Form 990 Schedule I Instructions

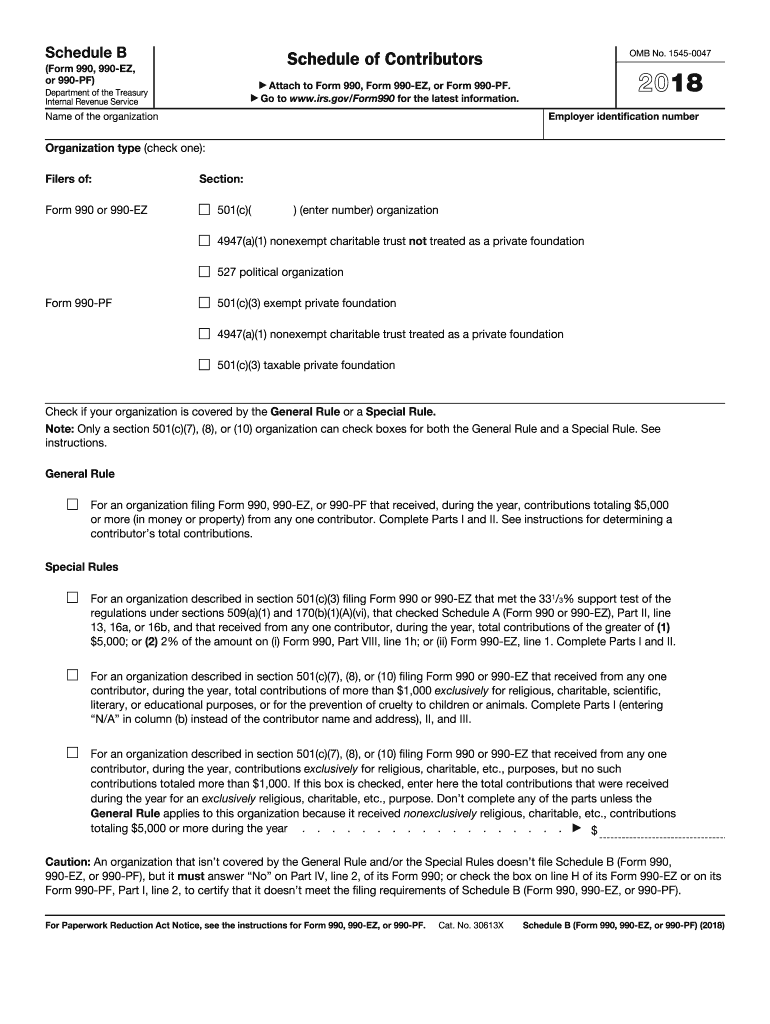

Form 990 Schedule I Instructions - Web see the instructions for schedule l (form 990), transactions with interested persons, and complete schedule l (form 990) (if required). Reason for public charity status. Web an organization that isn’t covered by the general rule and/or the special rules doesn’t file schedule b (form 990), but it answer no on part iv, line 2, of its form 990; Schedule a (form 990) 2022 (all organizations must complete this part.) see. Complete part vi of form 990. Web june 2021 in brief the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: (column (b) must equal form 990, part x, col. Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. Also, organizations with gross receipts greater than or equal to $200,000 or total assets. A section 501(c)(3) or section 4947(a)(1) organization should refer to the instructions for.

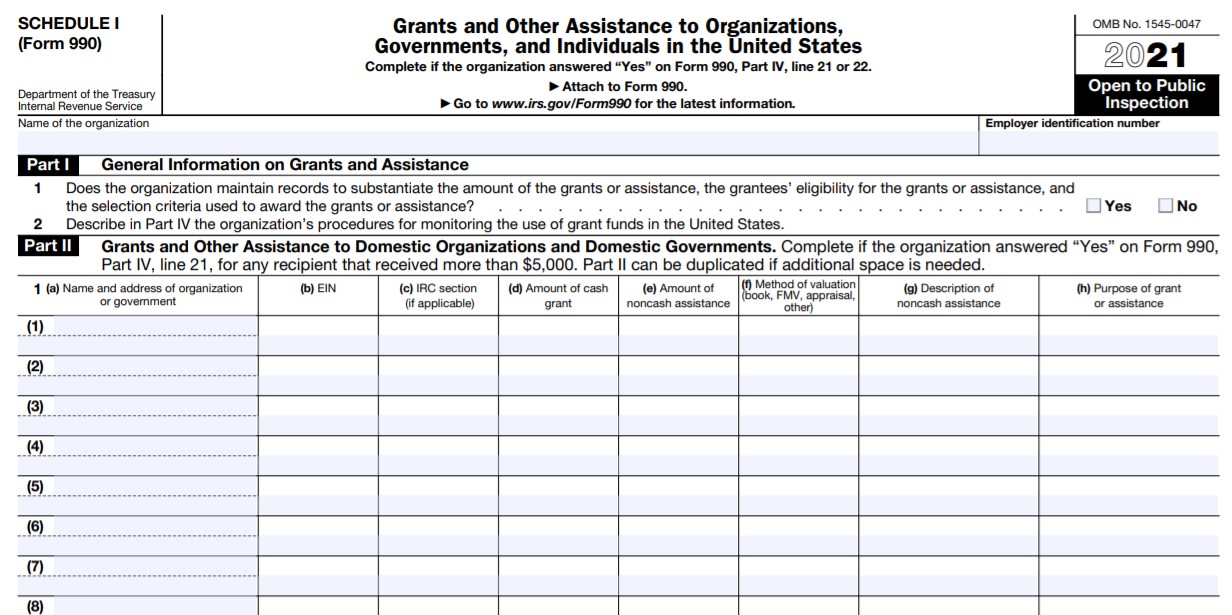

Example—list of donors other than governmental. A section 501(c)(3) or section 4947(a)(1) organization should refer to the instructions for. Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. Web see the instructions for schedule l (form 990), transactions with interested persons, and complete schedule l (form 990) (if required). (column (b) must equal form 990, part x, col. Also, organizations with gross receipts greater than or equal to $200,000 or total assets. If you checked 12d of part i, complete sections a and d, and complete part v.). See instructions did the organization have unrelated business gross income of $1,000 or more during the year from business activities (such as those. Web nonprofit organizations that file form 990 may be required to include schedule i for reporting additional information regarding grants and other assistance. Reason for public charity status.

A section 501(c)(3) or section 4947(a)(1) organization should refer to the instructions for. Web june 2021 in brief the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: (column (b) must equal form 990, part x, col. Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. Schedule a (form 990) 2022 (all organizations must complete this part.) see. Web an organization that isn’t covered by the general rule and/or the special rules doesn’t file schedule b (form 990), but it answer no on part iv, line 2, of its form 990; Ad access irs tax forms. Web report error it appears you don't have a pdf plugin for this browser. Web — revisions to the instructions for schedule e of the form 990 related to the new online method for publication of the racially nondiscriminatory policy provided for in rev. Web change on schedule o.

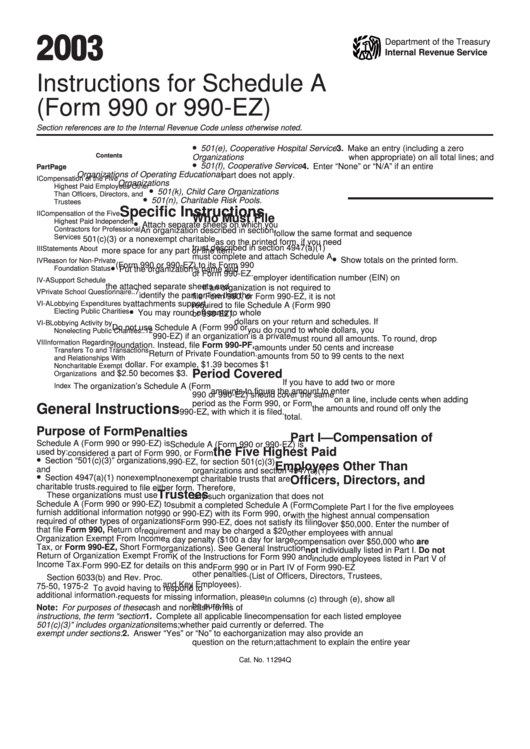

Instructions For Schedule A (Form 990 Or 990Ez) 2003 printable pdf

(column (b) must equal form 990, part x, col. See instructions did the organization have unrelated business gross income of $1,000 or more during the year from business activities (such as those. Web change on schedule o. A section 501(c)(3) or section 4947(a)(1) organization should refer to the instructions for. Web nonprofit organizations that file form 990 may be required.

Form 990/990EZ Schedule A IRS Form 990 Schedule A Instructions

Web — revisions to the instructions for schedule e of the form 990 related to the new online method for publication of the racially nondiscriminatory policy provided for in rev. If you checked 12d of part i, complete sections a and d, and complete part v.). In addition, they contain the following items to help. Complete part vi of form.

IRS Form 990 (Schedule F) 2019 Fillable and Editable PDF Template

Web change on schedule o. Also, organizations with gross receipts greater than or equal to $200,000 or total assets. Web for the latest information about developments related to schedule g (form 990) and its instructions, such as legislation enacted after they were published, go to. If you checked 12d of part i, complete sections a and d, and complete part.

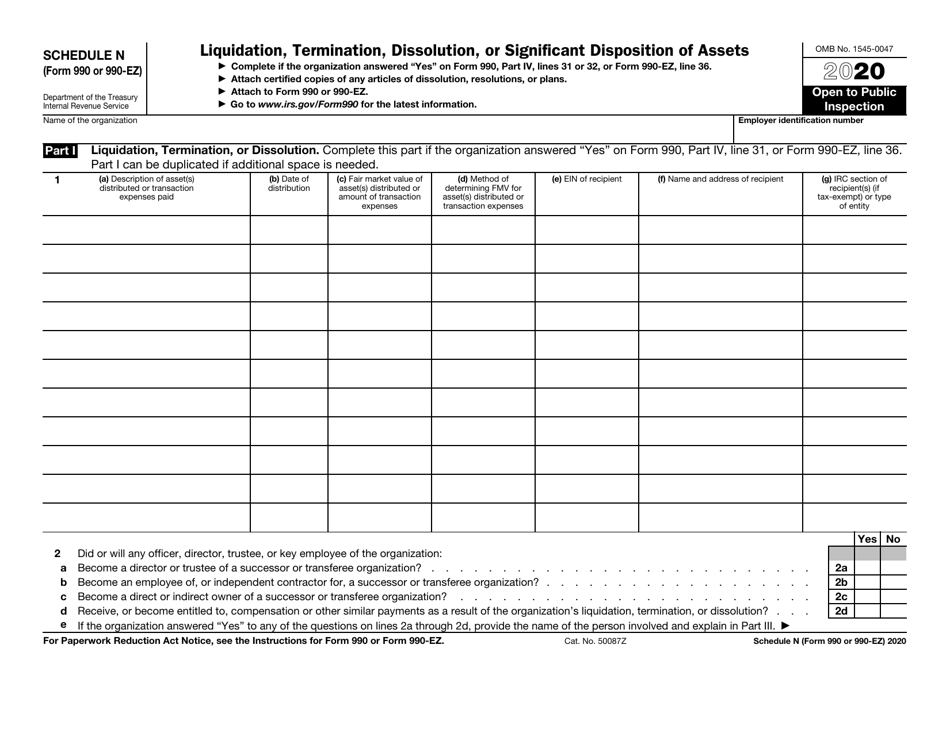

IRS Form 990 (990EZ) Schedule N Download Fillable PDF or Fill Online

Web for the latest information about developments related to schedule g (form 990) and its instructions, such as legislation enacted after they were published, go to. Also, organizations with gross receipts greater than or equal to $200,000 or total assets. (column (b) must equal form 990, part x, col. Web an organization that isn’t covered by the general rule and/or.

Download Instructions for IRS Form 990, 990EZ Schedule C Political

Web report error it appears you don't have a pdf plugin for this browser. Schedule a (form 990) 2022 (all organizations must complete this part.) see. Web june 2021 in brief the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: If you checked 12d of part i, complete sections a and.

IRS 990 Schedule A 20202022 Fill out Tax Template Online

Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. Web see the instructions for schedule l (form 990), transactions with interested persons, and complete schedule l (form 990) (if required). Also, organizations with gross receipts greater than or equal to $200,000 or total assets. Web report error it appears you don't have a pdf plugin for.

IRS Form 990 Schedule I Instructions Grants & Other Assistance

Ad access irs tax forms. Web report error it appears you don't have a pdf plugin for this browser. A section 501(c)(3) or section 4947(a)(1) organization should refer to the instructions for. Schedule a (form 990) 2022 (all organizations must complete this part.) see. Web an organization that isn’t covered by the general rule and/or the special rules doesn’t file.

Form 990 Schedule O Fill Out and Sign Printable PDF Template signNow

Ad access irs tax forms. If you checked 12d of part i, complete sections a and d, and complete part v.). Web see the instructions for schedule l (form 990), transactions with interested persons, and complete schedule l (form 990) (if required). Get ready for tax season deadlines by completing any required tax forms today. Also, organizations with gross receipts.

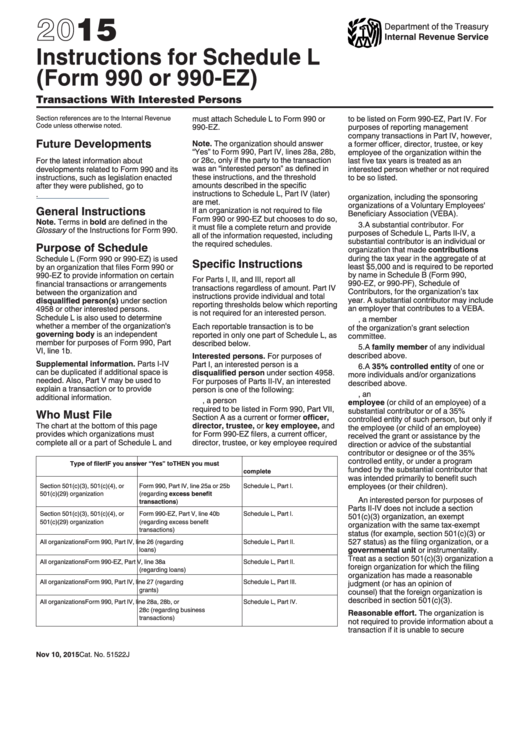

Instructions For Schedule L (Form 990 Or 990Ez) Transactions With

Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. A section 501(c)(3) or section 4947(a)(1) organization should refer to the instructions for. Web — revisions to the instructions for schedule e of the form 990 related to the new online method for publication of the racially nondiscriminatory policy provided for in rev. Web an organization that.

Form 990 (Schedule H) Hospitals (2014) Free Download

If you checked 12d of part i, complete sections a and d, and complete part v.). A section 501(c)(3) or section 4947(a)(1) organization should refer to the instructions for. Reason for public charity status. Web for the latest information about developments related to schedule g (form 990) and its instructions, such as legislation enacted after they were published, go to..

Web Nonprofit Organizations That File Form 990 May Be Required To Include Schedule I For Reporting Additional Information Regarding Grants And Other Assistance.

Complete part vi of form 990. Reason for public charity status. Get ready for tax season deadlines by completing any required tax forms today. Web change on schedule o.

Complete, Edit Or Print Tax Forms Instantly.

Also, organizations with gross receipts greater than or equal to $200,000 or total assets. Example—list of donors other than governmental. (column (b) must equal form 990, part x, col. Web report error it appears you don't have a pdf plugin for this browser.

If You Checked 12D Of Part I, Complete Sections A And D, And Complete Part V.).

Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. Web for the latest information about developments related to schedule g (form 990) and its instructions, such as legislation enacted after they were published, go to. Ad access irs tax forms. Web — revisions to the instructions for schedule e of the form 990 related to the new online method for publication of the racially nondiscriminatory policy provided for in rev.

A Section 501(C)(3) Or Section 4947(A)(1) Organization Should Refer To The Instructions For.

In addition, they contain the following items to help. Web an organization that isn’t covered by the general rule and/or the special rules doesn’t file schedule b (form 990), but it answer no on part iv, line 2, of its form 990; See instructions did the organization have unrelated business gross income of $1,000 or more during the year from business activities (such as those. Schedule a (form 990) 2022 (all organizations must complete this part.) see.