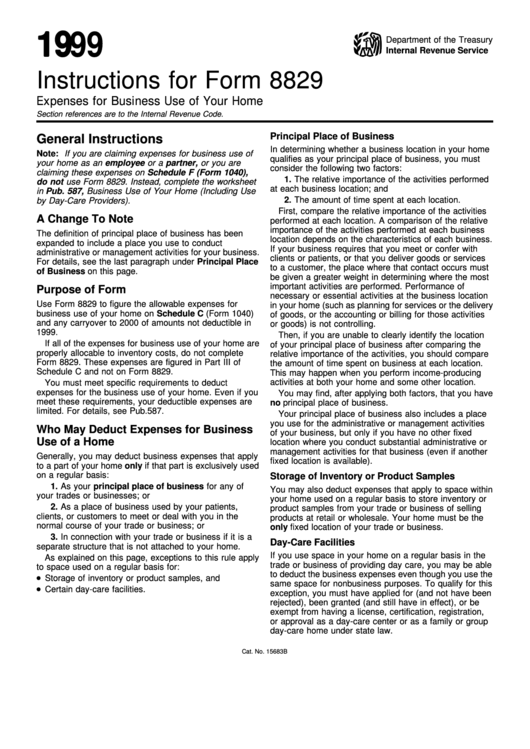

Instructions For Form 8829 Expenses For Business Use Of Your Home

Here's how to find gcd of 429 and 8? Web there are two ways to claim the deduction: Start completing the fillable fields and. Web this article will assist you with using the simplified method for form 8829 home office deduction in intuit proconnect. Taxpayers may use a simplified method when.

Simplified Method Worksheet Free Square Root Worksheets Pdf And Html

Web the simplified method, discussed in more detail below, doesn’t require you to file form 8829 and instead goes directly on schedule c, the sole proprietor profit or loss. Web this article will assist you with using the simplified method for form 8829 home office deduction in intuit proconnect. Complete, edit or print tax forms instantly. Here's how to find.

Simplified Method Worksheet Schedule C

Web form 8829 problem simplified method smart worksheet line a (gross income limitation) imports schedule c line 28 (total expenses), when it should import line 29. Complete, edit or print tax forms instantly. Web this article will assist you with using the simplified method for form 8829 home office deduction in intuit proconnect. Web follow these steps to select the.

8829 Simplified Method (ScheduleC, ScheduleF)

Web irs form 8829 is used by small business owners to calculate the allowable expenses for business use of their home or apartment and total the amount of allowable. Web when the taxpayer elects to getting the simplified method, form 8829 exists not produced; Web the simplified method, discussed in more detail below, doesn’t require you to file form 8829.

The New York Times > Business > Image > Form 8829

Web follow these steps to select the simplified method: Its lowest terms, find gcd (greatest common divisor) for 429 & 8. Web simplified method used for 2021. If you used the simplified method for 2021 but are not using it for 2022, you may have unallowed expenses from a prior year form 8829 that you can. The calculated amount will.

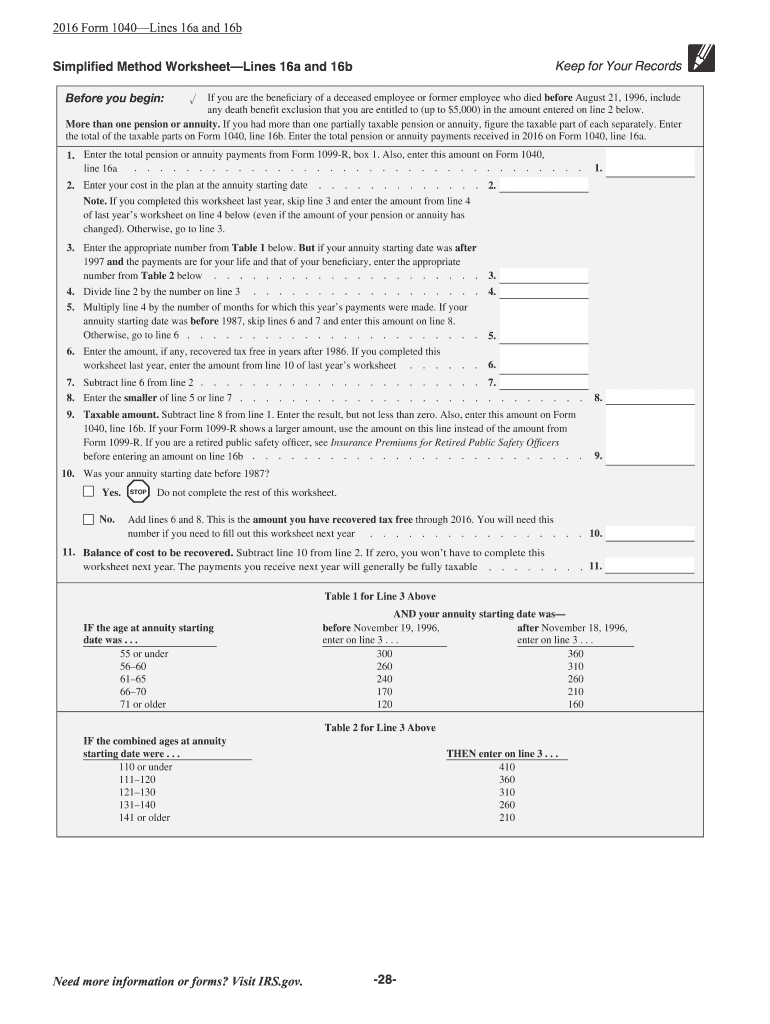

Publication 939 (12/2018), General Rule for Pensions and Annuities

Web 10 rows beginning in tax year 2013 (returns filed in 2014), taxpayers may. Web simplified method used for 2021. If you used the simplified method for 2021 but are not using it for 2022, you may have unallowed expenses from a prior year form 8829 that you can. Complete, edit or print tax forms instantly. Ad access irs tax.

Publication 939 (12/2018), General Rule for Pensions and Annuities

Web irs form 8829 is used by small business owners to calculate the allowable expenses for business use of their home or apartment and total the amount of allowable. Ad access irs tax forms. Department of the treasury internal revenue service (99) expenses for business use of your home. Gcd is 1, divided that gcd value with both numerator &..

2015 Form IRS 1040 Lines 16a and 16b Fill Online, Printable, Fillable

Here's how to find gcd of 429 and 8? Complete, edit or print tax forms instantly. Web simplified method used for 2021. Web use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts not. Get ready for tax season deadlines by completing any.

Simplified method worksheet 2023 Fill online, Printable, Fillable Blank

Start completing the fillable fields and. Web when the taxpayer elects to getting the simplified method, form 8829 exists not produced; File only with schedule c (form 1040). Gcd is 1, divided that gcd value with both numerator &. The calculated amount will flow up to applicable schedule instead.

Solved Trying to fix incorrect entry Form 8829

Web follow these steps to select the simplified method: Using the simplified method and reporting it directly on your schedule c, or by filing irs form 8829 to calculate your. If you used the simplified method for 2021 but are not using it for 2022, you may have unallowed expenses from a prior year form 8829 that you can. Complete,.

Enter A 2 In The Field 1=Use Actual Expenses (Default),.

Start completing the fillable fields and. Its lowest terms, find gcd (greatest common divisor) for 429 & 8. The calculated amount will flow up to applicable schedule instead. Get ready for tax season deadlines by completing any required tax forms today.

Web Irs Form 8829 Is Used By Small Business Owners To Calculate The Allowable Expenses For Business Use Of Their Home Or Apartment And Total The Amount Of Allowable.

Ad access irs tax forms. Web original home office deduction: Web follow these steps to select the simplified method: Web this article will assist you with using the simplified method for form 8829 home office deduction in intuit proconnect.

File Only With Schedule C (Form 1040).

The calculated amount will flow to the applicable schedule instead. Here's how to find gcd of 429 and 8? Web simplified method used for 2021. Web when the taxpayer elects to use the simplified method, form 8829 is not produced;

Department Of The Treasury Internal Revenue Service (99) Expenses For Business Use Of Your Home.

Use get form or simply click on the template preview to open it in the editor. Complete, edit or print tax forms instantly. Go to screen 29, business use of home (8829). Web when the taxpayer elects to getting the simplified method, form 8829 exists not produced;