Form 990 Instructions 2020

Form 990 Instructions 2020 - For organizations following calendar tax year. Web for paperwork reduction act notice, see the instructions for form 990. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. Accordingly, where the form 990 references. • to figure the tax based on investment income, and • to report charitable distributions and activities. Sign and date your return. Instructions for these schedules are. An officer must sign and date the tax return. Web form 990 2020 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the.

Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. Sign and date your return. • to figure the tax based on investment income, and • to report charitable distributions and activities. Schedule i (form 990) 2020: For organizations following calendar tax year. Web the 2021 form 990, return of organization exempt from income tax, compared to the 2020 form 990, saw relatively few modifications other than minor stylistic changes and. Baa for paperwork reduction act notice, see the. Instructions for these schedules are. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Each unrelated trade or business of an organization has a separate schedule a attached to the return, with a list of how many.

Instructions for these schedules are. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Web form 990 2020 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the. • to figure the tax based on investment income, and • to report charitable distributions and activities. Web form 990 2020 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the. Accordingly, where the form 990 references. Web form 990 2020 return of organization exempt from income tax schedule a organization exempt under section 501(c)(3). Web form 990 2020 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the. Sign and date your return. Web filing due dates massa chusetts general laws (mgl) ch 62c, §§ 11 and 12 require c corpo rations to file their tax returns on or before the 15th day of the fourth month.

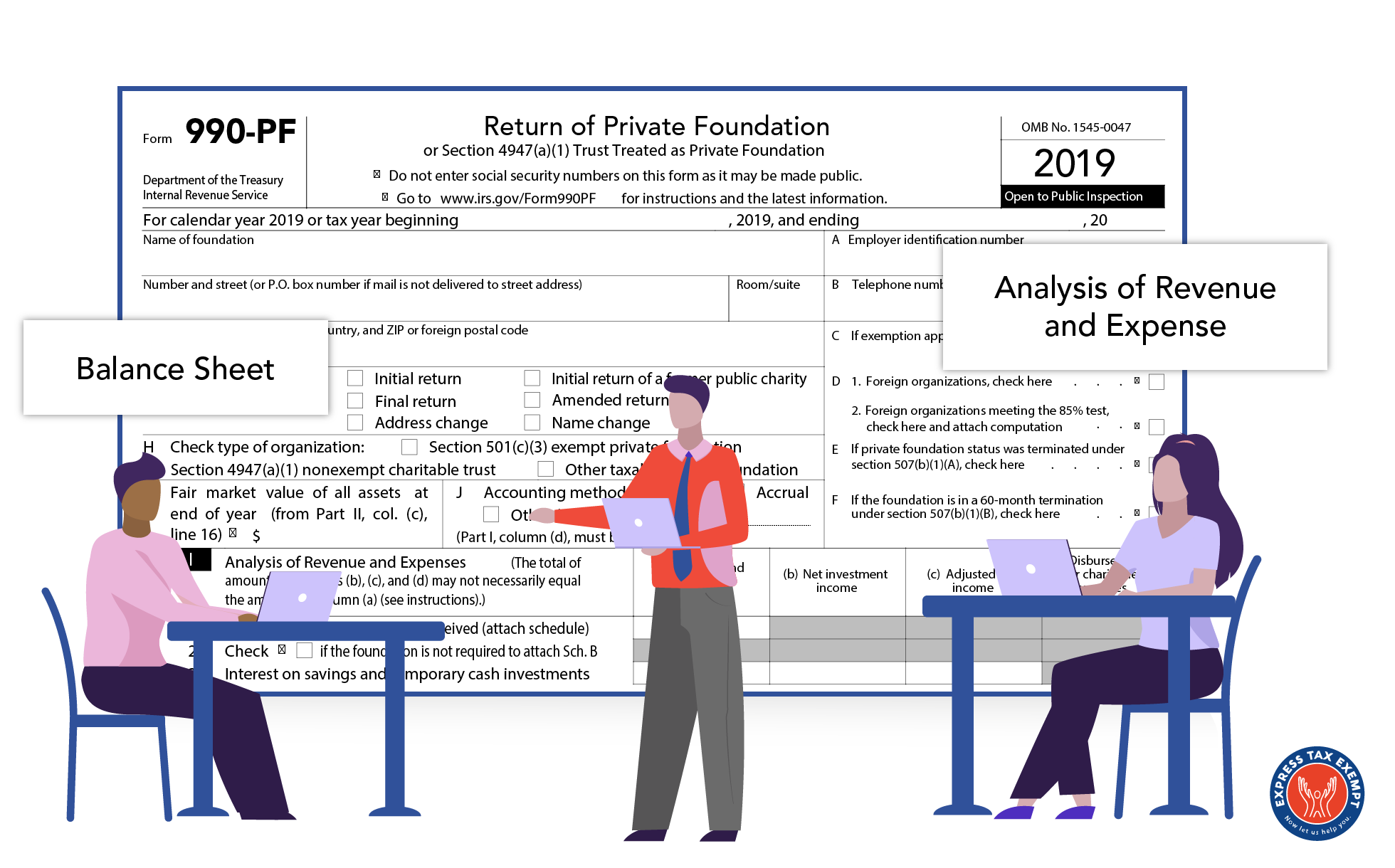

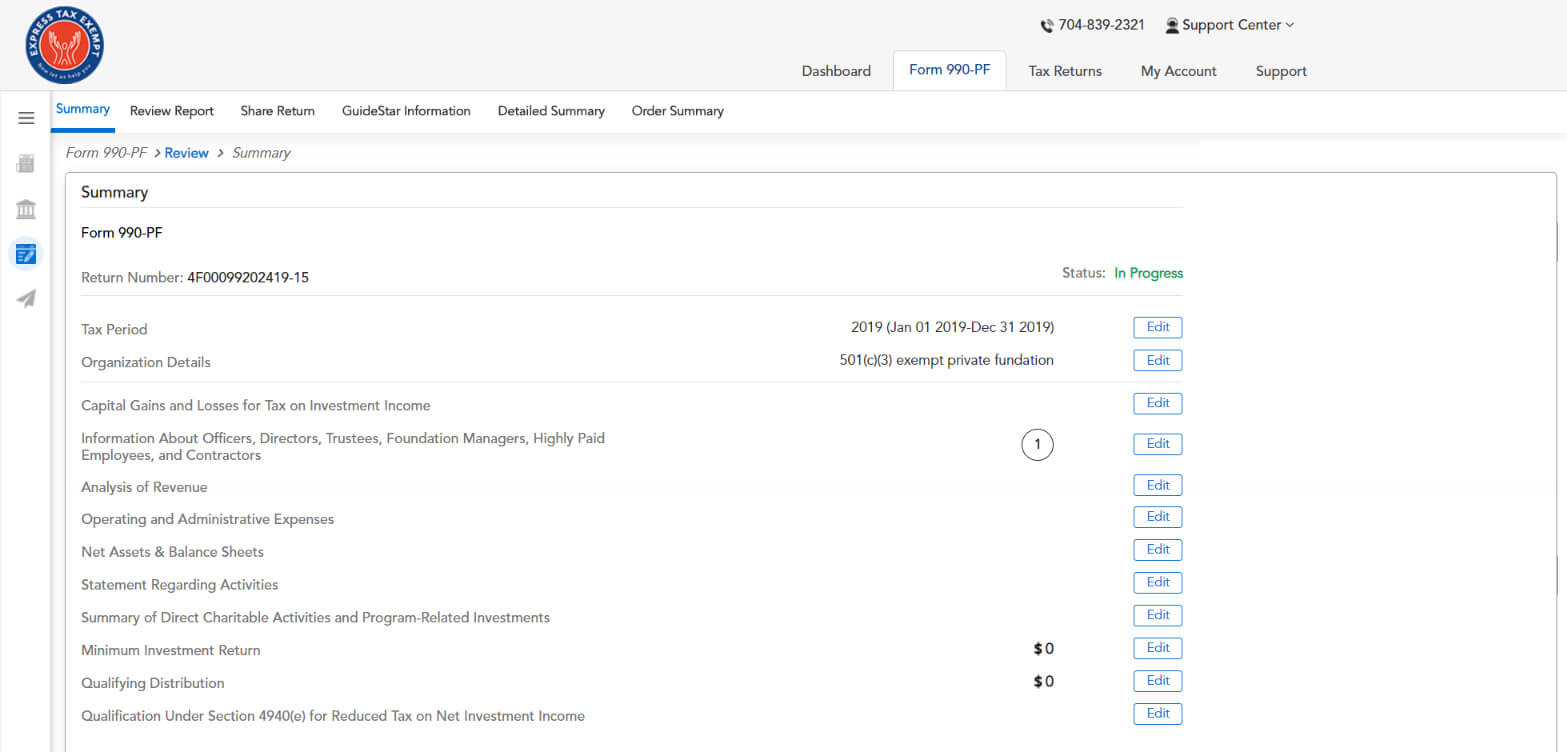

Instructions to file your Form 990PF A Complete Guide

Web for paperwork reduction act notice, see the instructions for form 990. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. Sign and date your return. Web the 2021 form 990, return of organization exempt from income tax, compared to the 2020 form 990, saw relatively.

2020 form 990 schedule c instructions Fill Online, Printable

Web form 990 2020 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the. For organizations following calendar tax year. Web filing due dates massa chusetts general laws (mgl) ch 62c, §§ 11 and 12 require c corpo rations to file their tax returns on or before the.

IRS Instructions Schedule A (990 Or 990EZ) 20202022 Fill out Tax

Sign and date your return. Web for paperwork reduction act notice, see the instructions for form 990. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Web the 2021 form 990, return of organization exempt from income tax, compared to the 2020 form 990, saw relatively few modifications other than.

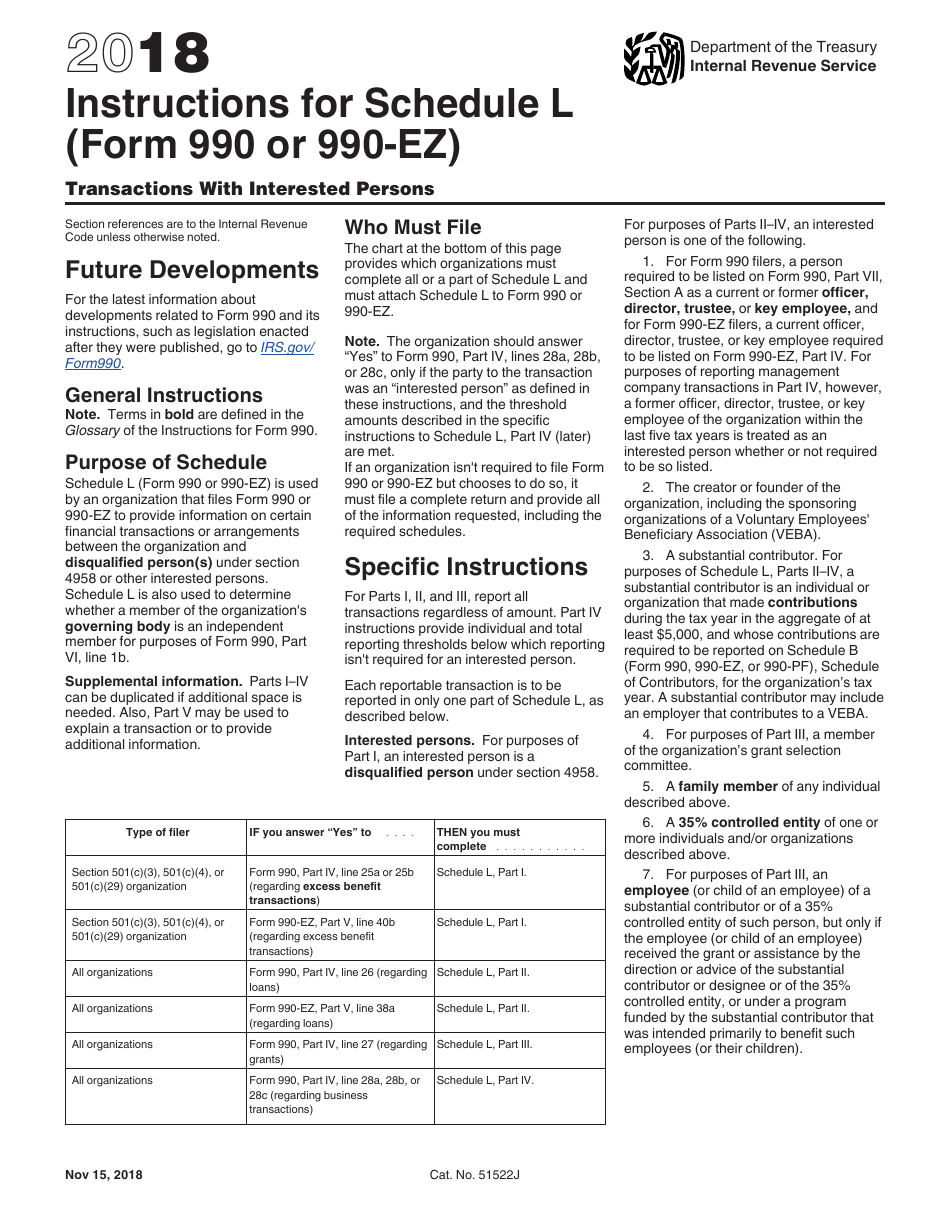

Download Instructions for IRS Form 990, 990EZ Schedule L Transactions

Exempt organization business income tax return. For organizations following calendar tax year. Web form 990 2020 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the. • to figure the tax based on investment income, and • to report charitable distributions and activities. Instructions for these schedules are.

form 990 schedule o Fill Online, Printable, Fillable Blank form990

Web form 990 2020 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the. Exempt organization business income tax return. Web filing due dates massa chusetts general laws (mgl) ch 62c, §§ 11 and 12 require c corpo rations to file their tax returns on or before the.

irs form 990 instructions 2017 Fill Online, Printable, Fillable Blank

Instructions for these schedules are. For organizations following calendar tax year. Web filing due dates massa chusetts general laws (mgl) ch 62c, §§ 11 and 12 require c corpo rations to file their tax returns on or before the 15th day of the fourth month. Web form 990 2020 department of the treasury internal revenue service return of organization exempt.

File 990PF Online Efile 990 PF Form 990PF 2021 Instructions

Web filing due dates massa chusetts general laws (mgl) ch 62c, §§ 11 and 12 require c corpo rations to file their tax returns on or before the 15th day of the fourth month. Web for paperwork reduction act notice, see the instructions for form 990. Baa for paperwork reduction act notice, see the. Web form 990 2020 return of.

Irs 990 Ez Instructions Tax Form Editable Online Blank in PDF

Web for paperwork reduction act notice, see the instructions for form 990. Exempt organization business income tax return. Web form 990 2020 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the. Sign and date your return. Web form 990 2020 return of organization exempt from income tax.

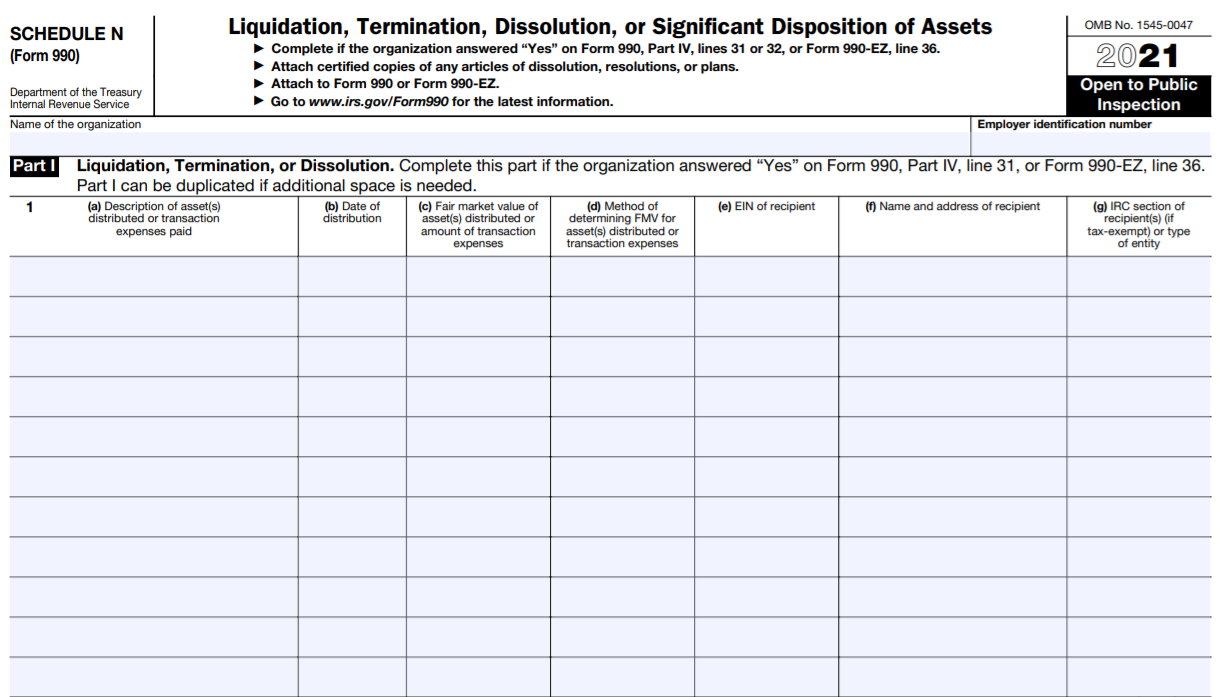

IRS Form 990/990EZ Schedule N Instructions Liquidation, Termination

Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. Instructions for these schedules are. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Web filing due dates massa chusetts general laws (mgl) ch 62c, §§ 11.

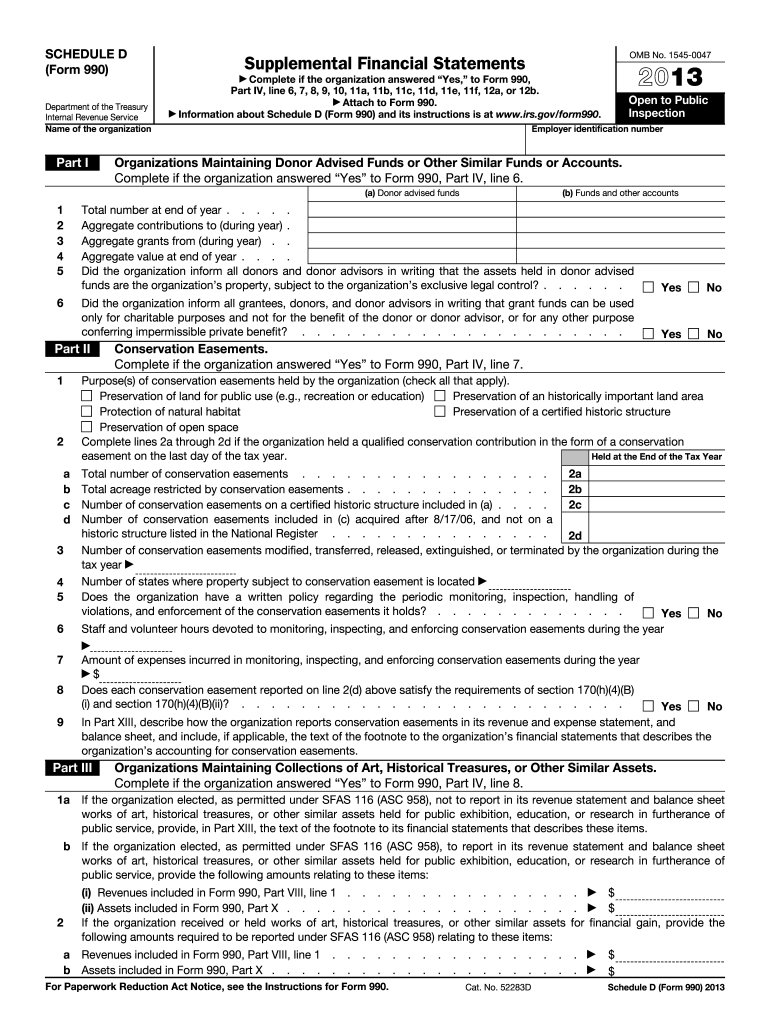

Form 990 Schedule D Fill Out and Sign Printable PDF Template signNow

Exempt organization business income tax return. Accordingly, where the form 990 references. Baa for paperwork reduction act notice, see the. Tax due/overpayment no tax is due. Web filing due dates massa chusetts general laws (mgl) ch 62c, §§ 11 and 12 require c corpo rations to file their tax returns on or before the 15th day of the fourth month.

Web Form 990 2020 Department Of The Treasury Internal Revenue Service Return Of Organization Exempt From Income Tax Under Section 501(C), 527, Or 4947(A)(1) Of The.

Each unrelated trade or business of an organization has a separate schedule a attached to the return, with a list of how many. • to figure the tax based on investment income, and • to report charitable distributions and activities. Web for paperwork reduction act notice, see the instructions for form 990. An officer must sign and date the tax return.

Web Form 990 2020 Department Of The Treasury Internal Revenue Service Return Of Organization Exempt From Income Tax Under Section 501(C), 527, Or 4947(A)(1) Of The.

Accordingly, where the form 990 references. Sign and date your return. Web the 2021 form 990, return of organization exempt from income tax, compared to the 2020 form 990, saw relatively few modifications other than minor stylistic changes and. Web form 990 2020 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the.

Web Filing Due Dates Massa Chusetts General Laws (Mgl) Ch 62C, §§ 11 And 12 Require C Corpo Rations To File Their Tax Returns On Or Before The 15Th Day Of The Fourth Month.

Exempt organization business income tax return. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Instructions for these schedules are. For organizations following calendar tax year.

Tax Due/Overpayment No Tax Is Due.

Schedule i (form 990) 2020: Baa for paperwork reduction act notice, see the. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. Web form 990 2020 return of organization exempt from income tax schedule a organization exempt under section 501(c)(3).