Form 990 Instructions 2022

Form 990 Instructions 2022 - Certain exempt organizations file this form to provide the irs with the information required by section 6033. (b) current year (a) prior year (optional) Web most of the changes to the 2022 form 990, schedules and instructions are relatively minor clarifications and updates. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form as it may be made public. Web schedule a (form 990) 2022 explain in explain in detail in schedule a (form 990) 2022 page check here if the organization satisfied the integral part test as a qualifying trust on nov. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. Web see instructions form (2022) form 990 (2022) page check if schedule o contains a response or note to any line in this part viii. Schedule c (form 990) 2022 ¥ section 501(c)(3) organizations: Some of the more significant changes include:

Instructions for these schedules are combined with the schedules. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Certain exempt organizations file this form to provide the irs with the information required by section 6033. (b) current year (a) prior year (optional) An organization checks “cash” on form 990, part xii, line 1. Web schedule a (form 990) 2022 explain in explain in detail in schedule a (form 990) 2022 page check here if the organization satisfied the integral part test as a qualifying trust on nov. Web see instructions form (2022) form 990 (2022) page check if schedule o contains a response or note to any line in this part viii. Schedule c (form 990) 2022 ¥ section 501(c)(3) organizations: Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form as it may be made public.

An organization checks “cash” on form 990, part xii, line 1. Web most of the changes to the 2022 form 990, schedules and instructions are relatively minor clarifications and updates. Schedule c (form 990) 2022 ¥ section 501(c)(3) organizations: Web schedule a (form 990) 2022 explain in explain in detail in schedule a (form 990) 2022 page check here if the organization satisfied the integral part test as a qualifying trust on nov. Instructions for these schedules are combined with the schedules. (b) current year (a) prior year (optional) Web see instructions form (2022) form 990 (2022) page check if schedule o contains a response or note to any line in this part viii. Certain exempt organizations file this form to provide the irs with the information required by section 6033. Some of the more significant changes include: Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file.

Irs Form 990 Ez Schedule A Instructions Form Resume Examples

Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. Web schedule a (form 990) 2022 explain in explain in detail in schedule a (form 990) 2022 page check here if the organization satisfied the integral part test as a qualifying trust on nov. Schedule c (form.

Form 990 20141 Center for Watershed Protection

(b) current year (a) prior year (optional) Web see instructions form (2022) form 990 (2022) page check if schedule o contains a response or note to any line in this part viii. Certain exempt organizations file this form to provide the irs with the information required by section 6033. Schedule c (form 990) 2022 ¥ section 501(c)(3) organizations: Web most.

IRS Instructions 990 2018 2019 Printable & Fillable Sample in PDF

(b) current year (a) prior year (optional) Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form as it may be made public. Certain exempt organizations file this form to.

File 990PF Online Efile 990 PF Form 990PF 2021 Instructions

An organization checks “cash” on form 990, part xii, line 1. Web most of the changes to the 2022 form 990, schedules and instructions are relatively minor clarifications and updates. Some of the more significant changes include: Instructions for these schedules are combined with the schedules. Web information about form 990, return of organization exempt from income tax, including recent.

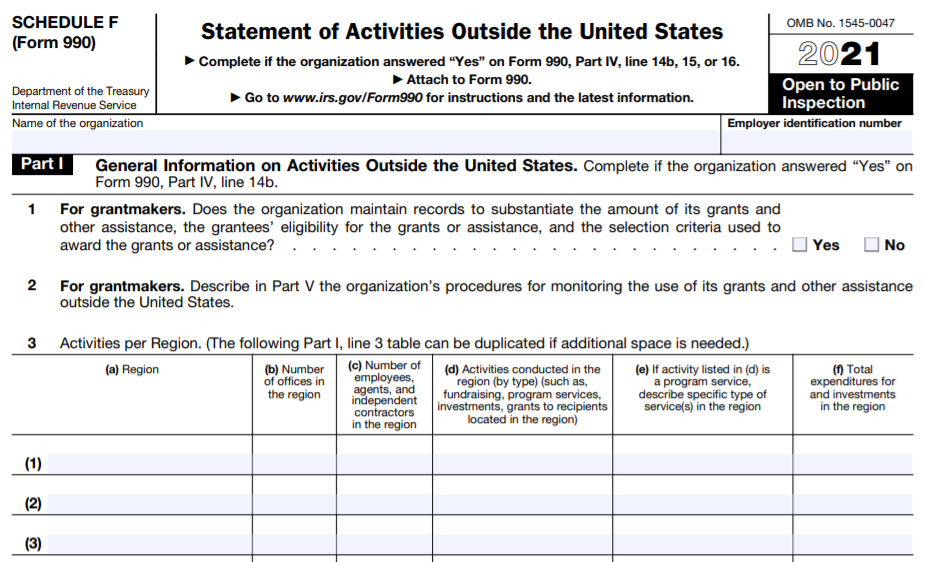

IRS Form 990 Schedule F Instructions Statement of Activities Outside

Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Web see instructions form (2022) form 990 (2022) page check if schedule o contains a response or note to any line in this part viii. Instructions for these schedules are combined with the schedules. Schedule c (form 990) 2022 ¥ section.

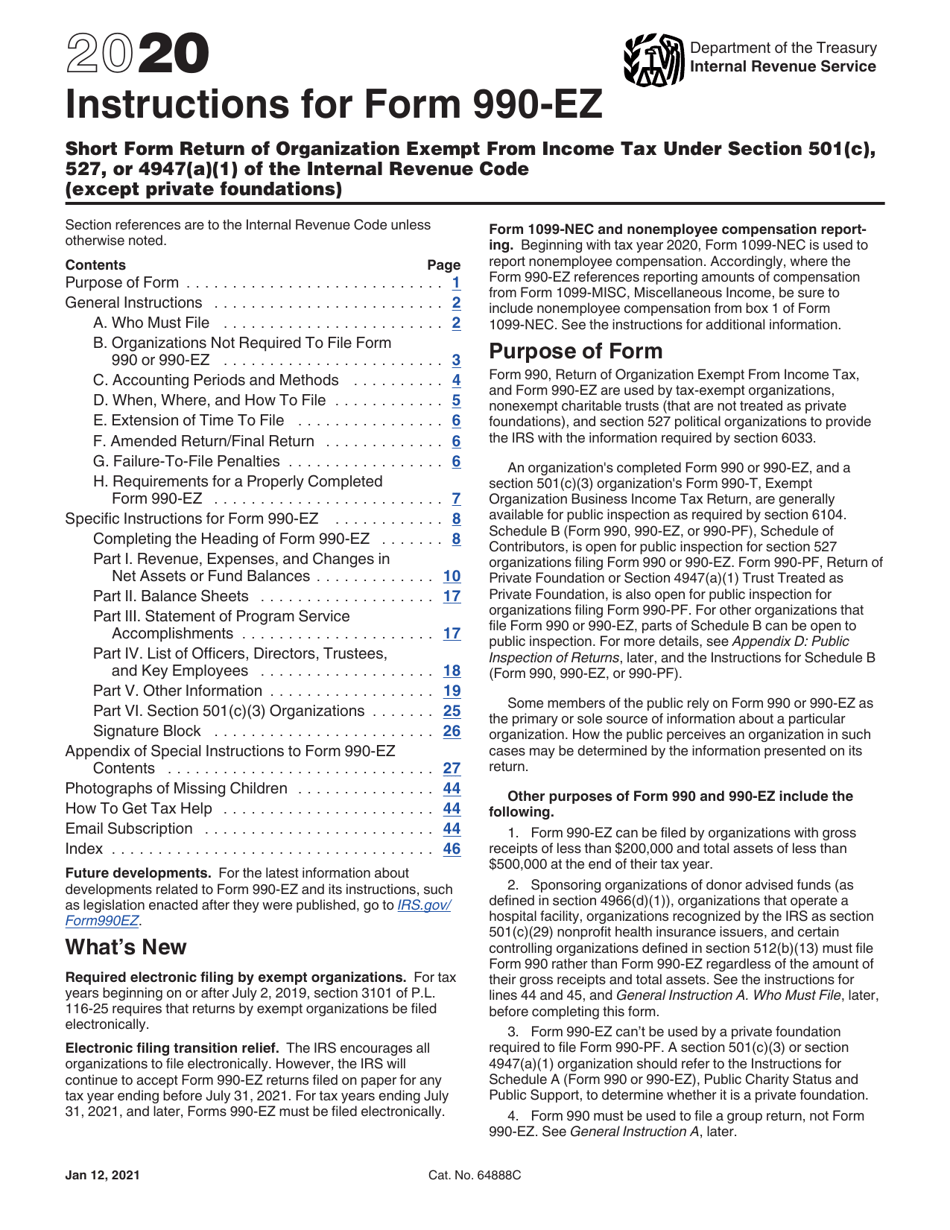

Download Instructions for IRS Form 990EZ Short Form Return of

An organization checks “cash” on form 990, part xii, line 1. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. (b) current year (a) prior year (optional) Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions..

IRS Instructions Schedule A (990 Or 990EZ) 20202022 Fill out Tax

An organization checks “cash” on form 990, part xii, line 1. Some of the more significant changes include: Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. Certain exempt organizations file this form to provide the irs with the information required by section 6033. Web schedule.

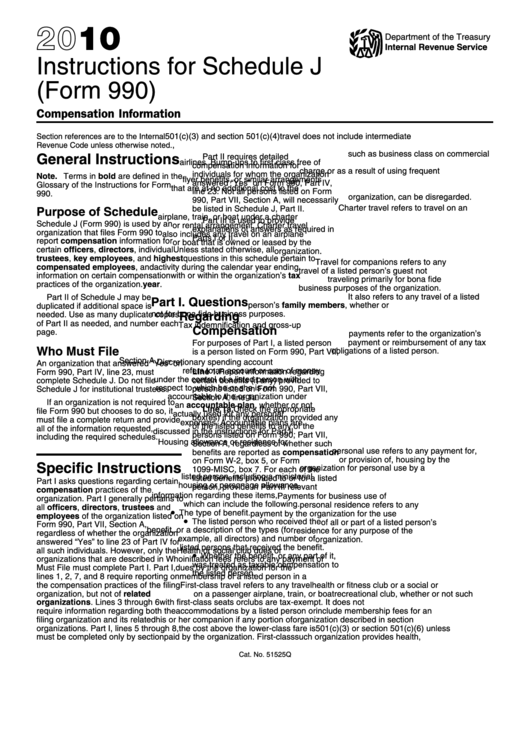

Form 990 Instructions For Schedule J printable pdf download

(b) current year (a) prior year (optional) Some of the more significant changes include: Web most of the changes to the 2022 form 990, schedules and instructions are relatively minor clarifications and updates. Web schedule a (form 990) 2022 explain in explain in detail in schedule a (form 990) 2022 page check here if the organization satisfied the integral part.

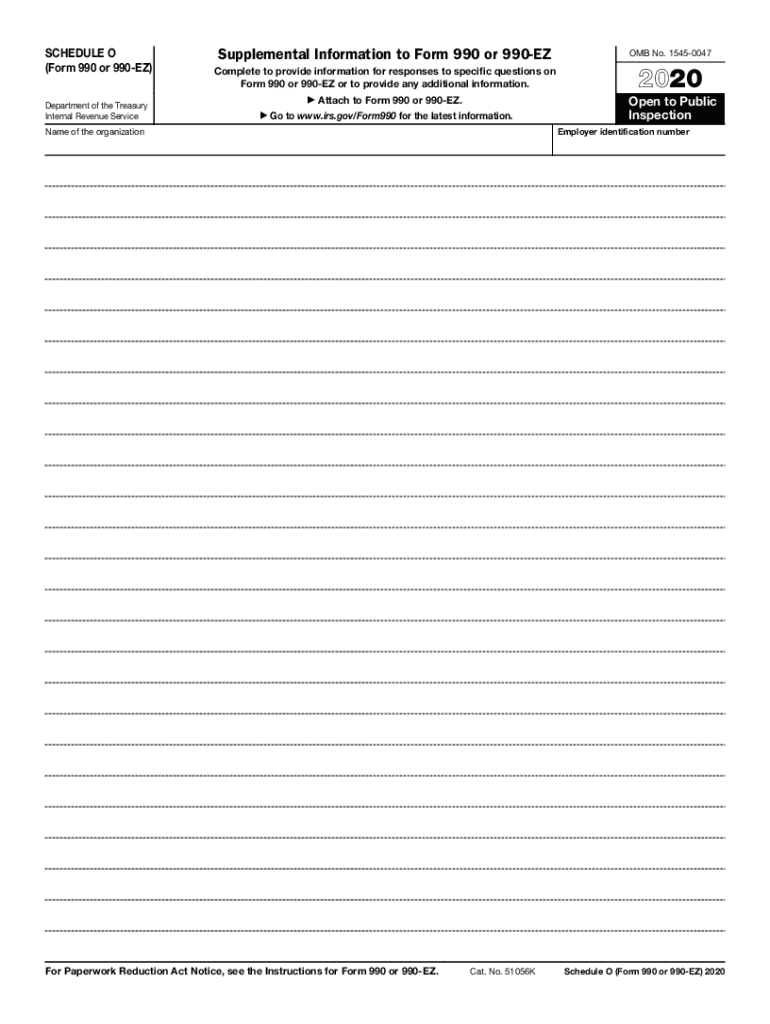

990 Schedule O Fill Out and Sign Printable PDF Template signNow

Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form as it may be made public. Instructions for these schedules are combined with the schedules. Some of the more significant.

Schedule H 990 Online PDF Template

Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Web most of the changes to the 2022 form 990, schedules and instructions are relatively minor clarifications and updates. (b) current year (a) prior year (optional) Instructions for these schedules are combined with the schedules. Web schedule a (form 990) 2022.

Web See Instructions Form (2022) Form 990 (2022) Page Check If Schedule O Contains A Response Or Note To Any Line In This Part Viii.

Schedule c (form 990) 2022 ¥ section 501(c)(3) organizations: Web most of the changes to the 2022 form 990, schedules and instructions are relatively minor clarifications and updates. Instructions for these schedules are combined with the schedules. Some of the more significant changes include:

An Organization Checks “Cash” On Form 990, Part Xii, Line 1.

Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form as it may be made public. Web schedule a (form 990) 2022 explain in explain in detail in schedule a (form 990) 2022 page check here if the organization satisfied the integral part test as a qualifying trust on nov. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. (b) current year (a) prior year (optional)

Web Information About Form 990, Return Of Organization Exempt From Income Tax, Including Recent Updates, Related Forms And Instructions On How To File.

Certain exempt organizations file this form to provide the irs with the information required by section 6033.