Form 8974 Instructions

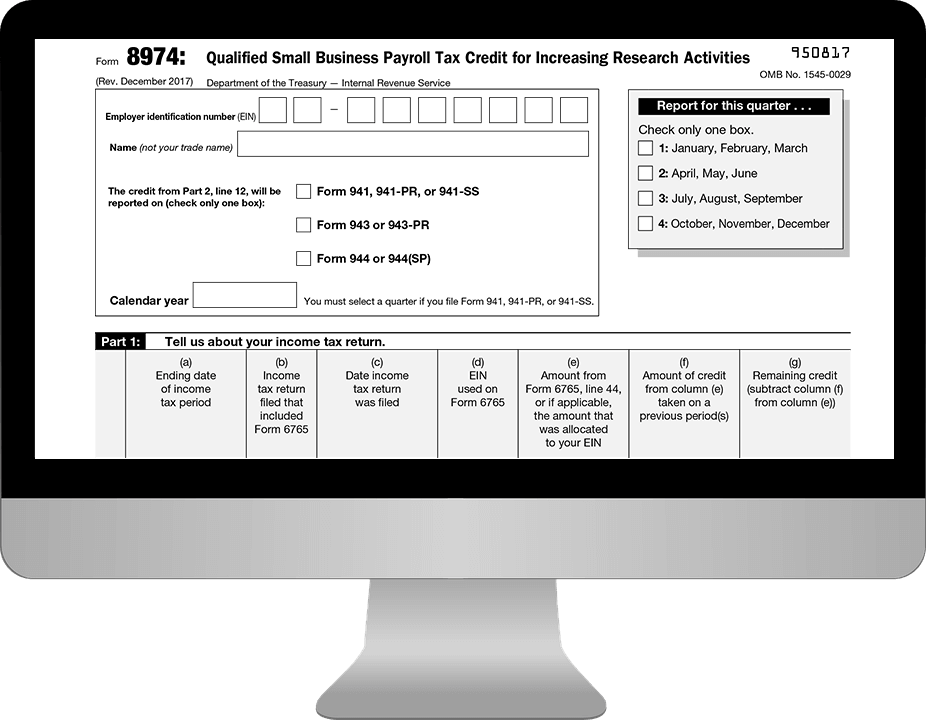

Form 8974 Instructions - Web in this video, you will learn all about irs form 8974, also known as the qualified small business payroll tax credit for increasing research activities.00:00. Web instructions for form 8974 (03/2023) qualified small business payroll tax credit for increasing research activities section references are to the internal revenue code unless otherwise noted. Web home instructions instructions for form 6765 (01/2023) instructions for form 6765 (01/2023) credit for increasing research activities section references are to the internal revenue code unless otherwise noted. Only qualified small businesses that elect to claim payroll tax credits should file form 8974. Election by qualified small business to claim payroll tax credit for increasing research activities other current. Instructions comments at the federal level, the internal revenue service gives many companies tax incentives for investing in their company’s future growth. Web instructions for form 8974 (print version) pdf recent developments none at this time. Qualified purpose —your research must have the purpose of either creating a new business component or improving an existing one. Web to be eligible for this tax credit, your business must meet these four criteria (and remember, if you’re filing form 8974, you must also meet the above requirements of a qualified small business): Employer identification number (ein) — name (not your trade name) the credit from part 2, line 12 or, if applicable,

Web in this video, you will learn all about irs form 8974, also known as the qualified small business payroll tax credit for increasing research activities.00:00. Web instructions for form 8974 (print version) pdf recent developments none at this time. Qualified purpose —your research must have the purpose of either creating a new business component or improving an existing one. Web to be eligible for this tax credit, your business must meet these four criteria (and remember, if you’re filing form 8974, you must also meet the above requirements of a qualified small business): After making an election to claim payroll tax credits, those employers can file form 8974 alongside form 941, 943, or 944 to claim their qualified small business. Only qualified small businesses that elect to claim payroll tax credits should file form 8974. Web irs form 8974 instructions by forrest baumhover 10 minutes watch video get the form! Web only employers who made elections when filing form 6765 can file form 8974. Instructions comments at the federal level, the internal revenue service gives many companies tax incentives for investing in their company’s future growth. Web home instructions instructions for form 6765 (01/2023) instructions for form 6765 (01/2023) credit for increasing research activities section references are to the internal revenue code unless otherwise noted.

Web instructions for form 8974 (03/2023) qualified small business payroll tax credit for increasing research activities section references are to the internal revenue code unless otherwise noted. Instructions comments at the federal level, the internal revenue service gives many companies tax incentives for investing in their company’s future growth. After making an election to claim payroll tax credits, those employers can file form 8974 alongside form 941, 943, or 944 to claim their qualified small business. Web instructions for form 8974 (print version) pdf recent developments none at this time. Employer identification number (ein) — name (not your trade name) the credit from part 2, line 12 or, if applicable, Qualified purpose —your research must have the purpose of either creating a new business component or improving an existing one. Web only employers who made elections when filing form 6765 can file form 8974. Web to be eligible for this tax credit, your business must meet these four criteria (and remember, if you’re filing form 8974, you must also meet the above requirements of a qualified small business): Election by qualified small business to claim payroll tax credit for increasing research activities other current. Web in this video, you will learn all about irs form 8974, also known as the qualified small business payroll tax credit for increasing research activities.00:00.

How to File Your Form 8974 with ADP Run

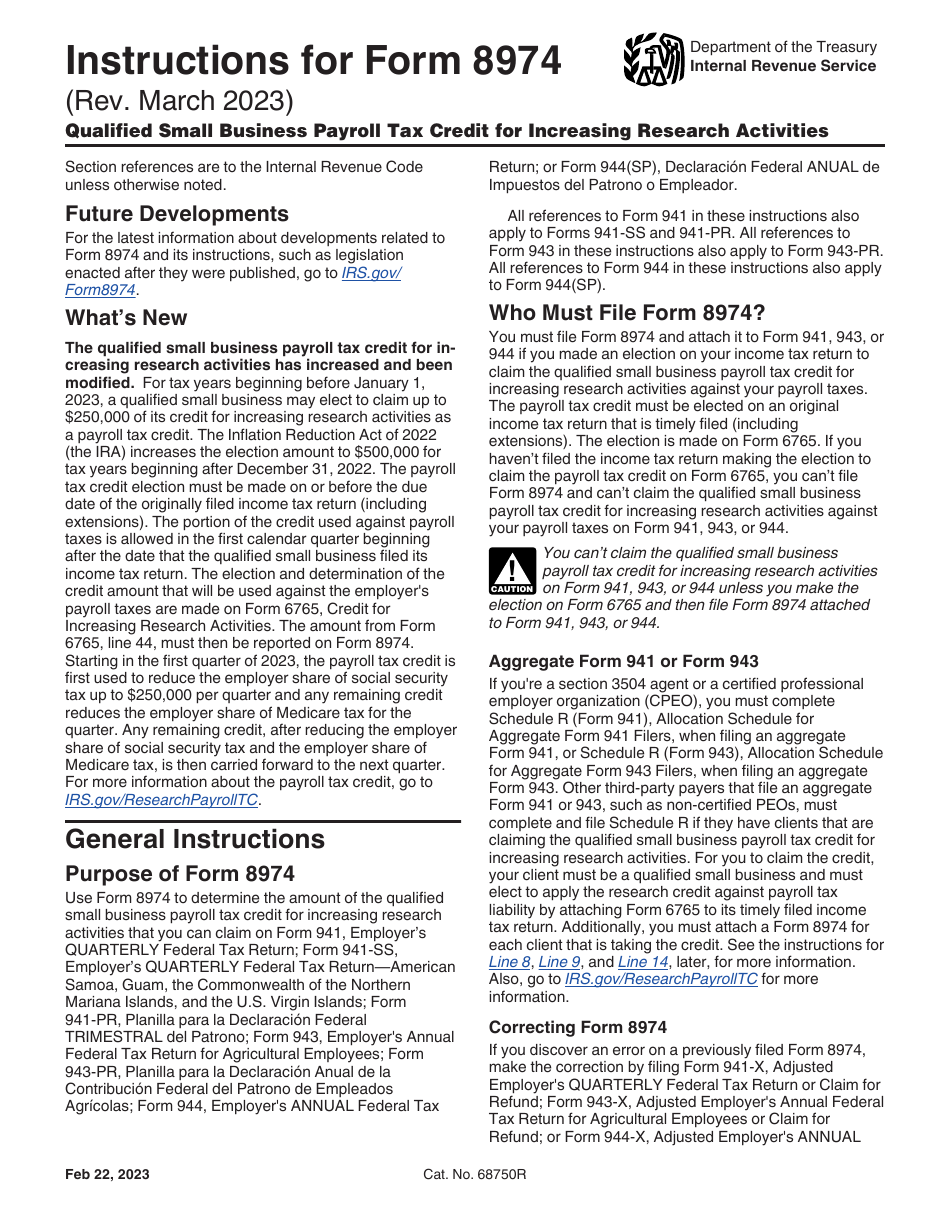

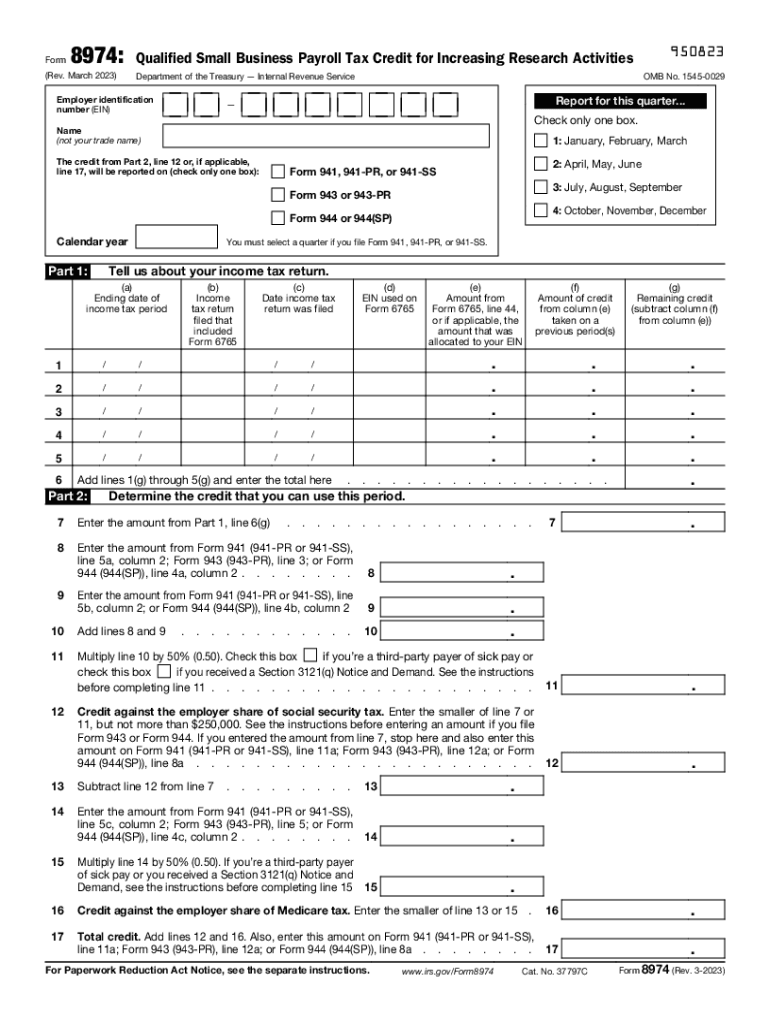

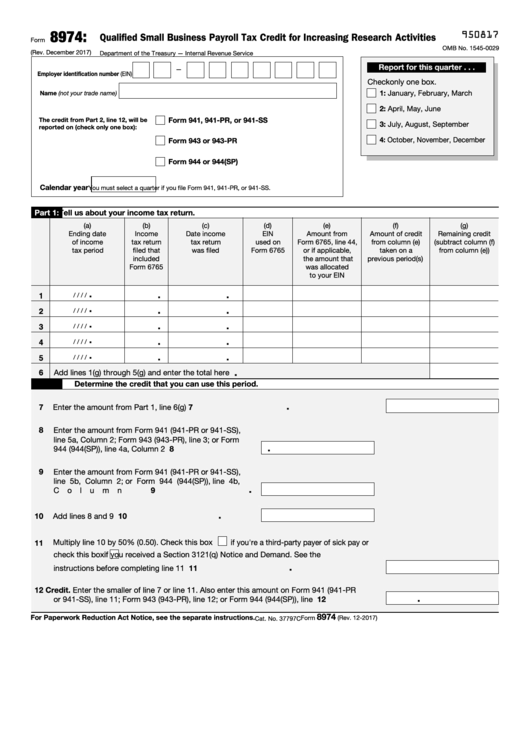

Instructions comments at the federal level, the internal revenue service gives many companies tax incentives for investing in their company’s future growth. Web instructions for form 8974 (03/2023) qualified small business payroll tax credit for increasing research activities section references are to the internal revenue code unless otherwise noted. Employer identification number (ein) — name (not your trade name) the.

8974 Form ≡ Fill Out Printable PDF Forms Online

Instructions comments at the federal level, the internal revenue service gives many companies tax incentives for investing in their company’s future growth. March 2023) qualified small business payroll tax credit for increasing research activities department of the treasury — internal revenue service omb no. Web home instructions instructions for form 6765 (01/2023) instructions for form 6765 (01/2023) credit for increasing.

2017 Form IRS 8974 Fill Online, Printable, Fillable, Blank pdfFiller

Employer identification number (ein) — name (not your trade name) the credit from part 2, line 12 or, if applicable, Web instructions for form 8974 (print version) pdf recent developments none at this time. Election by qualified small business to claim payroll tax credit for increasing research activities other current. After making an election to claim payroll tax credits, those.

2020 IRS Form 8974 Complete Online, Generate & Download for FREE

Web a qsb claiming the payroll tax credit on its employment tax return must complete form 8974, qualified small business payroll tax credit for increasing research activities, and attach the completed form to the employment tax return. Web instructions for form 8974 (print version) pdf recent developments none at this time. Web in this video, you will learn all about.

Form 8974 Everything You Want to Know [FAQs] Parachor Consulting

March 2023) qualified small business payroll tax credit for increasing research activities department of the treasury — internal revenue service omb no. Web only employers who made elections when filing form 6765 can file form 8974. Election by qualified small business to claim payroll tax credit for increasing research activities other current. Only qualified small businesses that elect to claim.

Download Instructions for IRS Form 8974 Qualified Small Business

After making an election to claim payroll tax credits, those employers can file form 8974 alongside form 941, 943, or 944 to claim their qualified small business. Web instructions for form 8974 (print version) pdf recent developments none at this time. Employer identification number (ein) — name (not your trade name) the credit from part 2, line 12 or, if.

Form 8974 Fill Out and Sign Printable PDF Template signNow

Qualified purpose —your research must have the purpose of either creating a new business component or improving an existing one. Web a qsb claiming the payroll tax credit on its employment tax return must complete form 8974, qualified small business payroll tax credit for increasing research activities, and attach the completed form to the employment tax return. Web to be.

Form 8974 Complete Guide & FAQs TaxRobot

Web irs form 8974 instructions by forrest baumhover 10 minutes watch video get the form! Web only employers who made elections when filing form 6765 can file form 8974. Instructions comments at the federal level, the internal revenue service gives many companies tax incentives for investing in their company’s future growth. March 2023) qualified small business payroll tax credit for.

Form 8974 Payroll Tax Credit

Web irs form 8974 instructions by forrest baumhover 10 minutes watch video get the form! Web only employers who made elections when filing form 6765 can file form 8974. After making an election to claim payroll tax credits, those employers can file form 8974 alongside form 941, 943, or 944 to claim their qualified small business. Election by qualified small.

Fillable Form 8974 Qualified Small Business Payroll Tax Credit For

Web home instructions instructions for form 6765 (01/2023) instructions for form 6765 (01/2023) credit for increasing research activities section references are to the internal revenue code unless otherwise noted. Web instructions for form 8974 (print version) pdf recent developments none at this time. Web to be eligible for this tax credit, your business must meet these four criteria (and remember,.

Web To Be Eligible For This Tax Credit, Your Business Must Meet These Four Criteria (And Remember, If You’re Filing Form 8974, You Must Also Meet The Above Requirements Of A Qualified Small Business):

Web home instructions instructions for form 6765 (01/2023) instructions for form 6765 (01/2023) credit for increasing research activities section references are to the internal revenue code unless otherwise noted. Instructions comments at the federal level, the internal revenue service gives many companies tax incentives for investing in their company’s future growth. Employer identification number (ein) — name (not your trade name) the credit from part 2, line 12 or, if applicable, Only qualified small businesses that elect to claim payroll tax credits should file form 8974.

Web In This Video, You Will Learn All About Irs Form 8974, Also Known As The Qualified Small Business Payroll Tax Credit For Increasing Research Activities.00:00.

After making an election to claim payroll tax credits, those employers can file form 8974 alongside form 941, 943, or 944 to claim their qualified small business. March 2023) qualified small business payroll tax credit for increasing research activities department of the treasury — internal revenue service omb no. Election by qualified small business to claim payroll tax credit for increasing research activities other current. Web irs form 8974 instructions by forrest baumhover 10 minutes watch video get the form!

Qualified Purpose —Your Research Must Have The Purpose Of Either Creating A New Business Component Or Improving An Existing One.

Web only employers who made elections when filing form 6765 can file form 8974. Web instructions for form 8974 (print version) pdf recent developments none at this time. Web instructions for form 8974 (03/2023) qualified small business payroll tax credit for increasing research activities section references are to the internal revenue code unless otherwise noted. Web a qsb claiming the payroll tax credit on its employment tax return must complete form 8974, qualified small business payroll tax credit for increasing research activities, and attach the completed form to the employment tax return.

![Form 8974 Everything You Want to Know [FAQs] Parachor Consulting](https://parachorconsulting.com/wp-content/uploads/2021/09/female-tax-consultant-1024x576.jpg)