Form 944-X

Form 944-X - Form 944 is available for processing only when the employer type for. Web what is irs form 944? Or claim for refund, to replace form 941c, supporting statement to correct information. Adjusted employer's annual federal tax return or claim for. Adjusted employer's annual federal tax return or claim for refund 2012. This checklist provides guidance for preparing and reviewing the 2022 form 944 (employer’s annual federal tax return). “no” answers indicate possible errors in. Form 944 allows small employers. Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file. The information on form 944 will be collected to ensure the smallest nonagricultural and non.

Or claim for refund, to replace form 941c, supporting statement to correct information. Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file. Adjusted employer's annual federal tax return or claim for refund 2012. Revised draft instructions for form 944. “no” answers indicate possible errors in. Adjusted employer's annual federal tax return or claim for. The information on form 944 will be collected to ensure the smallest nonagricultural and non. This checklist provides guidance for preparing and reviewing the 2022 form 944 (employer’s annual federal tax return). Form 944 is an irs tax form that reports the taxes — including federal income tax, social security tax and medicare tax — that you’ve. Form 944 allows small employers.

Adjusted employer's annual federal tax return or claim for refund 2012. Or claim for refund, to replace form 941c, supporting statement to correct information. This checklist provides guidance for preparing and reviewing the 2022 form 944 (employer’s annual federal tax return). “no” answers indicate possible errors in. The information on form 944 will be collected to ensure the smallest nonagricultural and non. Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file. Revised draft instructions for form 944. The information on form 944 will be collected to ensure the smallest nonagricultural and non. Form 944 allows small employers. Web what is irs form 944?

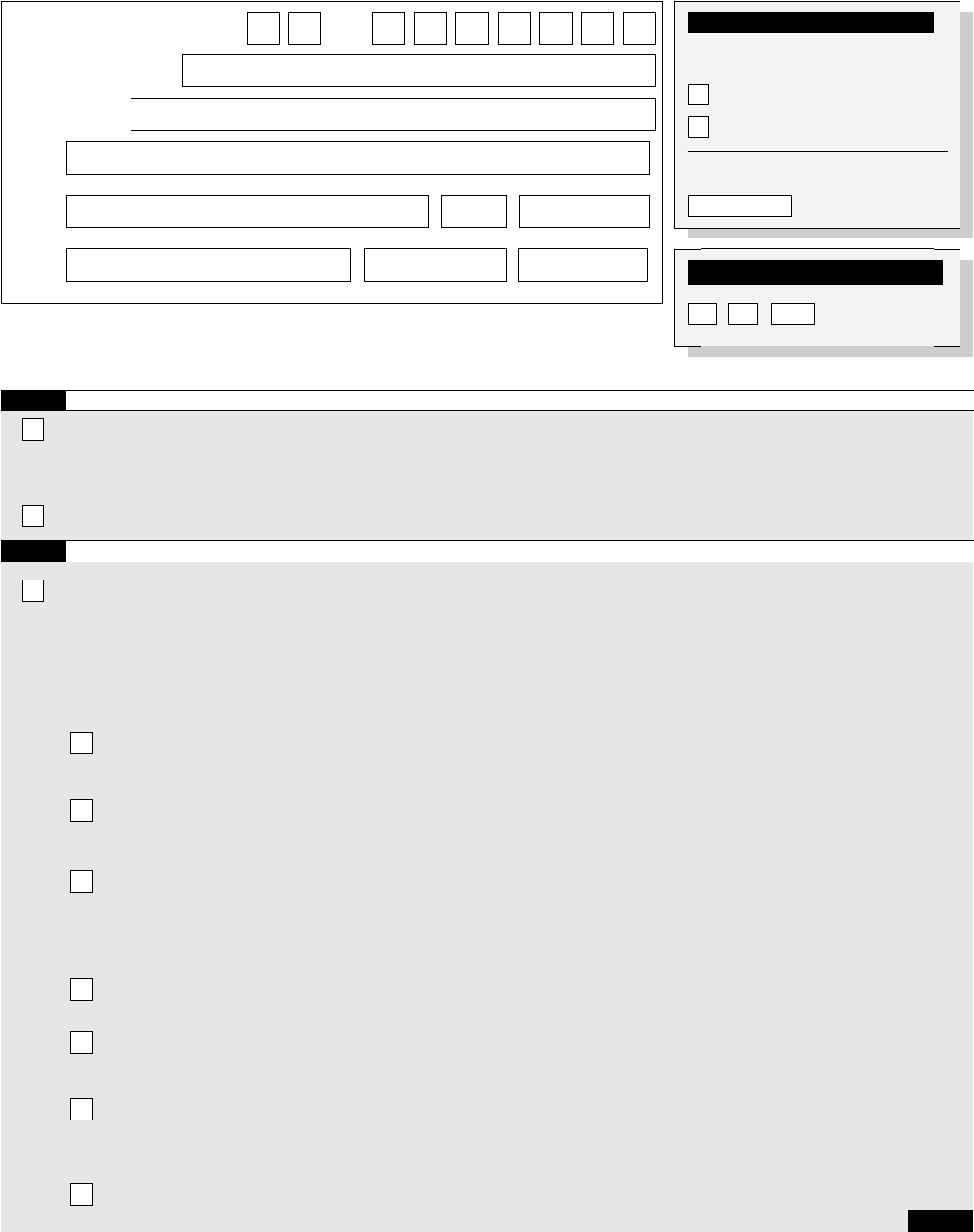

Form 944X Edit, Fill, Sign Online Handypdf

Adjusted employer's annual federal tax return or claim for refund 2012. Web what is irs form 944? Revised draft instructions for form 944. Adjusted employer's annual federal tax return or claim for. Or claim for refund, to replace form 941c, supporting statement to correct information.

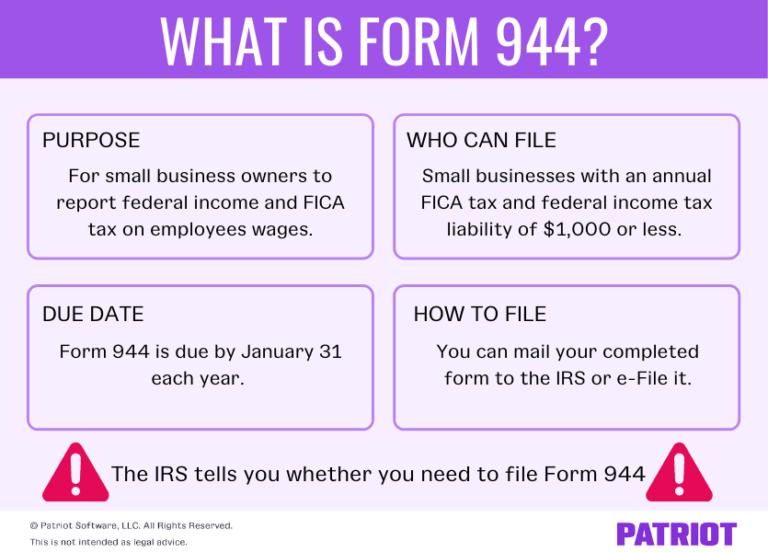

Form 944X Adjusted Employer's Annual Federal Tax Return or Claim fo…

Adjusted employer's annual federal tax return or claim for. Form 944 is available for processing only when the employer type for. Revised draft instructions for form 944. Adjusted employer's annual federal tax return or claim for refund 2012. Form 944 is an irs tax form that reports the taxes — including federal income tax, social security tax and medicare tax.

Form 944X Edit, Fill, Sign Online Handypdf

The information on form 944 will be collected to ensure the smallest nonagricultural and non. Web what is irs form 944? Revised draft instructions for form 944. Adjusted employer's annual federal tax return or claim for refund 2012. Adjusted employer's annual federal tax return or claim for.

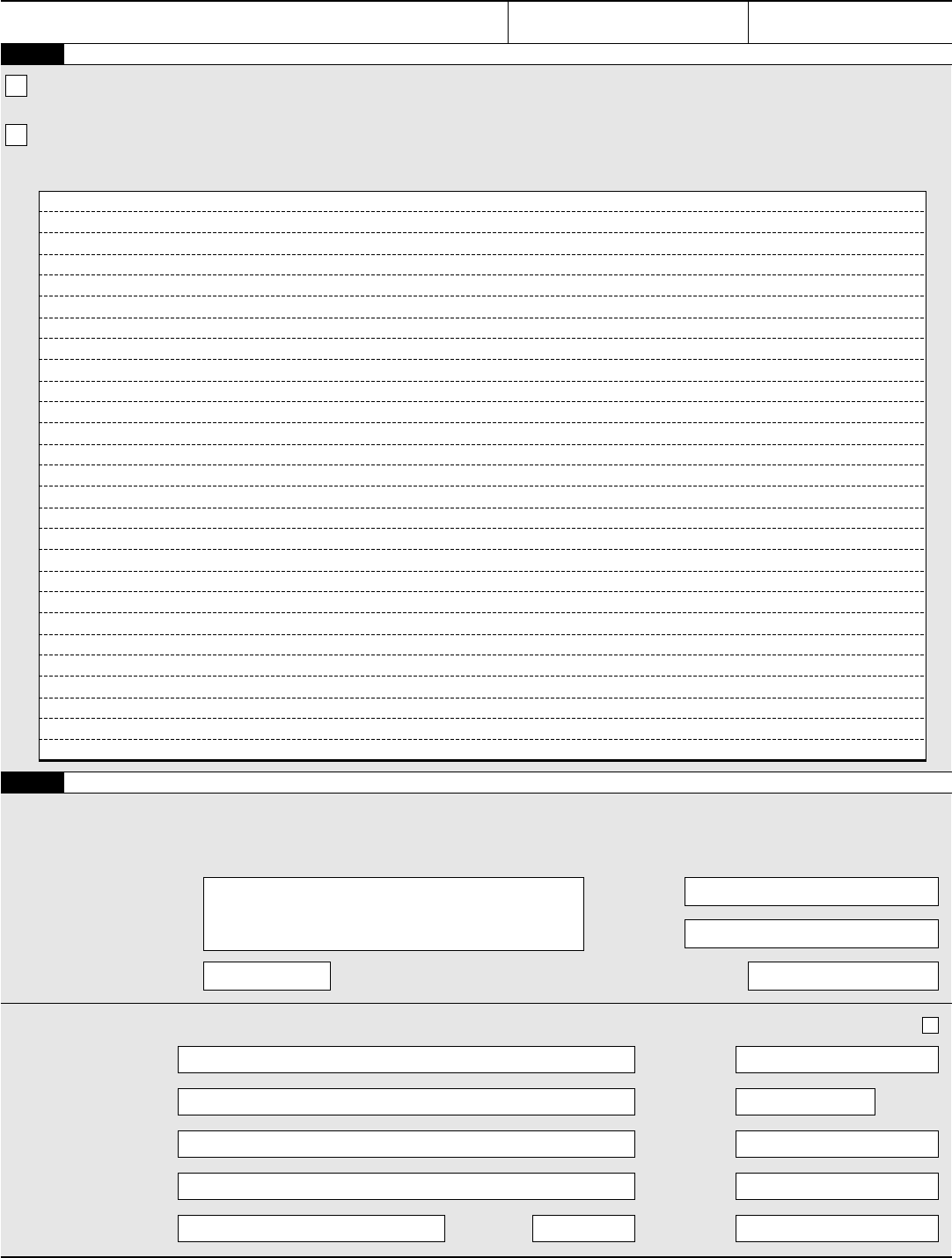

What is Form 944? Reporting Federal & FICA Taxes

This checklist provides guidance for preparing and reviewing the 2022 form 944 (employer’s annual federal tax return). Form 944 is available for processing only when the employer type for. Adjusted employer's annual federal tax return or claim for. Form 944 allows small employers. Or claim for refund, to replace form 941c, supporting statement to correct information.

File Form 944 Online EFile 944 Form 944 for 2021

Adjusted employer's annual federal tax return or claim for refund 2012. “no” answers indicate possible errors in. The information on form 944 will be collected to ensure the smallest nonagricultural and non. Form 944 allows small employers. Form 944 is an irs tax form that reports the taxes — including federal income tax, social security tax and medicare tax —.

Form 944X Adjusted Employer's Annual Federal Tax Return or Claim fo…

Revised draft instructions for form 944. This checklist provides guidance for preparing and reviewing the 2022 form 944 (employer’s annual federal tax return). “no” answers indicate possible errors in. Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file. Web what is irs form 944?

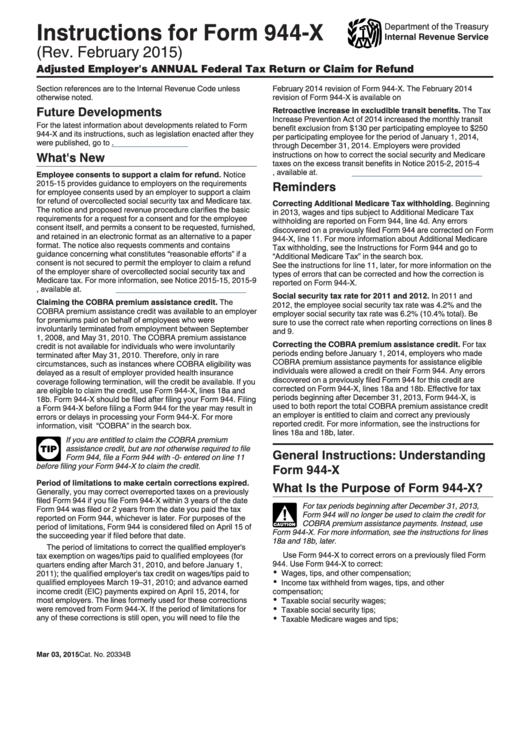

Instructions For Form 944X (Rev. February 2015) printable pdf download

Form 944 is an irs tax form that reports the taxes — including federal income tax, social security tax and medicare tax — that you’ve. Adjusted employer's annual federal tax return or claim for refund 2012. Web what is irs form 944? Form 944 allows small employers. The information on form 944 will be collected to ensure the smallest nonagricultural.

Fill Free fillable IRS PDF forms

Web what is irs form 944? “no” answers indicate possible errors in. The information on form 944 will be collected to ensure the smallest nonagricultural and non. Form 944 allows small employers. Form 944 is available for processing only when the employer type for.

What Is Form 944 What Is Federal Form 944 For Employers How To

Web what is irs form 944? Form 944 allows small employers. “no” answers indicate possible errors in. Form 944 is available for processing only when the employer type for. Or claim for refund, to replace form 941c, supporting statement to correct information.

IRS 944 Instructions 2019 Fill and Sign Printable Template Online

This checklist provides guidance for preparing and reviewing the 2022 form 944 (employer’s annual federal tax return). Form 944 is available for processing only when the employer type for. Web what is irs form 944? Revised draft instructions for form 944. Adjusted employer's annual federal tax return or claim for refund 2012.

Form 944 Is An Irs Tax Form That Reports The Taxes — Including Federal Income Tax, Social Security Tax And Medicare Tax — That You’ve.

“no” answers indicate possible errors in. Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file. The information on form 944 will be collected to ensure the smallest nonagricultural and non. Adjusted employer's annual federal tax return or claim for refund 2012.

Adjusted Employer's Annual Federal Tax Return Or Claim For.

Revised draft instructions for form 944. This checklist provides guidance for preparing and reviewing the 2022 form 944 (employer’s annual federal tax return). The information on form 944 will be collected to ensure the smallest nonagricultural and non. Form 944 allows small employers.

Web What Is Irs Form 944?

Or claim for refund, to replace form 941c, supporting statement to correct information. Form 944 is available for processing only when the employer type for.