Form 941-X Instructions For Employee Retention Credit

Form 941-X Instructions For Employee Retention Credit - Web form 941 x is the main tax form used to file an amended return to claim the employee retention credit. Web the employee retention credit for wages paid march 13, 2020, through march 31, 2020, is claimed on form 941 for the second quarter of 2020; However, to properly show the amount as a credit. Web for wages paid before july 1, 2021, the nonrefundable portion of the employee retention credit is against the employer share of social security tax. Web consequently, most employers will need to instead file an amended return or claim for refund for the quarters ended in june, september and december of 2020 using. Web employee retention credit, including the dates for which the credit may be claimed, go to irs.gov/erc. Complete the company information on each page, the. Enter the calendar year of the quarter you’re correcting, and select the date you discovered. Employers who underreported payroll tax should correct errors in the period. For all quarters you qualify for, get your original 941, a blank 941.

Web form 941x is not just for claiming the ertc; However, to properly show the amount as a credit. Web for wages paid before july 1, 2021, the nonrefundable portion of the employee retention credit is against the employer share of social security tax. Determine which payroll quarters in 2020 and 2021 your business qualifies for. 941 x instructions can be somewhat confusing, so let’s look deeper into. Web the employee retention credit for wages paid march 13, 2020, through march 31, 2020, is claimed on form 941 for the second quarter of 2020; June 6, 2022 last updated: Web full time and part time employees qualify. Employers who underreported payroll tax should correct errors in the period. Web employee retention credit, including the dates for which the credit may be claimed, go to irs.gov/erc.

Web the employee retention credit is a complex credit that requires careful review before applying. Employers who underreported payroll tax should correct errors in the period. Therefore, any corrections to the. Enter the calendar year of the quarter you’re correcting, and select the date you discovered. Ad get a payroll tax refund & receive up to $26k per employee even if you received ppp funds. Web employee retention credit, including the dates for which the credit may be claimed, go to irs.gov/erc. Web form 941 x is the main tax form used to file an amended return to claim the employee retention credit. For all quarters you qualify for, get your original 941, a blank 941. Web form 941x is not just for claiming the ertc; Large upfront fees to claim the credit.

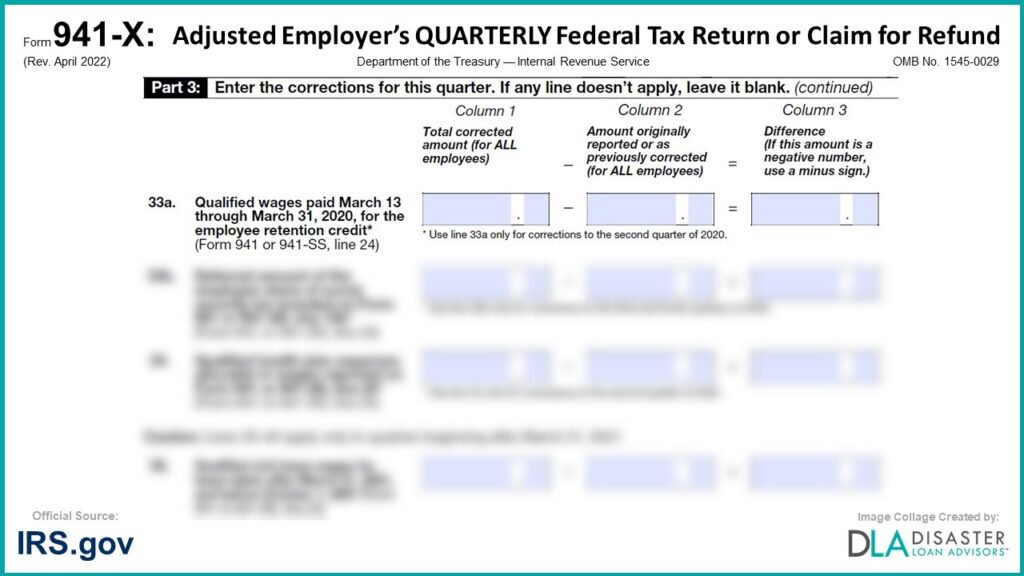

941X 33a. Qualified Wages Paid March 13 Through March 31, 2020, for

June 6, 2022 last updated: Employers who underreported payroll tax should correct errors in the period. Web the employee retention credit is a complex credit that requires careful review before applying. January 13, 2023 see more in: Ad get a payroll tax refund & receive up to $26k per employee even if you received ppp funds.

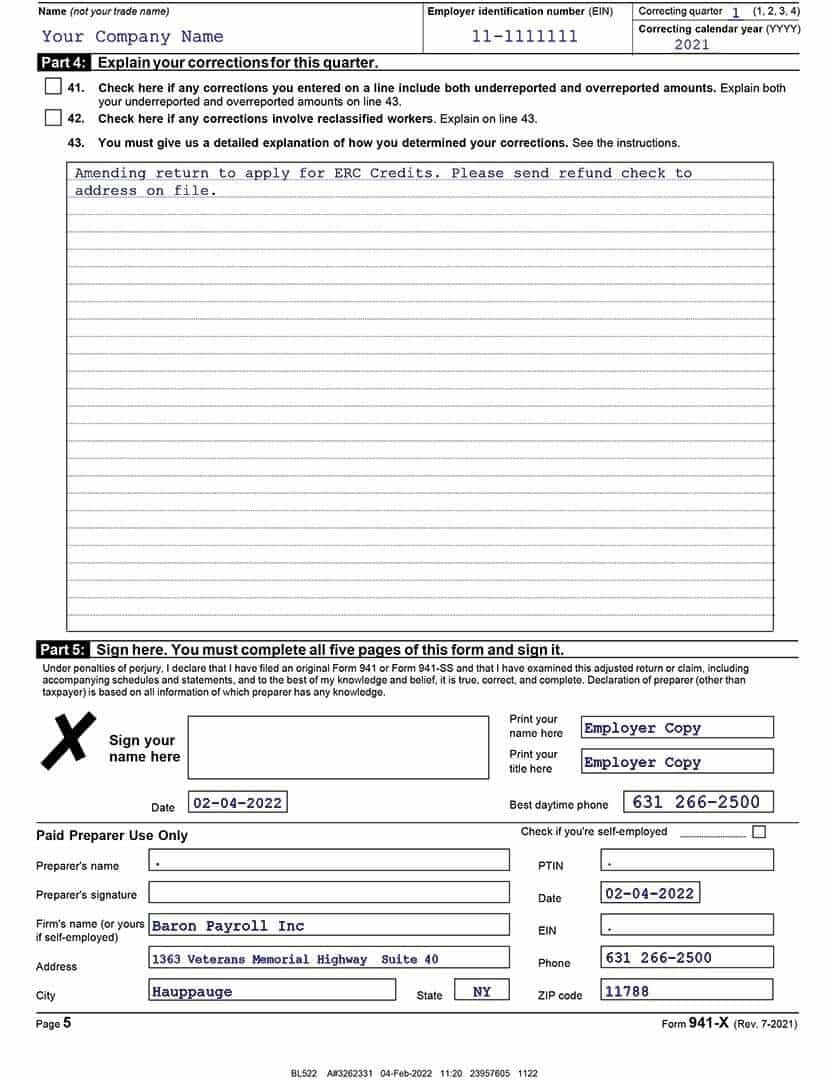

StepbyStep How to Guide to Filing Your 941X ERTC Baron Payroll

June 6, 2022 last updated: Web for wages paid before july 1, 2021, the nonrefundable portion of the employee retention credit is against the employer share of social security tax. Web employee retention credit, including the dates for which the credit may be claimed, go to irs.gov/erc. See page 6 for additional guidance, including information on how to treat employment.

Employee Retention Credit (ERC) Form 941X Everything You Need to Know

Web employee retention credit, including the dates for which the credit may be claimed, go to irs.gov/erc. June 6, 2022 last updated: •corrections to the deferred amount of the employer share of social. Large upfront fees to claim the credit. January 13, 2023 see more in:

How to File IRS Form 941X Instructions & ERC Guidelines

Web form 941 x is the main tax form used to file an amended return to claim the employee retention credit. Web the employee retention credit is a complex credit that requires careful review before applying. Employers who underreported payroll tax should correct errors in the period. Web full time and part time employees qualify. Large upfront fees to claim.

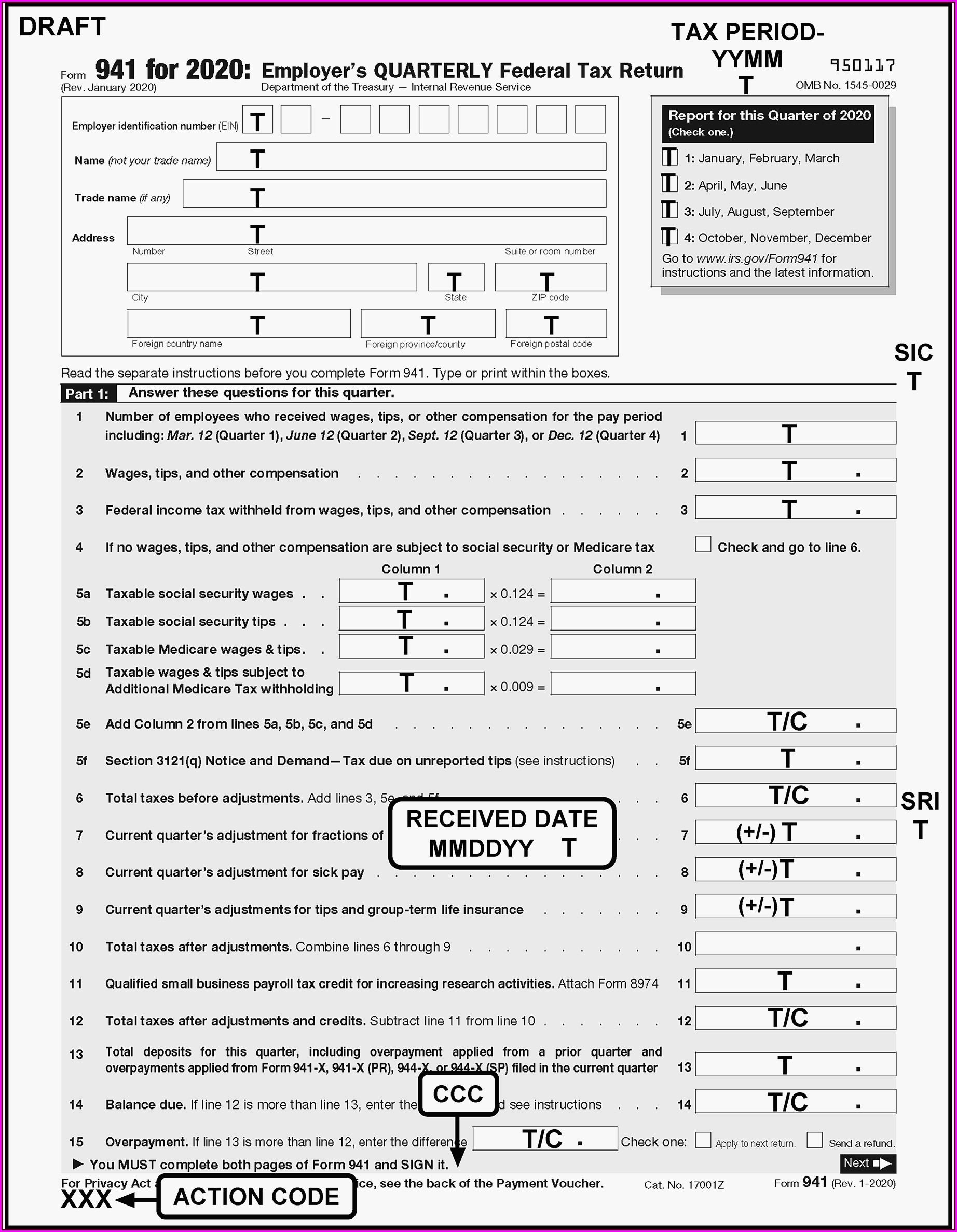

2020 Form IRS Instructions 941 Fill Online, Printable, Fillable, Blank

Therefore, any corrections to the. However, to properly show the amount as a credit. Enter the calendar year of the quarter you’re correcting, and select the date you discovered. Large upfront fees to claim the credit. Web for wages paid before july 1, 2021, the nonrefundable portion of the employee retention credit is against the employer share of social security.

How to Complete & Download Form 941X (Amended Form 941)?

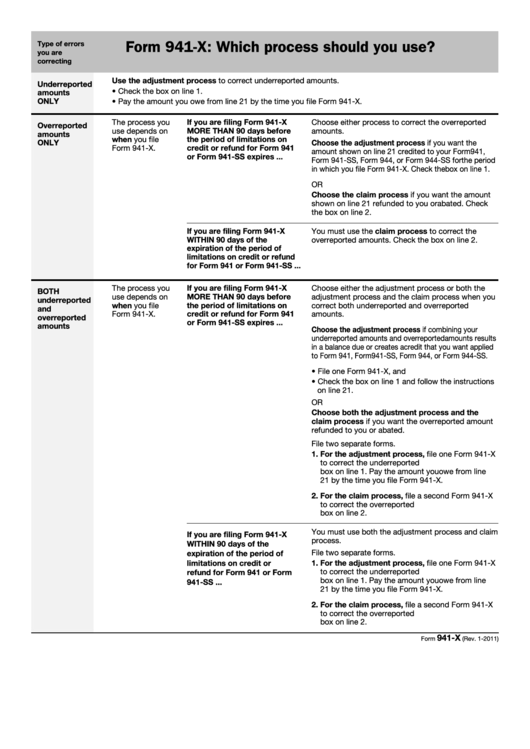

Rather, it is the form you use anytime you need to correct a previously filed 941 form. See page 6 for additional guidance, including information on how to treat employment tax credits and social security tax deferrals. Complete the company information on each page, the. Web form 941 x is the main tax form used to file an amended return.

Irs.gov Forms 941 X Form Resume Examples 1ZV8dXoV3X

See page 6 for additional guidance, including information on how to treat employment tax credits and social security tax deferrals. Web consequently, most employers will need to instead file an amended return or claim for refund for the quarters ended in june, september and december of 2020 using. Web 941x instructions for the irs employee retention credit published by: Web.

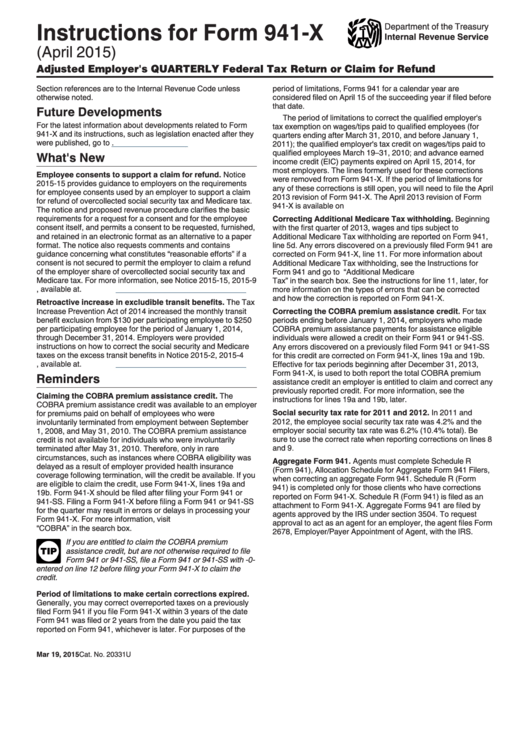

Instructions For Form 941X Adjusted Employer'S Quarterly Federal Tax

Web full time and part time employees qualify. 941 x instructions can be somewhat confusing, so let’s look deeper into. Rather, it is the form you use anytime you need to correct a previously filed 941 form. Ad get a payroll tax refund & receive up to $26k per employee even if you received ppp funds. Web the employee retention.

Instructions For Form 941x Adjusted Employer's Quarterly Federal Tax

Large upfront fees to claim the credit. Enter the calendar year of the quarter you’re correcting, and select the date you discovered. Web form 941x is not just for claiming the ertc; Web consequently, most employers will need to instead file an amended return or claim for refund for the quarters ended in june, september and december of 2020 using..

StepbyStep How to Guide to Filing Your 941X ERTC Baron Payroll

Web consequently, most employers will need to instead file an amended return or claim for refund for the quarters ended in june, september and december of 2020 using. Web form 941x is not just for claiming the ertc; See page 6 for additional guidance, including information on how to treat employment tax credits and social security tax deferrals. Web employee.

Ad Get A Payroll Tax Refund & Receive Up To $26K Per Employee Even If You Received Ppp Funds.

Web 941x instructions for the irs employee retention credit published by: January 13, 2023 see more in: June 6, 2022 last updated: 941 x instructions can be somewhat confusing, so let’s look deeper into.

Web Consequently, Most Employers Will Need To Instead File An Amended Return Or Claim For Refund For The Quarters Ended In June, September And December Of 2020 Using.

See page 6 for additional guidance, including information on how to treat employment tax credits and social security tax deferrals. Therefore, any corrections to the. However, to properly show the amount as a credit. Web full time and part time employees qualify.

Complete The Company Information On Each Page, The.

For all quarters you qualify for, get your original 941, a blank 941. Web employee retention credit, including the dates for which the credit may be claimed, go to irs.gov/erc. Web the employee retention credit is a complex credit that requires careful review before applying. Web form 941 x is the main tax form used to file an amended return to claim the employee retention credit.

Rather, It Is The Form You Use Anytime You Need To Correct A Previously Filed 941 Form.

Large upfront fees to claim the credit. Determine which payroll quarters in 2020 and 2021 your business qualifies for. •corrections to the deferred amount of the employer share of social. Enter the calendar year of the quarter you’re correcting, and select the date you discovered.