Form 8919 Pdf

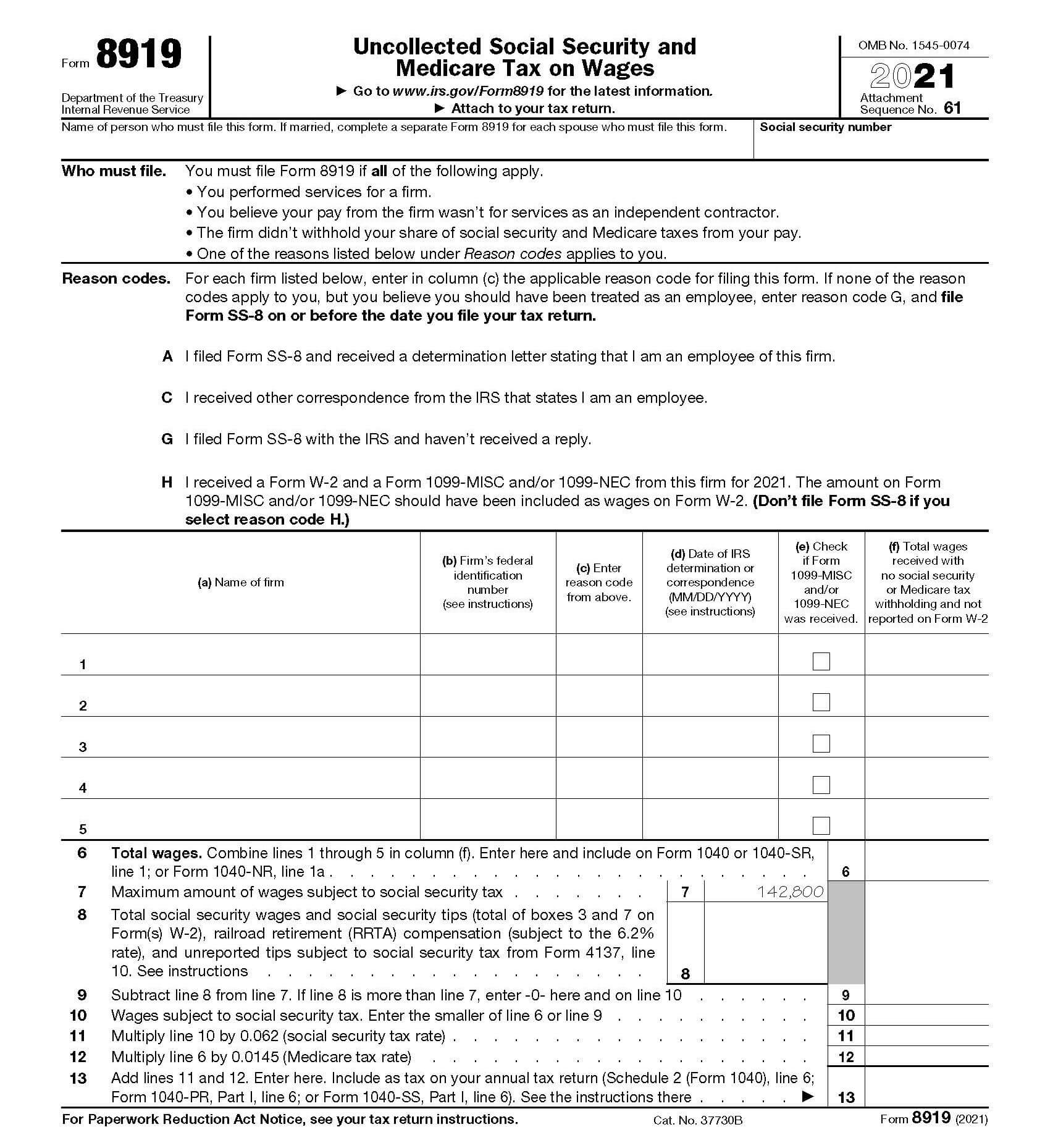

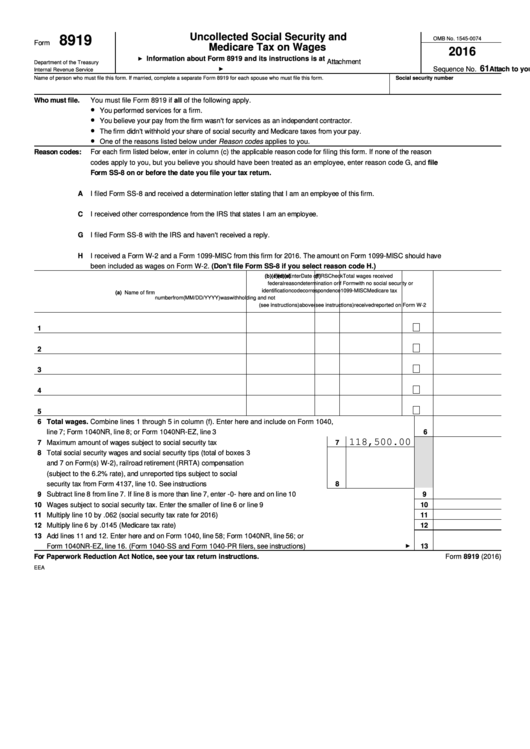

Form 8919 Pdf - Web information about form 8919, uncollected social security and medicare tax on wages, including recent updates, related forms, and instructions on how to file. Completion of form 8919 will also ensure that you. • if the election is made on behalf of a noncontrolled section 902 corporation or branch of a. Download your fillable irs form 8919 in pdf. If married, complete a separate form 8919 for each spouse who must file this form. Web attach additional form(s) 8919 with lines 1 through 5 completed. Web to be employees by irs can use form 8919 to calculate fica tax on the income that has been determined to be wages. What is the difference in employment status. First of all click fill this form button, and in case you'd like to find it letter see the steps below: To begin with, look for the “get form”.

Read the following instructions to use cocodoc to start editing and completing your form 8919: Web how to edit and fill out form 8919 online. You performed services for a firm. The line 6 amount on that form 8919 should be the. Social security number who must file. Web department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest information attach. If married, complete a separate form 8919 for each spouse who must file this form. Web to be employees by irs can use form 8919 to calculate fica tax on the income that has been determined to be wages. • if the election is made on behalf of a noncontrolled section 902 corporation or branch of a. To begin with, look for the “get form”.

Sign it in a few clicks draw your signature, type it,. Web to be employees by irs can use form 8919 to calculate fica tax on the income that has been determined to be wages. Web attach additional form(s) 8919 with lines 1 through 5 completed. Web information about form 8919, uncollected social security and medicare tax on wages, including recent updates, related forms, and instructions on how to file. If married, complete a separate form 8919 for each spouse who must file this form. Complete lines 6 through 13 on only one form 8919. Web name of person who must file this form. Social security number who must file. Download your fillable irs form 8919 in pdf. • if the election is made on behalf of a noncontrolled section 902 corporation or branch of a.

Form 8919 Uncollected Social Security and Medicare Tax on Wages (2014

Web form 8819 is used to elect the u.s. Web information about form 8919, uncollected social security and medicare tax on wages, including recent updates, related forms, and instructions on how to file. If married, complete a separate form 8919 for each spouse who must file this form. Web name of person who must file this form. The line 6.

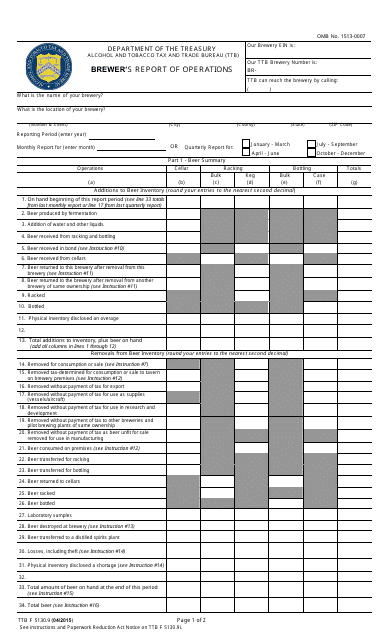

TTB Form 5130.9 Download Fillable PDF or Fill Online Brewer's Report of

Sign it in a few clicks draw your signature, type it,. If married, complete a separate form 8919 for each spouse who must file this form. Web corporation, form 8819 must be filed by an authorized officer or director of the corporation. Download your fillable irs form 8919 in pdf. First of all click fill this form button, and in.

How to Generate 2011 IRS Schedule D and Form 8949 using www.form8949

First of all click fill this form button, and in case you'd like to find it letter see the steps below: To begin with, look for the “get form”. What is the difference in employment status. Completion of form 8919 will also ensure that you. You performed services for a firm.

Form 8959 Additional Medicare Tax (2014) Free Download

Web form 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages ago to www.irs.gov/form8919 for the latest. Web department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest information attach. Web information about form 8919, uncollected social security and medicare tax on.

how to fill out form 8919 Fill Online, Printable, Fillable Blank

The line 6 amount on that form 8919 should be the. What is the difference in employment status. If married, complete a separate form 8919 for each spouse who must file this form. Web how to edit and fill out form 8919 online. Web information about form 8919, uncollected social security and medicare tax on wages, including recent updates, related.

When to Use IRS Form 8919

Web form 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages ago to www.irs.gov/form8919 for the latest. Social security number who must file. Download your fillable irs form 8919 in pdf. Web name of person who must file this form. Web department of the treasury internal revenue service uncollected social security and medicare.

20182022 Form CA ADOPT200 Fill Online, Printable, Fillable, Blank

Web get your blank document online at pdfliner. To begin with, look for the “get form”. First of all click fill this form button, and in case you'd like to find it letter see the steps below: • if the election is made on behalf of a noncontrolled section 902 corporation or branch of a. Read the following instructions to.

Form 1099NEC Nonemployee Compensation (1099NEC)

Web form 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages ago to www.irs.gov/form8919 for the latest. Web department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest information attach. Complete lines 6 through 13 on only one form 8919. Completion of.

Form 8919 Uncollected Social Security And Medicare Tax On Wages

Web department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest information attach. Web form 8819 is used to elect the u.s. Web get your blank document online at pdfliner. Web form 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages ago.

New Patient form Template Beautiful New Patient Medical History form

Web department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest information attach. Complete lines 6 through 13 on only one form 8919. To begin with, look for the “get form”. First of all click fill this form button, and in case you'd like to find it letter see.

Download Your Fillable Irs Form 8919 In Pdf.

Edit your form 8919 2021 online type text, add images, blackout confidential details, add comments, highlights and more. Web information about form 8919, uncollected social security and medicare tax on wages, including recent updates, related forms, and instructions on how to file. Web form 8819 is used to elect the u.s. Web name of person who must file this form.

Web Corporation, Form 8819 Must Be Filed By An Authorized Officer Or Director Of The Corporation.

Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were treated as. Web how to edit and fill out form 8919 online. First of all click fill this form button, and in case you'd like to find it letter see the steps below: If married, complete a separate form 8919 for each spouse who must file this form.

Web Get Your Blank Document Online At Pdfliner.

What is the difference in employment status. Web form 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages ago to www.irs.gov/form8919 for the latest. Web department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest information attach. Web department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest information attach.

To Begin With, Look For The “Get Form”.

If married, complete a separate form 8919 for each spouse who must file this form. Web name of person who must file this form. You performed services for a firm. Social security number who must file.