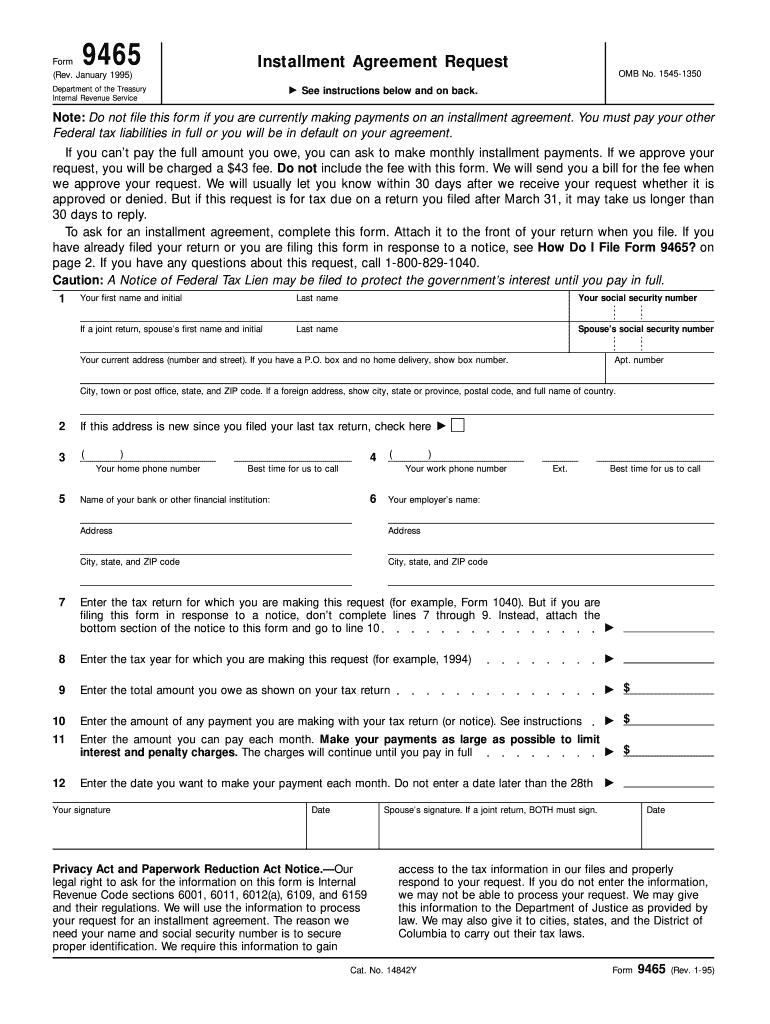

Form 9465 Electronic Filing

Form 9465 Electronic Filing - Where do i file irs form 9465? Web where to file your taxes for form 9465. Electronic filing of form 9465 is not available if the amount you owe is greater than $50,000. Web to print form 9465: Complete, edit or print tax forms instantly. Web how to file when to file where to file update my information popular get your tax record file your taxes for free apply for an employer id number (ein) check your. Web general instructions purpose of form use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax. Try it for free now! Web the 9465 form is rather short and only requires your personal information, the name and addresses of your bank and employer, the amount of tax you owe, an estimate. Try irs free file your online account view your tax records, adjusted gross income and estimated tax payments.

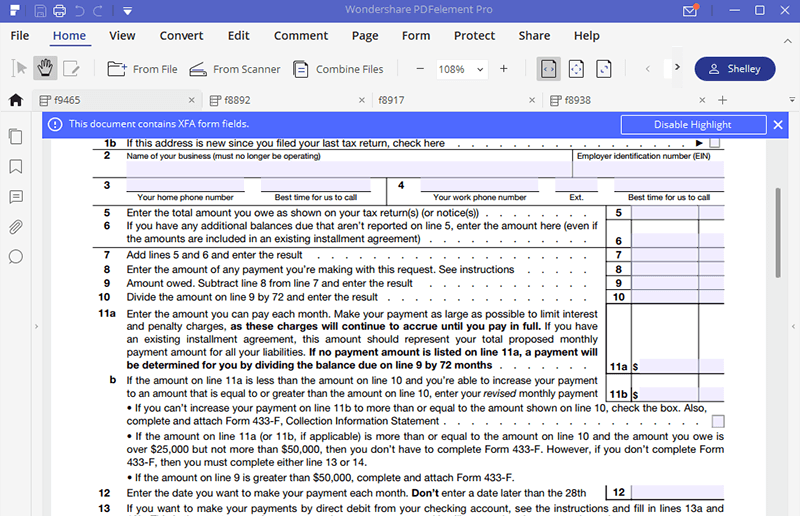

Ad fill your 9465 installment agreement request online, download & print. January 24, 25, and 26, 2023 time: Web prepare and file your federal income taxes online for free. Ad access irs tax forms. Ad irs form 9465, get ready for tax deadlines by filling online any tax form for free. Web the 9465 form is rather short and only requires your personal information, the name and addresses of your bank and employer, the amount of tax you owe, an estimate. Upload, modify or create forms. Form 9465 is used by taxpayers to request. When you enter your information for form 9465, you’ll be prompted to enter your banking information. See option 1below for details.

Try it for free now! October 2020) installment agreement request (for use with form 9465 (rev. Web to print form 9465: Web general instructions purpose of form use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax. Web where to file your taxes for form 9465. September 2020)) department of the treasury internal revenue. Where do i file irs form 9465? Upload, modify or create forms. Online navigation instructions from within your taxact return ( online ), click the print center dropdown, then click custom print. Ad irs form 9465, get ready for tax deadlines by filling online any tax form for free.

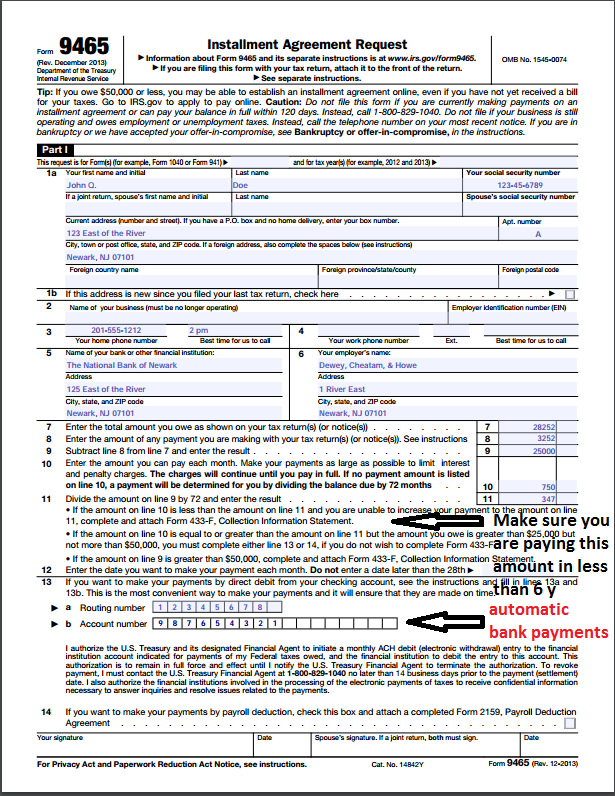

Form 9465 Installment Agreement Request Fill Out and Sign Printable

September 2020)) department of the treasury internal revenue. Web how to file when to file where to file update my information popular get your tax record file your taxes for free apply for an employer id number (ein) check your. January 24, 25, and 26, 2023 time: Under installment agreement request (9465), enter the. Ad irs form 9465, get ready.

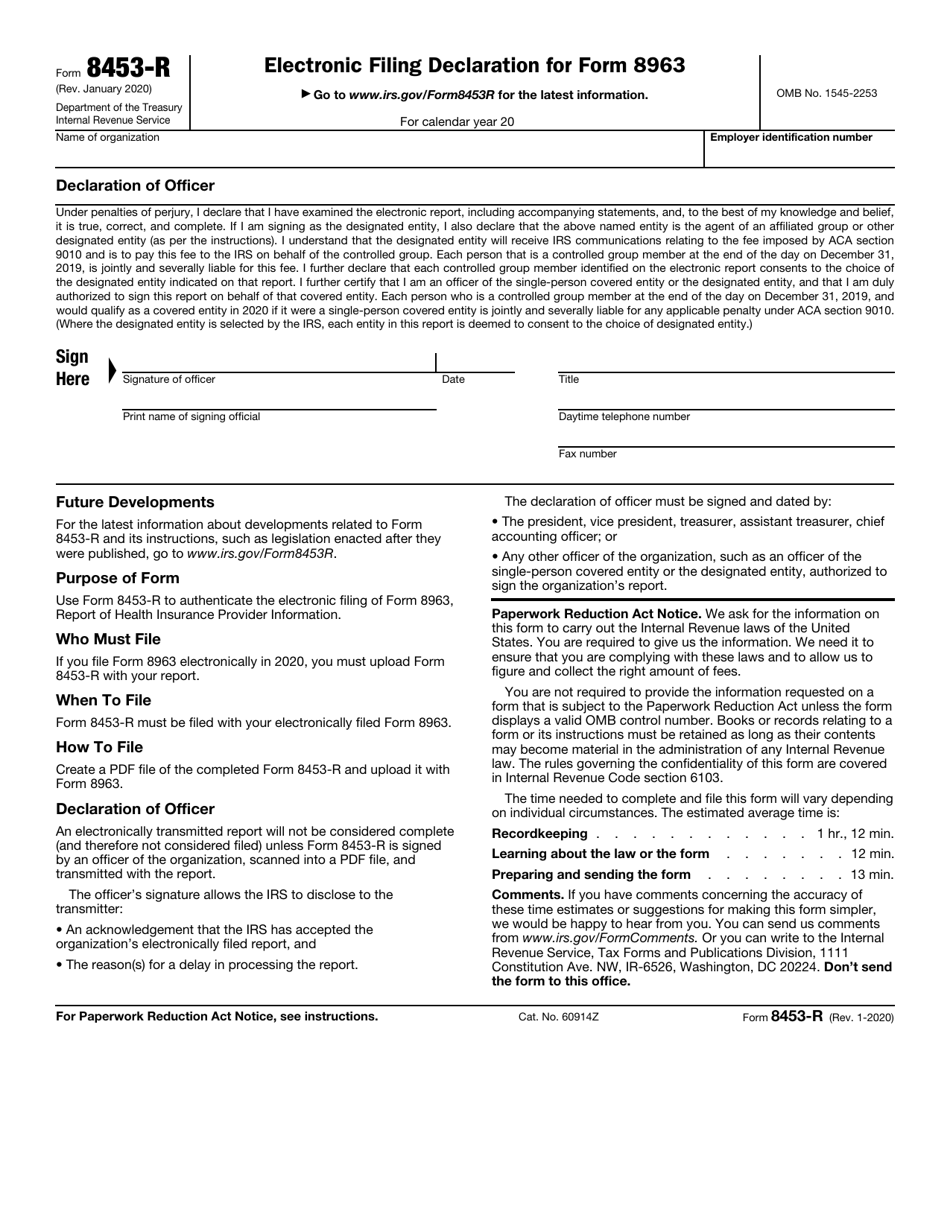

IRS Form 8453R Download Fillable PDF or Fill Online Electronic Filing

Ad access irs tax forms. Upload, modify or create forms. In the forms and schedules. Form 9465 is used by taxpayers to request. Upload, modify or create forms.

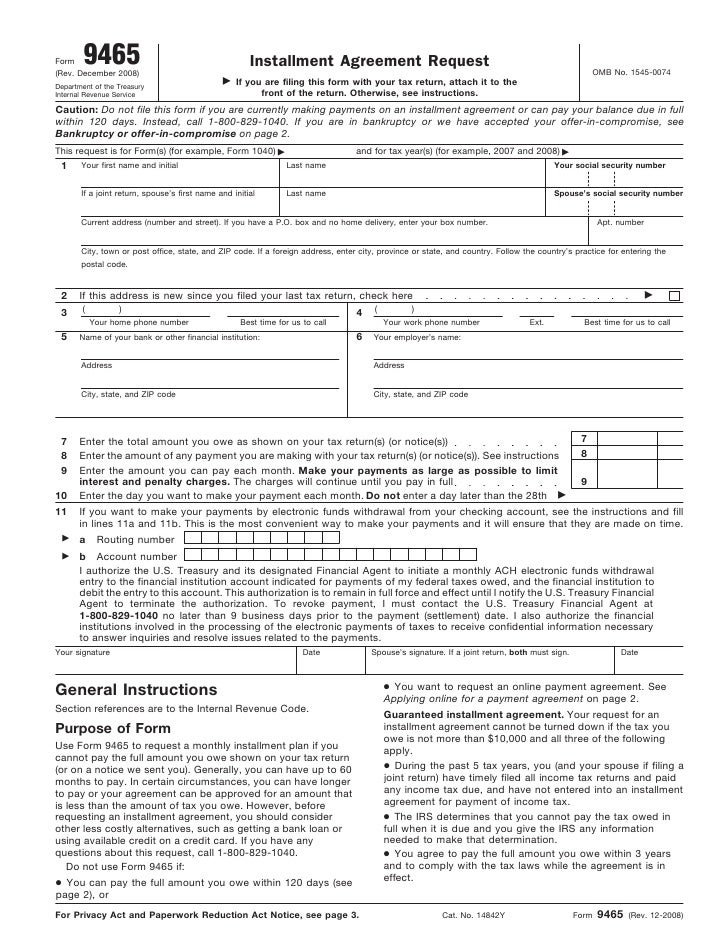

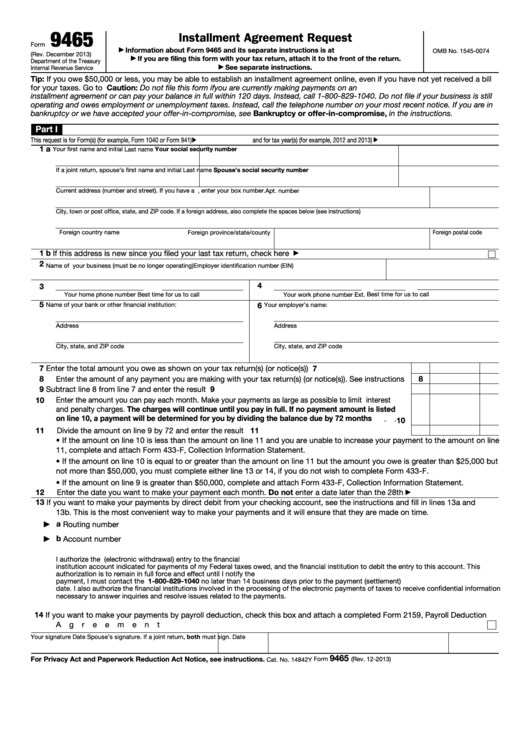

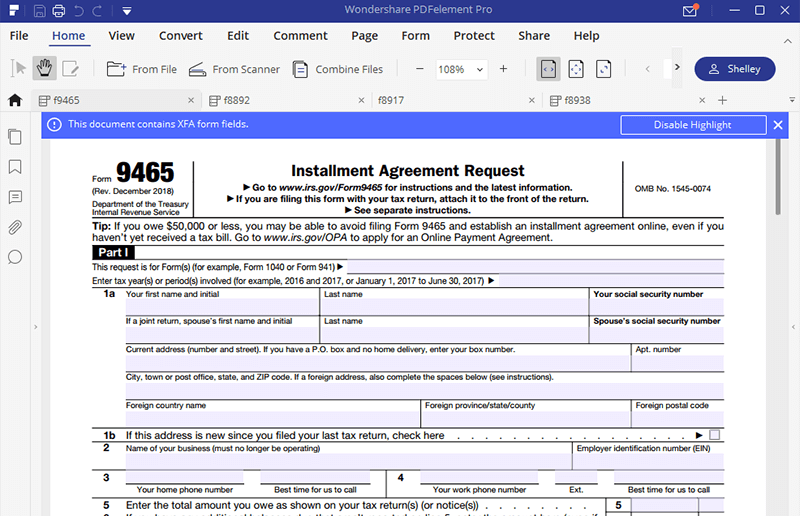

IRS Form 9465 Installment Agreement Request

Under installment agreement request (9465), enter the. Try it for free now! Web follow these steps to enter form 9465 in the program: Web instructions for form 9465 (rev. Web to print form 9465:

Form 9465Installment Agreement Request

Ad access irs tax forms. If you are filing form 9465 with your return, attach it to the front of your return when you file. If you are filing form 9465. Web to print form 9465: Web how to file when to file where to file update my information popular get your tax record file your taxes for free apply.

Fillable Form 9465 Installment Agreement Request printable pdf download

Complete, edit or print tax forms instantly. Try it for free now! Web information about form 9465, installment agreement request, including recent updates, related forms and instructions on how to file. In the forms and schedules. Go to screen 80, installment agreement (9465).

How To Submit Form 9465 Santos Czerwinski's Template

Web follow these steps to enter form 9465 in the program: Web information about form 9465, installment agreement request, including recent updates, related forms and instructions on how to file. Ad irs form 9465, get ready for tax deadlines by filling online any tax form for free. In the forms and schedules. If you are filing form 9465.

IRS Form 9465 Instructions for How to Fill it Correctly File

October 2020) installment agreement request (for use with form 9465 (rev. Try irs free file your online account view your tax records, adjusted gross income and estimated tax payments. In the forms and schedules. Web to print form 9465: Web how to file when to file where to file update my information popular get your tax record file your taxes.

How to Complete Form 9465 for Electronic Filing and Payment by

Web to print form 9465: Electronic filing of form 9465 is not available if the amount you owe is greater than $50,000. Web follow these steps to enter form 9465 in the program: Web where to file your taxes for form 9465. Upload, modify or create forms.

IRS Form 9465 Instructions for How to Fill it Correctly File

See option 1below for details. Ad fill your 9465 installment agreement request online, download & print. Where do i file irs form 9465? Web how to file when to file where to file update my information popular get your tax record file your taxes for free apply for an employer id number (ein) check your. Note that filing form 9465.

How to Set Up a Payment Plan with the IRS (Form 9465) The Handy Tax

Web follow these steps to enter form 9465 in the program: Upload, modify or create forms. Ad irs form 9465, get ready for tax deadlines by filling online any tax form for free. Web to print form 9465: Go to screen 80, installment agreement (9465).

September 2020)) Department Of The Treasury Internal Revenue.

Web general instructions purpose of form use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax. Where do i file irs form 9465? Try it for free now! Go to screen 80, installment agreement (9465).

Web Instructions For Form 9465 (Rev.

Web follow these steps to enter form 9465 in the program: Complete, edit or print tax forms instantly. When you enter your information for form 9465, you’ll be prompted to enter your banking information. Upload, modify or create forms.

Note That Filing Form 9465 Does Not Guarantee Your Request For A Payment Plan.

In the forms and schedules. If you are filing form 9465. December 2011) department of the treasury internal revenue service installment agreement request if you are filing this form with your tax return, attach it to. Ad access irs tax forms.

Upload, Modify Or Create Forms.

Web where to file your taxes for form 9465. *permanent residents of guam or the virgin. Under installment agreement request (9465), enter the. Online navigation instructions from within your taxact return ( online ), click the print center dropdown, then click custom print.