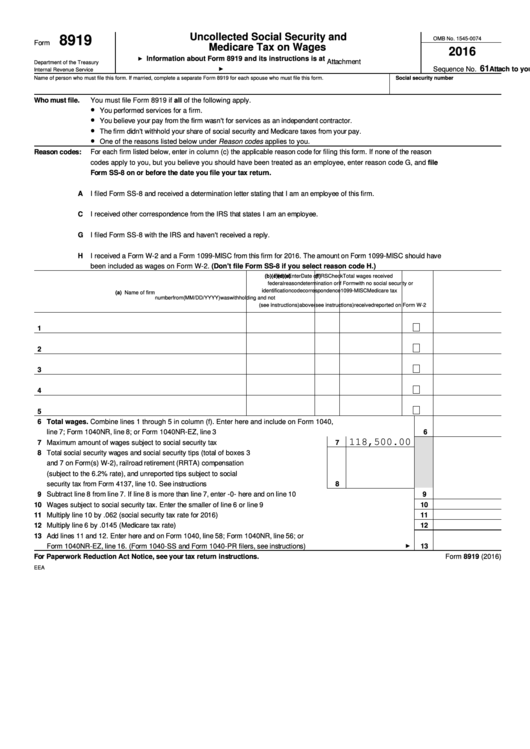

Form 8919 2022

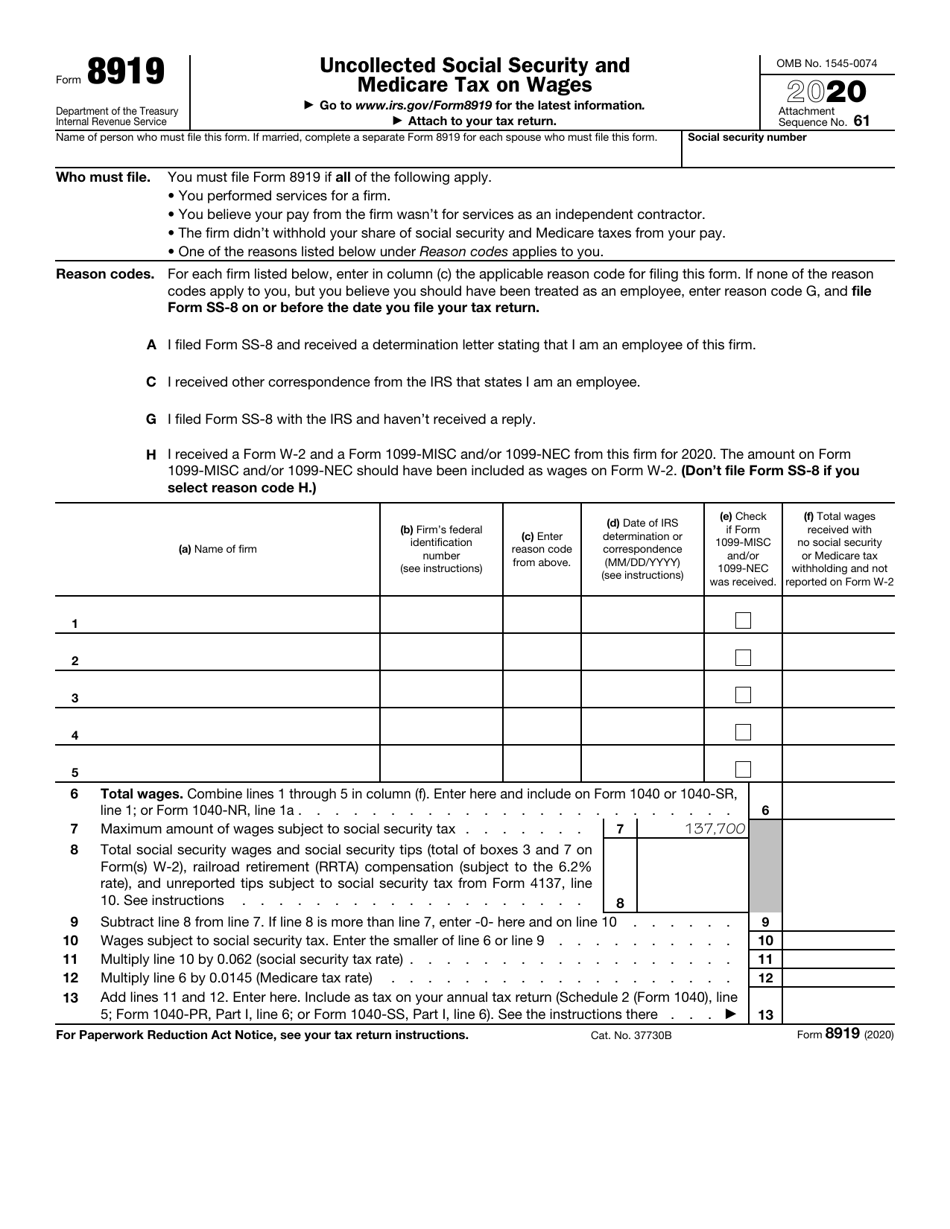

Form 8919 2022 - Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is the latest version of form 8919, fully updated for tax year 2022. You must file form 8919 if. Use irs form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your earnings, if you were an employee who was treated as an independent contractor by your employer. You will carry the amounts to one of the following returns. Web information about form 8919, uncollected social security and medicare tax on wages, including recent updates, related forms, and instructions on how to file. One of the reasons listed below under reason codes applies to you reason codes. • you performed services for a firm. Web you performed services for a firm. You believe your pay from the firm wasn’t for services as an independent contractor. Web form 8819 is filed by or on behalf of a noncontrolled section 902 corporation (defined in section 904(d)(2)(e)) operating in a hyperinflationary environment that elects the u.s.

If married, complete a separate form 8919 for each spouse who must file this form. Web information about form 8919, uncollected social security and medicare tax on wages, including recent updates, related forms, and instructions on how to file. The firm didn’t withhold your share of social security and medicare taxes from your pay. Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is the latest version of form 8919, fully updated for tax year 2022. When an employee is misclassified as an independent contractor, discrepancies arise with social security and medicare taxes. Web form 8919, uncollected social security and medicare tax on wages. Web updated for tax year 2022 • may 19, 2023 11:34 am overview your employment status has a significant impact on the employment tax you pay and on the amount that an employer pays on your behalf. When to use form 8919 You will carry the amounts to one of the following returns. One of the reasons listed below under reason codes applies to you reason codes.

Web updated for tax year 2022 • may 19, 2023 11:34 am overview your employment status has a significant impact on the employment tax you pay and on the amount that an employer pays on your behalf. The firm didn’t withhold your share of social security and medicare taxes from your pay. When to use form 8919 This article will cover everything related to irs form 8919. You believe your pay from the firm wasn’t for services as an independent contractor. You must file form 8919 if. Web form 8919 is used to report uncollected social security and medicare tax on wages. Use irs form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your earnings, if you were an employee who was treated as an independent contractor by your employer. Web information about form 8919, uncollected social security and medicare tax on wages, including recent updates, related forms, and instructions on how to file. Web general instructions purpose of form use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any.

Form 8919 Uncollected Social Security And Medicare Tax On Wages

Name of person who must file this form. Web you performed services for a firm. Web updated for tax year 2022 • may 19, 2023 11:34 am overview your employment status has a significant impact on the employment tax you pay and on the amount that an employer pays on your behalf. The firm didn’t withhold your share of social.

カチタス[8919]:四半期報告書-第45期第1四半期(令和4年4月1日-令和4年6月30日) (有価証券報告書) :日経会社情報

Web updated for tax year 2022 • may 19, 2023 11:34 am overview your employment status has a significant impact on the employment tax you pay and on the amount that an employer pays on your behalf. Web form 8919 is used to report uncollected social security and medicare tax on wages. You must file form 8919 if. When an.

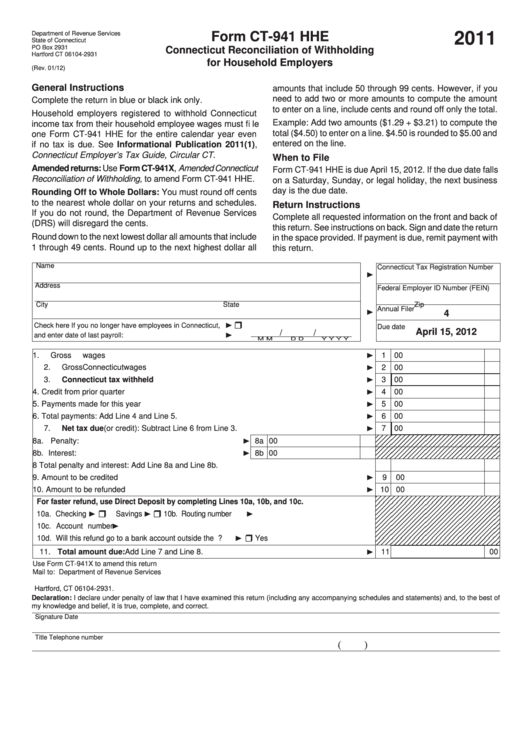

Form Ct941 Hhe Connecticut Reconciliation Of Withholding For

Web general instructions purpose of form use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. Web form 8919, uncollected social security and medicare tax on wages. Use irs form 8919 to figure and report your share of the uncollected social security and medicare.

8915 d form Fill out & sign online DocHub

• you performed services for a firm. Web you performed services for a firm. You must file form 8919 if. When to use form 8919 Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is the latest version of form 8919, fully updated for tax year 2022.

Form 8919 Edit, Fill, Sign Online Handypdf

You believe your pay from the firm wasn’t for services as an independent contractor. Dollar as its (or its qualified business unit (qbu) branch’s) functional currency. Web updated for tax year 2022 • may 19, 2023 11:34 am overview your employment status has a significant impact on the employment tax you pay and on the amount that an employer pays.

カチタス[8919]:コーポレート・ガバナンスに関する報告書 2022/06/30 2022年6月30日(適時開示) :日経会社情報

This article will cover everything related to irs form 8919. The firm didn’t withhold your share of social security and medicare taxes from your pay. Web general instructions purpose of form use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. Web information about.

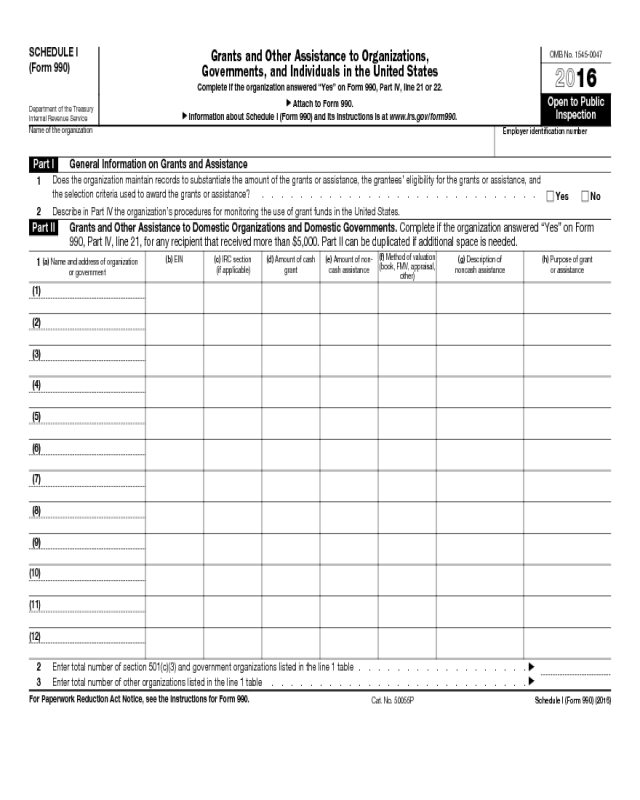

Form 990 Schedule I Edit, Fill, Sign Online Handypdf

Web you performed services for a firm. One of the reasons listed below under reason codes applies to you reason codes. Web information about form 8919, uncollected social security and medicare tax on wages, including recent updates, related forms, and instructions on how to file. Web form 8819 is filed by or on behalf of a noncontrolled section 902 corporation.

Form 1099NEC Nonemployee Compensation (1099NEC)

Web general instructions purpose of form use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. When to use form 8919 Dollar as its (or its qualified business unit (qbu) branch’s) functional currency. Web form 8919 is used to report uncollected social security and.

IRS Form 8919 Download Fillable PDF or Fill Online Uncollected Social

Web updated for tax year 2022 • may 19, 2023 11:34 am overview your employment status has a significant impact on the employment tax you pay and on the amount that an employer pays on your behalf. You will carry the amounts to one of the following returns. Web form 8819 is filed by or on behalf of a noncontrolled.

Form 8919 Uncollected Social Security and Medicare Tax on Wages (2014

Web form 8919 is used to report uncollected social security and medicare tax on wages. Use irs form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your earnings, if you were an employee who was treated as an independent contractor by your employer. Web information about form 8919, uncollected social security.

This Article Will Cover Everything Related To Irs Form 8919.

If married, complete a separate form 8919 for each spouse who must file this form. Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is the latest version of form 8919, fully updated for tax year 2022. You will carry the amounts to one of the following returns. Web form 8919, uncollected social security and medicare tax on wages.

Dollar As Its (Or Its Qualified Business Unit (Qbu) Branch’s) Functional Currency.

Web form 8819 is filed by or on behalf of a noncontrolled section 902 corporation (defined in section 904(d)(2)(e)) operating in a hyperinflationary environment that elects the u.s. Use irs form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your earnings, if you were an employee who was treated as an independent contractor by your employer. You must file form 8919 if. Name of person who must file this form.

Web Updated For Tax Year 2022 • May 19, 2023 11:34 Am Overview Your Employment Status Has A Significant Impact On The Employment Tax You Pay And On The Amount That An Employer Pays On Your Behalf.

Web information about form 8919, uncollected social security and medicare tax on wages, including recent updates, related forms, and instructions on how to file. When an employee is misclassified as an independent contractor, discrepancies arise with social security and medicare taxes. • you performed services for a firm. Form 8919 is used by certain employees to report uncollected social security and medicare taxes due on compensation.

You Believe Your Pay From The Firm Wasn’t For Services As An Independent Contractor.

When to use form 8919 One of the reasons listed below under reason codes applies to you reason codes. The firm didn’t withhold your share of social security and medicare taxes from your pay. Web general instructions purpose of form use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any.