Form T2201 Cra

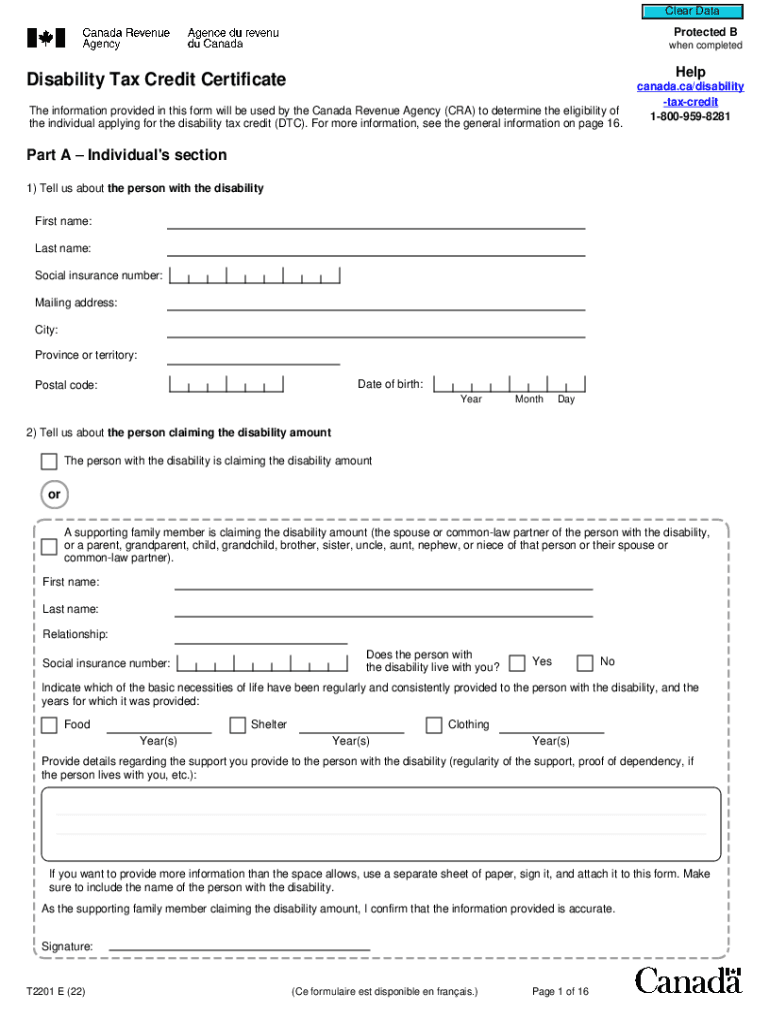

Form T2201 Cra - This form helps to determine a person’s eligibility. Web in your t2201 form, you must provide incontrovertible proof to the cra that you are living with a severe or prolonged mental or physical disability that is keeping you out of the. Forms, guides, tax packages, and other canada revenue agency (cra) publications. Web we would like to show you a description here but the site won’t allow us. Web t2201 form disability tax credit form. Here’s what you need to. A check box is provided. Web form t2201, disability tax credit certificate is the form you must submit to the canada revenue agency in order to apply for the disability tax credit. Web up to $40 cash back the cra form t2201 disability tax credit certificate is used to apply for the federal disability tax credit (dtc). Web 1127 rows forms and publications canada revenue agency forms listed by number this paginated table is initially sorted by last update, so new and recently updated forms are.

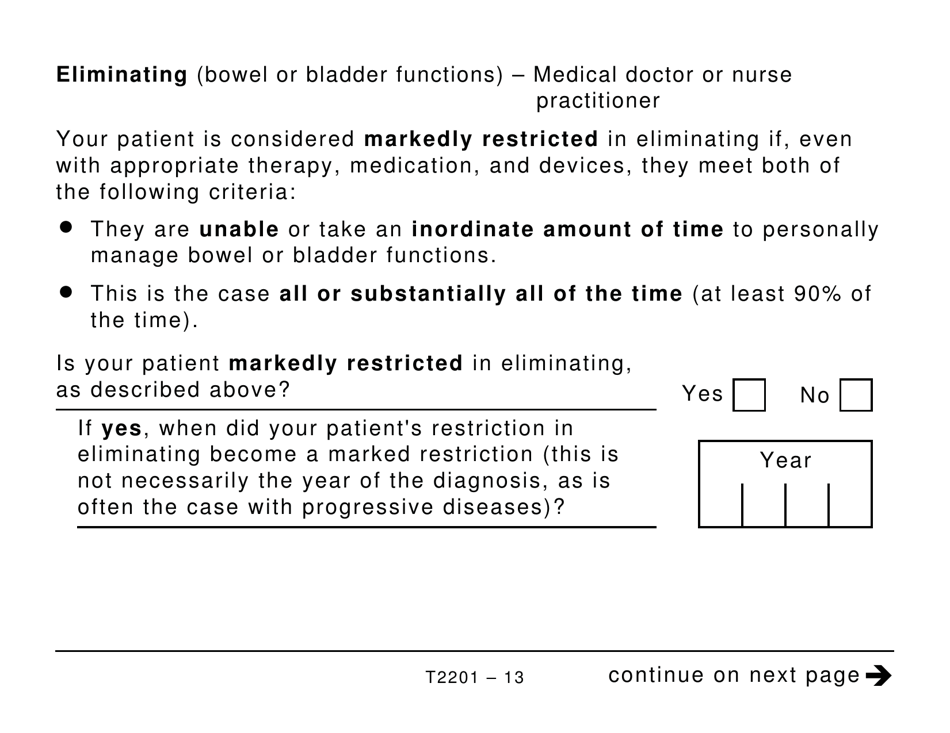

Select the disability amount box in the identification form in order for taxprep to determine the disability tax credit. Web form t2201 is a disability tax credit certificate you are expected to fill to claim disability benefits from the support programs available. Web applicants can now complete part a of the dtc application using the new digital form. Web in your t2201 form, you must provide incontrovertible proof to the cra that you are living with a severe or prolonged mental or physical disability that is keeping you out of the. Here’s what you need to. Tax packages for all years. Web form t2201 determines if you qualify for a range of government benefits meant to help financially support canadians with severe and prolonged disabilities. Web what is the t2201 form? Web 1127 rows forms and publications canada revenue agency forms listed by number this paginated table is initially sorted by last update, so new and recently updated forms are. The eligibility criteria for mental illnesses and psychological impairments have been modified.

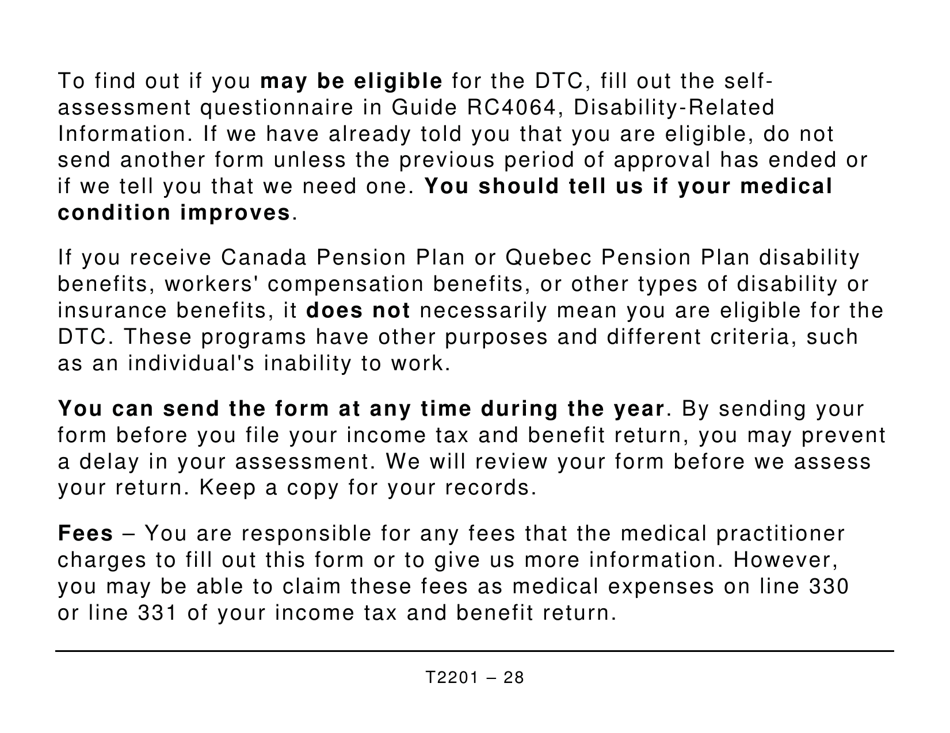

Web completing the disability tax credit certificate, or t2201 application form, correctly is essential in order to receive your disability tax credit refund. Solved•by turbotax•13•updated october 05, 2022. Web form t2201 is a disability tax credit certificate you are expected to fill to claim disability benefits from the support programs available. Web 1127 rows forms and publications canada revenue agency forms listed by number this paginated table is initially sorted by last update, so new and recently updated forms are. Web form t2201, disability tax credit certificate is the form you must submit to the canada revenue agency in order to apply for the disability tax credit. The eligibility criteria for mental illnesses and psychological impairments have been modified. Select the disability amount box in the identification form in order for taxprep to determine the disability tax credit. Web how do i submit form t2201 (disability tax credit certificate) to the cra? A check box is provided. This form helps to determine a person’s eligibility.

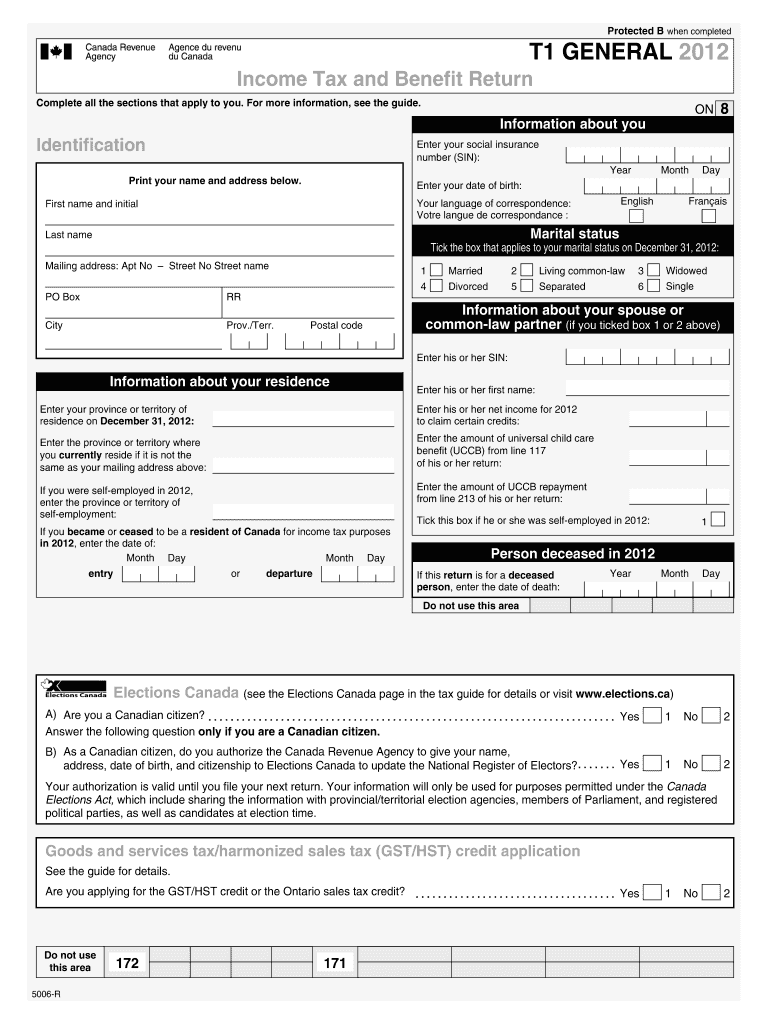

2012 Form Canada T1 General Fill Online, Printable, Fillable, Blank

Forms, guides, tax packages, and other canada revenue agency (cra) publications. Select the disability amount box in the identification form in order for taxprep to determine the disability tax credit. Web in your t2201 form, you must provide incontrovertible proof to the cra that you are living with a severe or prolonged mental or physical disability that is keeping you.

Form T2201 Download Printable PDF or Fill Online Disability Tax Credit

Web up to $40 cash back the cra form t2201 disability tax credit certificate is used to apply for the federal disability tax credit (dtc). Here’s what you need to. Solved•by turbotax•13•updated october 05, 2022. Web how do i submit form t2201 (disability tax credit certificate) to the cra? Web we would like to show you a description here but.

Revenue Canada Form T2201 REVNEUS

We base our decision on the information given by the medical. Solved•by turbotax•13•updated october 05, 2022. Web we would like to show you a description here but the site won’t allow us. Web form t2201 determines if you qualify for a range of government benefits meant to help financially support canadians with severe and prolonged disabilities. Web completing the disability.

Revenue Canada Disability Tax Credit Form T2201

We base our decision on the information given by the medical. Web up to $40 cash back the cra form t2201 disability tax credit certificate is used to apply for the federal disability tax credit (dtc). Web what is the t2201 form? Check out how easy it is to complete and esign documents online using fillable templates and a powerful.

GST34 2 E 12 PDF

Here’s what you need to. Canada revenue agency (cra) offers the disability tax credit (dtc) certificate, also known as the t2201 form. Web in your t2201 form, you must provide incontrovertible proof to the cra that you are living with a severe or prolonged mental or physical disability that is keeping you out of the. A check box is provided..

T2201 Printable Form Fill Out and Sign Printable PDF Template signNow

Web check your copy of your application, form t2201, disability tax credit certificate, against the reason (s) given. A check box is provided. Web in your t2201 form, you must provide incontrovertible proof to the cra that you are living with a severe or prolonged mental or physical disability that is keeping you out of the. Web applicants can now.

Compatible ink for T220XL T2201 Refillable Cartridge for EPSON WF2630

Canada revenue agency (cra) offers the disability tax credit (dtc) certificate, also known as the t2201 form. We base our decision on the information given by the medical. Here’s what you need to. Forms, guides, tax packages, and other canada revenue agency (cra) publications. Web the next pages), or their representative, use form t2201 to apply for the disability amount.

Form T2201 Download Printable PDF or Fill Online Disability Tax Credit

Web the next pages), or their representative, use form t2201 to apply for the disability amount by completing part a of the form. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web how do i submit form t2201 (disability tax credit certificate) to the cra? Web form t2201, disability.

Cra website forms Fill out & sign online DocHub

Web 1127 rows forms and publications canada revenue agency forms listed by number this paginated table is initially sorted by last update, so new and recently updated forms are. Web check your copy of your application, form t2201, disability tax credit certificate, against the reason (s) given. Web form t2201 is a disability tax credit certificate you are expected to.

How Much Is Disability Tax Credit Worth

Web what is the t2201 form? Web t2201 form disability tax credit form. Solved•by turbotax•13•updated october 05, 2022. Web check your copy of your application, form t2201, disability tax credit certificate, against the reason (s) given. Canada revenue agency (cra) offers the disability tax credit (dtc) certificate, also known as the t2201 form.

The Eligibility Criteria For Mental Illnesses And Psychological Impairments Have Been Modified.

Forms, guides, tax packages, and other canada revenue agency (cra) publications. Web form t2201, disability tax credit certificate is the form you must submit to the canada revenue agency in order to apply for the disability tax credit. Here’s what you need to. Tax packages for all years.

Web We Would Like To Show You A Description Here But The Site Won’t Allow Us.

Solved•by turbotax•13•updated october 05, 2022. Select the disability amount box in the identification form in order for taxprep to determine the disability tax credit. Do you need information or forms? Web up to $40 cash back the cra form t2201 disability tax credit certificate is used to apply for the federal disability tax credit (dtc).

A Check Box Is Provided.

Web form t2201 determines if you qualify for a range of government benefits meant to help financially support canadians with severe and prolonged disabilities. Web in your t2201 form, you must provide incontrovertible proof to the cra that you are living with a severe or prolonged mental or physical disability that is keeping you out of the. Web applicants can now complete part a of the dtc application using the new digital form. Web the next pages), or their representative, use form t2201 to apply for the disability amount by completing part a of the form.

Web Completing The Disability Tax Credit Certificate, Or T2201 Application Form, Correctly Is Essential In Order To Receive Your Disability Tax Credit Refund.

Canada revenue agency (cra) offers the disability tax credit (dtc) certificate, also known as the t2201 form. We base our decision on the information given by the medical. Web what is the t2201 form? Web how do i submit form t2201 (disability tax credit certificate) to the cra?