Form 8960 Rejection

Form 8960 Rejection - Definitions controlled foreign corporation (cfc). Attach to your tax return. This rejection occurs when form 8960 line 4a, does not match form 1040 ,schedule 1, line 17. Web per irs, form 8960 is not required on sale of a primary residence. Department of the treasury internal revenue service. We do not have an estimate for when the problem will. Web the rejected return states mathh error, not sure how to fix this. I have a loss for my llc of (i. We do not have an estimate for when the problem will be. Web use form 8960 to figure the amount of your net investment income tax (niit).

I have a loss for my llc of (i. We do not have an estimate for when the problem will be. Net investment income tax— individuals, estates, and trusts. Web 1 bookmark icon tobias_funke level 2 @bligbluelaser when you look at form 8960 and then look at lines 4a, 4b and 4c, this is where the issue is. Generally, a cfc is any foreign. Only sch d and form 8949. We do not have an estimate for when the problem will. We do not have an estimate for when the problem will be. Definitions controlled foreign corporation (cfc). Department of the treasury internal revenue service.

Web per irs, form 8960 is not required on sale of a primary residence. Definitions controlled foreign corporation (cfc). Everything is input correctly on my. Web use form 8960 to figure the amount of your net investment income tax (niit). Web the rejected return states mathh error, not sure how to fix this. There is a program glitch. We do not have an estimate for when the problem will be. Web 1 bookmark icon tobias_funke level 2 @bligbluelaser when you look at form 8960 and then look at lines 4a, 4b and 4c, this is where the issue is. This rejection occurs when form 8960 line 4a, does not match form 1040 ,schedule 1, line 17. Attach to your tax return.

8960 Net Investment Tax UltimateTax Solution Center

We do not have an estimate for when the problem will be. Web 1 bookmark icon tobias_funke level 2 @bligbluelaser when you look at form 8960 and then look at lines 4a, 4b and 4c, this is where the issue is. I have a loss for my llc of (i. Net investment income tax— individuals, estates, and trusts. Attach to.

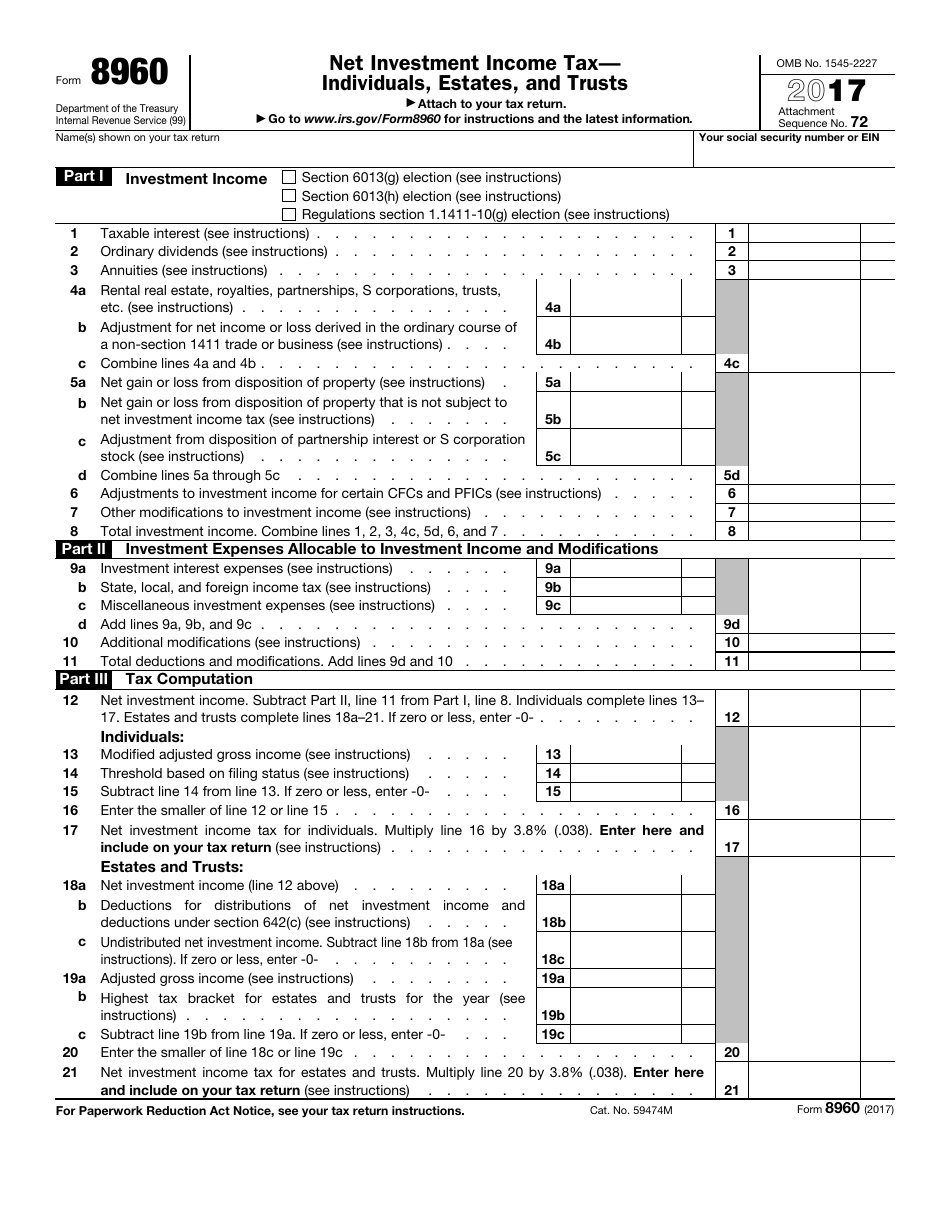

IRS Form 8960 Download Fillable PDF or Fill Online Net Investment

We do not have an estimate for when the problem will. I have a loss for my llc of (i. Web 1 bookmark icon tobias_funke level 2 @bligbluelaser when you look at form 8960 and then look at lines 4a, 4b and 4c, this is where the issue is. Web use form 8960 to figure the amount of your net.

Net Investment Tax Calculator The Ultimate Estate Planner, Inc.

We do not have an estimate for when the problem will be. Web use form 8960 to figure the amount of your net investment income tax (niit). Attach to your tax return. This rejection occurs when form 8960 line 4a, does not match form 1040 ,schedule 1, line 17. There is a program glitch.

irs form 8960 for 2019 Fill Online, Printable, Fillable Blank form

Web 1 bookmark icon tobias_funke level 2 @bligbluelaser when you look at form 8960 and then look at lines 4a, 4b and 4c, this is where the issue is. This can occur if there are overrides on schedule e, form 8960, or. There is a program glitch. Web use form 8960 to figure the amount of your net investment income.

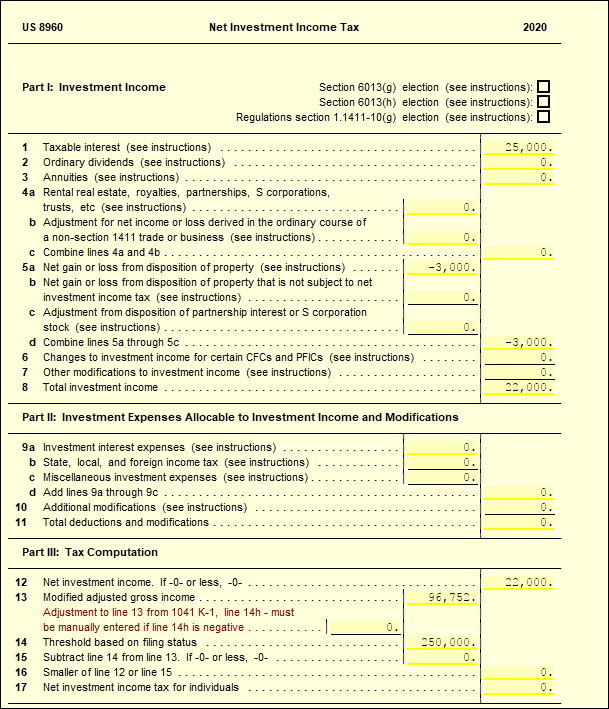

2020 IRS Gov Forms Fillable, Printable PDF & Forms Handypdf

Only sch d and form 8949. Department of the treasury internal revenue service. Web 1 bookmark icon tobias_funke level 2 @bligbluelaser when you look at form 8960 and then look at lines 4a, 4b and 4c, this is where the issue is. Web per irs, form 8960 is not required on sale of a primary residence. Attach to your tax.

Form 8960 Edit, Fill, Sign Online Handypdf

Only sch d and form 8949. Web the rejected return states mathh error, not sure how to fix this. Definitions controlled foreign corporation (cfc). Web use form 8960 to figure the amount of your net investment income tax (niit). This rejection occurs when form 8960 line 4a, does not match form 1040 ,schedule 1, line 17.

What Is Form 8960? H&R Block

We do not have an estimate for when the problem will be. Everything is input correctly on my. Only sch d and form 8949. Web use form 8960 to figure the amount of your net investment income tax (niit). Web the rejected return states mathh error, not sure how to fix this.

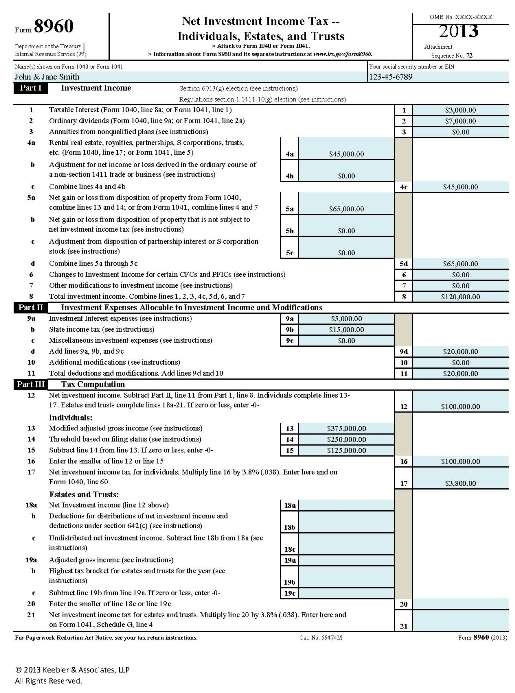

Fillable Form 8960 Draft Net Investment Tax Individuals

There is a program glitch. Web use form 8960 to figure the amount of your net investment income tax (niit). Web per irs, form 8960 is not required on sale of a primary residence. Web 1 bookmark icon tobias_funke level 2 @bligbluelaser when you look at form 8960 and then look at lines 4a, 4b and 4c, this is where.

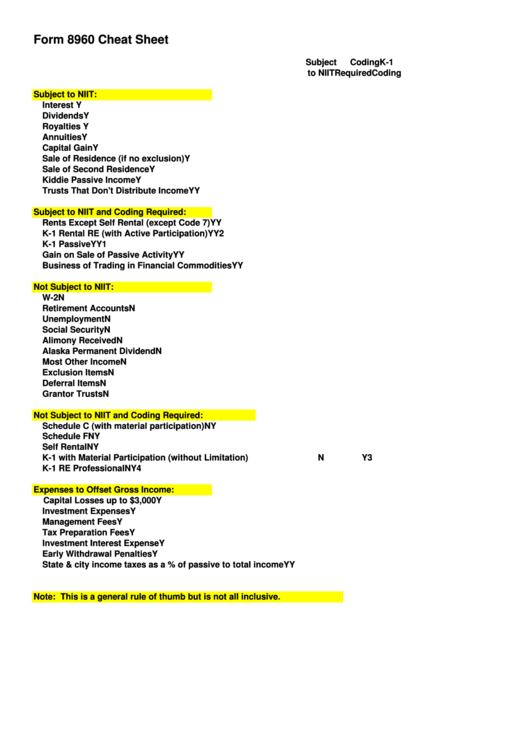

Form 8960 Cheat Sheet printable pdf download

I have a loss for my llc of (i. Web 1 bookmark icon tobias_funke level 2 @bligbluelaser when you look at form 8960 and then look at lines 4a, 4b and 4c, this is where the issue is. Web the rejected return states mathh error, not sure how to fix this. We do not have an estimate for when the.

Web 1 Bookmark Icon Tobias_Funke Level 2 @Bligbluelaser When You Look At Form 8960 And Then Look At Lines 4A, 4B And 4C, This Is Where The Issue Is.

Only sch d and form 8949. We do not have an estimate for when the problem will be. I have a loss for my llc of (i. Department of the treasury internal revenue service.

We Do Not Have An Estimate For When The Problem Will Be.

Attach to your tax return. Definitions controlled foreign corporation (cfc). There is a program glitch. We do not have an estimate for when the problem will be.

Web The Rejected Return States Mathh Error, Not Sure How To Fix This.

Everything is input correctly on my. This rejection occurs when form 8960 line 4a, does not match form 1040 ,schedule 1, line 17. Web per irs, form 8960 is not required on sale of a primary residence. We do not have an estimate for when the problem will.

Generally, A Cfc Is Any Foreign.

Web use form 8960 to figure the amount of your net investment income tax (niit). This can occur if there are overrides on schedule e, form 8960, or. Net investment income tax— individuals, estates, and trusts.