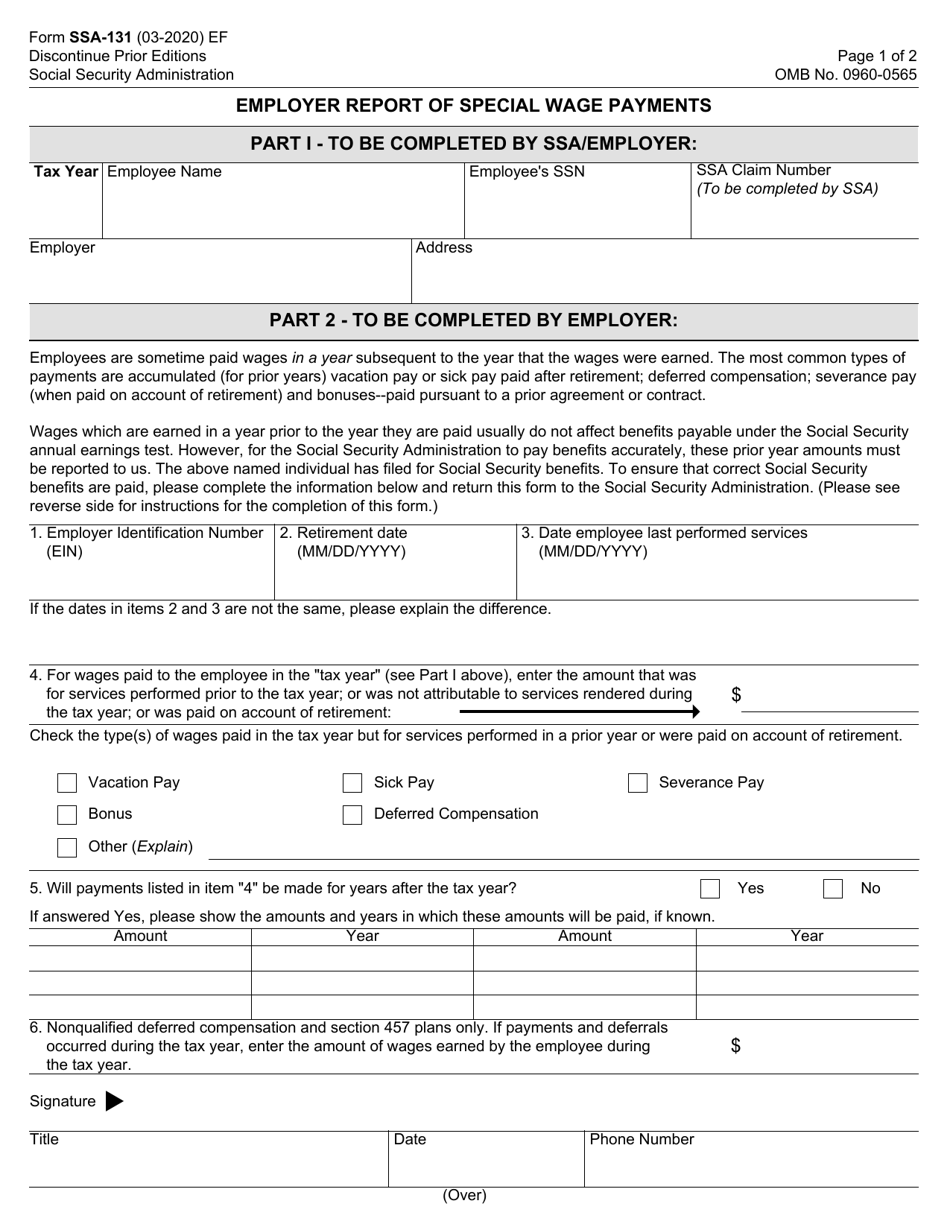

Form Ssa 131

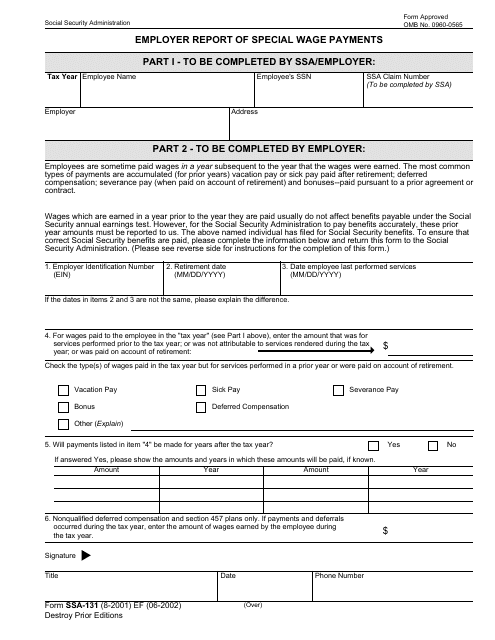

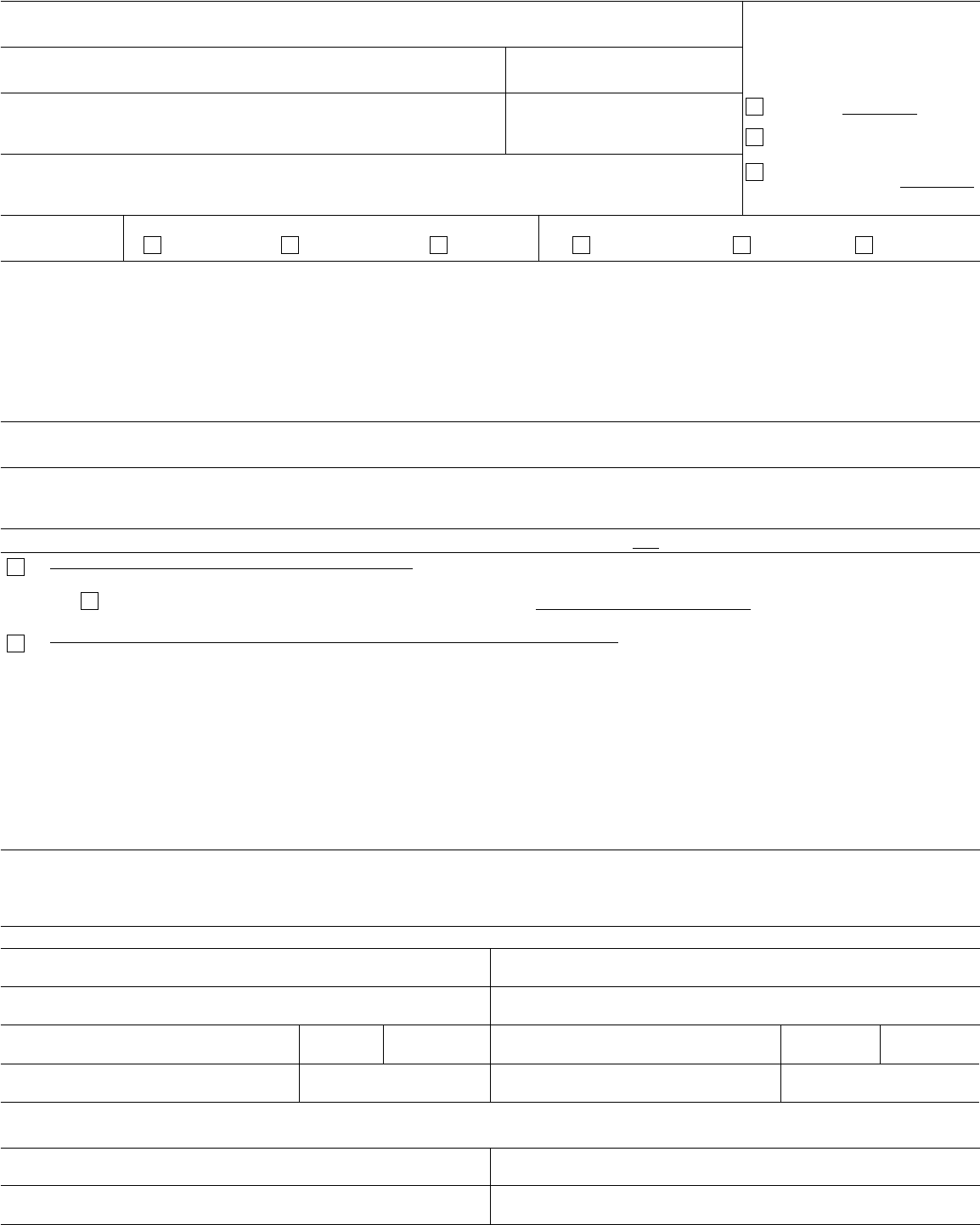

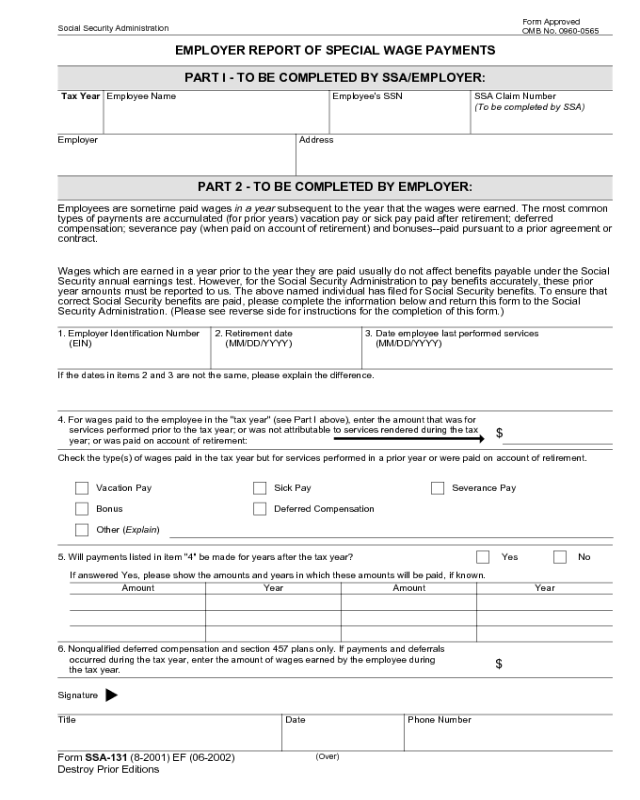

Form Ssa 131 - Change the blanks with exclusive fillable areas. If you worked for wages, income received after retirement counts as a special payment. If payments and deferrals occurred during the tax year, enter the amount of wages earned by the employee during $ the tax year. How you can complete the ssa 131 form on the internet: Questionnaire for children claiming ssi benefits: Show details this website is not affiliated with any governmental entity. Not all forms are listed. Sign online button or tick the preview image of the form. Social security administration, united states federal legal forms and united states legal forms. Open it with online editor and start altering.

Employer instructions for completing special wage payment form 1. Employees are sometime paid wages in a year. Social security administration, united states federal legal forms and united states legal forms. Employer reporting to the social security administration special wage payments made to an employee for a prior year. Enter not retired if the employee has not. Web what qualifies as a special payment? How you can complete the ssa 131 form on the internet: Involved parties names, addresses and phone numbers etc. Certification of low birth weight for ssi eligibility: The intent is to have a standard form that employers are familiar with and that can be sent to employers and returned directly to ssa.

The respondents are employers who provide special wage payment verification. Social security administration, united states federal legal forms and united states legal forms. Open it with online editor and start altering. Nonqualified deferred compensation and section 457 plans only. Certification of election for reduced widow(er)'s and surviving divorced spouse. Nonqualified deferred compensation and section 457 plans only. Employer instructions for completing special wage payment form 1. If you worked for wages, income received after retirement counts as a special payment. Employer reporting to the social security administration special wage payments made to an employee for a prior year. Enter the date the employee retired.

Form SSA131 Fill Out, Sign Online and Download Fillable PDF

Fill out the employer report of special wage payments online and print it out for free. Web what qualifies as a special payment? Enter the date the employee retired. How it works open the omb no 0960 0565 and follow the instructions easily sign the ssa131 with your finger send filled & signed form ssa 131 ocr mailing address or.

Form SSA789 Edit, Fill, Sign Online Handypdf

Enter not retired if the employee has not. If you worked for wages, income received after retirement counts as a special payment. Enter the date the employee retired. Certification of election for reduced widow(er)'s and surviving divorced spouse. Employer reporting to the social security administration special wage payments made to an employee for a prior year.

Form SSA131 Edit, Fill, Sign Online Handypdf

Employer instructions for completing special wage payment form 1. The respondents are employers who provide special wage payment verification. Certification of low birth weight for ssi eligibility: If you worked for wages, income received after retirement counts as a special payment. Enter not retired if the employee has not.

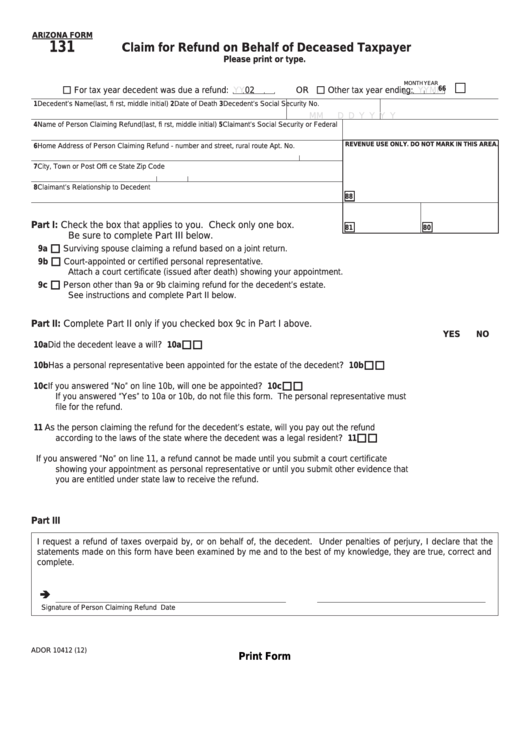

Fillable Form 131 Claim For Refund On Behalf Of Deceased Taxpayer

Social security administration, united states federal legal forms and united states legal forms. Show details this website is not affiliated with any governmental entity. Certification of election for reduced widow(er)'s and surviving divorced spouse. To get started on the document, utilize the fill camp; Nonqualified deferred compensation and section 457 plans only.

Form SSA131 Download Fillable PDF or Fill Online Employer Report of

Web social security forms | social security administration forms all forms are free. This applies if the last task you did to earn the payment was completed before you stopped work. Sign online button or tick the preview image of the form. If you worked for wages, income received after retirement counts as a special payment. Employer instructions for completing.

2020 SSA Gov Forms Fillable, Printable PDF & Forms Handypdf

Certification of low birth weight for ssi eligibility: Sign online button or tick the preview image of the form. Nonqualified deferred compensation and section 457 plans only. Employees are sometime paid wages in a year. If payments and deferrals occurred during the tax year, enter the amount of wages earned by the employee during $ the tax year.

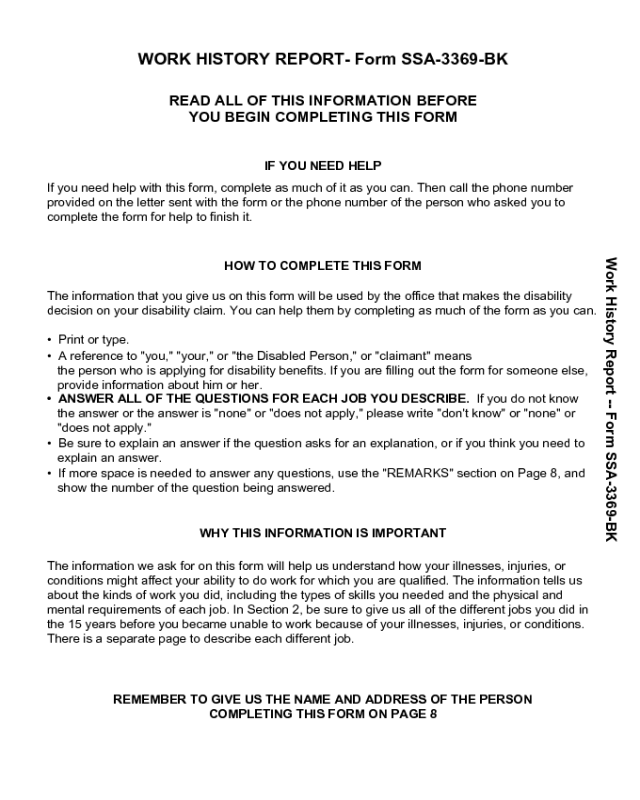

SSA3441BK 2004 Fill and Sign Printable Template Online US Legal Forms

This applies if the last task you did to earn the payment was completed before you stopped work. Open it with online editor and start altering. Social security administration, united states federal legal forms and united states legal forms. Employer reporting to the social security administration special wage payments made to an employee for a prior year. Sign online button.

Publication 957 Reporting Back Pay and Special Wage Payments to SSA

Social security administration, united states federal legal forms and united states legal forms. How you can complete the ssa 131 form on the internet: Show details this website is not affiliated with any governmental entity. If payments and deferrals occurred during the tax year, enter the amount of wages earned by the employee during $ the tax year. Employer instructions.

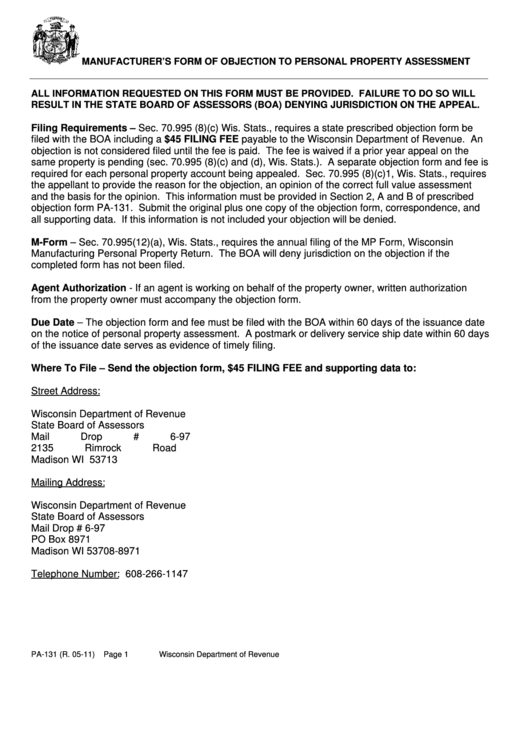

Form Pa131 Manufacturer'S Form Of Objection To Personal Property

If payments and deferrals occurred during the tax year, enter the amount of wages earned by the employee during $ the tax year. Not all forms are listed. Nonqualified deferred compensation and section 457 plans only. If you worked for wages, income received after retirement counts as a special payment. Employer reporting to the social security administration special wage payments.

Form SSA131 Edit, Fill, Sign Online Handypdf

Change the blanks with exclusive fillable areas. Nonqualified deferred compensation and section 457 plans only. Employees are sometime paid wages in a year. Questionnaire for children claiming ssi benefits: If payments and deferrals occurred during the tax year, enter the amount of wages earned by the employee during $ the tax year.

Certification Of Election For Reduced Widow(Er)'S And Surviving Divorced Spouse.

Enter not retired if the employee has not. Web social security forms | social security administration forms all forms are free. Fill out the employer report of special wage payments online and print it out for free. The intent is to have a standard form that employers are familiar with and that can be sent to employers and returned directly to ssa.

Nonqualified Deferred Compensation And Section 457 Plans Only.

Employer instructions for completing special wage payment form 1. Enter the date the employee retired. Employer reporting to the social security administration special wage payments made to an employee for a prior year. How you can complete the ssa 131 form on the internet:

Social Security Administration, United States Federal Legal Forms And United States Legal Forms.

The respondents are employers who provide special wage payment verification. Open it with online editor and start altering. To get started on the document, utilize the fill camp; Involved parties names, addresses and phone numbers etc.

If Payments And Deferrals Occurred During The Tax Year, Enter The Amount Of Wages Earned By The Employee During $ The Tax Year.

Web ssa form 131 use a ssa form 131 template to make your document workflow more streamlined. Questionnaire for children claiming ssi benefits: Certification of low birth weight for ssi eligibility: Nonqualified deferred compensation and section 457 plans only.