Form Il 1120

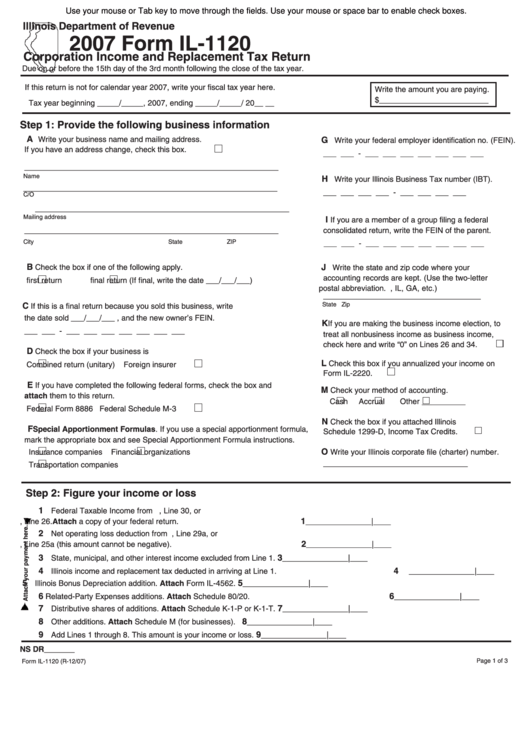

Form Il 1120 - In order to avoid late payment penalties, you must attach proof of the federal finalization date, We will compute any penalty or interest dueand notify you. For tax years ending before december 31, 2022, use the 2021 form. Enter your complete legal business name. Step 9 — figure your refund or balance due Web this form is for tax years ending on or after december 31, 2021, and before december 31, 2022. To file a federal income tax return (regardless of net income or loss). Payment voucher for amended corporation income and replacement tax. Amended corporation income and replacement tax return. Corporation income and replacement tax return.

How do i register my business? Or • is qualified to do business in the state of illinois and is required. Using the wrong form will delay the processing of your return. Corporation income and replacement tax return. Payment voucher for amended corporation income and replacement tax. Amended corporation income and replacement tax return. In order to avoid late payment penalties, you must attach proof of the federal finalization date, Amended corporation income and replacement tax return. Identify your small business corporation a. Tax year beginning , ending.

Tax year beginning month if you are filing an amended return for tax years ending day year , ending month day B enter your mailing address. Indicate what tax year you are amending: Illinois department of revenue, p.o. Tax year beginning , ending. Using the wrong form will delay the processing of your return. Corporation income and replacement tax return. Corporation income and replacement tax return. Enter your complete legal business name. For all other situations, see instructions to determine the correct form to use.

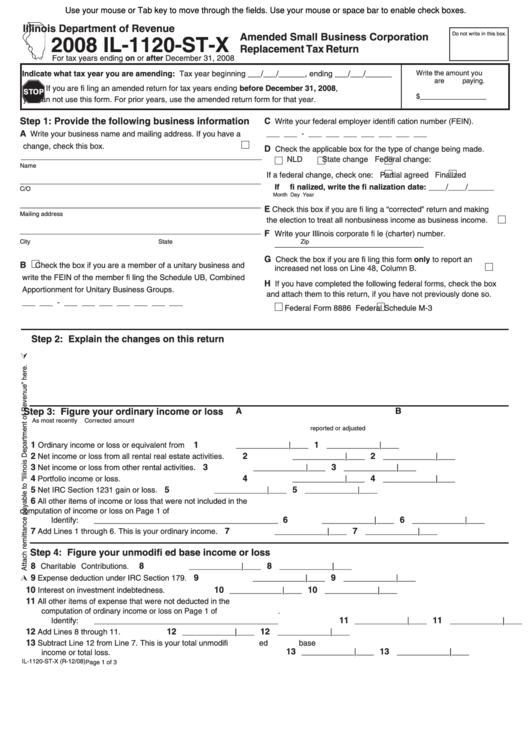

Fillable Form Il1120StX Amended Small Business

How do i register my business? Corporation income and replacement tax return. Illinois department of revenue, p.o. To file a federal income tax return (regardless of net income or loss). Or • is qualified to do business in the state of illinois and is required.

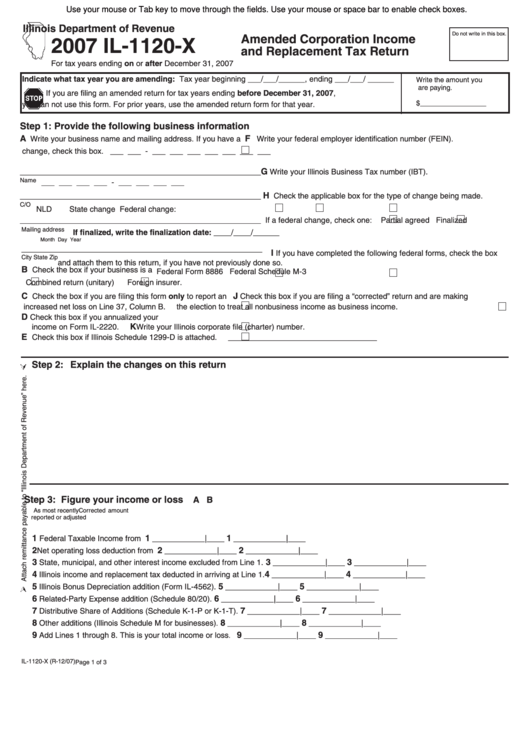

Fillable Form Il1120X Amended Corporation And Replacement

Identify your small business corporation a. Payment voucher for 2021 corporation income and replacement tax. Using the wrong form will delay the processing of your return. We will compute any penalty or interest dueand notify you. Enter your complete legal business name.

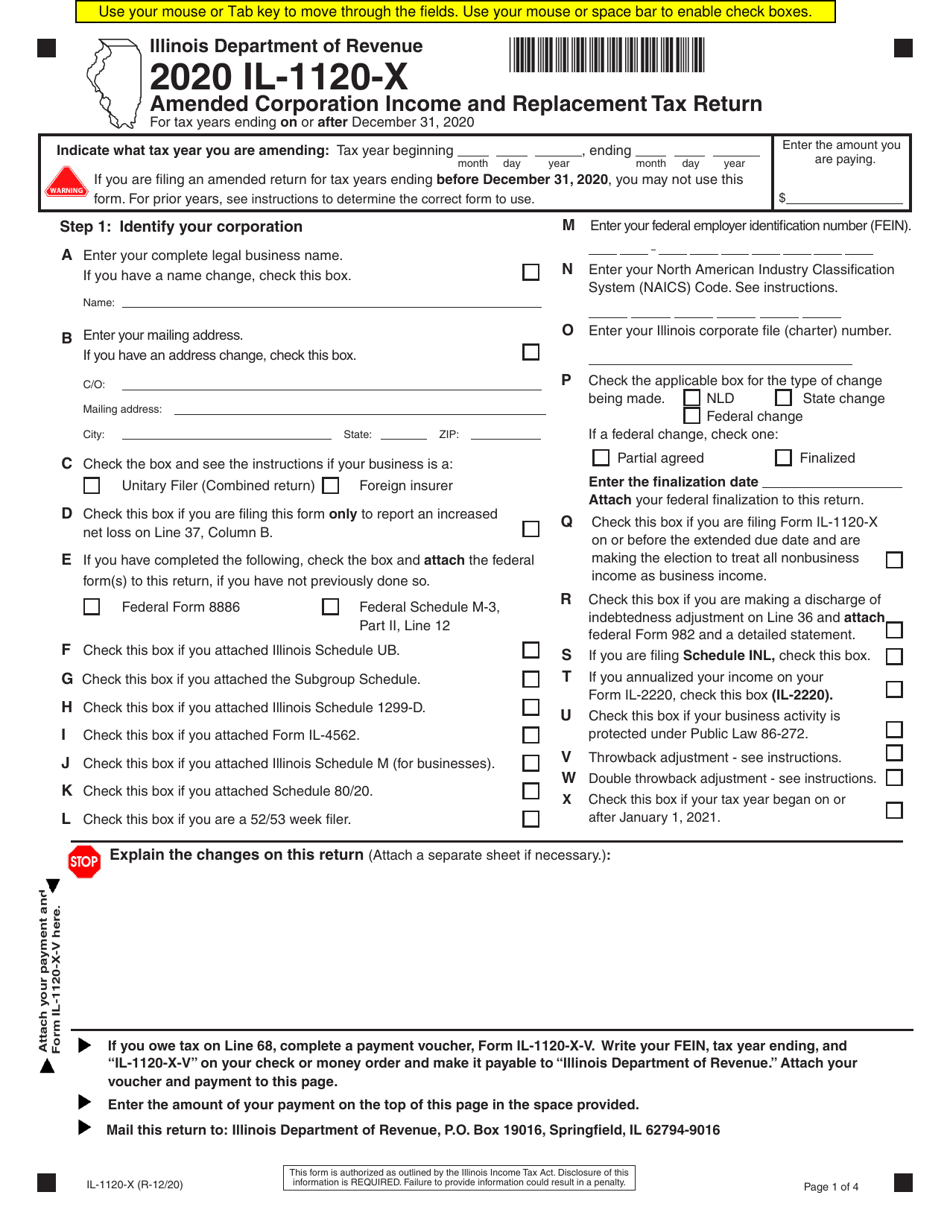

Form IL1120X Download Fillable PDF or Fill Online Amended Corporation

Tax year beginning month if you are filing an amended return for tax years ending day year , ending month day Identify your small business corporation a. Illinois department of revenue, p.o. Amended corporation income and replacement tax return. In order to avoid late payment penalties, you must attach proof of the federal finalization date,

Fillable Form Il1120StX Amended Small Business Corporation

If you have a name change, check this box. Illinois department of revenue, p.o. Step 9 — figure your refund or balance due Corporation income and replacement tax return. B enter your mailing address.

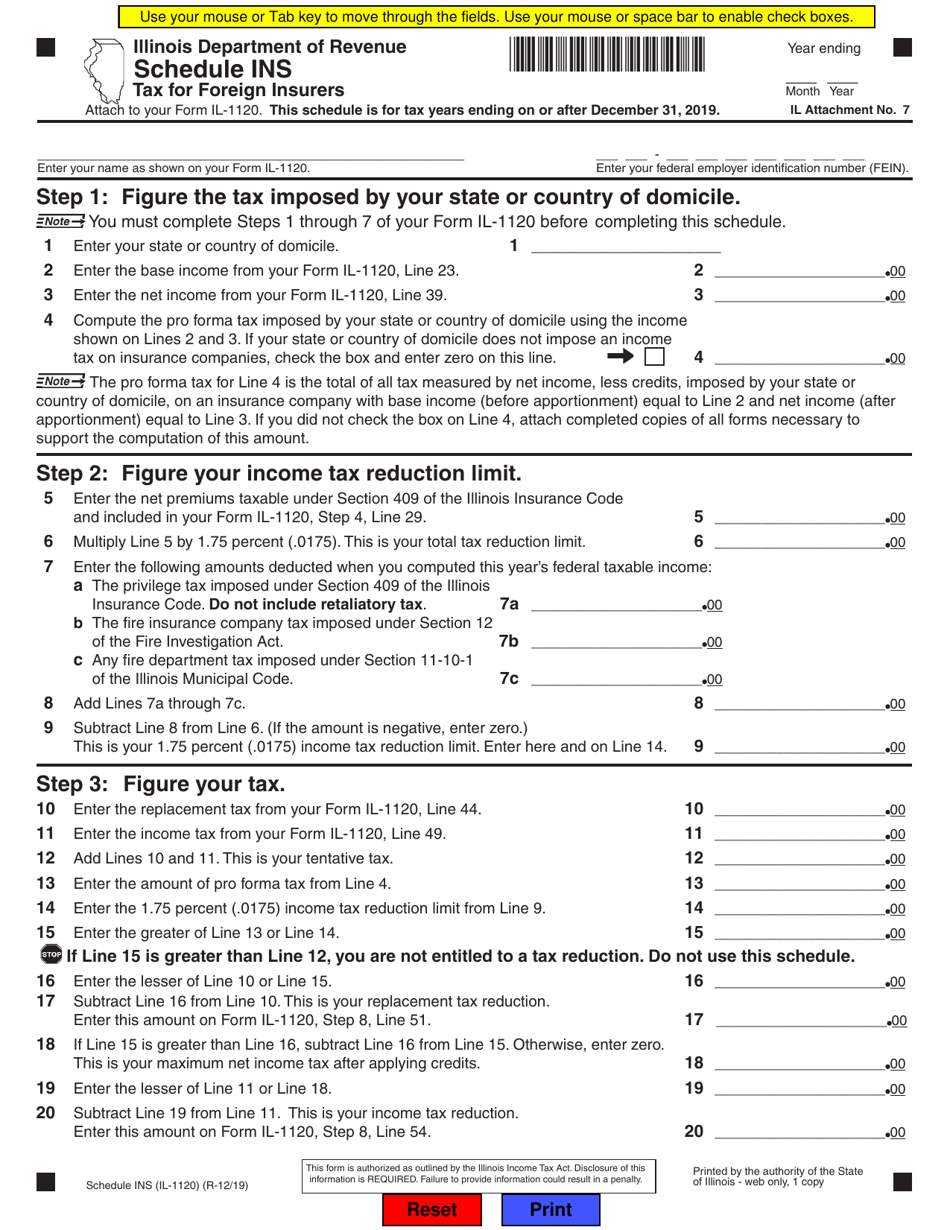

Form IL1120 Schedule INS Download Fillable PDF or Fill Online Tax for

Tax year beginning month if you are filing an amended return for tax years ending day year , ending month day Amended corporation income and replacement tax return. Step 9 — figure your refund or balance due For tax years ending before december 31, 2022, use the 2021 form. Corporation income and replacement tax return.

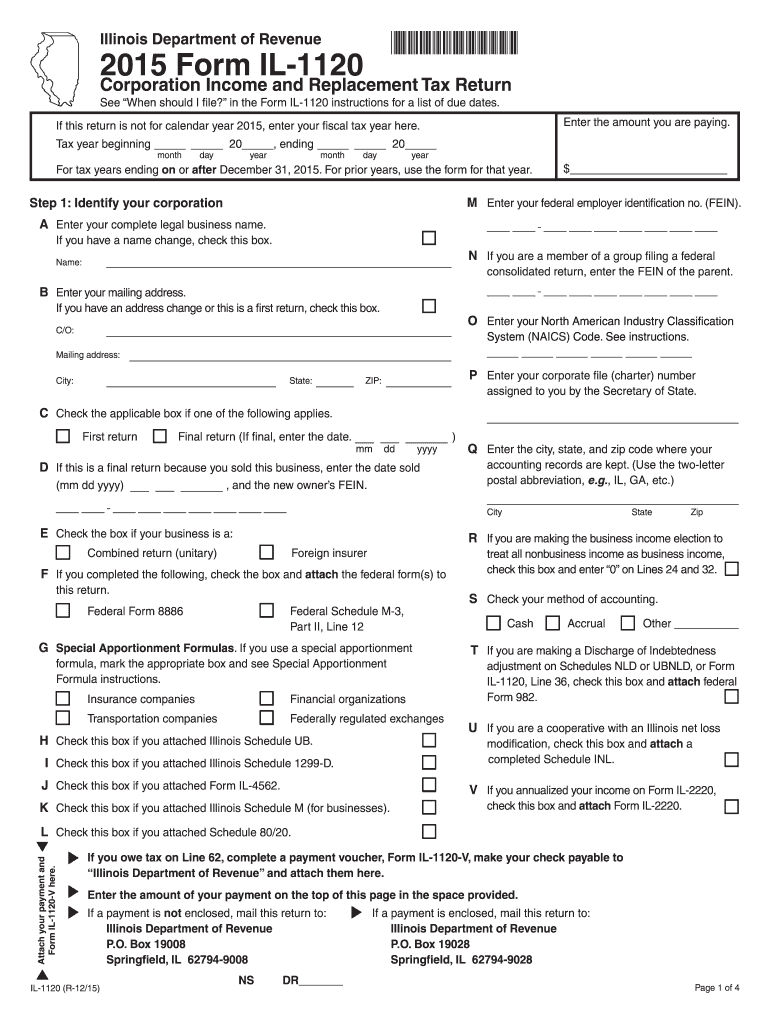

2015 Form IL DoR IL1120 Fill Online, Printable, Fillable, Blank

If you have a name change, check this box. Using the wrong form will delay the processing of your return. In order to avoid late payment penalties, you must attach proof of the federal finalization date, B enter your mailing address. Identify your small business corporation a.

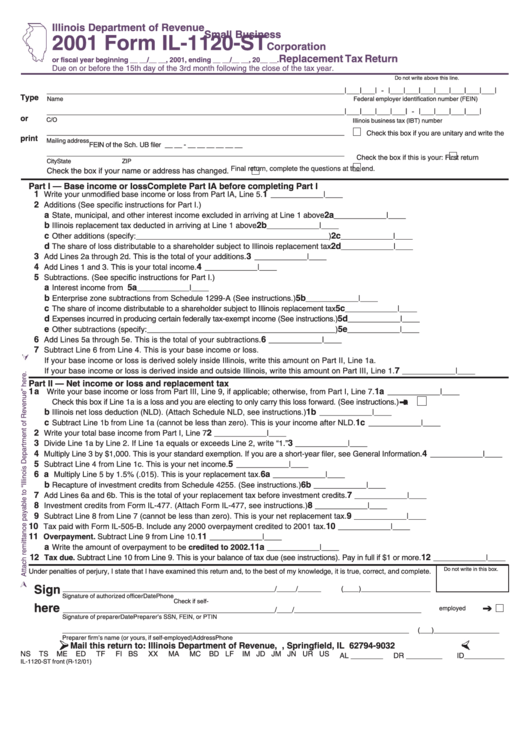

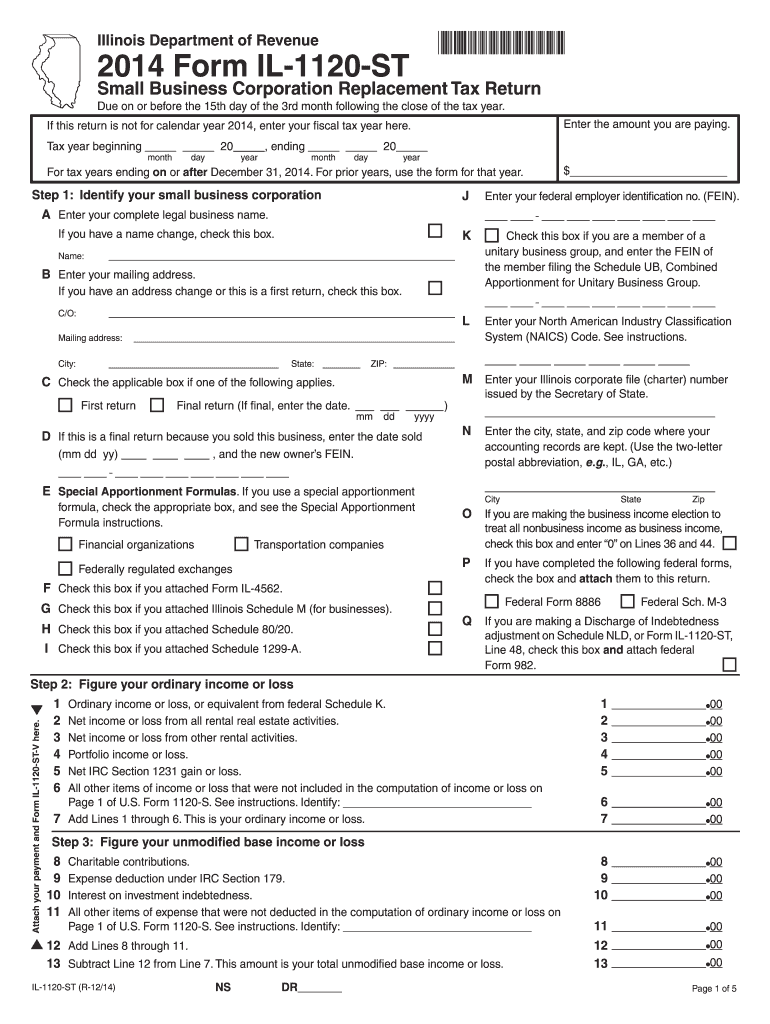

Form Il1120St Small Business Corporation Replacement Tax Return

For tax years ending before december 31, 2022, use the 2021 form. Tax year beginning month if you are filing an amended return for tax years ending day year , ending month day Web this form is for tax years ending on or after december 31, 2021, and before december 31, 2022. If you have a name change, check this.

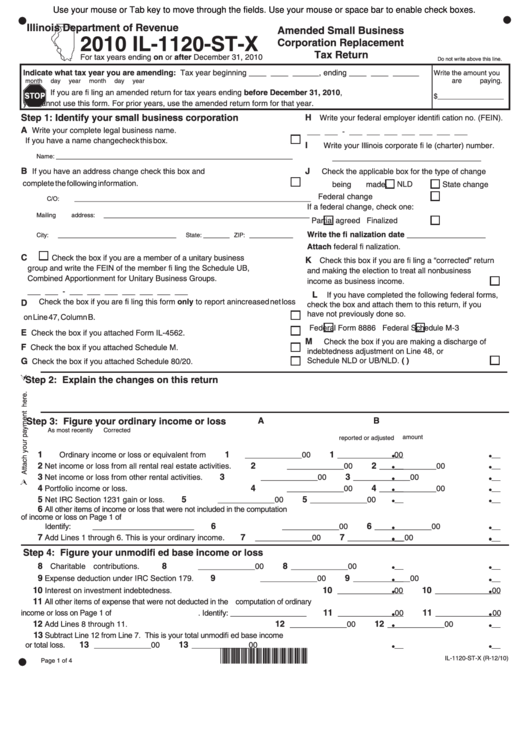

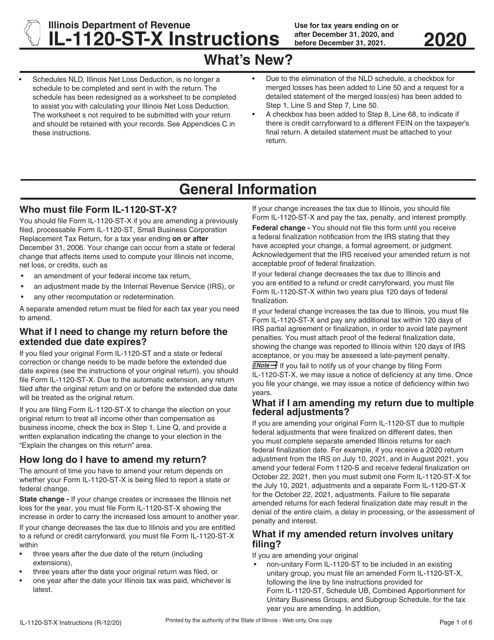

Download Instructions for Form IL1120STX Amended Small Business

Web this form is for tax years ending on or after december 31, 2021, and before december 31, 2022. Using the wrong form will delay the processing of your return. Amended corporation income and replacement tax return. Indicate what tax year you are amending: To file a federal income tax return (regardless of net income or loss).

2014 Form IL DoR IL1120ST Fill Online, Printable, Fillable, Blank

Identify your small business corporation a. Or • is qualified to do business in the state of illinois and is required. Payment voucher for amended corporation income and replacement tax. To file a federal income tax return (regardless of net income or loss). Enter your complete legal business name.

Fillable Form Il1120 Corporation And Replacement Tax Return

Corporation income and replacement tax return. Tax year beginning month if you are filing an amended return for tax years ending day year , ending month day Amended corporation income and replacement tax return. B enter your mailing address. Using the wrong form will delay the processing of your return.

In Order To Avoid Late Payment Penalties, You Must Attach Proof Of The Federal Finalization Date,

Corporation income and replacement tax return. Illinois department of revenue, p.o. Indicate what tax year you are amending: For tax years ending before december 31, 2022, use the 2021 form.

Tax Year Beginning , Ending.

Amended corporation income and replacement tax return. Or • is qualified to do business in the state of illinois and is required. How do i register my business? B enter your mailing address.

Amended Corporation Income And Replacement Tax Return.

Step 9 — figure your refund or balance due Identify your small business corporation a. For all other situations, see instructions to determine the correct form to use. If you have a name change, check this box.

Enter Your Complete Legal Business Name.

We will compute any penalty or interest dueand notify you. Web this form is for tax years ending on or after december 31, 2021, and before december 31, 2022. Payment voucher for amended corporation income and replacement tax. To file a federal income tax return (regardless of net income or loss).