Form 943 Due Date

Form 943 Due Date - Web employer’s annual federal tax return form 943 2020 employer’s annual federal tax return for agricultural employees department of the treasury internal revenue service. Web when is form 943 due date for 2022 tax year? However, if you made deposits on time in full payment of. Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file. Web r reinstatement r withdrawal or termination r merger — date of merger. 2023) | file 2022 forms 940, 941 (2022 q4), 943, 944, 945 february 15: Monthly schedule depositors who accumulate $100,000 or more during any month become semiweekly schedule depositors on the. When is the deadline to file the 943 tax form? However, if you made deposits on time in full payment of the taxes due for the year, you may file the return by february 10, 2020. The due date to file form 943 for the tax year 2022 is january 31, 2023.

I require a sales or use tax certificate of no tax due for the following: Monthly schedule depositors who accumulate $100,000 or more during any month become semiweekly schedule depositors on the. Web generally, you must file your form 943 by january 31 of the year after you paid the wages, unless you made timely deposits during the year in full payment of your. Web form 943 is due by january 31 of the subsequent year. Web get your free download. If you made deposits on time, in full payment of the taxes. When is the deadline to file the 943 tax form? However, if you paid all your taxes owed for the year with. Web form 943 is due by january 31st every year, regardless of the filing method (paper or electronic filing). Web when is form 943 due date for 2022 tax year?

5 mistakes people make when filing old tax returns! 31, 2024, or the due date for the 2023 form 943. However, if you made your deposits on time and in full, you can file form 943 by february 10. Web we last updated the employer's annual federal tax return for agricultural employees in february 2023, so this is the latest version of form 943, fully updated for tax year 2022. Web generally, you must file your form 943 by january 31 of the year after you paid the wages, unless you made timely deposits during the year in full payment of your. When is the deadline to file the 943 tax form? If you made deposits on time, in full payment of the taxes. Web when is form 943 due date for 2022 tax year? For 2022 tax year, file form 943 by january 31, 2023. However, if you paid all your taxes owed for the year with.

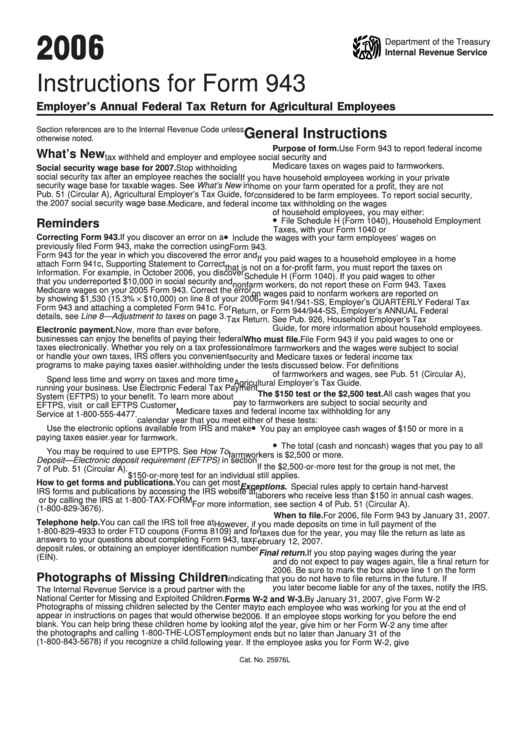

Instructions For Form 943 Employer'S Annual Federal Tax Return For

However, if you made deposits on time in full payment of the taxes due for the year, you can file the return by. Web form 943 is due by january 31 of the subsequent year. I require a sales or use tax certificate of no tax due for the following: For 2022 tax year, file form 943 by january 31,.

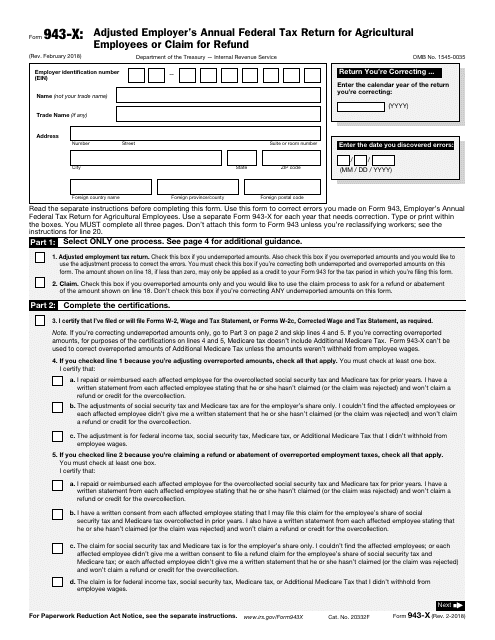

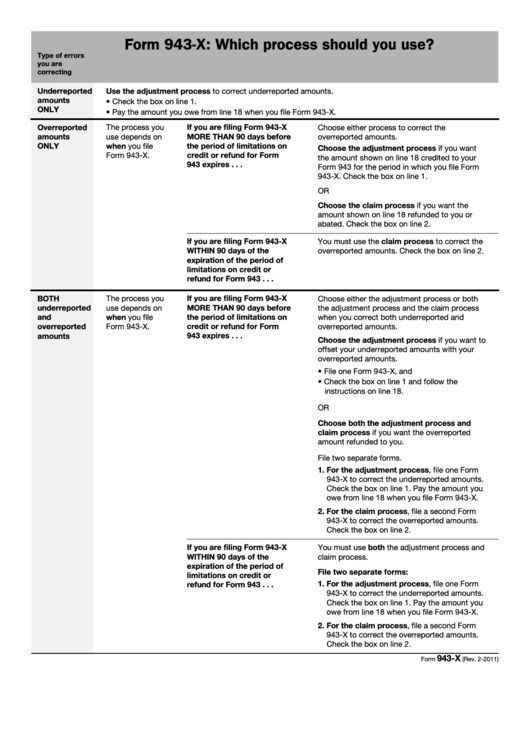

IRS Form 943X Download Fillable PDF or Fill Online Adjusted Employer's

However, if you made your deposits on time and in full, you can file form 943 by february 10. Web form 943 is due by january 31st every year, regardless of the filing method (paper or electronic filing). 2023) | file 2022 forms 940, 941 (2022 q4), 943, 944, 945 february 15: Web employer’s annual federal tax return form 943.

Drafts of Form 943, 944 and 940 are Now Available with COVID19 Changes

Monthly schedule depositors who accumulate $100,000 or more during any month become semiweekly schedule depositors on the. Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file. However, if you made deposits on time in full payment of. Web however, employers that pay qualified sick and.

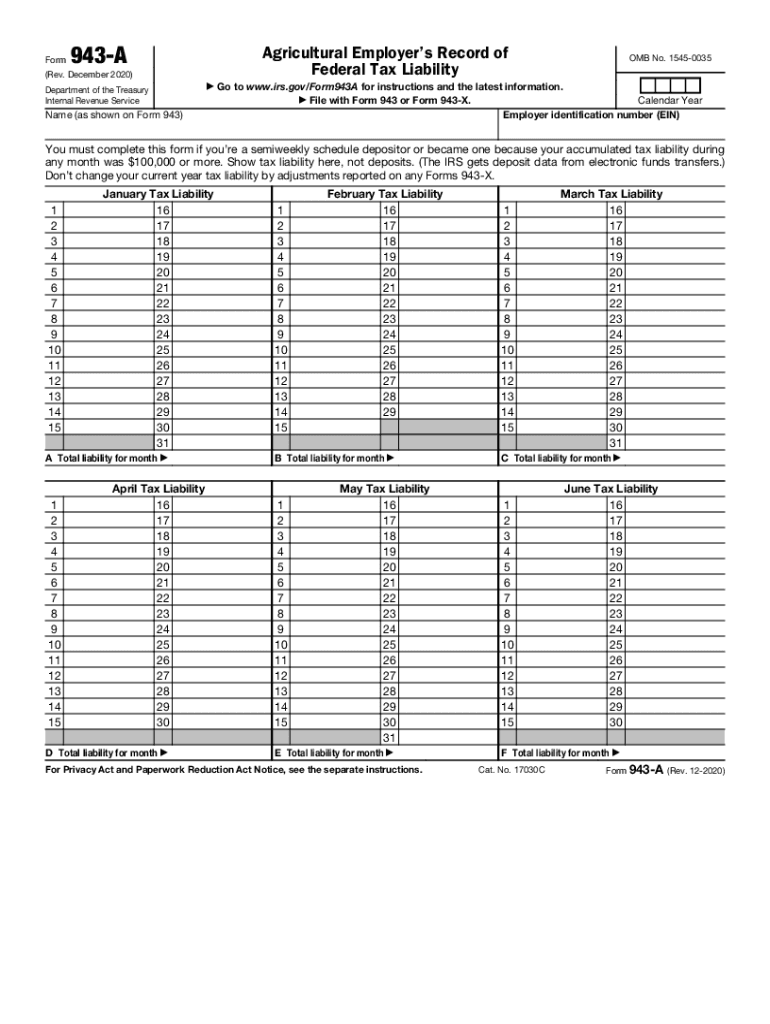

Tax Liability Form Fill Out and Sign Printable PDF Template signNow

Web the 2021 form 943 is due on january 31, 2022. Web employer’s annual federal tax return form 943 2020 employer’s annual federal tax return for agricultural employees department of the treasury internal revenue service. When is the deadline to file the 943 tax form? Web get your free download. However, if you paid all your taxes owed for the.

Instructions For Form 943X printable pdf download

Web get your free download. However, if you made deposits on time in full payment of. Web employer’s annual federal tax return form 943 2020 employer’s annual federal tax return for agricultural employees department of the treasury internal revenue service. Web we last updated the employer's annual federal tax return for agricultural employees in february 2023, so this is the.

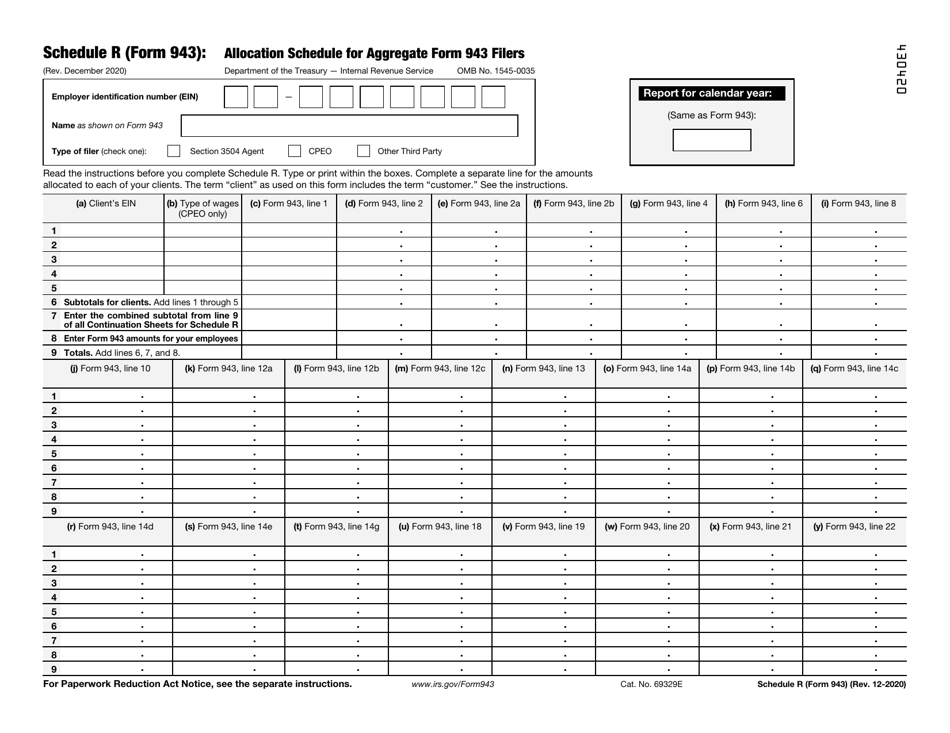

IRS Form 943 Schedule R Download Fillable PDF or Fill Online Allocation

For 2022 tax year, file form 943 by january 31, 2023. I require a sales or use tax certificate of no tax due for the following: Web employer’s annual federal tax return form 943 2020 employer’s annual federal tax return for agricultural employees department of the treasury internal revenue service. Web r reinstatement r withdrawal or termination r merger —.

Fill Free fillable F943x Accessible Form 943X (Rev. February 2018

Web file form 940, employer’s annual federal unemployment (futa) tax return, with the irs to report taxable futa wages paid in the previous year. Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file. However, if you made deposits on time in full payment of the..

IRS Form 943 Complete PDF Tenplate Online in PDF

Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file. Web for 2019, file form 943 by january 31, 2020. Web when is form 943 due date for 2022 tax year? Web since the 2022 error was discovered during 2023, the due date for correcting the.

Form 943 Employer's Annual Federal Tax Return for Agricultural

Web when is form 943 due date for 2022 tax year? Web generally, you must file your form 943 by january 31 of the year after you paid the wages, unless you made timely deposits during the year in full payment of your. Web since the 2022 error was discovered during 2023, the due date for correcting the underpayment is.

IRS Form 943 Online Efile 943 for 4.95 Form 943 for 2020

Web for 2019, file form 943 by january 31, 2020. However, if you paid all your taxes owed for the year with. Monthly schedule depositors who accumulate $100,000 or more during any month become semiweekly schedule depositors on the. Web form 943 is due by january 31st every year, regardless of the filing method (paper or electronic filing). Web since.

Web Employer’s Annual Federal Tax Return Form 943 2020 Employer’s Annual Federal Tax Return For Agricultural Employees Department Of The Treasury Internal Revenue Service.

If you made deposits on time, in full payment of the taxes. However, if you made deposits on time in full payment of the taxes due for the year, you may file the return by february 10, 2020. Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file. Web regardless of the filing method, form 943 is due by january 31st each year (paper or electronic filing).

However, If You Made Deposits On Time In Full Payment Of.

The due date to file form 943 for the tax year 2022 is january 31, 2023. However, if you made your deposits on time and in full, you can file form 943 by february 10. Web when is form 943 due date for 2022 tax year? I require a sales or use tax certificate of no tax due for the following:

Web Since The 2022 Error Was Discovered During 2023, The Due Date For Correcting The Underpayment Is Jan.

For 2022 tax year, file form 943 by january 31, 2023. Web the 2021 form 943 is due on january 31, 2022. When is the deadline to file the 943 tax form? However, if you made deposits on time in full payment of the taxes due for the year, you can file the return by.

5 Mistakes People Make When Filing Old Tax Returns!

Web form 943 is due by january 31st every year, regardless of the filing method (paper or electronic filing). Web r reinstatement r withdrawal or termination r merger — date of merger. Web we last updated the employer's annual federal tax return for agricultural employees in february 2023, so this is the latest version of form 943, fully updated for tax year 2022. Web for 2019, file form 943 by january 31, 2020.