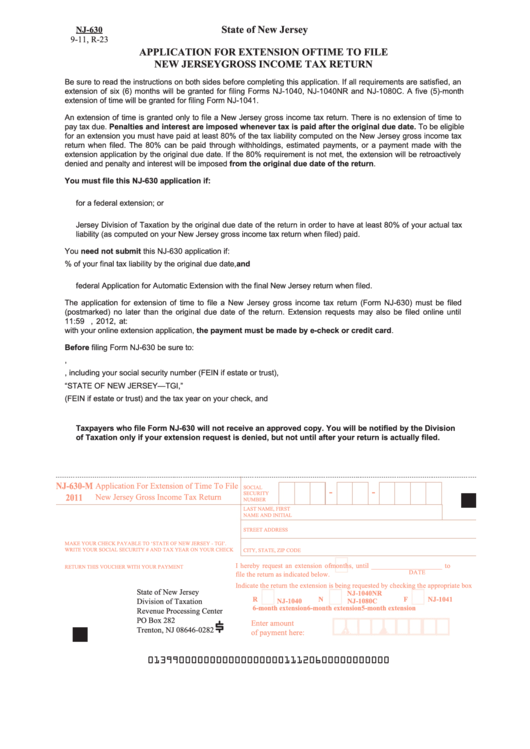

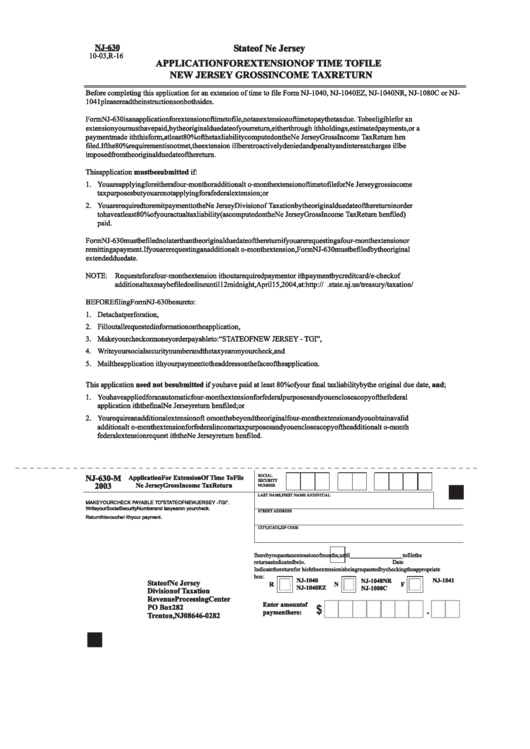

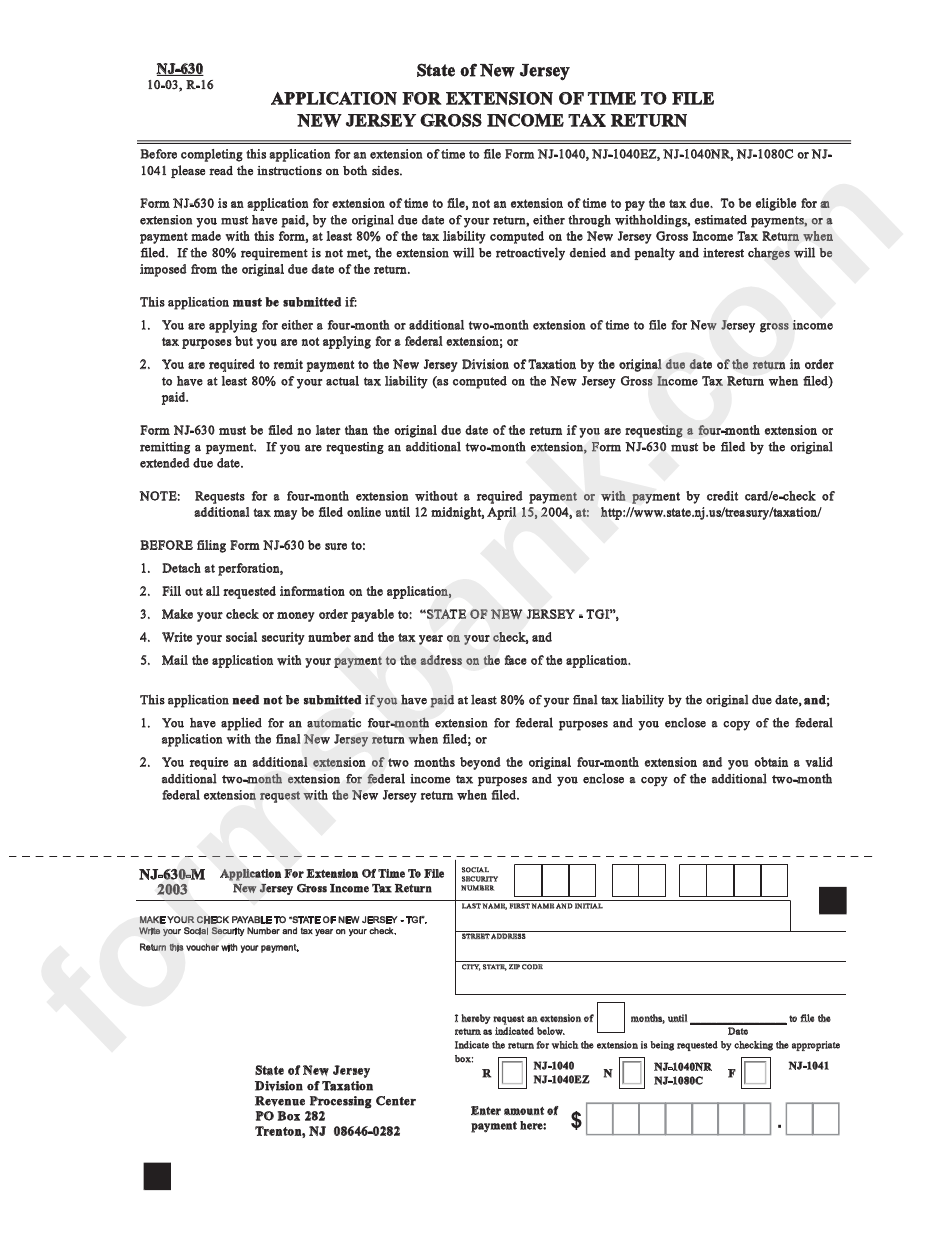

Form Nj 630

Form Nj 630 - Nj division of taxation subject: Nowadays, most americans tend to prefer to do their own income taxes and, furthermore, to complete papers in electronic format. Web method #1 ‐ indicates the detailed spreadsheet (a‐3730‐uez‐1) is submitted in electronic form on a compact disc for claims with 25 or more transactions. Enter social security number or federal identification. Method #2 ‐ indicates a. Use fill to complete blank online the state. Save or instantly send your ready documents. This form is for income earned in tax year 2022, with tax returns due in april. Mail the completed extension application and any. Estimated income tax payment voucher for 2023.

You must pay at least 80% of your tax liability in order for new jersey to accept your extension, you. Method #2 ‐ indicates a. Effortlessly add and underline text, insert images, checkmarks, and icons, drop new fillable areas, and rearrange or delete pages from your paperwork. Easily fill out pdf blank, edit, and sign them. Application for extension of time to file income tax return. Web follow the simple instructions below: Use fill to complete blank online the state. The request must be made under the filing entity’s federal identification number. The state grants an extension if you already have an approved federal extension rather than requesting an extension using the state extension form. Mail the completed extension application and any.

The state grants an extension if you already have an approved federal extension rather than requesting an extension using the state extension form. Web follow the simple instructions below: Web you may file the form: Save or instantly send your ready documents. To be eligible for an extension you must have paid, by the original due date. The request must be made under the filing entity’s federal identification number. Effortlessly add and underline text, insert images, checkmarks, and icons, drop new fillable areas, and rearrange or delete pages from your paperwork. Method #2 ‐ indicates a. Use fill to complete blank online the state. You must pay at least 80% of your tax liability in order for new jersey to accept your extension, you.

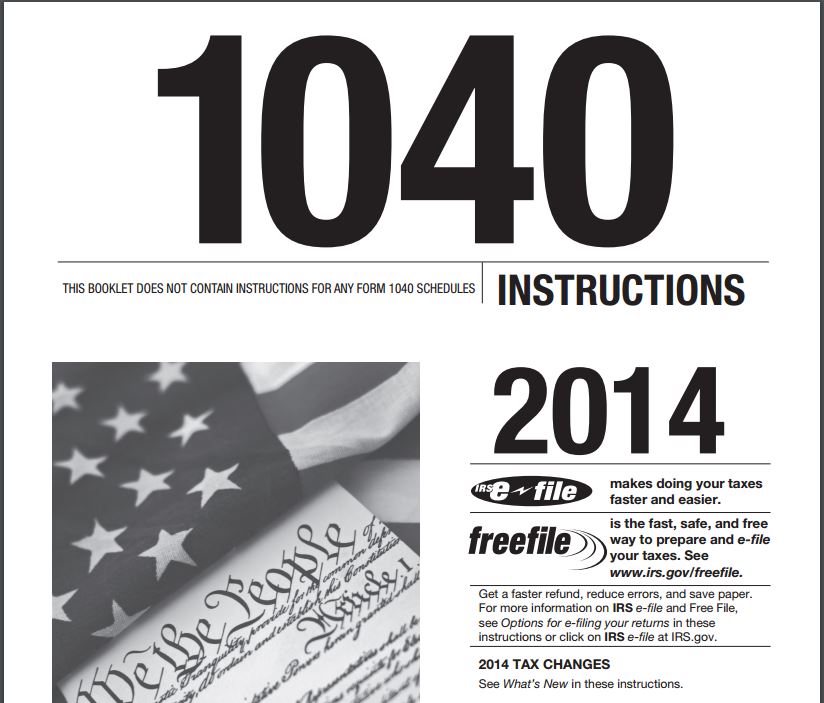

2014 Form 1040 Instructions

You must pay at least 80% of your tax liability in order for new jersey to accept your extension, you. Effortlessly add and underline text, insert images, checkmarks, and icons, drop new fillable areas, and rearrange or delete pages from your paperwork. Use fill to complete blank online the state. To be eligible for an extension you must have paid,.

Fillable Form Nj630 Application For Extension Of Time To File New

The state grants an extension if you already have an approved federal extension rather than requesting an extension using the state extension form. Estimated income tax payment voucher for 2023. Mail the completed extension application and any. Method #2 ‐ indicates a. Nj division of taxation subject:

Nuova jolly Nj 630 in Hérault Power boats used 01999 iNautia

Mail the completed extension application and any. Application for extension of time to file income tax return. Enter social security number or federal identification. The request must be made under the filing entity’s federal identification number. Estimated income tax payment voucher for 2023.

Form Nj630 Application For Extension Of Time To File New Jersey

You must pay at least 80% of your tax liability in order for new jersey to accept your extension, you. Web method #1 ‐ indicates the detailed spreadsheet (a‐3730‐uez‐1) is submitted in electronic form on a compact disc for claims with 25 or more transactions. Web follow the simple instructions below: Estimated income tax payment voucher for 2023. Enter social.

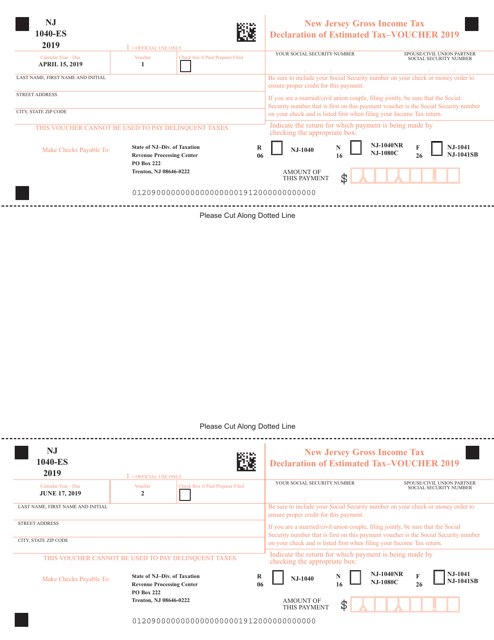

Form NJ1040ES Download Fillable PDF or Fill Online Estimated Tax

Effortlessly add and underline text, insert images, checkmarks, and icons, drop new fillable areas, and rearrange or delete pages from your paperwork. The request must be made under the filing entity’s federal identification number. This form is for income earned in tax year 2022, with tax returns due in april. Estimated income tax payment voucher for 2023. Save or instantly.

Form NJ1040 Download Fillable PDF or Fill Online Resident Tax

Easily fill out pdf blank, edit, and sign them. The state grants an extension if you already have an approved federal extension rather than requesting an extension using the state extension form. This form is for income earned in tax year 2022, with tax returns due in april. Nowadays, most americans tend to prefer to do their own income taxes.

NUOVA JOLLY NJ 630 in Var Rigid inflatable boats used 54546 iNautia

Mail the completed extension application and any. To be eligible for an extension you must have paid, by the original due date. Nowadays, most americans tend to prefer to do their own income taxes and, furthermore, to complete papers in electronic format. Application for extension of time to file income tax return. Estimated income tax payment voucher for 2023.

Form Nj630 Application For Extension Of Time To File New Jersey

Nowadays, most americans tend to prefer to do their own income taxes and, furthermore, to complete papers in electronic format. Mail the completed extension application and any. Easily fill out pdf blank, edit, and sign them. This form is for income earned in tax year 2022, with tax returns due in april. Application for extension of time to file income.

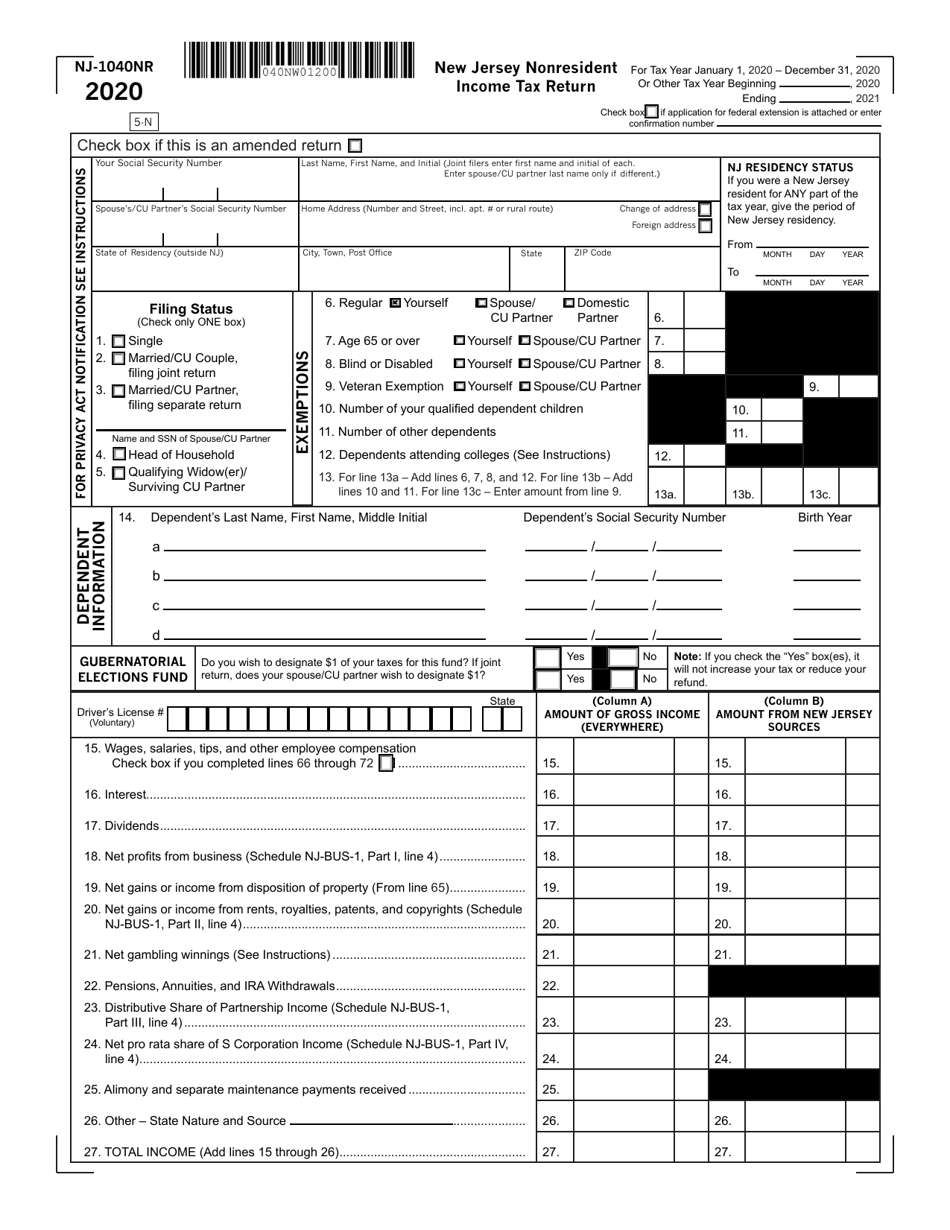

Form NJ1040NR Download Fillable PDF or Fill Online New Jersey

Nj division of taxation subject: Web you may file the form: To be eligible for an extension you must have paid, by the original due date. Use fill to complete blank online the state. Mail the completed extension application and any.

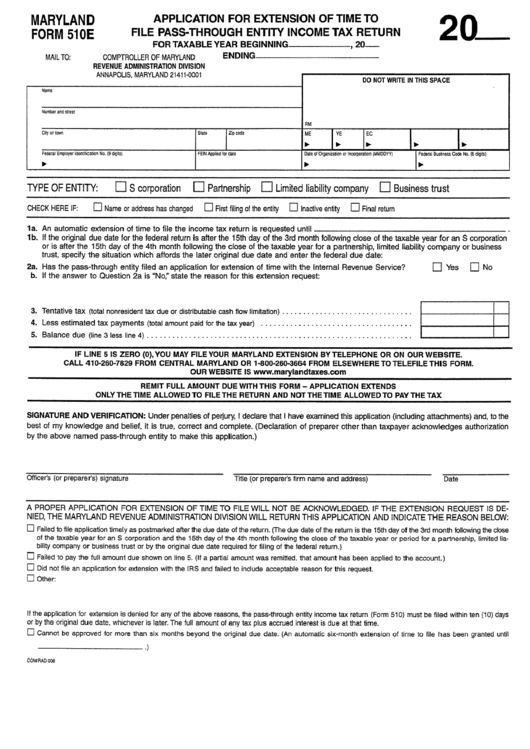

Maryland Form 510e Application For Extension Of Time To File Pass

The request must be made under the filing entity’s federal identification number. Nj division of taxation subject: Use fill to complete blank online the state. Enter social security number or federal identification. Easily fill out pdf blank, edit, and sign them.

The State Grants An Extension If You Already Have An Approved Federal Extension Rather Than Requesting An Extension Using The State Extension Form.

Nj division of taxation subject: Effortlessly add and underline text, insert images, checkmarks, and icons, drop new fillable areas, and rearrange or delete pages from your paperwork. Save or instantly send your ready documents. Web you may file the form:

Web Method #1 ‐ Indicates The Detailed Spreadsheet (A‐3730‐Uez‐1) Is Submitted In Electronic Form On A Compact Disc For Claims With 25 Or More Transactions.

This form is for income earned in tax year 2022, with tax returns due in april. Use fill to complete blank online the state. To be eligible for an extension you must have paid, by the original due date. Estimated income tax payment voucher for 2023.

Method #2 ‐ Indicates A.

Enter social security number or federal identification. Application for extension of time to file income tax return. Mail the completed extension application and any. Nowadays, most americans tend to prefer to do their own income taxes and, furthermore, to complete papers in electronic format.

Easily Fill Out Pdf Blank, Edit, And Sign Them.

You must pay at least 80% of your tax liability in order for new jersey to accept your extension, you. Web follow the simple instructions below: The request must be made under the filing entity’s federal identification number.