Form Ct 1065 Ct 1120Si

Form Ct 1065 Ct 1120Si - Connecticut group and composite income taxpayers must file a 2007. Save or instantly send your ready documents. Web based on the provisions of the new pet legislation, calendar year entities would have an estimated payment due on june 15, 2018. Utilizing our ultimate online sofware you will see the best way to fill up ct drs. Department of revenue services state of connecticut (rev. It is highly recommended that a second version be. 12/20) 10651120si 1220w 01 9999. Connecticut > payments / penalties > estimates and application of overpayment. 2022 application for extension of time to file. 12/21) 10651120si 1221w 01 9999 2021.

See instructions before completing this return. Department of revenue services state of connecticut (rev. Connecticut group and composite income taxpayers must file a 2007. It is highly recommended that a second version be. Web based on the provisions of the new pet legislation, calendar year entities would have an estimated payment due on june 15, 2018. Utilizing our ultimate online sofware you will see the best way to fill up ct drs. 12/21) 10651120si 1221w 01 9999 2021. Easily fill out pdf blank, edit, and sign them. Connecticut > payments / penalties > estimates and application of overpayment. Save or instantly send your ready documents.

Web based on the provisions of the new pet legislation, calendar year entities would have an estimated payment due on june 15, 2018. 12/20) 10651120si 1220w 01 9999. Easily fill out pdf blank, edit, and sign them. Department of revenue services state of connecticut (rev. It is highly recommended that a second version be. 2022 application for extension of time to file. Save or instantly send your ready documents. 12/21) 10651120si 1221w 01 9999 2021. See instructions before completing this return. Connecticut > payments / penalties > estimates and application of overpayment.

Form Ct1120si Connecticut S Corporation Information And Composite

Utilizing our ultimate online sofware you will see the best way to fill up ct drs. It is highly recommended that a second version be. 12/20) 10651120si 1220w 01 9999. See instructions before completing this return. Department of revenue services state of connecticut (rev.

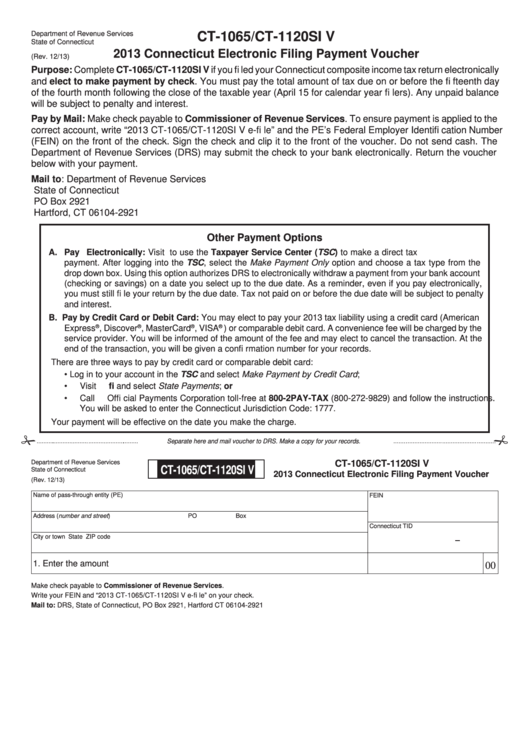

Form Ct1065/ct1120si V Connecticut Electronic Filing Payment

See instructions before completing this return. Connecticut > payments / penalties > estimates and application of overpayment. Connecticut group and composite income taxpayers must file a 2007. Web based on the provisions of the new pet legislation, calendar year entities would have an estimated payment due on june 15, 2018. It is highly recommended that a second version be.

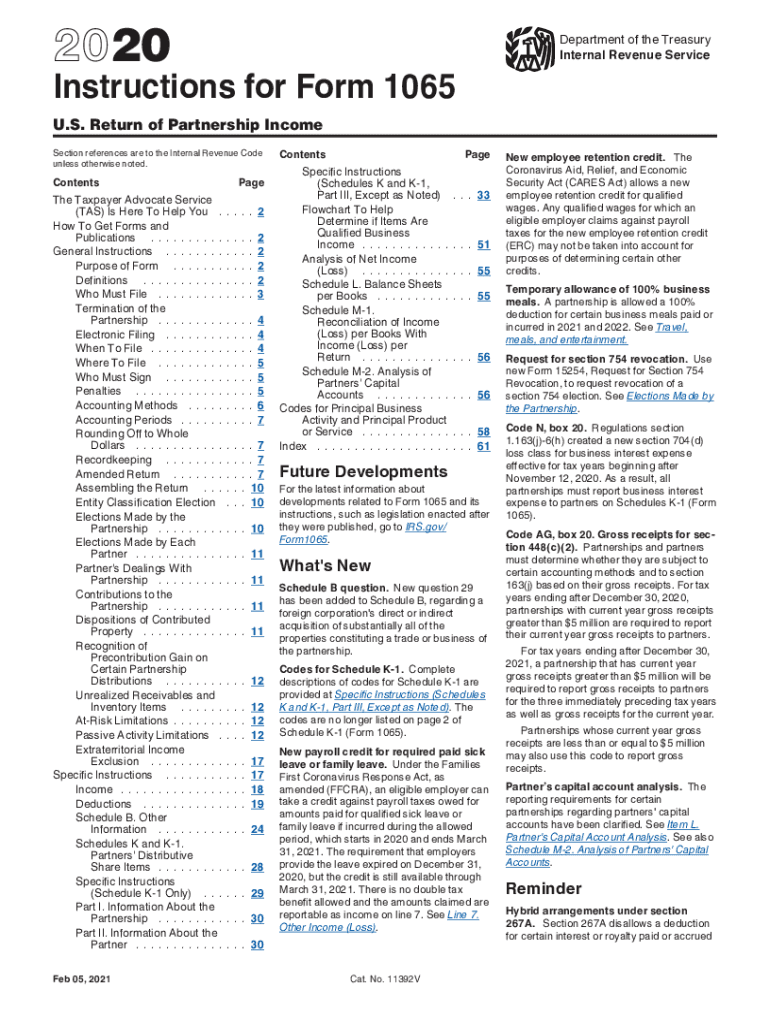

2020 Form IRS Instructions 1065 Fill Online, Printable, Fillable, Blank

Department of revenue services state of connecticut (rev. 12/21) 10651120si 1221w 01 9999 2021. See instructions before completing this return. Easily fill out pdf blank, edit, and sign them. It is highly recommended that a second version be.

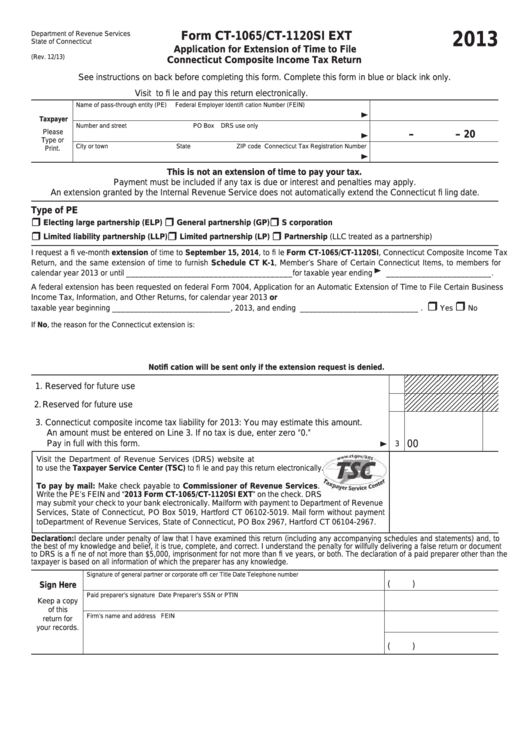

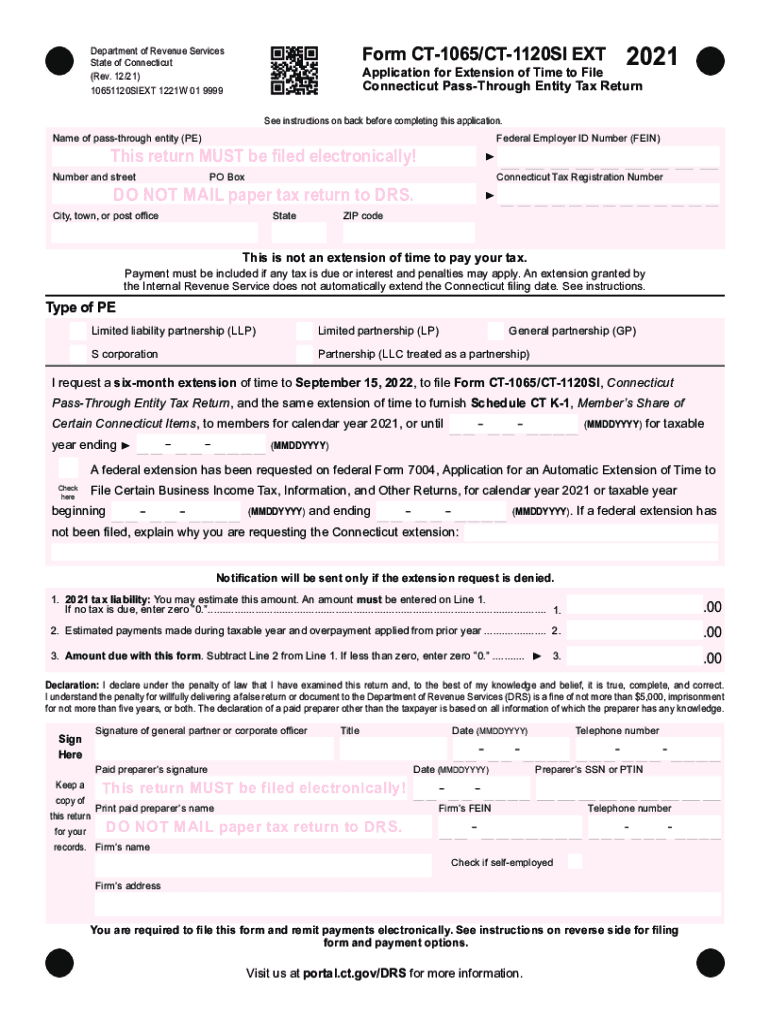

Form Ct1065/ct1120si Ext Application For Extension Of Time To File

Department of revenue services state of connecticut (rev. 12/21) 10651120si 1221w 01 9999 2021. Save or instantly send your ready documents. 12/20) 10651120si 1220w 01 9999. 2022 application for extension of time to file.

Llc Tax Return Form 1065 Instructions

Easily fill out pdf blank, edit, and sign them. 2022 application for extension of time to file. See instructions before completing this return. Connecticut > payments / penalties > estimates and application of overpayment. 12/20) 10651120si 1220w 01 9999.

Form Ct 1065 Ct 1120Si ≡ Fill Out Printable PDF Forms Online

12/21) 10651120si 1221w 01 9999 2021. 12/20) 10651120si 1220w 01 9999. Save or instantly send your ready documents. Web based on the provisions of the new pet legislation, calendar year entities would have an estimated payment due on june 15, 2018. It is highly recommended that a second version be.

2021 Form CT DRS CT1065/CT1120SI EXT Fill Online, Printable, Fillable

It is highly recommended that a second version be. Connecticut group and composite income taxpayers must file a 2007. See instructions before completing this return. Connecticut > payments / penalties > estimates and application of overpayment. Easily fill out pdf blank, edit, and sign them.

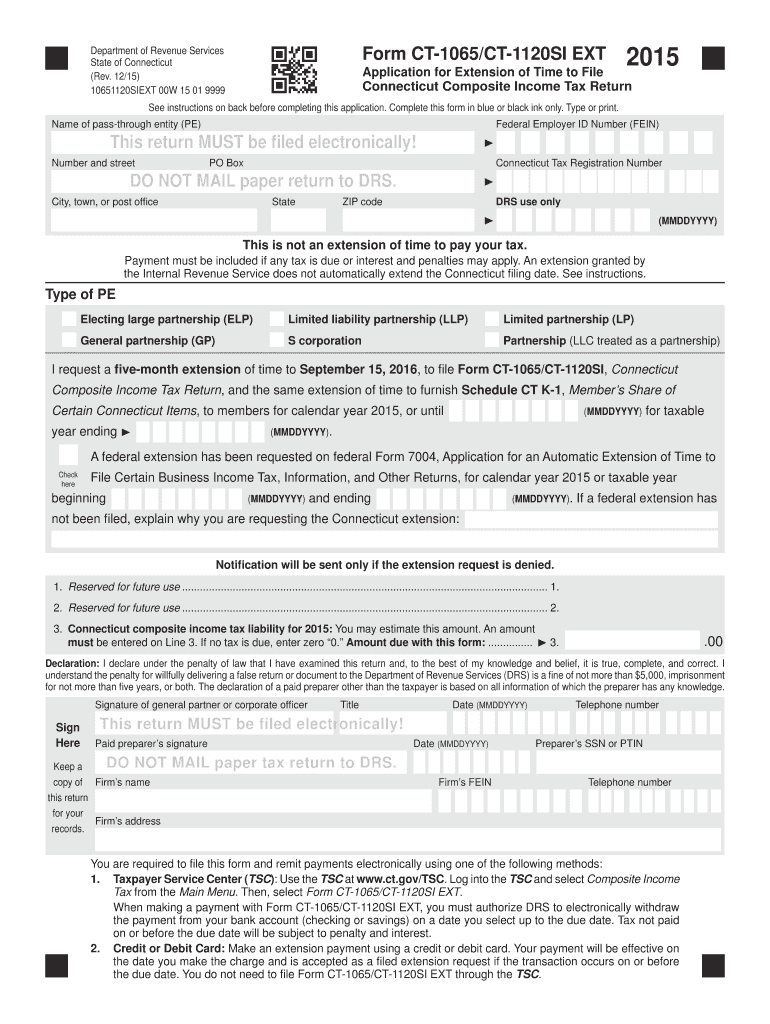

CT DRS CT1065/CT1120SI EXT 2015 Fill out Tax Template Online US

Department of revenue services state of connecticut (rev. Connecticut group and composite income taxpayers must file a 2007. Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents. Connecticut > payments / penalties > estimates and application of overpayment.

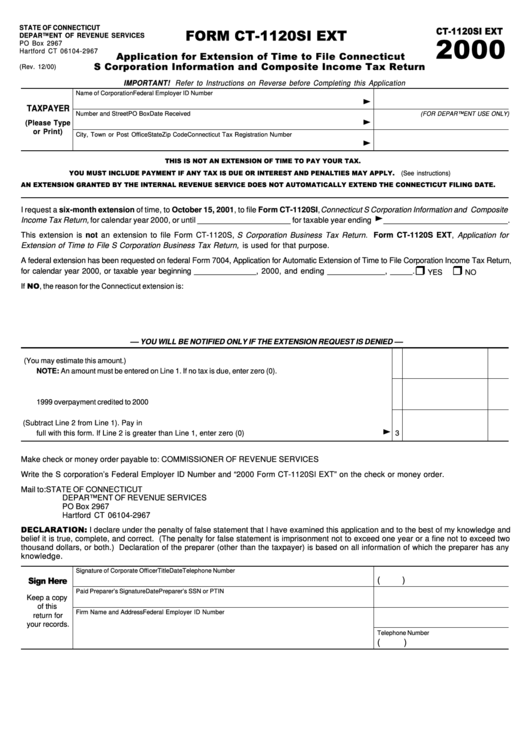

Form Ct1120si Ext Application For Extension Of Time To File

Save or instantly send your ready documents. Connecticut group and composite income taxpayers must file a 2007. 12/21) 10651120si 1221w 01 9999 2021. Department of revenue services state of connecticut (rev. Web based on the provisions of the new pet legislation, calendar year entities would have an estimated payment due on june 15, 2018.

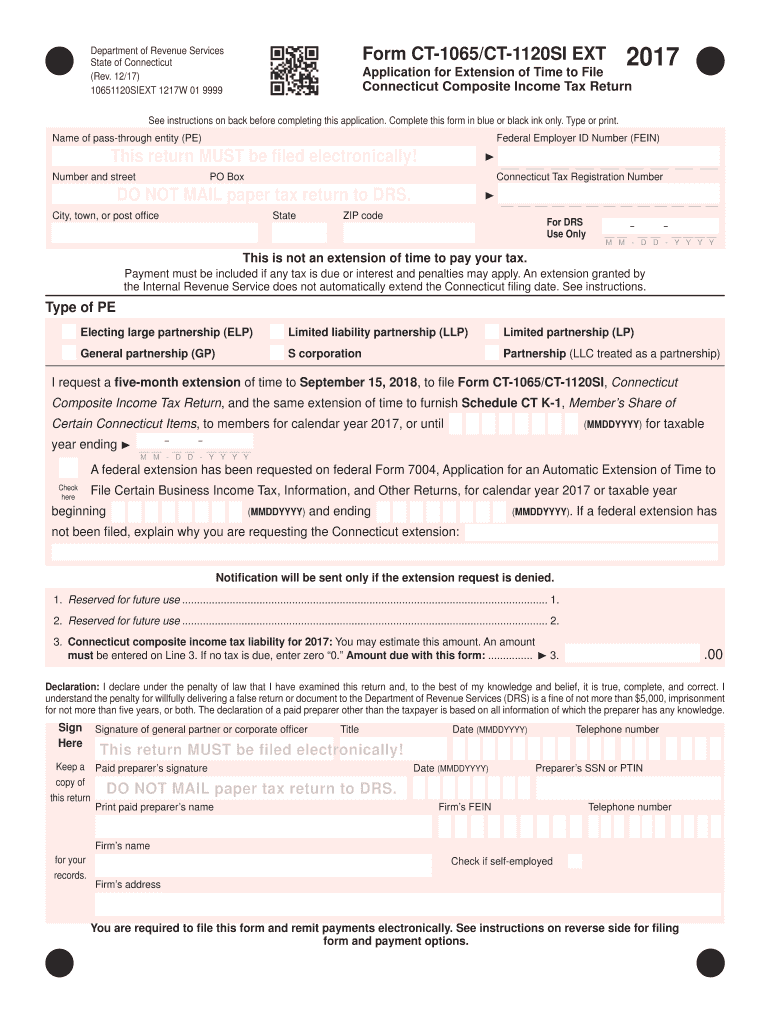

CT DRS CT1065/CT1120SI EXT 2017 Fill out Tax Template Online US

12/20) 10651120si 1220w 01 9999. 12/21) 10651120si 1221w 01 9999 2021. 2022 application for extension of time to file. Web based on the provisions of the new pet legislation, calendar year entities would have an estimated payment due on june 15, 2018. Connecticut group and composite income taxpayers must file a 2007.

Connecticut Group And Composite Income Taxpayers Must File A 2007.

Connecticut > payments / penalties > estimates and application of overpayment. Department of revenue services state of connecticut (rev. 2022 application for extension of time to file. 12/21) 10651120si 1221w 01 9999 2021.

Web Based On The Provisions Of The New Pet Legislation, Calendar Year Entities Would Have An Estimated Payment Due On June 15, 2018.

Save or instantly send your ready documents. 12/20) 10651120si 1220w 01 9999. Easily fill out pdf blank, edit, and sign them. Utilizing our ultimate online sofware you will see the best way to fill up ct drs.

It Is Highly Recommended That A Second Version Be.

See instructions before completing this return.