Form 8880 Pdf

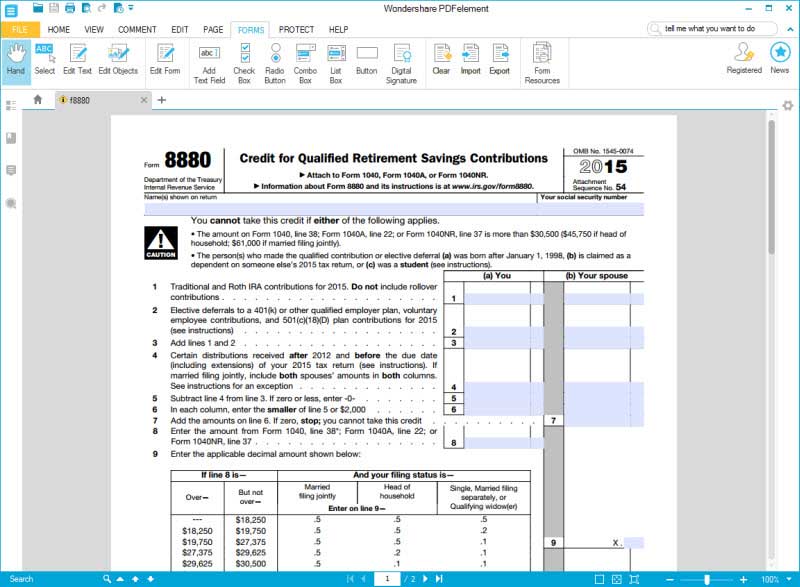

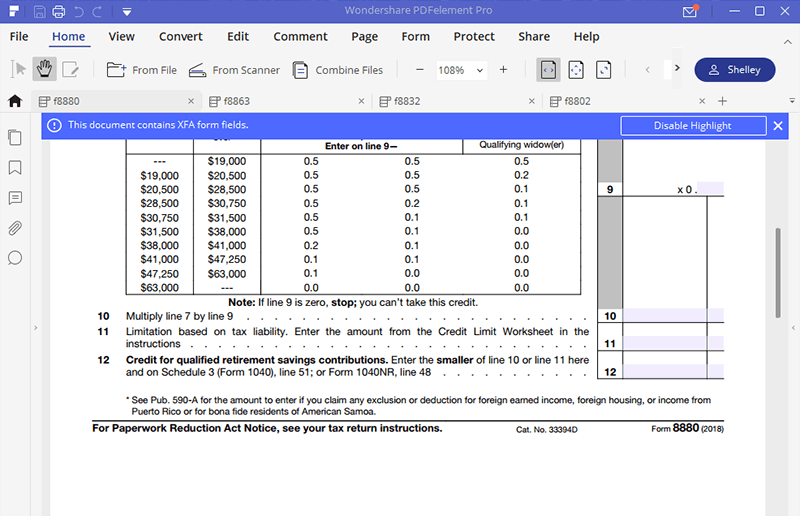

Form 8880 Pdf - Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). Cocodoc is the best place for you to go, offering you a convenient and. Register and subscribe now to work on your irs form 8880 & more fillable forms. Web • form 8880, credit for qualified retirement savings contributions, is used to claim this credit. Web 12 credit for qualified retirement savings contributions. In order to claim the retirement savings. Credit for qualified retirement savings contributions: Obtain a digital copy of the form in pdf format. Web use form 8880 to figure the amount, if any, of your retirement savings. This is where you’ll report your income to determine eligibility and all of the contributions you.

Taxpayers may be eligible for. This credit can be claimed in. Web a tax credit directly reduces the amount of tax you owe, unlike a deduction, which only decreases your taxable income. Sign online button or tick the preview image of the blank. Web irs form 8880 reports contributions made to qualified retirement savings accounts. Complete, edit or print tax forms instantly. To begin the document, utilize the fill camp; Web • form 8880, credit for qualified retirement savings contributions, is used to claim this credit. This is where you’ll report your income to determine eligibility and all of the contributions you. In order to claim the retirement savings.

Web up to $40 cash back do whatever you want with a 2020 form 8880. Web 10 11 12 see pub. Web here are the steps for completing and redacting the form online: Cocodoc is the best place for you to go, offering you a convenient and. Use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver's credit). Get ready for tax season deadlines by completing any required tax forms today. Sign online button or tick the preview image of the blank. Complete, edit or print tax forms instantly. Web irs form 8880 reports contributions made to qualified retirement savings accounts. Web use form 8880 to figure the amount, if any, of your retirement savings.

8880 Form ≡ Fill Out Printable PDF Forms Online

Open the form fs 5396 in a pdfliner editor. Web irs form 8880 reports contributions made to qualified retirement savings accounts. Use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver's credit). Web purpose of form use form 8880 to figure the amount, if any, of your retirement savings contributions.

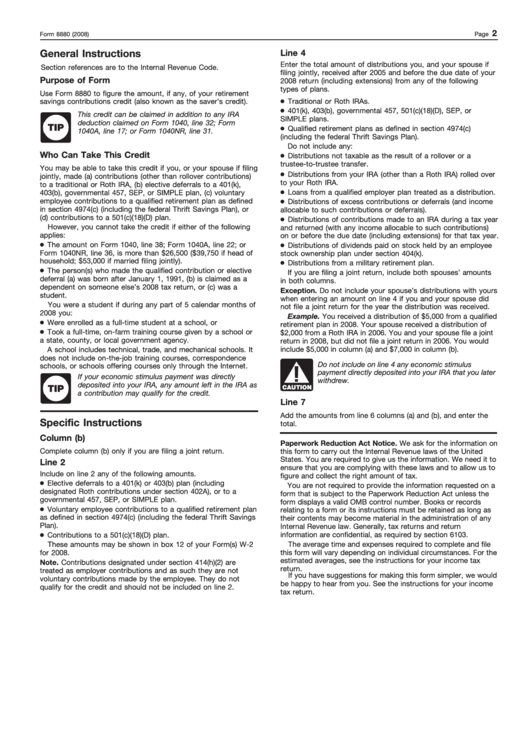

Instructions For Form 8880 2008 printable pdf download

Obtain a digital copy of the form in pdf format. Complete, edit or print tax forms instantly. Web 12 credit for qualified retirement savings contributions. This credit can be claimed in. Fill out the form with.

Retirement plan 8880 Early Retirement

Complete, edit or print tax forms instantly. Sign online button or tick the preview image of the blank. Web form 8880 is used to figure the amount, if any, of your retirement savings contributions credit that can be claimed in the current year. Web irs form 8880 reports contributions made to qualified retirement savings accounts. Credit for qualified retirement savings.

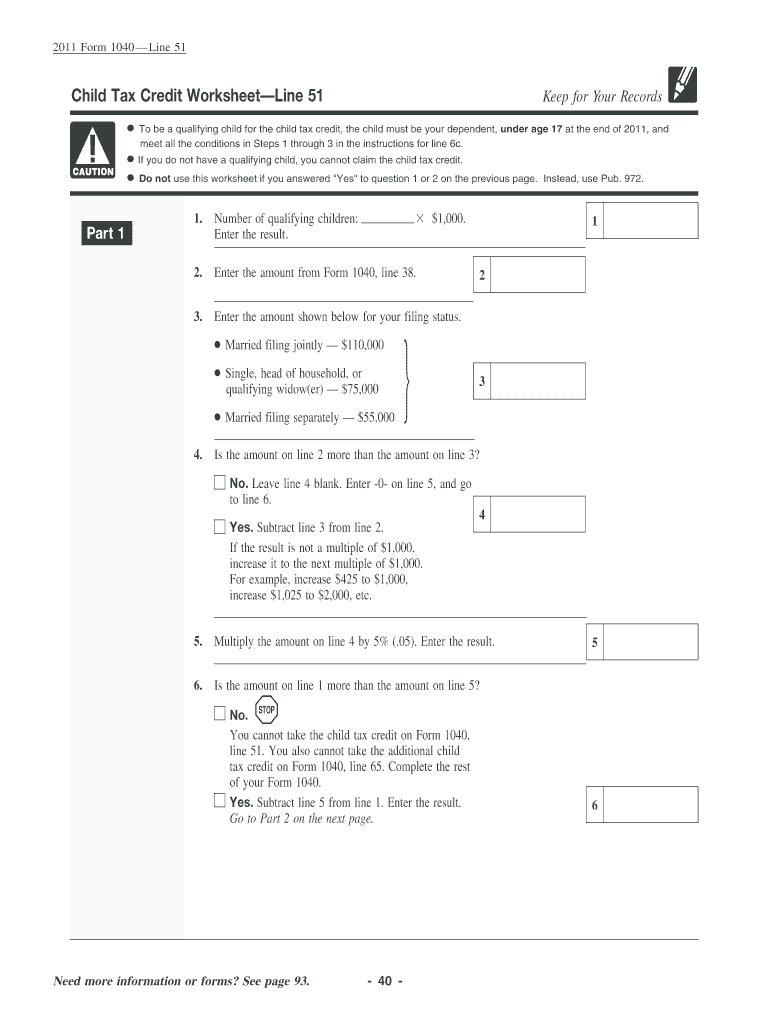

Child Tax Credit Worksheet Parents, this is what happens to your

Web purpose of form use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). In order to claim the retirement savings. To begin the document, utilize the fill camp; Web use form 8880 to figure the amount, if any, of your retirement savings. Obtain a digital copy of the.

IRS Form 8880 Get it Filled the Right Way

To begin the document, utilize the fill camp; Complete, edit or print tax forms instantly. Ad complete irs tax forms online or print government tax documents. This is where you’ll report your income to determine eligibility and all of the contributions you. This credit can be claimed in.

SimpleTax Form 8880 YouTube

Get ready for tax season deadlines by completing any required tax forms today. Taxpayers may be eligible for. Complete, edit or print tax forms instantly. Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). Web irs form 8880 reports contributions made to qualified retirement savings accounts.

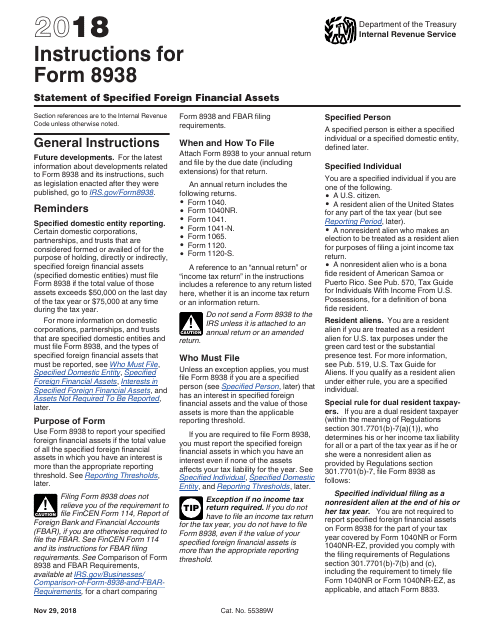

Download Instructions for IRS Form 8938 Statement of Specified Foreign

Cocodoc is the best place for you to go, offering you a convenient and. Enter the smaller of line 10 or line 11 here and on schedule 3 (form 1040), line 4. Web • form 8880, credit for qualified retirement savings contributions, is used to claim this credit. Credit for qualified retirement savings contributions: Web irs form 8880 is used.

Education credit form 2017 Fill out & sign online DocHub

Register and subscribe now to work on your irs form 8880 & more fillable forms. Fill out the form with. Taxpayers may be eligible for. Web • form 8880, credit for qualified retirement savings contributions, is used to claim this credit. Web form 8880 is used to figure the amount, if any, of your retirement savings contributions credit that can.

Irs.gov 2014 Form 8880 Universal Network

Web irs form 8880 is used specifically for the retirement saver’s credit. Web the way to fill out the get and sign form 8880 instructionsw on the internet: Web here are the steps for completing and redacting the form online: Sign online button or tick the preview image of the blank. Web up to $40 cash back do whatever you.

Ssurvivor Form 2106 Line 6

Complete, edit or print tax forms instantly. Web irs form 8880 reports contributions made to qualified retirement savings accounts. Register and subscribe now to work on your irs form 8880 & more fillable forms. Open the form fs 5396 in a pdfliner editor. Use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known.

Cocodoc Is The Best Place For You To Go, Offering You A Convenient And.

This is where you’ll report your income to determine eligibility and all of the contributions you. Web • form 8880, credit for qualified retirement savings contributions, is used to claim this credit. In order to claim the retirement savings. To begin the document, utilize the fill camp;

Web Use Form 8880 To Figure The Amount, If Any, Of Your Retirement Savings.

Form 8880, credit for qualified retirement savings contributions form 8880, credit for qualified retirement. Web irs form 8880 is used specifically for the retirement saver’s credit. Fillable, printable & blank pdf form for free | cocodoc looking for form 8880 to fill? Use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver's credit).

Web 12 Credit For Qualified Retirement Savings Contributions.

Fill, sign, print and send online instantly. Enter the smaller of line 10 or line 11 here and on schedule 3 (form 1040), line 4. Web up to $40 cash back do whatever you want with a 2020 form 8880. Ad complete irs tax forms online or print government tax documents.

Web Form 8880 Is Used To Figure The Amount, If Any, Of Your Retirement Savings Contributions Credit That Can Be Claimed In The Current Year.

Complete, edit or print tax forms instantly. This credit can be claimed in. Web irs form 8880 reports contributions made to qualified retirement savings accounts. Credit for qualified retirement savings contributions: