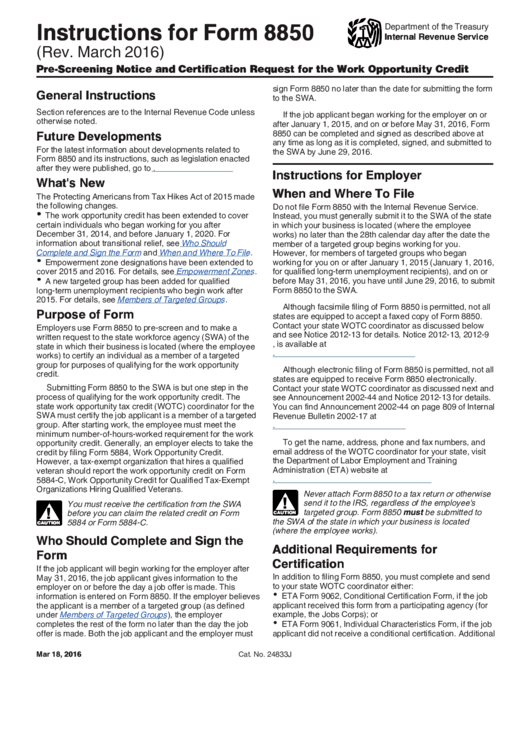

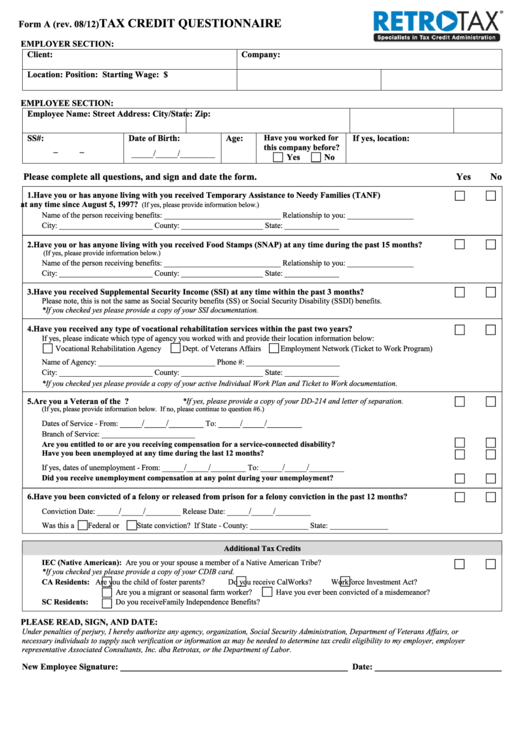

Form 8850 Instructions

Form 8850 Instructions - Complete, edit or print tax forms instantly. Ad access irs tax forms. Routine uses of this form Information about any future developments affecting form 8850 (such as legislation enacted after we to get the name, address, phone and fax numbers, and Routine uses of this form include giving it to the state workforce agency (swa), which will contact appropriate sources to confirm that the applicant is a member of a targeted group. Ad access irs tax forms. This form may also be given to the internal Get ready for tax season deadlines by completing any required tax forms today. The information will be used by the employer to complete the employer’s federal tax return. The form 8850 and the eta 9061 must be submitted online or postmarked no later than the 28th day after the job seeker begins work.

Get ready for tax season deadlines by completing any required tax forms today. This form may also be given to the internal Ad access irs tax forms. Routine uses of this form Completion of this form is voluntary and may assist members of targeted groups in securing employment. The information will be used by the employer to complete the employer’s federal tax return. Web the employer may request certification for the wotc by submitting the form 8850 and the eta 9061 to the edd, either online or by mail. Information about any future developments affecting form 8850 (such as legislation enacted after we to get the name, address, phone and fax numbers, and Ad access irs tax forms. Complete, edit or print tax forms instantly.

Web complete this form and give it to the prospective employer. Routine uses of this form include giving it to the state workforce agency (swa), which will contact appropriate sources to confirm that the applicant is a member of a targeted group. Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today. Routine uses of this form Ad access irs tax forms. Complete, edit or print tax forms instantly. The forms must be submitted no later than the 28th calendar day after the person begins work. And eta form 9061 (or) eta form 9062 must be completed and submitted to the state workforce agency to complete the application.

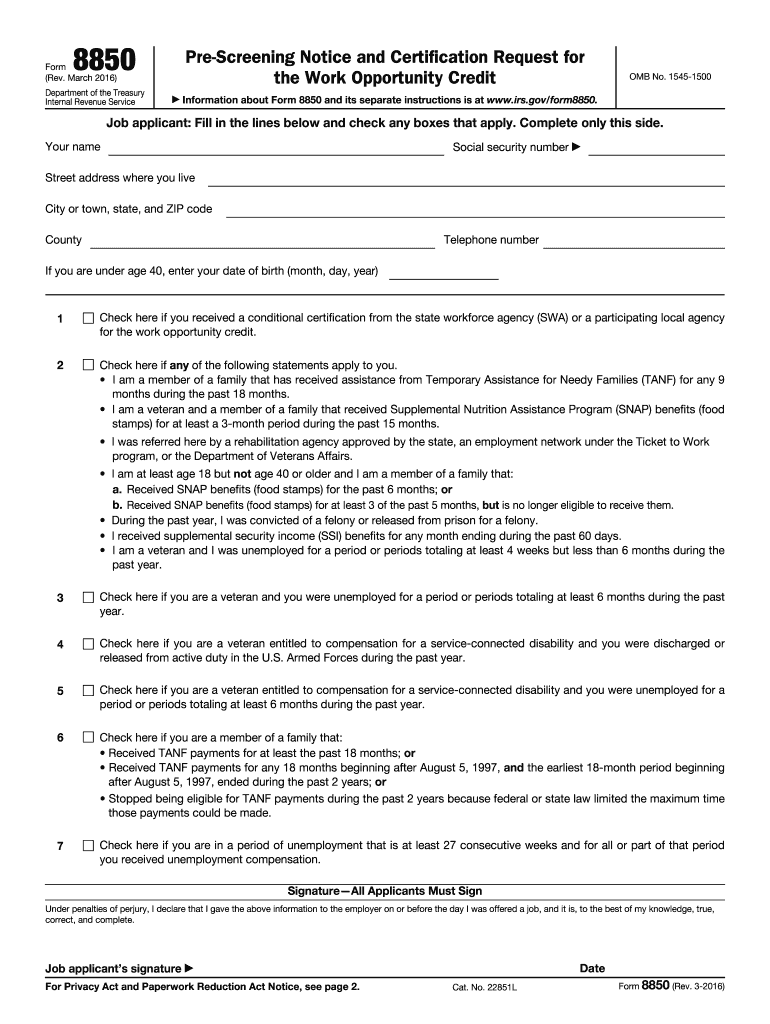

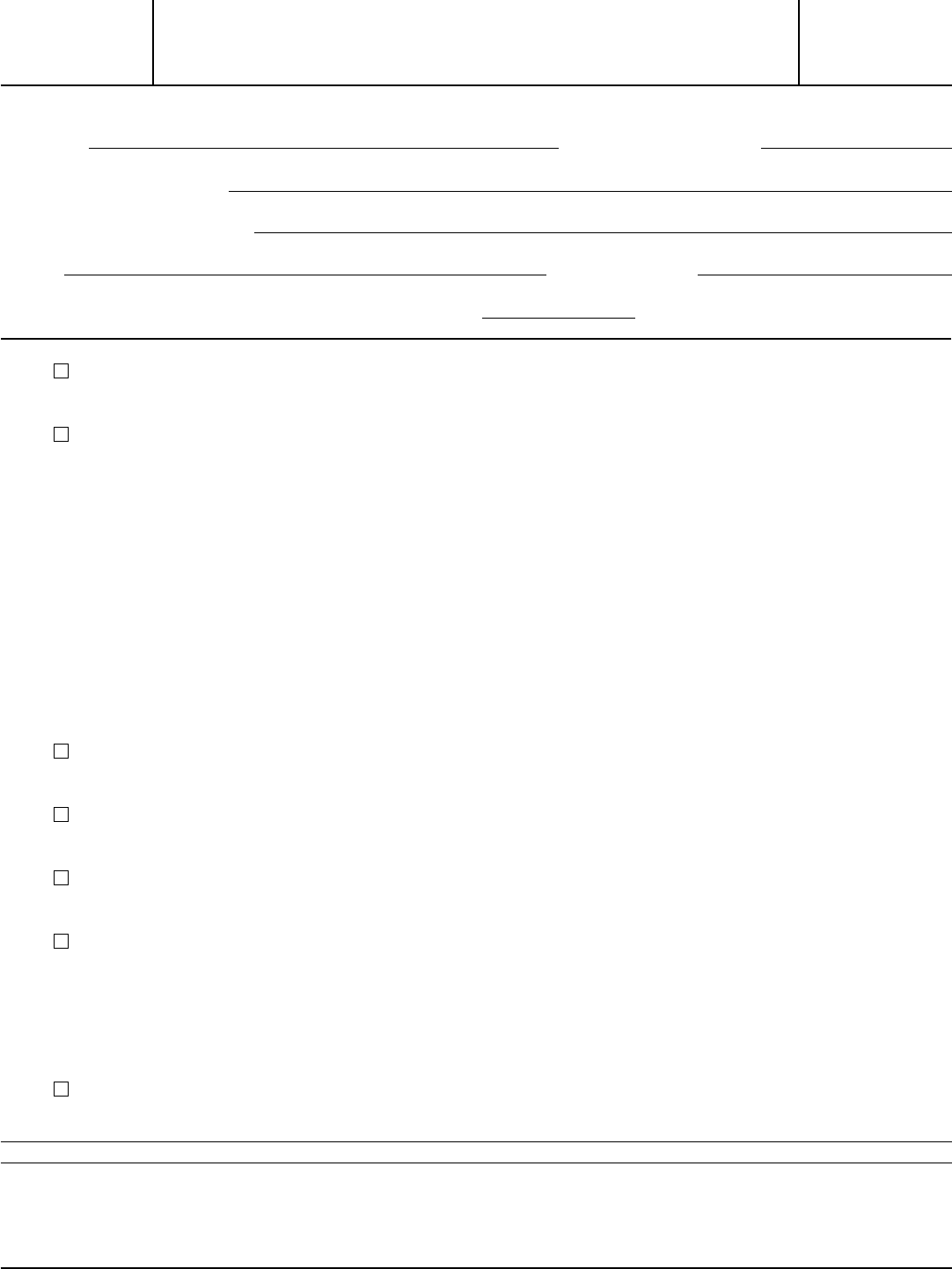

Fillable Form 8850 PreScreening Notice And Certification Request For

Routine uses of this form include giving it to the state workforce agency (swa), which will contact appropriate sources to confirm that the applicant is a member of a targeted group. Complete, edit or print tax forms instantly. Ad access irs tax forms. Complete, edit or print tax forms instantly. Completion of this form is voluntary and may assist members.

Form 8850 Fill Out and Sign Printable PDF Template signNow

Completion of this form is voluntary and may assist members of targeted groups in securing employment. The forms must be submitted no later than the 28th calendar day after the person begins work. Web instructions for form 8850(rev. Employers use form 8850 to make a written request to their swa to certify someone for the work opportunity credit. Complete, edit.

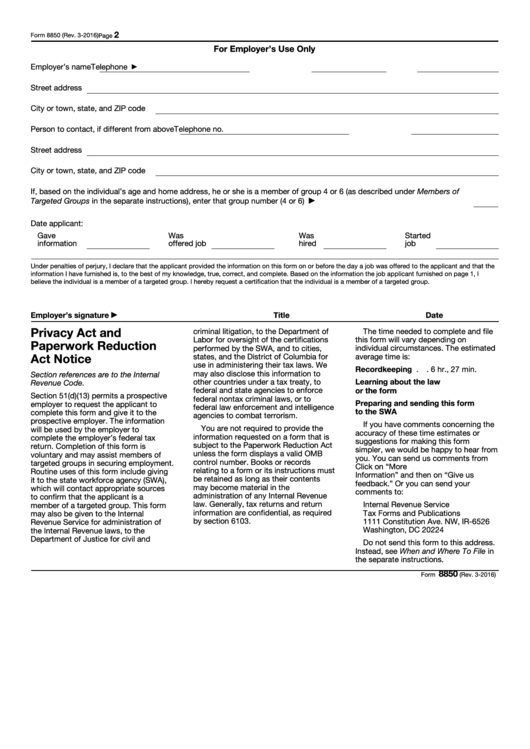

Instructions For Form 8850 PreScreening Notice And Certification

The information will be used by the employer to complete the employer’s federal tax return. Complete, edit or print tax forms instantly. The form 8850 and the eta 9061 must be submitted online or postmarked no later than the 28th day after the job seeker begins work. Web instructions for form 8850(rev. Web as soon as the person is hired,.

LEGO 8850 INSTRUCTIONS PDF

Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Web as soon as the person is hired, you must submit form 8850 and form 9061 to the state workforce or employment agency for a determination on the eligibility of this worker for wotc credit. Routine uses of this form.

Fillable Form 8850 PreScreening Notice And Certification Request For

Complete, edit or print tax forms instantly. This form may also be given to the internal The information will be used by the employer to complete the employer’s federal tax return. The forms must be submitted no later than the 28th calendar day after the person begins work. Ad access irs tax forms.

Form 8850 Edit, Fill, Sign Online Handypdf

Employers use form 8850 to make a written request to their swa to certify someone for the work opportunity credit. Web complete this form and give it to the prospective employer. Complete, edit or print tax forms instantly. Completion of this form is voluntary and may assist members of targeted groups in securing employment. The form 8850 and the eta.

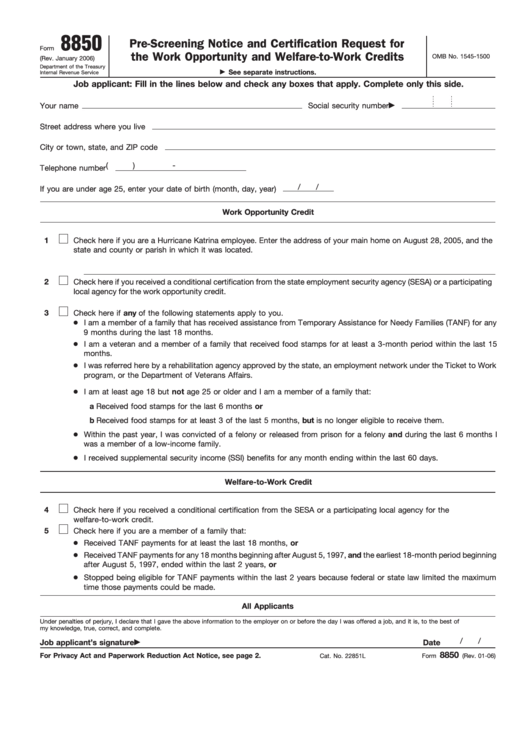

Fillable Form 8850 (Rev. August 2009) printable pdf download

Web the employer may request certification for the wotc by submitting the form 8850 and the eta 9061 to the edd, either online or by mail. Ad access irs tax forms. Information about any future developments affecting form 8850 (such as legislation enacted after we to get the name, address, phone and fax numbers, and Routine uses of this form.

Business Partners Chapman University

Complete, edit or print tax forms instantly. And eta form 9061 (or) eta form 9062 must be completed and submitted to the state workforce agency to complete the application. Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. This form may also be given to the internal

Instructions For Form 8850 Internal Revenue Service printable pdf

Get ready for tax season deadlines by completing any required tax forms today. Completion of this form is voluntary and may assist members of targeted groups in securing employment. Web as soon as the person is hired, you must submit form 8850 and form 9061 to the state workforce or employment agency for a determination on the eligibility of this.

Form 8850PreScreening Notice and Certification Request

And eta form 9061 (or) eta form 9062 must be completed and submitted to the state workforce agency to complete the application. The form 8850 and the eta 9061 must be submitted online or postmarked no later than the 28th day after the job seeker begins work. Routine uses of this form The information will be used by the employer.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Routine uses of this form Ad access irs tax forms. Employers use form 8850 to make a written request to their swa to certify someone for the work opportunity credit. Information about any future developments affecting form 8850 (such as legislation enacted after we to get the name, address, phone and fax numbers, and

Completion Of This Form Is Voluntary And May Assist Members Of Targeted Groups In Securing Employment.

Web as soon as the person is hired, you must submit form 8850 and form 9061 to the state workforce or employment agency for a determination on the eligibility of this worker for wotc credit. Web instructions for form 8850(rev. Web complete this form and give it to the prospective employer. The information will be used by the employer to complete the employer’s federal tax return.

The Forms Must Be Submitted No Later Than The 28Th Calendar Day After The Person Begins Work.

Get ready for tax season deadlines by completing any required tax forms today. Routine uses of this form include giving it to the state workforce agency (swa), which will contact appropriate sources to confirm that the applicant is a member of a targeted group. Web the employer may request certification for the wotc by submitting the form 8850 and the eta 9061 to the edd, either online or by mail. The form 8850 and the eta 9061 must be submitted online or postmarked no later than the 28th day after the job seeker begins work.

Complete, Edit Or Print Tax Forms Instantly.

Ad access irs tax forms. And eta form 9061 (or) eta form 9062 must be completed and submitted to the state workforce agency to complete the application. This form may also be given to the internal Complete, edit or print tax forms instantly.