Form 990-Ez Instructions

Form 990-Ez Instructions - Schedule a (form 990) 2022 (all organizations must complete this part.) see. Complete, edit or print tax forms instantly. Ad get ready for tax season deadlines by completing any required tax forms today. Excess or (deficit) for the year. Web to complete this portion of part i, you must report the following: Ad get ready for tax season deadlines by completing any required tax forms today. Net assets or fund balances at the beginning of the year. Complete if the organization is a section 501(c)(3). Organizations under section 501 (c), 527, or 4947 (a) (1) of the (irc). You’ll just need to file the standard form 990.

Ad get ready for tax season deadlines by completing any required tax forms today. Optional for others.) balance sheets (see the instructions. Web to complete this portion of part i, you must report the following: Web the form 990ez is very similar to the irs 990, just shorter and simpler. Complete, edit or print tax forms instantly. If you don’t qualify for the form, that’s fine! Schedule a (form 990) 2022 (all organizations must complete this part.) see. Excess or (deficit) for the year. Our system does not support. Organizations under section 501 (c), 527, or 4947 (a) (1) of the (irc).

Optional for others.) balance sheets (see the instructions. Ad get ready for tax season deadlines by completing any required tax forms today. Web to complete this portion of part i, you must report the following: Try it for free now! Organizations under section 501 (c), 527, or 4947 (a) (1) of the (irc). If you don’t qualify for the form, that’s fine! Upload, modify or create forms. Ad get ready for tax season deadlines by completing any required tax forms today. Our system does not support. Schedule a (form 990) 2022 (all organizations must complete this part.) see.

form 990 ez 2022 Fill Online, Printable, Fillable Blank form990ez

Web to complete this portion of part i, you must report the following: Optional for others.) balance sheets (see the instructions. Net assets or fund balances at the beginning of the year. Schedule a (form 990) 2022 (all organizations must complete this part.) see. If you don’t qualify for the form, that’s fine!

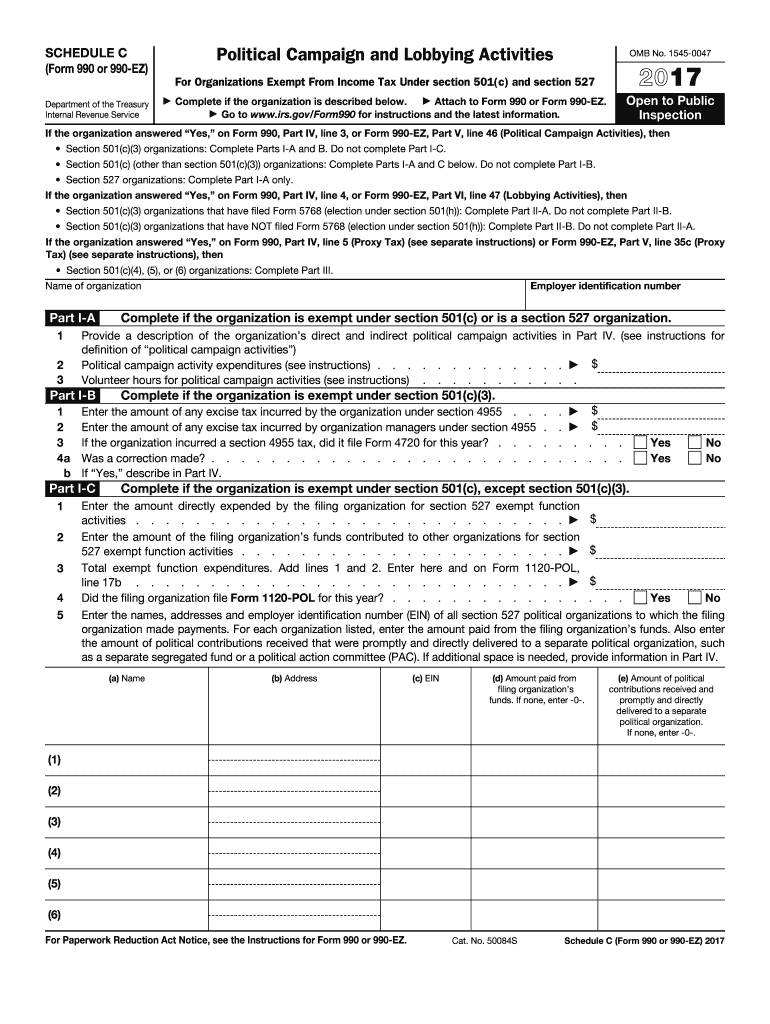

2017 Form IRS 990 or 990EZ Schedule C Fill Online, Printable

Ad get ready for tax season deadlines by completing any required tax forms today. You’ll just need to file the standard form 990. Optional for others.) balance sheets (see the instructions. Complete if the organization is a section 501(c)(3). Web the form 990ez is very similar to the irs 990, just shorter and simpler.

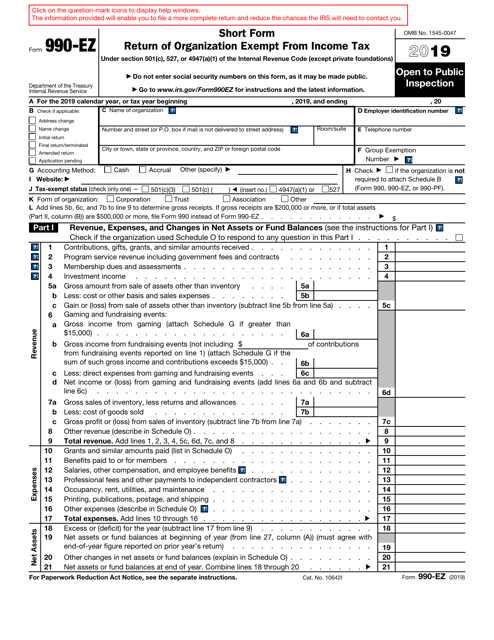

Printable Form 990ez 2019 Printable Word Searches

Web the form 990ez is very similar to the irs 990, just shorter and simpler. Optional for others.) balance sheets (see the instructions. Ad get ready for tax season deadlines by completing any required tax forms today. Ad get ready for tax season deadlines by completing any required tax forms today. Complete if the organization is a section 501(c)(3).

Fillable IRS Form 990EZ Free Printable PDF Sample FormSwift

Try it for free now! If you don’t qualify for the form, that’s fine! Net assets or fund balances at the beginning of the year. Upload, modify or create forms. Complete, edit or print tax forms instantly.

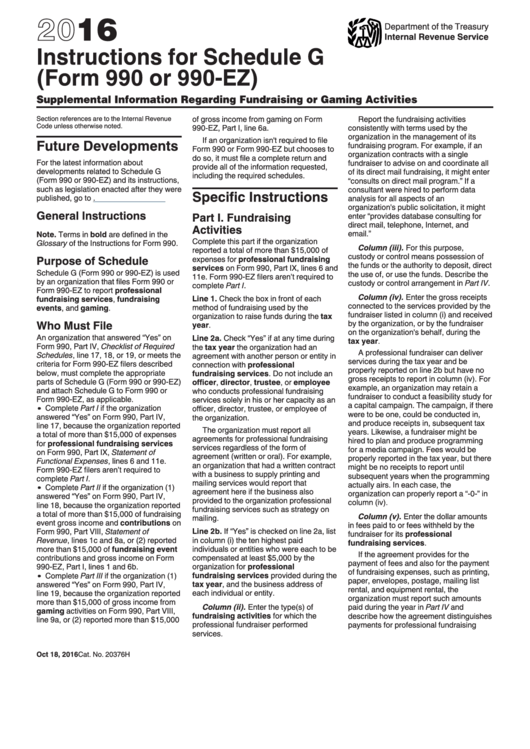

Instructions For Schedule G (Form 990 Or 990Ez) Supplemental

Schedule a (form 990) 2022 (all organizations must complete this part.) see. Ad get ready for tax season deadlines by completing any required tax forms today. Net assets or fund balances at the beginning of the year. Organizations under section 501 (c), 527, or 4947 (a) (1) of the (irc). Ad get ready for tax season deadlines by completing any.

990 Ez Form Fill Out and Sign Printable PDF Template signNow

Complete, edit or print tax forms instantly. Optional for others.) balance sheets (see the instructions. Try it for free now! Our system does not support. Excess or (deficit) for the year.

How to Complete Part I of IRS Form 990EZ

Our system does not support. Ad get ready for tax season deadlines by completing any required tax forms today. You’ll just need to file the standard form 990. Web to complete this portion of part i, you must report the following: Excess or (deficit) for the year.

Form 990EZ Short Form Return of Organization Exempt from Tax

Upload, modify or create forms. Optional for others.) balance sheets (see the instructions. You’ll just need to file the standard form 990. Ad get ready for tax season deadlines by completing any required tax forms today. Net assets or fund balances at the beginning of the year.

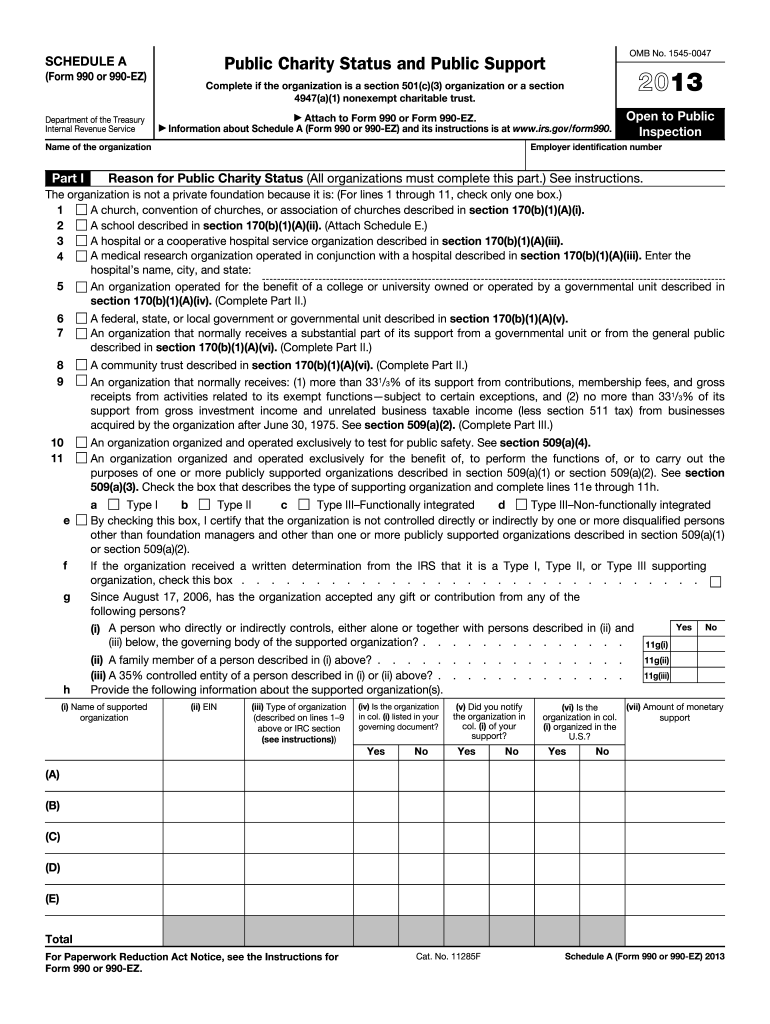

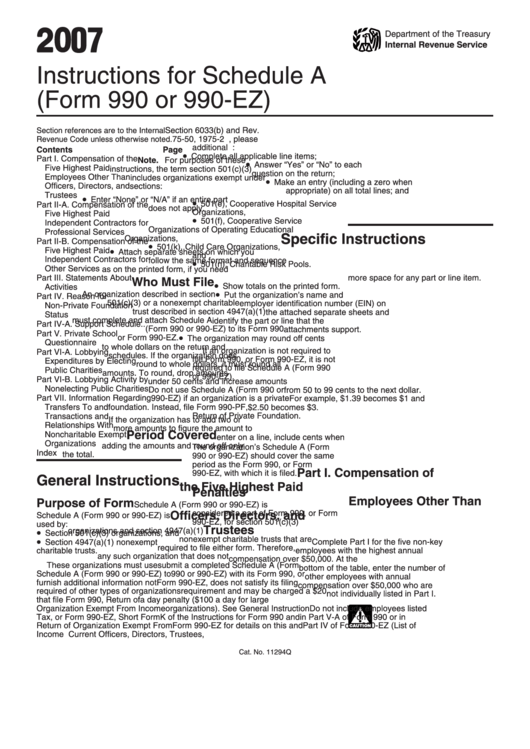

Instructions For Schedule A (Form 990 Or 990Ez) 2007 printable pdf

Ad get ready for tax season deadlines by completing any required tax forms today. Organizations under section 501 (c), 527, or 4947 (a) (1) of the (irc). If you don’t qualify for the form, that’s fine! Complete if the organization is a section 501(c)(3). Schedule a (form 990) 2022 (all organizations must complete this part.) see.

2021 Form IRS 990 or 990EZ Schedule E Fill Online, Printable

Ad get ready for tax season deadlines by completing any required tax forms today. Upload, modify or create forms. Complete if the organization is a section 501(c)(3). Optional for others.) balance sheets (see the instructions. Web to complete this portion of part i, you must report the following:

Ad Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Optional for others.) balance sheets (see the instructions. Try it for free now! Upload, modify or create forms. You’ll just need to file the standard form 990.

Web To Complete This Portion Of Part I, You Must Report The Following:

Schedule a (form 990) 2022 (all organizations must complete this part.) see. Our system does not support. Complete if the organization is a section 501(c)(3). If you don’t qualify for the form, that’s fine!

Ad Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Organizations under section 501 (c), 527, or 4947 (a) (1) of the (irc). Excess or (deficit) for the year. Web the form 990ez is very similar to the irs 990, just shorter and simpler. Net assets or fund balances at the beginning of the year.