Form 9465 Pdf

Form 9465 Pdf - For instructions and the latest information. Web use irs form 9465 installment agreement request to request a monthly installment plan if you can't pay your full tax due amount. This form is for income earned in tax year 2022, with tax returns due in april 2023. All • who owes income tax on form 1040, payments received will be applied to your account in the best • who may be responsible for a trust fund recovery penalty, interests of the united states. If you are filing this form with your tax return, attach it to the front of the return. The irs encourages you to pay a portion of the amount you owe and then request an installment for the remaining balance. Web instructions for form 9465 (rev. Web use irs form 9465 installment agreement request to request a monthly installment plan if you can't pay your full tax due amount. Form 9465 is available in all versions of taxact ®. More about the federal form 9465 we last updated federal form 9465 in january 2023 from the federal internal revenue service.

Web we last updated the installment agreement request in january 2023, so this is the latest version of form 9465, fully updated for tax year 2022. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web use irs form 9465 installment agreement request to request a monthly installment plan if you can't pay your full tax due amount. The irs encourages you to pay a portion of the amount you owe and then request an installment for the remaining balance. The irs encourages you to pay a portion of the amount you owe and then request an installment for the remaining balance. 216mm (81⁄ 2) 279mm (11) perforate: September 2020)) department of the treasury internal revenue service section references are to the internal revenue. Web instructions for form 9465 (rev. Form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. Web department of the treasury internal revenue service www.irs.gov/form9465.

All • who owes income tax on form 1040, payments received will be applied to your account in the best • who may be responsible for a trust fund recovery penalty, interests of the united states. If you are filing this form with your tax return, attach it to the front of the return. Form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. December 2018) department of the treasury internal revenue service. Web we last updated the installment agreement request in january 2023, so this is the latest version of form 9465, fully updated for tax year 2022. The irs encourages you to pay a portion of the amount you owe and then request an installment for the remaining balance. For instructions and the latest information. This form is for income earned in tax year 2022, with tax returns due in april 2023. Form 9465 is available in all versions of taxact ®. Web information about form 9465, installment agreement request, including recent updates, related forms and instructions on how to file.

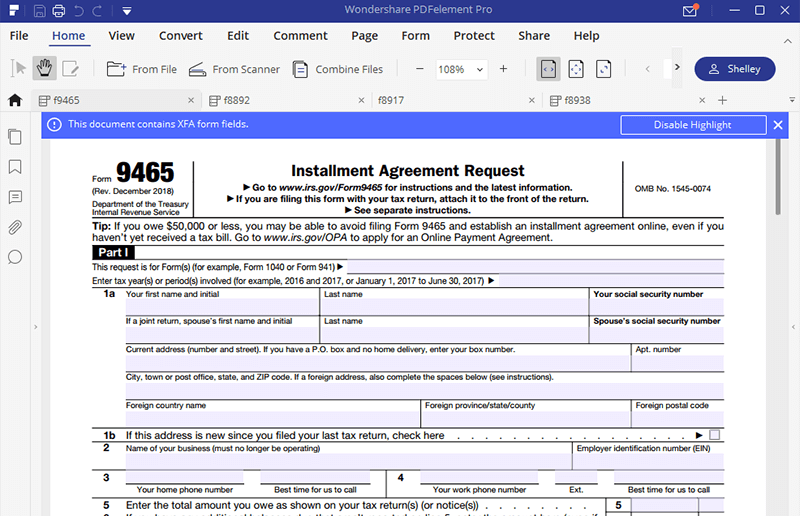

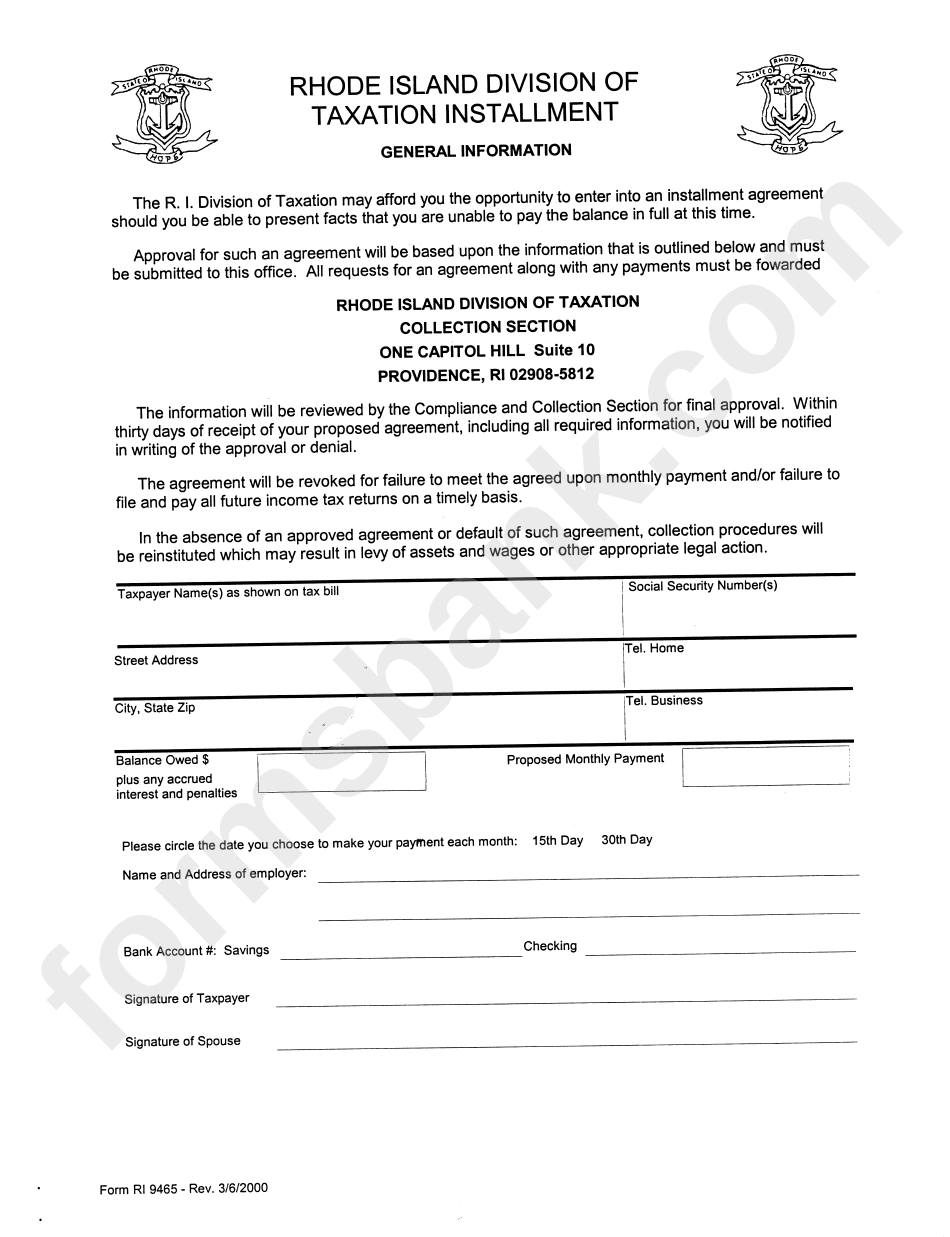

Form Ri9465 Installment Agreement Request Form 2000 printable pdf

September 2020)) department of the treasury internal revenue service section references are to the internal revenue. For instructions and the latest information. Form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. December 2018) department of the treasury internal revenue service. This form is for income earned.

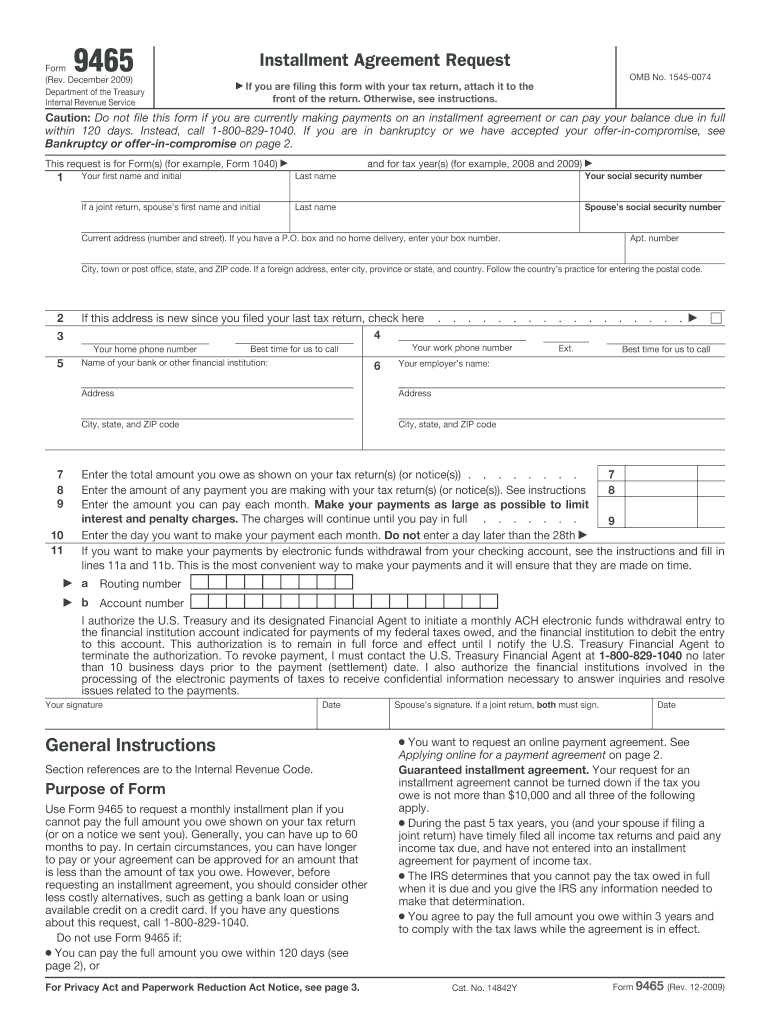

Form 9465 Installment Agreement Request Fill and Sign Printable

This form is for income earned in tax year 2022, with tax returns due in april 2023. Pay as much of the tax as possible with your return (or notice). You can file form 9465 by itself, even if. September 2020)) department of the treasury internal revenue service section references are to the internal revenue. Web use irs form 9465.

Fillable Form 9465 Installment Agreement Request printable pdf download

All • who owes income tax on form 1040, payments received will be applied to your account in the best • who may be responsible for a trust fund recovery penalty, interests of the united states. Form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. The.

Irs Installment Agreement Form 9465 Instructions Erin Anderson's Template

Form 9465 is available in all versions of taxact ®. If you are filing this form with your tax return, attach it to the front of the return. The irs encourages you to pay a portion of the amount you owe and then request an installment for the remaining balance. Web information about form 9465, installment agreement request, including recent.

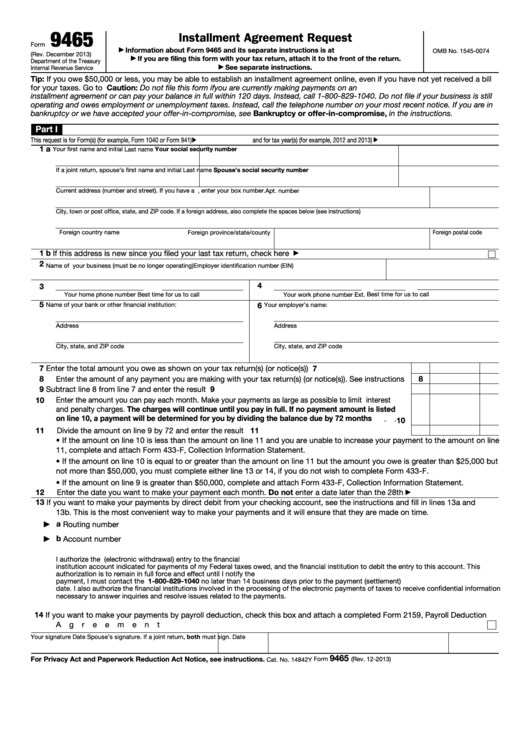

Instructions 9465 2018 Blank Sample to Fill out Online in PDF

Web information about form 9465, installment agreement request, including recent updates, related forms and instructions on how to file. This form is for income earned in tax year 2022, with tax returns due in april 2023. If you are filing this form with your tax return, attach it to the front of the return. 216mm (81⁄ 2) 279mm (11) perforate:.

Form 9465 Installment Agreement Request Definition

You can file form 9465 by itself, even if. The irs encourages you to pay a portion of the amount you owe and then request an installment for the remaining balance. The irs encourages you to pay a portion of the amount you owe and then request an installment for the remaining balance. September 2020)) department of the treasury internal.

Form 9465 Edit, Fill, Sign Online Handypdf

October 2020) installment agreement request (for use with form 9465 (rev. If you are filing this form with your tax return, attach it to the front of the return. The irs encourages you to pay a portion of the amount you owe and then request an installment for the remaining balance. More about the federal form 9465 we last updated.

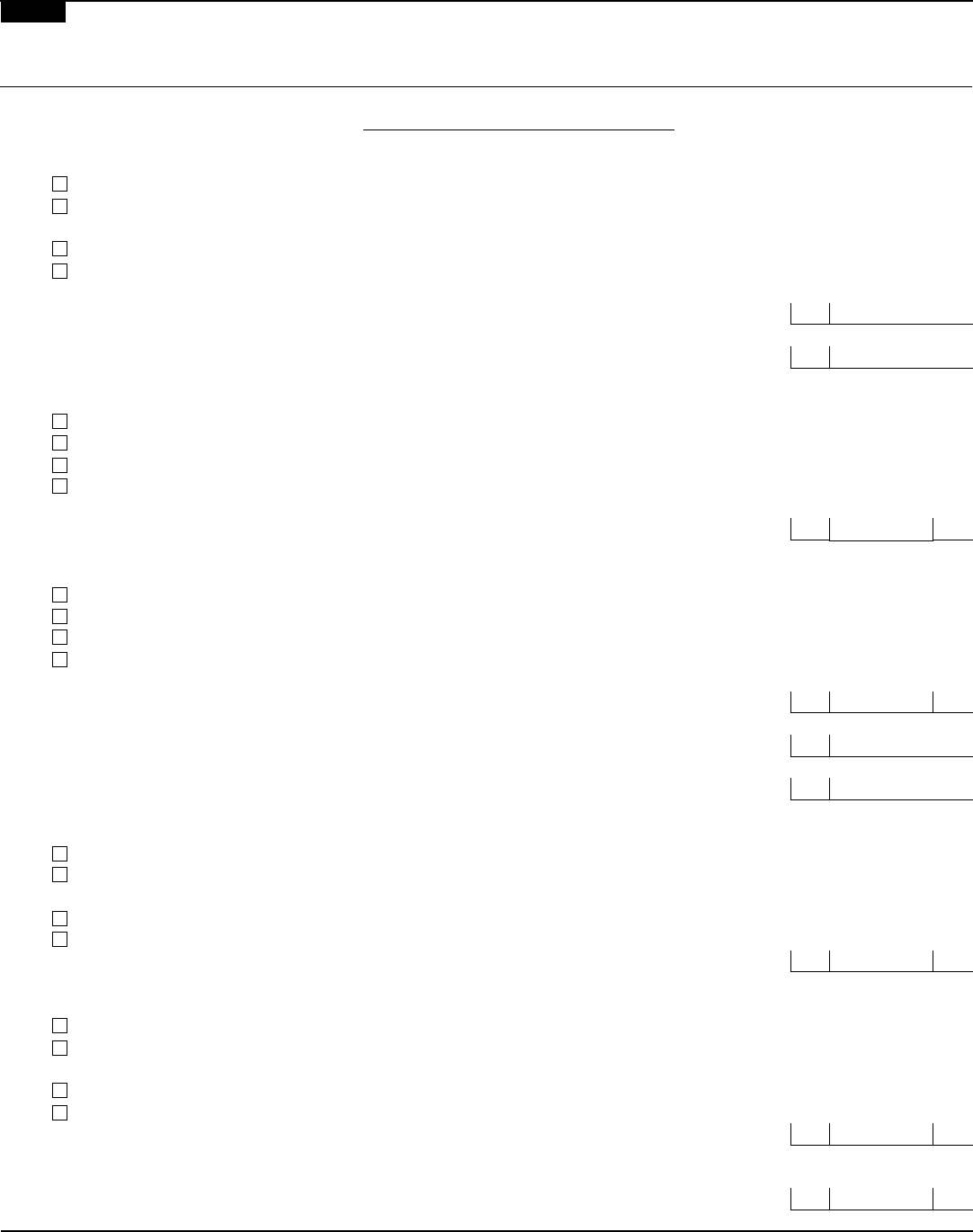

Form Ga9465 Installment Payment Agreement Request printable pdf download

Web department of the treasury internal revenue service www.irs.gov/form9465. You can file form 9465 by itself, even if. All • who owes income tax on form 1040, payments received will be applied to your account in the best • who may be responsible for a trust fund recovery penalty, interests of the united states. 216mm (81⁄ 2) 279mm (11) perforate:.

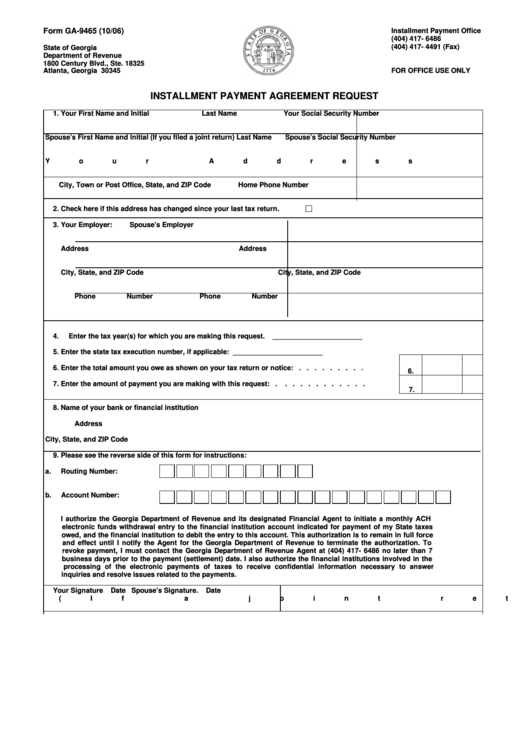

Instructions For Form 9465Fs Installment Agreement Request printable

If you are filing this form with your tax return, attach it to the front of the return. More about the federal form 9465 we last updated federal form 9465 in january 2023 from the federal internal revenue service. 216mm (81⁄ 2) 279mm (11) perforate: December 2018) department of the treasury internal revenue service. This form is for income earned.

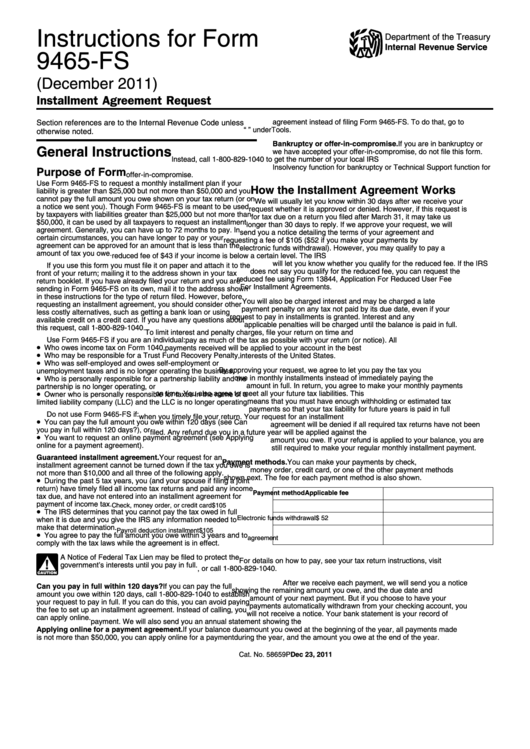

IRS Form 9465 Instructions for How to Fill it Correctly File

The irs encourages you to pay a portion of the amount you owe and then request an installment for the remaining balance. Web use irs form 9465 installment agreement request to request a monthly installment plan if you can't pay your full tax due amount. December 2018) department of the treasury internal revenue service. Web instructions for form 9465 (rev..

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April 2023.

Web department of the treasury internal revenue service www.irs.gov/form9465. You can file form 9465 by itself, even if. Form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. Form 9465 is available in all versions of taxact ®.

Web Information About Form 9465, Installment Agreement Request, Including Recent Updates, Related Forms And Instructions On How To File.

For instructions and the latest information. Web we last updated the installment agreement request in january 2023, so this is the latest version of form 9465, fully updated for tax year 2022. September 2020)) department of the treasury internal revenue service section references are to the internal revenue. Web instructions for form 9465 (rev.

October 2020) Installment Agreement Request (For Use With Form 9465 (Rev.

Web use irs form 9465 installment agreement request to request a monthly installment plan if you can't pay your full tax due amount. The irs encourages you to pay a portion of the amount you owe and then request an installment for the remaining balance. The irs encourages you to pay a portion of the amount you owe and then request an installment for the remaining balance. 216mm (81⁄ 2) 279mm (11) perforate:

December 2018) Department Of The Treasury Internal Revenue Service.

Web use irs form 9465 installment agreement request to request a monthly installment plan if you can't pay your full tax due amount. All • who owes income tax on form 1040, payments received will be applied to your account in the best • who may be responsible for a trust fund recovery penalty, interests of the united states. If you are filing this form with your tax return, attach it to the front of the return. If you are filing this form with your tax return, attach it to the front of the return.

:max_bytes(150000):strip_icc()/9465-700bb91065234917b8d2866f2306afe9.jpg)