Form 941-X Employee Retention Credit

Form 941-X Employee Retention Credit - Web 2 days agojul 31, 2023. Irs commissioner danny werfel is calling for a potential early end to the employee retention credit as the number of what he called “legitimate. Talk to our skilled attorneys about the employee retention credit. Web using worksheet 2 to update form 941x: Complete the required fields, including your ein, the quarter you are filing for, company name, and year. Qualified health plan expenses allocable to the employee retention credit are. Gather your 941, payroll log,. Qualified health plan expenses allocable to the employee retention credit. Web you have two options to file: Didn’t get requested ppp loan forgiveness?

Web you have two options to file: If you believe your company is eligible to receive the employee. Web irs form 941 is the form you regularly file quarterly with your payroll. Irs commissioner danny werfel is calling for a potential early end to the employee retention credit as the number of what he called “legitimate. Ad stentam is the nations leading tax technology firm. Qualified health plan expenses allocable to the employee retention credit. Ad get a payroll tax refund & receive up to $26k per employee even if you received ppp funds. Web using worksheet 2 to update form 941x: To claim the employee retention credit, utilize line 11c in form 941, and worksheet 1. Many people do not know.

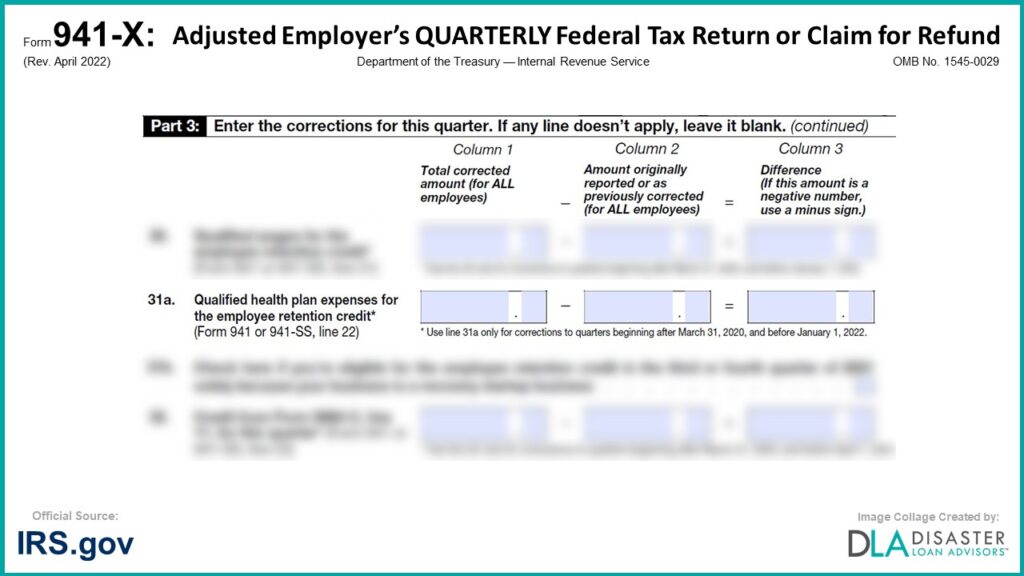

Web you have two options to file: Mark whether the form is for an adjusted employment tax return or claim (you can only check off one). Web using worksheet 2 to update form 941x: You will use worksheet 2 to make changes to the refundable portion of the employee tax credit that. Qualified health plan expenses allocable to the employee retention credit. To complete the form, you’ll need to. Claim your ercs with confidence today. Ad stentam is the nations leading tax technology firm. If you believe your company is eligible to receive the employee. Ad unsure if you qualify for erc?

What You Need to Know About Just Released IRS Form 941X Blog

Qualified health plan expenses allocable to the employee retention credit are. Mark whether the form is for an adjusted employment tax return or claim (you can only check off one). Didn’t get requested ppp loan forgiveness? Ad get a payroll tax refund & receive up to $26k per employee even if you received ppp funds. If you believe your company.

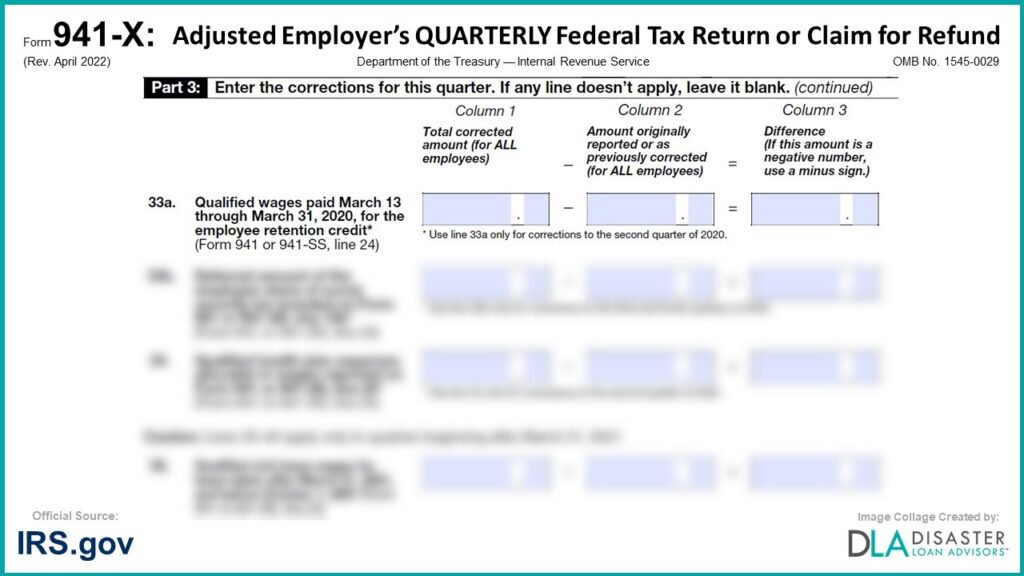

941X 33a. Qualified Wages Paid March 13 Through March 31, 2020, for

Web consequently, most employers will need to instead file an amended return or claim for refund for the quarters ended in june, september and december of 2020 using. If you claimed the employee retention credit for wages paid after june 30, 2021, and before january 1, 2022, and you make any. If you believe your company is eligible to receive.

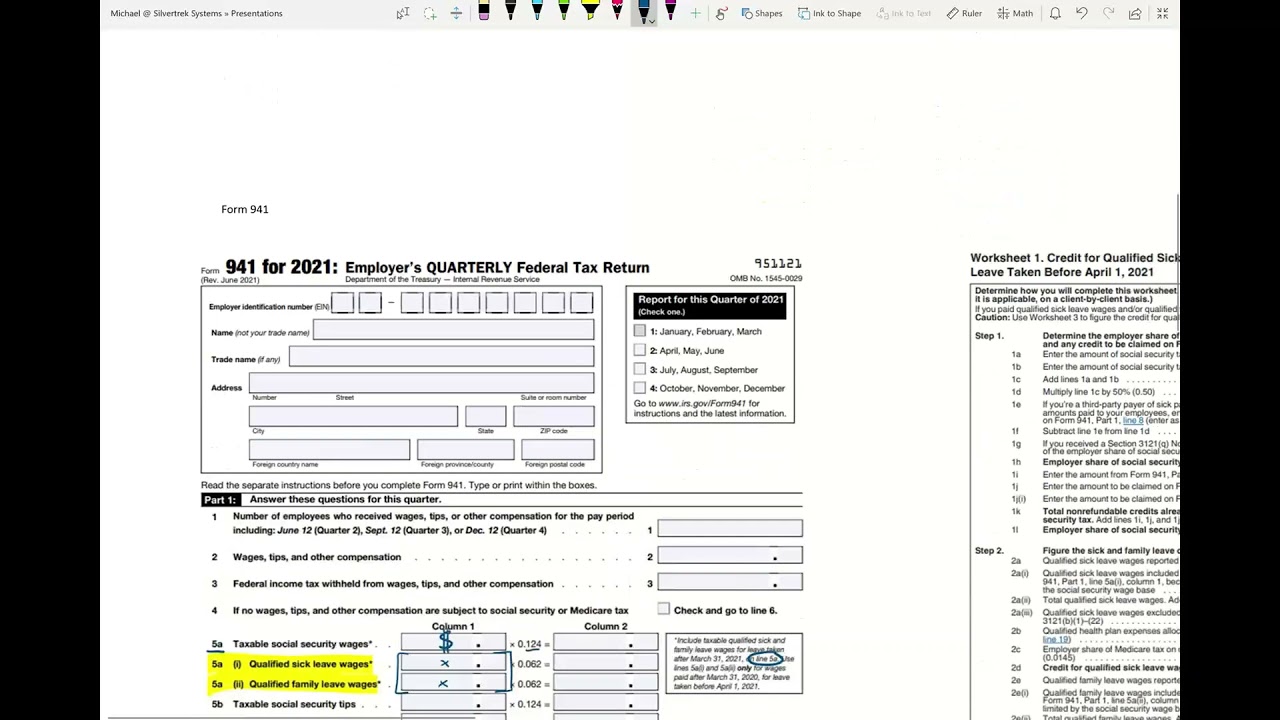

Updated 941 and Employee Retention Credit in Vista YouTube

If you believe your company is eligible to receive the employee. Web 2 days agojul 31, 2023. Qualified health plan expenses allocable to the employee retention credit are. Talk to our skilled attorneys about the employee retention credit. To complete the form, you’ll need to.

Employee Retention Credit (ERC) Form 941X Everything You Need to Know

Web consequently, most employers will need to instead file an amended return or claim for refund for the quarters ended in june, september and december of 2020 using. Web once you have the form, follow these steps: Irs commissioner danny werfel is calling for a potential early end to the employee retention credit as the number of what he called.

Employee Retention Credit Form MPLOYME

Web irs form 941 is the form you regularly file quarterly with your payroll. Ad stentam is the nations leading tax technology firm. Ad unsure if you qualify for erc? Claim your ercs with confidence today. Web once you have the form, follow these steps:

How To Fill Out Form 941 X For Employee Retention Credit In 2020

Ad stentam is the nations leading tax technology firm. Didn’t get requested ppp loan forgiveness? “the irs claims to have doubled the amount of employee. To claim the employee retention credit, utilize line 11c in form 941, and worksheet 1. Web you have two options to file:

941X 31a. Qualified Health Plan Expenses for the Employee Retention

Ad stentam is the nations leading tax technology firm. Work with an experienced professional. Claim your ercs with confidence today. Web once you have the form, follow these steps: Qualified health plan expenses allocable to the employee retention credit.

COVID19 Relief Legislation Expands Employee Retention Credit

To complete the form, you’ll need to. Web irs form 941 is the form you regularly file quarterly with your payroll. You will use worksheet 2 to make changes to the refundable portion of the employee tax credit that. Web using worksheet 2 to update form 941x: Web you have two options to file:

How to Complete & Download Form 941X (Amended Form 941)?

You will use worksheet 2 to make changes to the refundable portion of the employee tax credit that. Web you have two options to file: Work with an experienced professional. Gather your 941, payroll log,. To complete the form, you’ll need to.

How to Claim ERTC Retroactive Employee Retention Tax Credit [Form 941

Work with an experienced professional. Web irs form 941 is the form you regularly file quarterly with your payroll. Web using worksheet 2 to update form 941x: Ad stentam is the nations leading tax technology firm. Web 2 days agothe employee retention credit, or erc,.

Ad Unsure If You Qualify For Erc?

Irs commissioner danny werfel is calling for a potential early end to the employee retention credit as the number of what he called “legitimate. Web 2 days agojul 31, 2023. Mark whether the form is for an adjusted employment tax return or claim (you can only check off one). Didn’t get requested ppp loan forgiveness?

Web Irs Form 941 Is The Form You Regularly File Quarterly With Your Payroll.

“the irs claims to have doubled the amount of employee. Ad stentam is the nations leading tax technology firm. Work with an experienced professional. Many people do not know.

To Claim The Employee Retention Credit, Utilize Line 11C In Form 941, And Worksheet 1.

To complete the form, you’ll need to. Talk to our skilled attorneys about the employee retention credit. Web consequently, most employers will need to instead file an amended return or claim for refund for the quarters ended in june, september and december of 2020 using. Web using worksheet 2 to update form 941x:

If You Claimed The Employee Retention Credit For Wages Paid After June 30, 2021, And Before January 1, 2022, And You Make Any.

If you believe your company is eligible to receive the employee. Web 2 days agothe employee retention credit, or erc,. Gather your 941, payroll log,. Claim your ercs with confidence today.