Form 926 Filing Requirement

Form 926 Filing Requirement - You do not need to report. Web a corporation (other than an s corporation) must complete and file form 8926 if it paid or accrued disqualified interest during the current tax year or had a. The covered transfers are described in irc section. Web october 25, 2022 resource center forms form 926 for u.s. Taxpayer must complete form 926, return by a u.s. Web a domestic distributing corporation making a distribution of the stock or securities of a domestic corporation under section 355 is not required to file a form 926, as described. Web to fulfill this reporting obligation, the u.s. Citizens and residents to file the form 926: Citizen or resident, a domestic corporation, or a domestic estate or trust must complete and file form 926 to report certain transfers of property. Transferor of property to a foreign corporation.

Citizen or resident, a domestic corporation, or a domestic estate or trust must complete and file form 926 to report certain transfers of property. Web a domestic distributing corporation making a distribution of the stock or securities of a domestic corporation under section 355 is not required to file a form 926, as described. You do not need to report. Enter the corporation's taxable income or (loss) before the nol deduction,. Special rule for a partnership interest owned on. Transferor of property to a foreign corporation. Expats at a glance learn more about irs form 926 and if you’re required to file for exchanging. Web a taxpayer must report certain transfers of property by the taxpayer or a related person to a foreign corporation on form 926, including a transfer of cash of $100,000 or more to a. Web to fulfill this reporting obligation, the u.s. Web the irs requires certain u.s.

Web a domestic distributing corporation making a distribution of the stock or securities of a domestic corporation under section 355 is not required to file a form 926, as described. Citizen or resident, a domestic corporation, or a domestic estate or trust must complete and file form 926 to report certain transfers of property. Web taxpayers making these transfers must file form 926 and include the form with their individual income tax return in the year of the transfer. Web to fulfill this reporting obligation, the u.s. Citizens and residents to file the form 926: Web october 25, 2022 resource center forms form 926 for u.s. Transferor of property to a foreign corporation. Enter the corporation's taxable income or (loss) before the nol deduction,. Web this form applies to both domestic corporations as well as u.s. Expats at a glance learn more about irs form 926 and if you’re required to file for exchanging.

Form 926 Filing Requirements New Jersey Accountant Tax Reduction

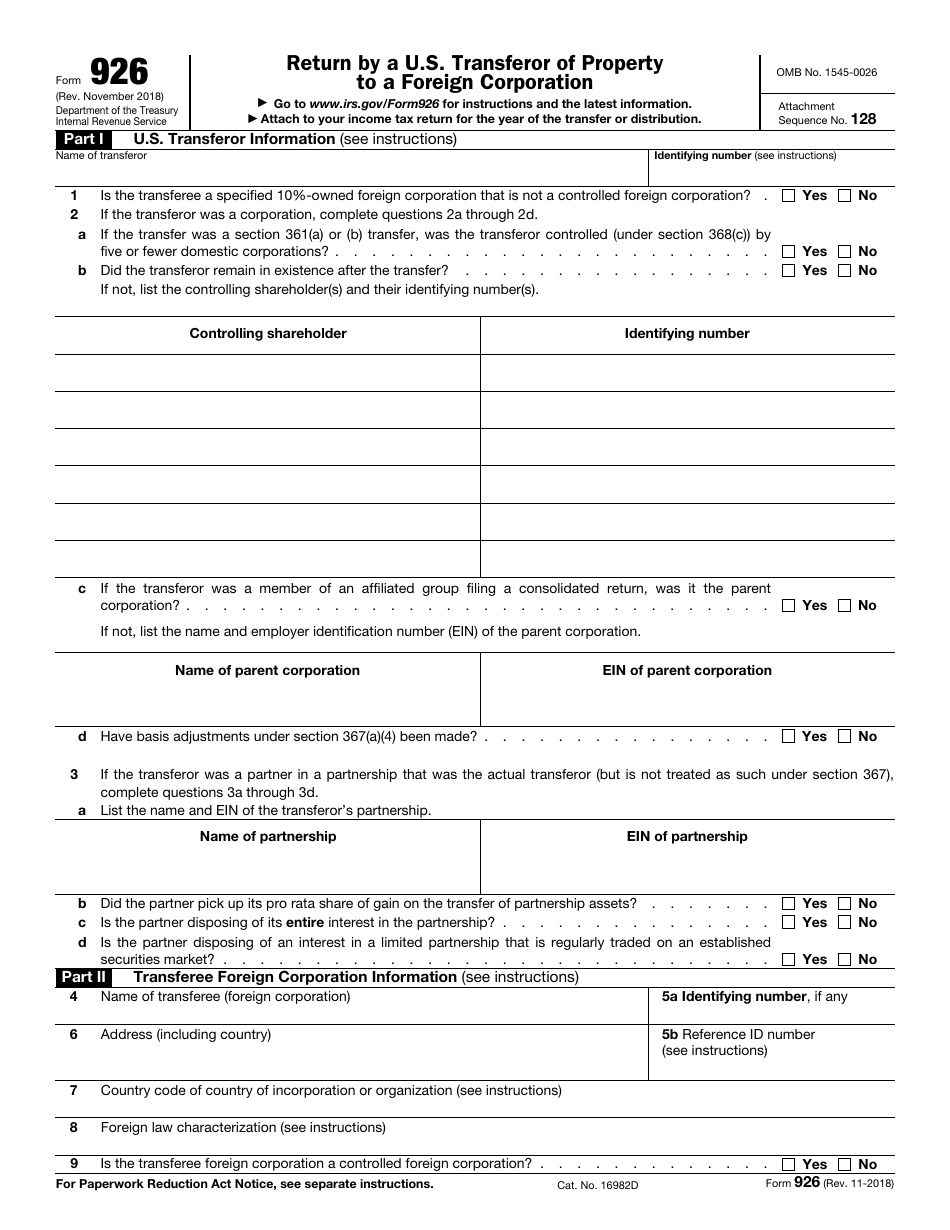

The covered transfers are described in irc section. Citizens, resident individuals, and trusts. Web october 25, 2022 resource center forms form 926 for u.s. Web new form 926 filing requirements the irs and the treasury department have expanded the reporting requirements associated with form 926, return by a u.s. November 2018) department of the treasury internal revenue service.

Sample Form 2

Enter the corporation's taxable income or (loss) before the nol deduction,. Taxpayer must complete form 926, return by a u.s. Web this form applies to both domestic corporations as well as u.s. Citizens and residents to file the form 926: Transferor of property to a foreign corporation.

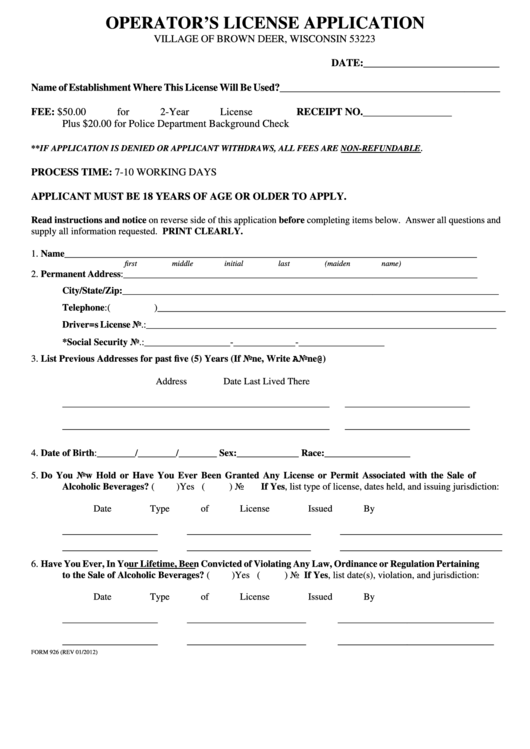

Form 926 Operator'S License Application Village Of Brown Deer

Web the irs requires certain u.s. Web this form applies to both domestic corporations as well as u.s. November 2018) department of the treasury internal revenue service. Web new form 926 filing requirements the irs and the treasury department have expanded the reporting requirements associated with form 926, return by a u.s. Web october 25, 2022 resource center forms form.

AVOIDING TAX OFFSHORE WITH FORM 926 YouTube

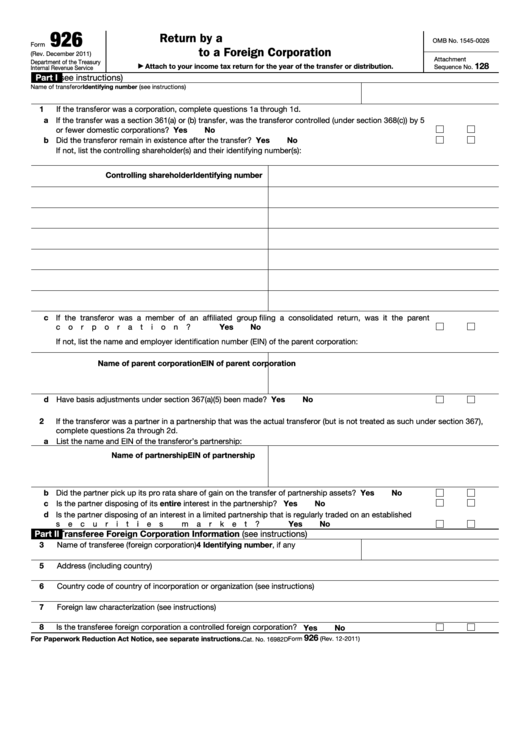

November 2018) department of the treasury internal revenue service. Special rule for a partnership interest owned on. Web (ii) filing a form 926 (modified to reflect that the transferee is a partnership, not a corporation) with the taxpayer's income tax return (including a partnership return of. Transferor of property to a foreign corporation. Transferors of property to a foreign corporation.

Fillable Form 926 (Rev. December 2011) Return By A U.s. Transferor Of

Transferor of property to a foreign corporation. Transferor of property to a foreign corporation was filed by the partnership and sent to you for information. Web (ii) filing a form 926 (modified to reflect that the transferee is a partnership, not a corporation) with the taxpayer's income tax return (including a partnership return of. Web new form 926 filing requirements.

Form 926Return by a U.S. Transferor of Property to a Foreign Corpora…

Special rule for a partnership interest owned on. Transferors of property to a foreign corporation. Web taxpayers making these transfers must file form 926 and include the form with their individual income tax return in the year of the transfer. The covered transfers are described in irc section. You do not need to report.

Form 926Return by a U.S. Transferor of Property to a Foreign Corpora…

Taxable income or (loss) before net operating loss deduction. Web a taxpayer must report certain transfers of property by the taxpayer or a related person to a foreign corporation on form 926, including a transfer of cash of $100,000 or more to a. Taxpayer must complete form 926, return by a u.s. Web this form applies to both domestic corporations.

IRS Form 926 Download Fillable PDF or Fill Online Return by a U.S

Citizen or resident, a domestic corporation, or a domestic estate or trust must complete. Enter the corporation's taxable income or (loss) before the nol deduction,. Web october 25, 2022 resource center forms form 926 for u.s. Citizen or resident, a domestic corporation, or a domestic estate or trust must complete and file form 926 to report certain transfers of property..

Form 926 Return by a U.S. Transferor of Property to a Foreign

Web this form applies to both domestic corporations as well as u.s. Form 926 must be filed by a u.s. You do not need to report. Web a domestic distributing corporation making a distribution of the stock or securities of a domestic corporation under section 355 is not required to file a form 926, as described. Citizens and residents to.

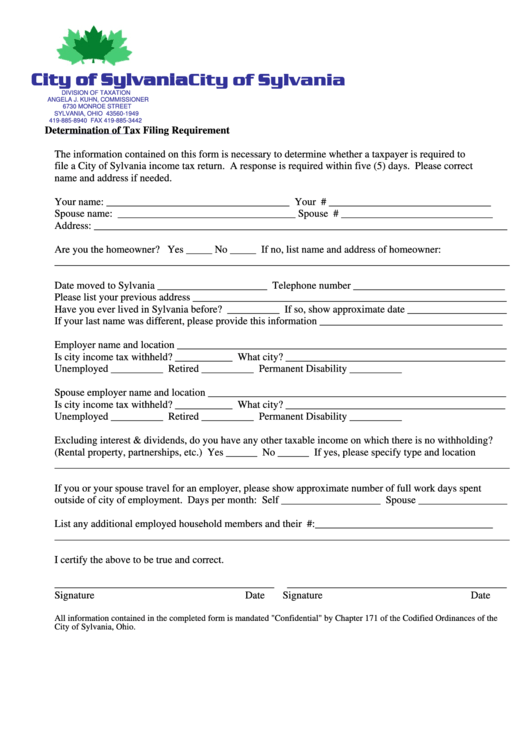

Determination Of Tax Filing Requirement Form Division Of Taxation

Taxable income or (loss) before net operating loss deduction. Expats at a glance learn more about irs form 926 and if you’re required to file for exchanging. Person who transfers property to a foreign. Transferors of property to a foreign corporation. Citizen or resident, a domestic corporation, or a domestic estate or trust must complete and file form 926 to.

Web Taxpayers Making These Transfers Must File Form 926 And Include The Form With Their Individual Income Tax Return In The Year Of The Transfer.

Citizen or resident, a domestic corporation, or a domestic estate or trust must complete and file form 926 to report certain transfers of property. Taxable income or (loss) before net operating loss deduction. Web october 25, 2022 resource center forms form 926 for u.s. Form 926 must be filed by a u.s.

Transferor Of Property To A Foreign Corporation.

Web a corporation (other than an s corporation) must complete and file form 8926 if it paid or accrued disqualified interest during the current tax year or had a. Web the irs requires certain u.s. Web new form 926 filing requirements the irs and the treasury department have expanded the reporting requirements associated with form 926, return by a u.s. Web to fulfill this reporting obligation, the u.s.

Transferors Of Property To A Foreign Corporation.

This article will focus briefly on the. November 2018) department of the treasury internal revenue service. Web this form applies to both domestic corporations as well as u.s. Transferor of property to a foreign corporation.

Citizens, Resident Individuals, And Trusts.

Expats at a glance learn more about irs form 926 and if you’re required to file for exchanging. Taxpayer must complete form 926, return by a u.s. Person who transfers property to a foreign. Transferor of property to a foreign corporation was filed by the partnership and sent to you for information.