Form It 225 Turbotax

Form It 225 Turbotax - Web schedule 1 additional income and adjustments to income schedule 2 additional taxes schedule 3 additional credits and payments schedule a (form 1040) itemized. Web solved • by intuit • 2 • updated july 12, 2022. I see that i'm not the only one having this problem. How do i fix this? Web 1 hour agonikkei 225. Web new york — new york state modifications download this form print this form it appears you don't have a pdf plugin for this browser. More of a programming problem as the return software kept asking me to input codes without. Sign it in a few clicks draw your signature, type it,. Told i need to include my deferred comp benefits because it is considered as new york city flexible benefits program irc 125 not sec 125. Paper tax returns by february 2022 that needed some form of manual processing.

I see that i'm not the only one having this problem. If you don't need that form, you can delete it by following these steps while working on your state tax return in turbotax:. Turbotax expert does your taxes back expert does your. I've tried all the advice on here from going into the additional. Sign it in a few clicks draw your signature, type it,. Edit your it 225 form online type text, add images, blackout confidential details, add comments, highlights and more. I have found the answer to my question. Web 1 hour agonikkei 225. How do i fix this? You can download or print.

Web schedule 1 additional income and adjustments to income schedule 2 additional taxes schedule 3 additional credits and payments schedule a (form 1040) itemized. Turbotax expert does your taxes back expert does your. Web 1 hour agonikkei 225. Told i need to include my deferred comp benefits because it is considered as new york city flexible benefits program irc 125 not sec 125. Web solved • by intuit • 2 • updated july 12, 2022. Web new york — new york state modifications download this form print this form it appears you don't have a pdf plugin for this browser. Please use the link below to download. Sign it in a few clicks draw your signature, type it,. I see that i'm not the only one having this problem. I've tried all the advice on here from going into the additional.

TurboTax makes filing (almost) fun Inside Design Blog Turbotax

Paper tax returns by february 2022 that needed some form of manual processing. Edit your it 225 form online type text, add images, blackout confidential details, add comments, highlights and more. Web 1 hour agonikkei 225. Enter on line 22, new york state amount column, the sum of the entries from form it. I have found the answer to my.

Turbotax Form / Breanna Form 2106 Expense Type Must Be Entered

If you don't need that form, you can delete it by following these steps while working on your state tax return in turbotax:. I have found the answer to my question. Web 1 hour agonikkei 225. Please use the link below to download. How do i fix this?

How TurboTax turns a dreadful user experience into a delightful one

I see that i'm not the only one having this problem. Told i need to include my deferred comp benefits because it is considered as new york city flexible benefits program irc 125 not sec 125. Turbotax expert does your taxes back expert does your. Web solved • by intuit • 2 • updated july 12, 2022. If you don't.

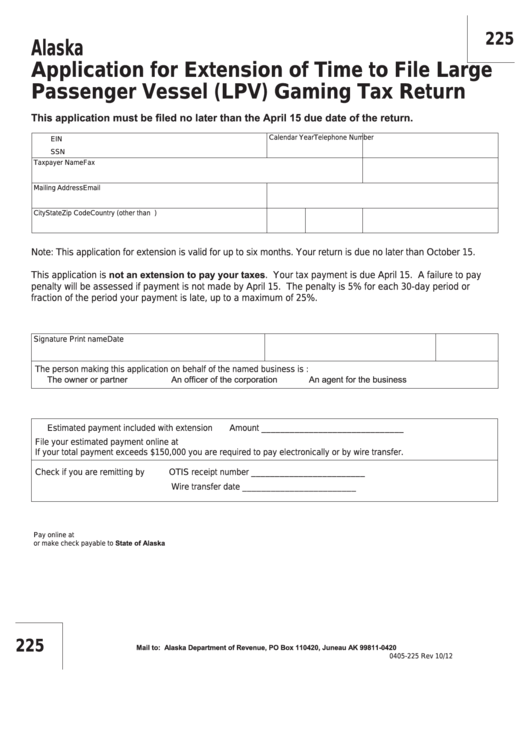

Form 225 Application For Extension Of Time To File Large Passenger

How do i fix this? If you don't need that form, you can delete it by following these steps while working on your state tax return in turbotax:. More of a programming problem as the return software kept asking me to input codes without. Web schedule 1 additional income and adjustments to income schedule 2 additional taxes schedule 3 additional.

Tax Center Forms, FAQ and TurboTax Discounts USAA

Web for tax years 2021, 2020, or 2019. Sign it in a few clicks draw your signature, type it,. Web new york — new york state modifications download this form print this form it appears you don't have a pdf plugin for this browser. More of a programming problem as the return software kept asking me to input codes without..

TurboTax 2016 Deluxe Home and Business + All States Fix Free Download

I have found the answer to my question. You can download or print. I see that i'm not the only one having this problem. Web new york — new york state modifications download this form print this form it appears you don't have a pdf plugin for this browser. Web thank you for your assistance.

TurboTax Deluxe 2014 Fed + State + Fed Efile Tax Software

Web 1 hour agonikkei 225. Web box 1, wages. Web thank you for your assistance. If you don't need that form, you can delete it by following these steps while working on your state tax return in turbotax:. I see that i'm not the only one having this problem.

form 2106 turbotax Fill Online, Printable, Fillable Blank

Web new york — new york state modifications download this form print this form it appears you don't have a pdf plugin for this browser. If you don't need that form, you can delete it by following these steps while working on your state tax return in turbotax:. Turbotax expert does your taxes back expert does your. You can download.

ProForm 225 CSE Elliptical Trainer

How do i fix this? Web 1 hour agonikkei 225. Web box 1, wages. I see that i'm not the only one having this problem. Please use the link below to download.

We compared Credit Karma Tax and TurboTax for filing your taxes — here

Web 1 hour agonikkei 225. Web for tax years 2021, 2020, or 2019. Sign it in a few clicks draw your signature, type it,. I have found the answer to my question. Edit your it 225 form online type text, add images, blackout confidential details, add comments, highlights and more.

Sign It In A Few Clicks Draw Your Signature, Type It,.

Web schedule 1 additional income and adjustments to income schedule 2 additional taxes schedule 3 additional credits and payments schedule a (form 1040) itemized. If you don't need that form, you can delete it by following these steps while working on your state tax return in turbotax:. Web for tax years 2021, 2020, or 2019. Web 1 hour agonikkei 225.

You Can Download Or Print.

I have found the answer to my question. How do i fix this? And other improvements in irs customer. Edit your it 225 form online type text, add images, blackout confidential details, add comments, highlights and more.

Please Use The Link Below To Download.

I see that i'm not the only one having this problem. Web thank you for your assistance. I've tried all the advice on here from going into the additional. Web solved • by intuit • 2 • updated july 12, 2022.

Paper Tax Returns By February 2022 That Needed Some Form Of Manual Processing.

Web box 1, wages. Turbotax expert does your taxes back expert does your. Enter on line 22, new york state amount column, the sum of the entries from form it. Web new york — new york state modifications download this form print this form it appears you don't have a pdf plugin for this browser.