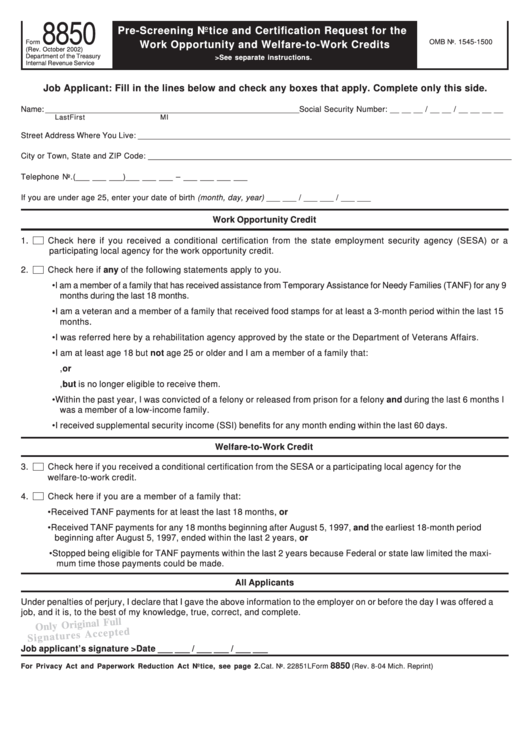

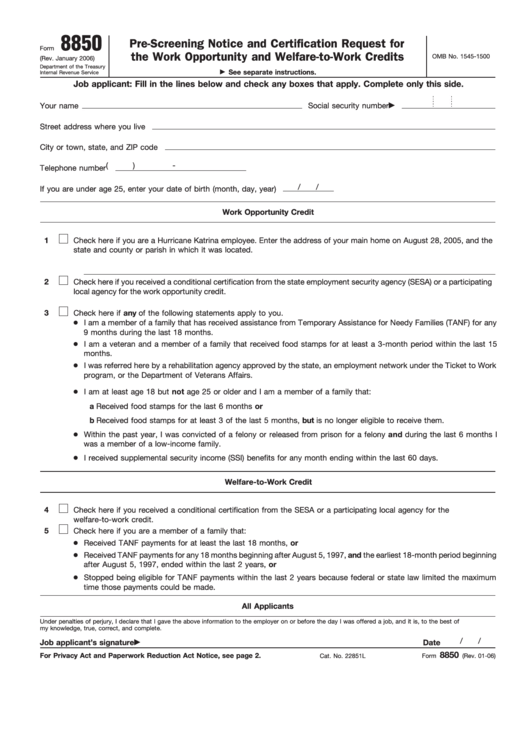

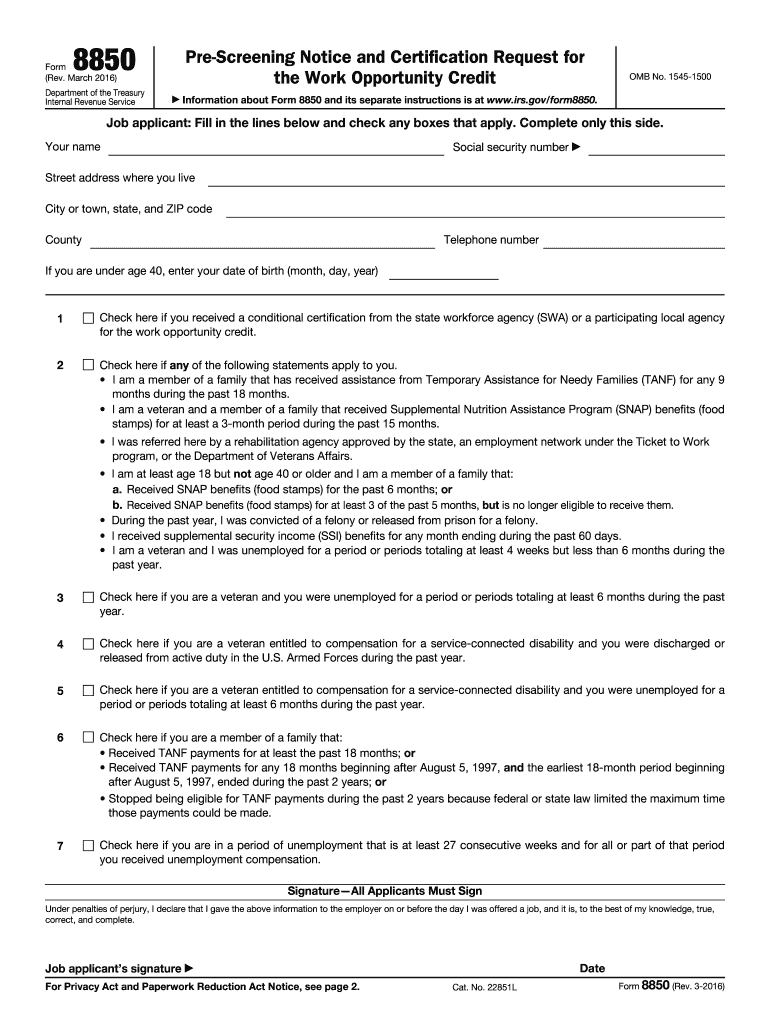

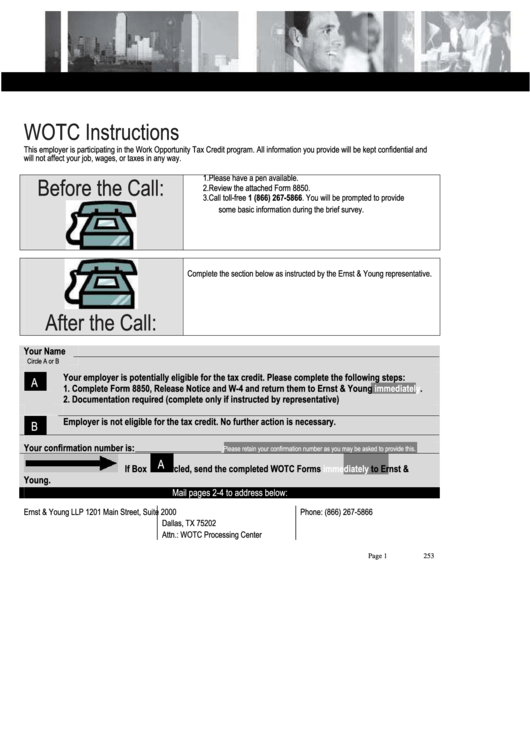

Form 8850 Work Opportunity Credit

Form 8850 Work Opportunity Credit - Download or email irs 8850 & more fillable forms, register and subscribe now! The wotc applies to certain wages paid or. Ad complete irs tax forms online or print government tax documents. Edit, sign and save irs 8850 form. The work opportunity tax credit program (wotc) has been around for several decades, yet many employers are still not aware of its. Web what is form 8850. Where do you call to get more information? Department of labor ( dol) for employers who hire individuals. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly.

Web to apply for the work opportunity tax credit, employers must submit the following: Web forms overview the work opportunity tax credit ( wotc) is a federal income tax benefit administered by the u.s. Where do you call to get more information? Web to be able to claim the work opportunity tax credit, the employer must submit the completed form 8850 to state workforce agency within 28 days after the. Get ready for tax season deadlines by completing any required tax forms today. Who should complete and sign the form the job applicant furnishes information to the employer on or before the day a job. Web the work opportunity tax credit (wotc) is a federal tax credit available to employers who invest in american job seekers who have consistently faced barriers to employment. Web form 5884, work opportunity credit, for more details. Get ready for tax season deadlines by completing any required tax forms today. The wotc applies to certain wages paid or.

Edit, sign and save irs 8850 form. Get ready for tax season deadlines by completing any required tax forms today. The wotc applies to certain wages paid or. Form 8850, page 1, must be filled. Download or email irs 8850 & more fillable forms, register and subscribe now! Where do you call to get more information? Web to be able to claim the work opportunity tax credit, the employer must submit the completed form 8850 to state workforce agency within 28 days after the. Web the work opportunity tax credit (wotc) is a federal tax credit available to employers who invest in american job seekers who have consistently faced barriers to employment. Department of labor ( dol) for employers who hire individuals. Web form 5884, work opportunity credit, for more details.

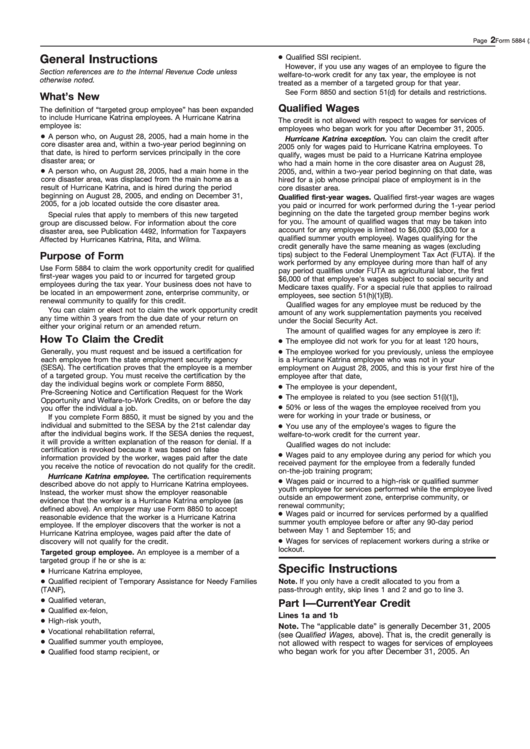

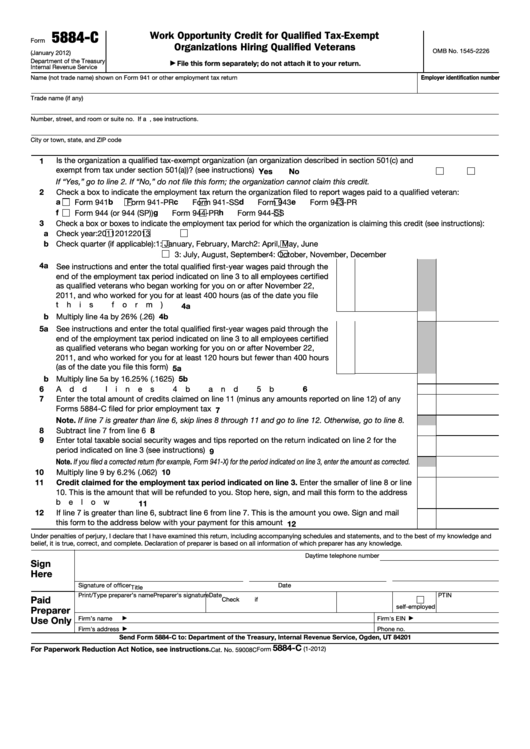

Form 5884 Work Opportunity Credit (2014) Free Download

Ad complete irs tax forms online or print government tax documents. Web form 5884, work opportunity credit, for more details. Get ready for tax season deadlines by completing any required tax forms today. Web the work opportunity tax credit (wotc) is a federal tax credit available to employers who invest in american job seekers who have consistently faced barriers to.

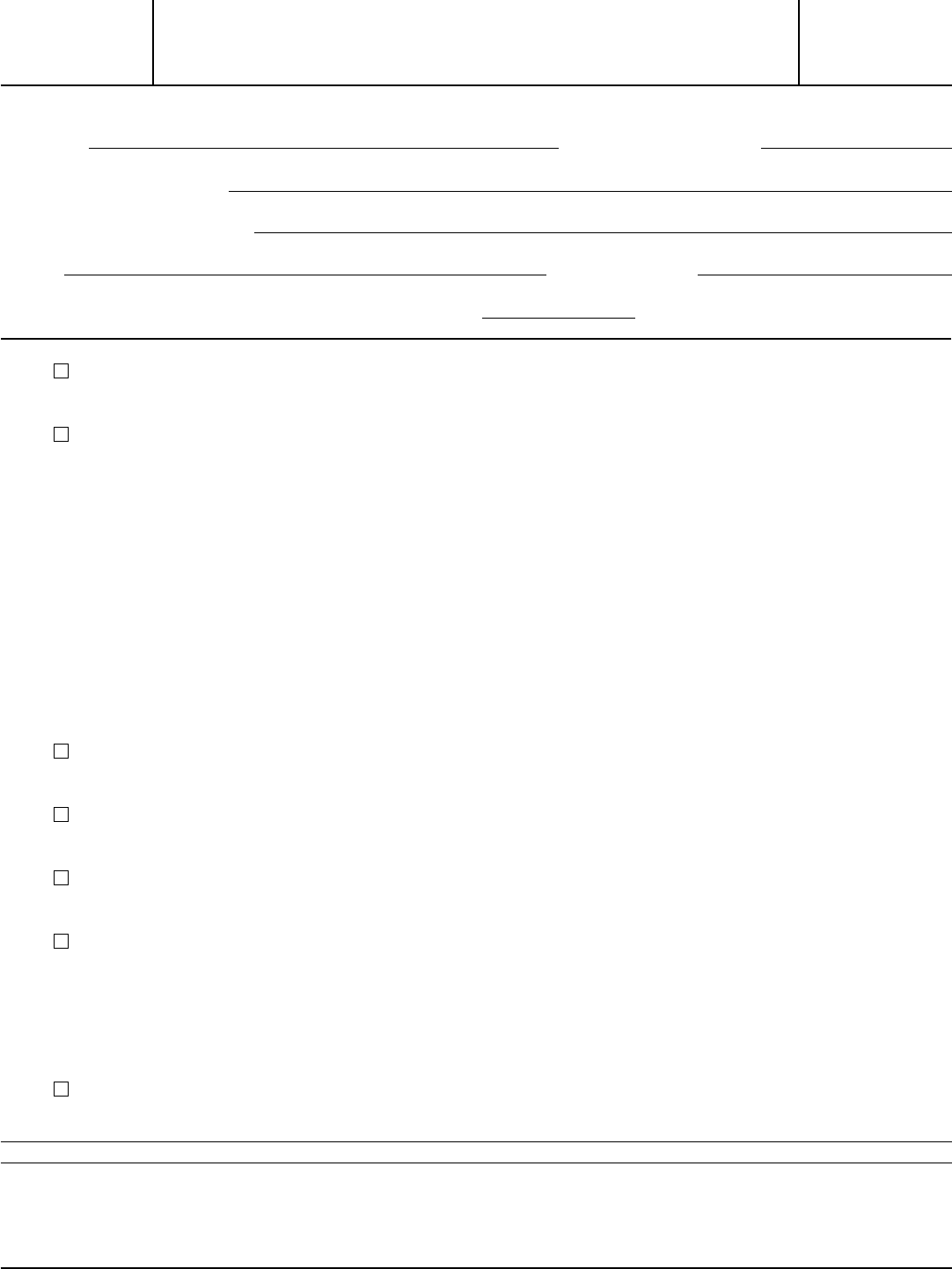

CMS WOTC Newsletter May 2020 Cost Management Services Work

Where do you call to get more information? Download or email irs 8850 & more fillable forms, register and subscribe now! Ad complete irs tax forms online or print government tax documents. Form 8850, page 1, must be filled. Web what is form 8850.

Instructions For Form 5884 Work Opportunity Credit 2005 printable

Form 8850, page 1, must be filled. Web an employer must submit form 8850 to the dla not later than the 28th day after the individual begins work for the employer. Web to apply for the work opportunity tax credit, employers must submit the following: Web show sources > form 8850 is a federal other form. Who should complete and.

Form 8850 PreScreening Notice And Certification Request For The Work

Web the work opportunity tax credit (wotc) is a federal tax credit available to employers who invest in american job seekers who have consistently faced barriers to employment. Web to apply for the work opportunity tax credit, employers must submit the following: Get ready for tax season deadlines by completing any required tax forms today. Download or email irs 8850.

Fillable Form 8850 PreScreening Notice And Certification Request For

Department of labor ( dol) for employers who hire individuals. Web form 5884, work opportunity credit, for more details. Get ready for tax season deadlines by completing any required tax forms today. Form 8850, page 1, must be filled. Ad complete irs tax forms online or print government tax documents.

Form 5884 Work Opportunity Credit (2014) Free Download

The wotc applies to certain wages paid or. Who should complete and sign the form the job applicant furnishes information to the employer on or before the day a job. Web form 5884, work opportunity credit, for more details. Department of labor ( dol) for employers who hire individuals. Get ready for tax season deadlines by completing any required tax.

Form 8850 Fill out & sign online DocHub

Web to be able to claim the work opportunity tax credit, the employer must submit the completed form 8850 to state workforce agency within 28 days after the. Complete, edit or print tax forms instantly. Who should complete and sign the form the job applicant furnishes information to the employer on or before the day a job. Get ready for.

Form 8850 Edit, Fill, Sign Online Handypdf

Get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today. The work opportunity tax credit program (wotc) has been around for several decades, yet many employers are still not aware of its. Web the work opportunity tax credit (wotc) is a federal tax credit.

Form 8850 PreScreening Notice And Certification Request For The Work

Download or email irs 8850 & more fillable forms, register and subscribe now! Edit, sign and save irs 8850 form. Form 8850, page 1, must be filled. Web show sources > form 8850 is a federal other form. Get ready for tax season deadlines by completing any required tax forms today.

Fillable Form 5884C Work Opportunity Credit For Qualified TaxExempt

Web an employer must submit form 8850 to the dla not later than the 28th day after the individual begins work for the employer. Web to be able to claim the work opportunity tax credit, the employer must submit the completed form 8850 to state workforce agency within 28 days after the. Who should complete and sign the form the.

Download Or Email Irs 8850 & More Fillable Forms, Register And Subscribe Now!

Complete, edit or print tax forms instantly. Web to be able to claim the work opportunity tax credit, the employer must submit the completed form 8850 to state workforce agency within 28 days after the. The wotc applies to certain wages paid or. Form 8850, page 1, must be filled.

Ad Complete Irs Tax Forms Online Or Print Government Tax Documents.

Get ready for tax season deadlines by completing any required tax forms today. Edit, sign and save irs 8850 form. Web forms overview the work opportunity tax credit ( wotc) is a federal income tax benefit administered by the u.s. Web show sources > form 8850 is a federal other form.

The Work Opportunity Tax Credit Program (Wotc) Has Been Around For Several Decades, Yet Many Employers Are Still Not Aware Of Its.

Where do you call to get more information? Get ready for tax season deadlines by completing any required tax forms today. Web the work opportunity tax credit (wotc) is a federal tax credit available to employers who invest in american job seekers who have consistently faced barriers to employment. Web an employer must submit form 8850 to the dla not later than the 28th day after the individual begins work for the employer.

Web To Apply For The Work Opportunity Tax Credit, Employers Must Submit The Following:

Department of labor ( dol) for employers who hire individuals. Web form 5884, work opportunity credit, for more details. Web what is form 8850. Who should complete and sign the form the job applicant furnishes information to the employer on or before the day a job.