Form 944 For 2021

Form 944 For 2021 - 4 by the internal revenue service. To get the form either hit the fill this form button or do the steps below: Web for 2022, file form 944 by january 31, 2023. Create an account with expressirsforms. Like form 941, it’s used to. Web form 944 was intended to give small business employers a break when it came to filing and paying federal payroll taxes. Web april 1, 2021, through periods of coverage beginning on or before september 30, 2021. Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file. The other reason for form 944 is to save the irs man. Web irs form 944 is the employer's annual federal tax return.

Web form 944 is due by january 31st every year, regardless of the filing method (paper or electronic filing). However, if you made deposits on time in full payment of the. Try it for free now! Please use the link below to. However, if you made deposits on time in full payment of the taxes due for the year, you may file the return by february 10, 2023. Create an account with expressirsforms. Upload, modify or create forms. Like form 941, it’s used to. Web form 944 was intended to give small business employers a break when it came to filing and paying federal payroll taxes. The form was introduced by the irs to give smaller employers a break in filing and paying federal.

Get ready for tax season deadlines by completing any required tax forms today. Only recovery startup businesses qualify for q4. The form was introduced by the irs to give smaller employers a break in filing and paying federal. Like form 941, it’s used to. Web april 1, 2021, through periods of coverage beginning on or before september 30, 2021. Who must file form 944. Section 9501 of the nov 02, 2022 cat. Please use the link below to. Web form 944 for 2021: Upload, modify or create forms.

What is Form 944? Reporting Federal & FICA Taxes

Get ready for tax season deadlines by completing any required tax forms today. 4 by the internal revenue service. Web draft instructions for the 2021 form 944, employer’s annual federal tax return, were issued oct. Web form 944 for 2021: Upload, modify or create forms.

Form 944 Fill Out and Sign Printable PDF Template signNow

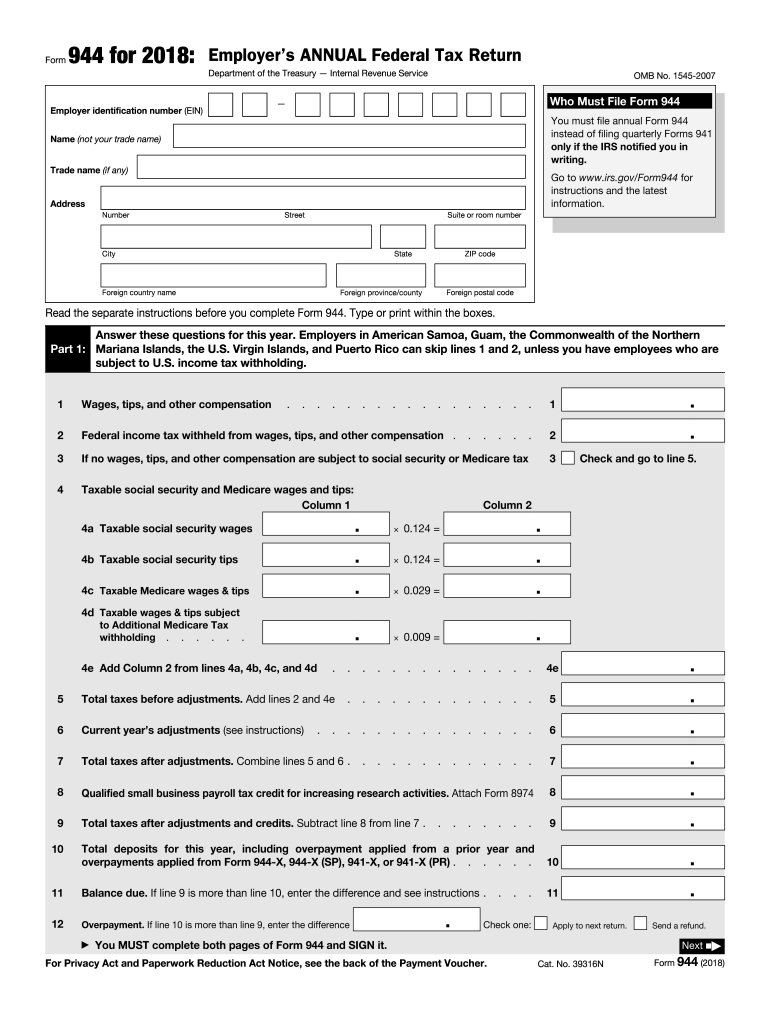

Please use the link below to. Employer’s annual federal tax return department of the treasury — internal revenue service. Web april 1, 2021, through periods of coverage beginning on or before september 30, 2021. Web draft instructions for the 2021 form 944, employer’s annual federal tax return, were issued oct. However, if you made deposits on time in full payment.

944 d4

The form was introduced by the irs to give smaller employers a break in filing and paying federal. Form 944 allows small employers. However, if you made deposits on time in full payment of the taxes due for the year, you may file the return by february 10, 2023. Employer’s annual federal tax return department of the treasury — internal.

Form 944SS Employer's Annual Federal Tax Return Form (2011) Free

Try it for free now! Employer’s annual federal tax return department of the treasury — internal revenue service. To get the form either hit the fill this form button or do the steps below: However, if you made deposits on time in full payment of the taxes due for the year, you may file the return by february 10, 2023..

How To Fill Out Form I944 StepByStep Instructions [2021]

Select “form 944” from “annual 94x forms”. The form was introduced by the irs to give smaller employers a break in filing and paying federal. Employer’s annual federal tax return department of the treasury — internal revenue service. Web form 944 for 2022: Form 944 allows small employers.

944 d5

Form 944 allows small employers. Like form 941, it’s used to. Select “form 944” from “annual 94x forms”. Only recovery startup businesses qualify for q4. Section 9501 of the nov 02, 2022 cat.

Form 944 2020 Fill Out and Sign Printable PDF Template signNow

Web april 1, 2021, through periods of coverage beginning on or before september 30, 2021. Web form 944 is an irs tax form that reports the taxes — including federal income tax, social security tax and medicare tax — that you’ve withheld from your. Only recovery startup businesses qualify for q4. Web federal employer's annual federal tax return form 944.

944 Instruction Fill out and Edit Online PDF Template

Get ready for tax season deadlines by completing any required tax forms today. Create an account with expressirsforms. Try it for free now! You can get the form online at here at pdfliner. Employer’s annual federal tax return department of the treasury — internal revenue service.

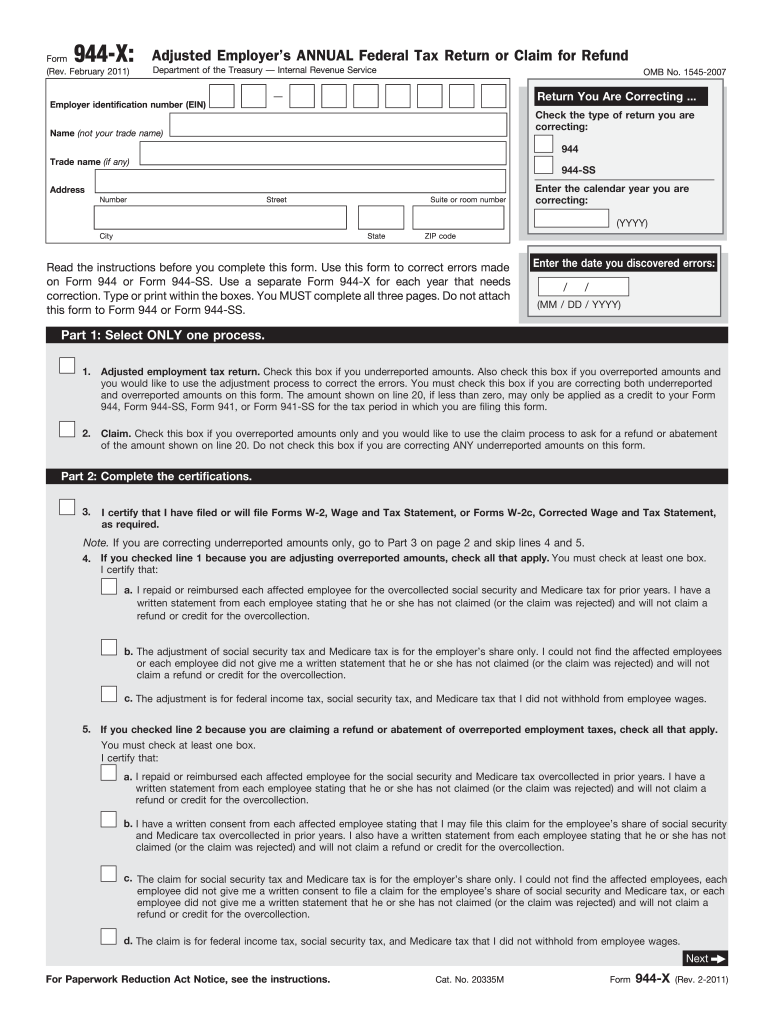

Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return

Section 9501 of the nov 02, 2022 cat. Web for 2022, file form 944 by january 31, 2023. Try it for free now! The form was introduced by the irs to give smaller employers a break in filing and paying federal. However, if you made deposits on time in full payment of the taxes due for the year, you may.

Fillable IRS Form 944 Printable, Blank PDF and Instructions in

Create an account with expressirsforms. Web form 944 is due by january 31st every year, regardless of the filing method (paper or electronic filing). Employer’s annual federal tax return department of the treasury — internal revenue service. Ad register and subscribe now to work on your irs 944 & more fillable forms. Try it for free now!

Who Must File Form 944.

Web federal employer's annual federal tax return form 944 pdf form content report error it appears you don't have a pdf plugin for this browser. Try it for free now! Complete, edit or print tax forms instantly. Only recovery startup businesses qualify for q4.

Web Form 944 Was Intended To Give Small Business Employers A Break When It Came To Filing And Paying Federal Payroll Taxes.

Get ready for tax season deadlines by completing any required tax forms today. Section 9501 of the nov 02, 2022 cat. Select “form 944” from “annual 94x forms”. You can get the form online at here at pdfliner.

Upload, Modify Or Create Forms.

Web for 2022, file form 944 by january 31, 2023. Form 944 allows small employers. The form was introduced by the irs to give smaller employers a break in filing and paying federal. To get the form either hit the fill this form button or do the steps below:

However, If You Made Deposits On Time In Full Payment Of The.

Web form 944 is due by january 31st every year, regardless of the filing method (paper or electronic filing). Create an account with expressirsforms. Ad register and subscribe now to work on your irs 944 & more fillable forms. Employer’s annual federal tax return department of the treasury — internal revenue service.

![How To Fill Out Form I944 StepByStep Instructions [2021]](https://self-lawyer.com/wp-content/uploads/2020/05/I-944-2-1024x572.png)