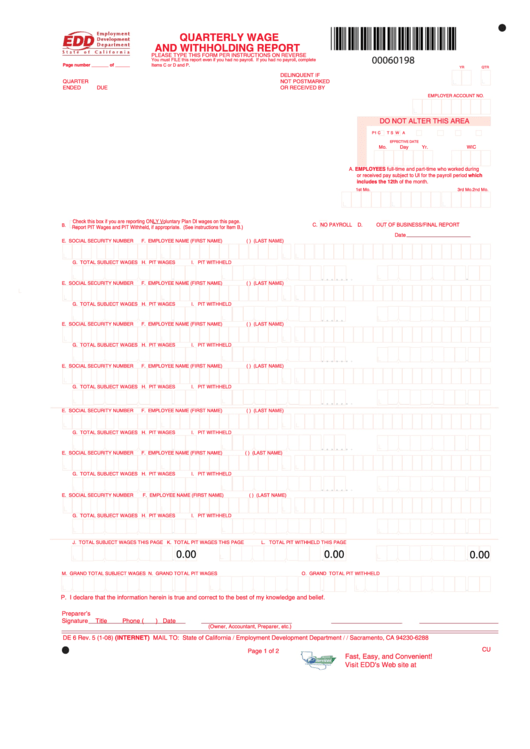

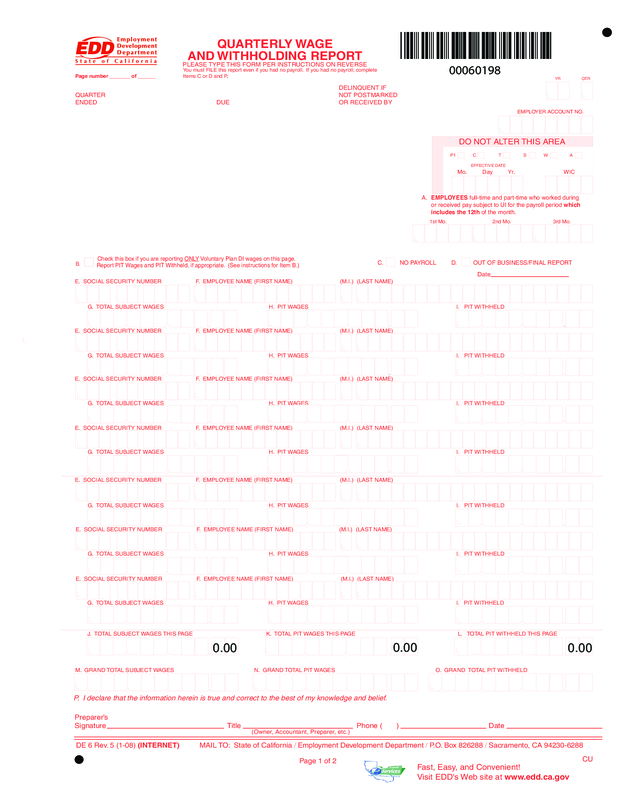

Form De 6

Form De 6 - Web the de 6 form is the quarterly wage and withholding report, which is a required report that must be completed by california employers on a quarterly basis. Coming to a formation near you. Web declaration of individual claiming benefits due an incapacitated or deceased claimant (de 2522): Web da 7906 individual development plan (idp) when: Now (published on apd nov 2022) where: Getting a legal expert, creating a scheduled appointment and going to the business office for a private meeting makes finishing a ca. California form de 6 has been replaced with form de 9c effective the first quarter of 2011. Web employers can file the de 9 form electronically or via paper. To begin the document, use the fill camp; It provides a reason for the decision,.

Web specify which form type the system uses to create the report. Now (published on apd nov 2022) where: Web personal income tax was withheld from their pay. Web wages and withholdings to report on a separate de 6 prepare a de 6 to report the types of exemptions listed below. What is the de 6 form? Write the exemption title(s) at the top of the form (e.g., sole. To begin the document, use the fill camp; Web complete this form so that your employer can withhold the correct california state income tax from your paycheck. Web prepare a de 9c to report the types of exemptions listed below. You can visit online forms and publications for a complete list of edd forms available to view or order online.

Ca employers easily print edd de 6 form from your computer using our payroll program. You may still use the de 6 option to create an electronic file to. Write the exemption title(s) at the top of the form. Form to claim benefits on behalf of a deceased or incapacitated claimant. Getting a legal expert, creating a scheduled appointment and going to the business office for a private meeting makes finishing a ca. Web specify which form type the system uses to create the report. Use worksheet a for regular withholding allowances. Web follow the simple instructions below: All three exemptions can be reported on one de 6. Formal and informal counseling sessions.

Dell 7FJW4 300 GB 15 K SAS 2,5 12 G (reacondicionado Certificado

Web how you can complete the de 6 form form online: Sign online button or tick the preview image of the document. Now (published on apd nov 2022) where: Web prepare a de 9c to report the types of exemptions listed below. Use worksheet a for regular withholding allowances.

い形容詞 iadjective+ない form Japanese Quizzes Japanese language

Use worksheet a for regular withholding allowances. What is the de 6 form? Web da 7906 individual development plan (idp) when: Web up to $3 cash back prepare a de 6 to report the types of exemptions listed below. You may still use the de 6 option to create an electronic file to.

Edd Disability Claim Form De 2501 Form Resume Examples GX3Gpp7w8x

All three exemptions can be reported on one de 9c. Web declaration of individual claiming benefits due an incapacitated or deceased claimant (de 2522): You may still use the de 6 option to create an electronic file to. Statute of limitations a claim for refund or credit must. Coming to a formation near you.

EDD DE6 PDF

Now (published on apd nov 2022) where: Web declaration of individual claiming benefits due an incapacitated or deceased claimant (de 2522): Web the de 6 form is the quarterly wage and withholding report, which is a required report that must be completed by california employers on a quarterly basis. To begin the document, use the fill camp; All three exemptions.

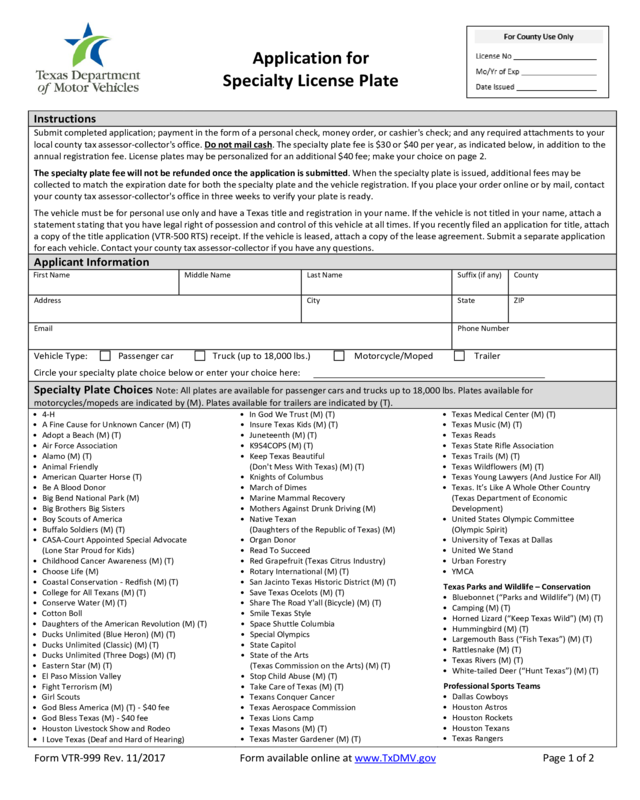

Vtr 999 Application For Specialty License Plates Edit, Fill, Sign

You can visit online forms and publications for a complete list of edd forms available to view or order online. What is the de 6 form? Write the exemption title(s) at the top of the form. Web employers can file the de 9 form electronically or via paper. Web wages and withholdings to report on a separate de 6 prepare.

Fillable Form De 6 Quarterly Wage And Withholding Report 2008

Sign online button or tick the preview image of the document. All three exemptions can be reported on one de 9c. Web personal income tax was withheld from their pay. Write the exemption title(s) at the top of the form. The de 6 form is the quarterly wage and withholding report, which is a.

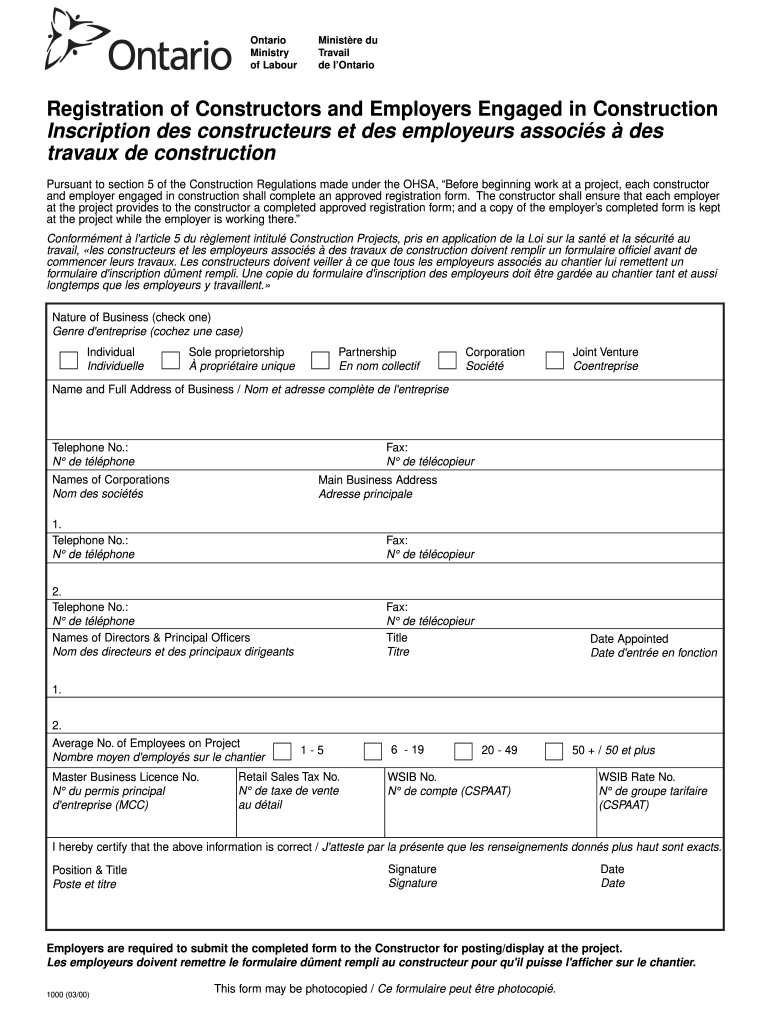

Form 1000 Fill Online, Printable, Fillable, Blank pdfFiller

Web notice of determination/ruling (de 1080cz) this notice advises employers of edd’s decision about a claimant’s eligibility for ui benefits. What is the de 6 form? Web how you can complete the de 6 form form online: Getting a legal expert, creating a scheduled appointment and going to the business office for a private meeting makes finishing a ca. Coming.

Nezuko Kamado Oni ANIME April 2022

Coming to a formation near you. All three exemptions can be reported on one. Web the de 6 form is the quarterly wage and withholding report, which is a required report that must be completed by california employers on a quarterly basis. Web follow the simple instructions below: The de 6 form is the quarterly wage and withholding report, which.

TOPS Hazardous Material Short Form, ThreePart Carbonless, 7 x 8.5, 1

Web how you can complete the de 6 form form online: You may still use the de 6 option to create an electronic file to. Web specify which form type the system uses to create the report. To begin the document, use the fill camp; Web wages and withholdings to report on a separate de 6 prepare a de 6.

De 6 Form Edit, Fill, Sign Online Handypdf

California form de 6 has been replaced with form de 9c effective the first quarter of 2011. Web wages and withholdings to report on a separate de 6 prepare a de 6 to report the types of exemptions listed below. Write the exemption title(s) at the top of the form. Ca employers easily print edd de 6 form from your.

Form To Claim Benefits On Behalf Of A Deceased Or Incapacitated Claimant.

Web declaration of individual claiming benefits due an incapacitated or deceased claimant (de 2522): Formal and informal counseling sessions. Now (published on apd nov 2022) where: Web the tax and wage adjustment form, de 678, is used to make changes to theannual reconciliation statement, de 7,quarterlywage and withholding report, de 6, and.

Web Employers Can File The De 9 Form Electronically Or Via Paper.

Write the exemption title(s) at the top of the form (e.g., sole. All three exemptions can be reported on one. Web da 7906 individual development plan (idp) when: Web complete this form so that your employer can withhold the correct california state income tax from your paycheck.

Getting A Legal Expert, Creating A Scheduled Appointment And Going To The Business Office For A Private Meeting Makes Finishing A Ca.

California form de 6 has been replaced with form de 9c effective the first quarter of 2011. To begin the document, use the fill camp; It provides a reason for the decision,. Web personal income tax was withheld from their pay.

Web How You Can Complete The De 6 Form Form Online:

Use worksheet a for regular withholding allowances. Sign online button or tick the preview image of the document. All three exemptions can be reported on one de 9c. Web the de 6 form is the quarterly wage and withholding report, which is a required report that must be completed by california employers on a quarterly basis.