Form 941 X Erc Example

Form 941 X Erc Example - Businesses can receive up to $26k per eligible employee. Note that we cannot give any tax advice as to whether your erc wages. Here is what you need to know. A catering business with 10 employees faqs about the erc 1. To learn more about how. Employer a received a ppp loan of $100,000. There is no cost to you until you receive the funds from the irs. Any employer that began carrying on a trade or business after february 15, 2020, with average annual gross receipts for the three prior. Employer a is an eligible employer and paid $100,000 in qualified wages that would qualify for the erc. Web the tax deferral and credits are reportable on an employer’s form 941, employer’s quarterly federal tax return, starting with the second calendar quarter of.

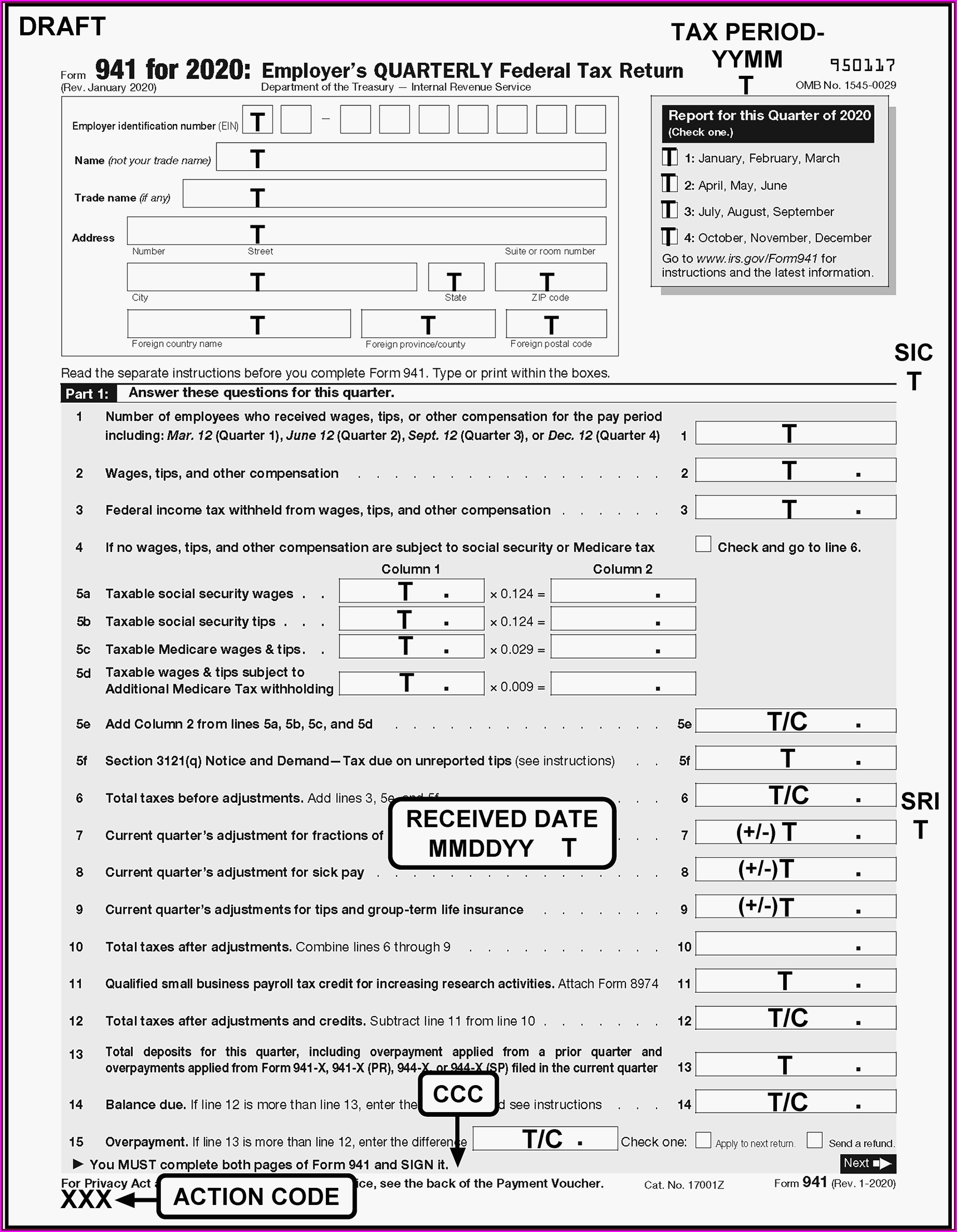

Fill in the required details on the page header, such as the ein number, quarter, company name, and year. Is it too late to claim the erc? A catering business with 10 employees faqs about the erc 1. Web did you determine you can take the employee retention tax credit and need to submit a 941x to update your information for 2020 through the 2nd quarter 2021? Web for example, if you filed the first three quarterly returns in 2017 and you filed the fourth quarter form 941 on january 31, 2018, the irs treats all tax returns as though they were. Here is what you need to know. Employer a is an eligible employer and paid $100,000 in qualified wages that would qualify for the erc. Note that we cannot give any tax advice as to whether your erc wages. There are many other factors to consider. Web this guide explains how to fill out the 941x form.

Is it too late to claim the erc? You can also report changes to qualified wages for the employee retention credit for the time period. There are many other factors to consider. Web using worksheet 4 to update form 941x: A catering business with 10 employees faqs about the erc 1. See if you do in 2 min. Businesses can receive up to $26k per eligible employee. Web the tax deferral and credits are reportable on an employer’s form 941, employer’s quarterly federal tax return, starting with the second calendar quarter of. Web we will use a 2021 example since this is the most common year for erc corrections. To learn more about how.

How to Complete & Download Form 941X (Amended Form 941)?

Web for example, if you filed the first three quarterly returns in 2017 and you filed the fourth quarter form 941 on january 31, 2018, the irs treats all tax returns as though they were. Companies qualify to get up to $26,000 per employee. To learn more about how. Web using worksheet 4 to update form 941x: See if you.

erc form download romanholidayvannuys

Web did you determine you can take the employee retention tax credit and need to submit a 941x to update your information for 2020 through the 2nd quarter 2021? Web using worksheet 4 to update form 941x: Any employer that began carrying on a trade or business after february 15, 2020, with average annual gross receipts for the three prior..

Worksheet 1 941x

Web did you determine you can take the employee retention tax credit and need to submit a 941x to update your information for 2020 through the 2nd quarter 2021? Web using worksheet 4 to update form 941x: April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Web.

Irs.gov Form 941 X Instructions Form Resume Examples 1ZV8dX3V3X

To learn more about how. You can also report changes to qualified wages for the employee retention credit for the time period. A catering business with 10 employees faqs about the erc 1. Any employer that began carrying on a trade or business after february 15, 2020, with average annual gross receipts for the three prior. Web we will use.

How To Fill Out 941X For Employee Retention Credit [Stepwise Guide

Note that we cannot give any tax advice as to whether your erc wages. Web the tax deferral and credits are reportable on an employer’s form 941, employer’s quarterly federal tax return, starting with the second calendar quarter of. A nonprofit with 20 employees example 2: You can also report changes to qualified wages for the employee retention credit for.

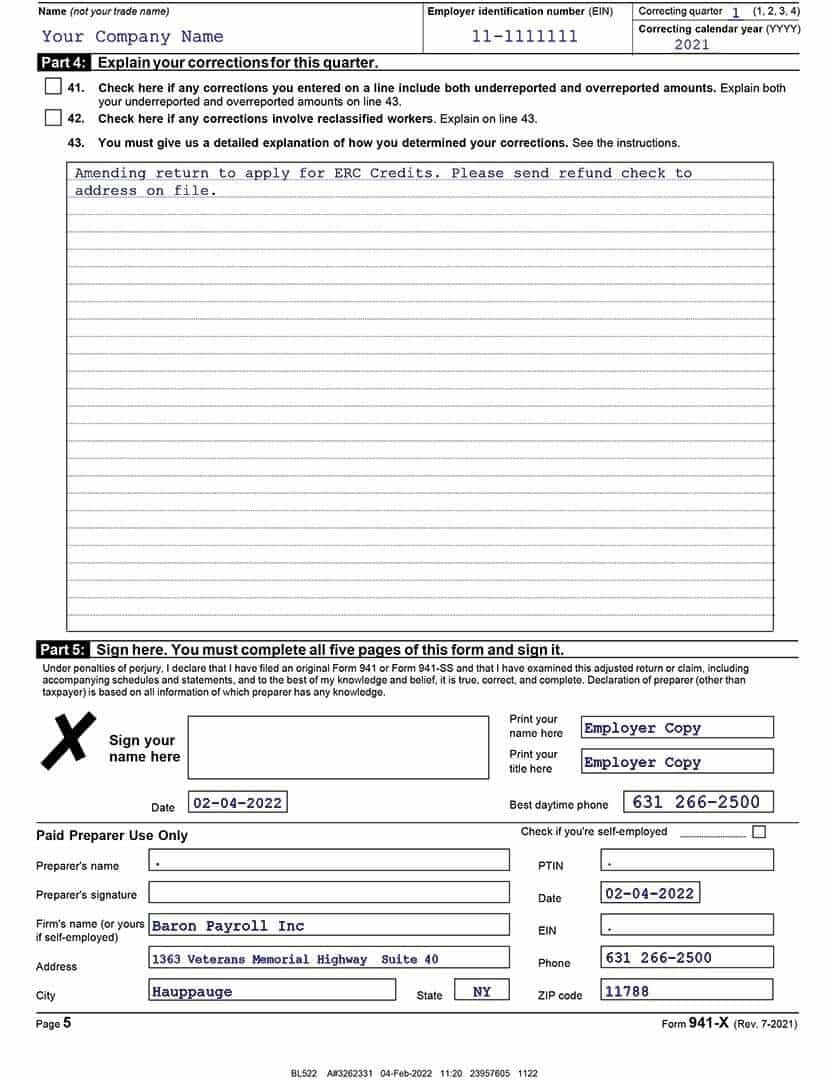

StepbyStep How to Guide to Filing Your 941X ERTC Baron Payroll

Is it too late to claim the erc? There are many other factors to consider. A catering business with 10 employees faqs about the erc 1. Employer a is an eligible employer and paid $100,000 in qualified wages that would qualify for the erc. Employer a received a ppp loan of $100,000.

How to fill out IRS Form 941 2019 PDF Expert

A nonprofit with 20 employees example 2: Employer a received a ppp loan of $100,000. There is no cost to you until you receive the funds from the irs. A catering business with 10 employees faqs about the erc 1. Web this guide explains how to fill out the 941x form.

StepbyStep How to Guide to Filing Your 941X ERTC Baron Payroll

Businesses can receive up to $26k per eligible employee. Any employer that began carrying on a trade or business after february 15, 2020, with average annual gross receipts for the three prior. A nonprofit with 20 employees example 2: Web did you determine you can take the employee retention tax credit and need to submit a 941x to update your.

Worksheet 1 941x

A nonprofit with 20 employees example 2: Any employer that began carrying on a trade or business after february 15, 2020, with average annual gross receipts for the three prior. Here is what you need to know. Web for example, if you filed the first three quarterly returns in 2017 and you filed the fourth quarter form 941 on january.

How to File IRS Form 941X Instructions & ERC Guidelines

Web we will use a 2021 example since this is the most common year for erc corrections. April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. To learn more about how. Web the tax deferral and credits are reportable on an employer’s form 941, employer’s quarterly federal.

There Is No Cost To You Until You Receive The Funds From The Irs.

Web for example, if you filed the first three quarterly returns in 2017 and you filed the fourth quarter form 941 on january 31, 2018, the irs treats all tax returns as though they were. To learn more about how. Fill in the required details on the page header, such as the ein number, quarter, company name, and year. A nonprofit with 20 employees example 2:

Web Using Worksheet 4 To Update Form 941X:

Businesses can receive up to $26k per eligible employee. Web this guide explains how to fill out the 941x form. Web the tax deferral and credits are reportable on an employer’s form 941, employer’s quarterly federal tax return, starting with the second calendar quarter of. Employer a received a ppp loan of $100,000.

See If You Do In 2 Min.

Web we will use a 2021 example since this is the most common year for erc corrections. Companies qualify to get up to $26,000 per employee. Is it too late to claim the erc? Employer a is an eligible employer and paid $100,000 in qualified wages that would qualify for the erc.

Note That We Cannot Give Any Tax Advice As To Whether Your Erc Wages.

You can also report changes to qualified wages for the employee retention credit for the time period. Businesses can receive up to $26k per eligible employee. Here is what you need to know. A catering business with 10 employees faqs about the erc 1.