Form To Change Llc To S Corp

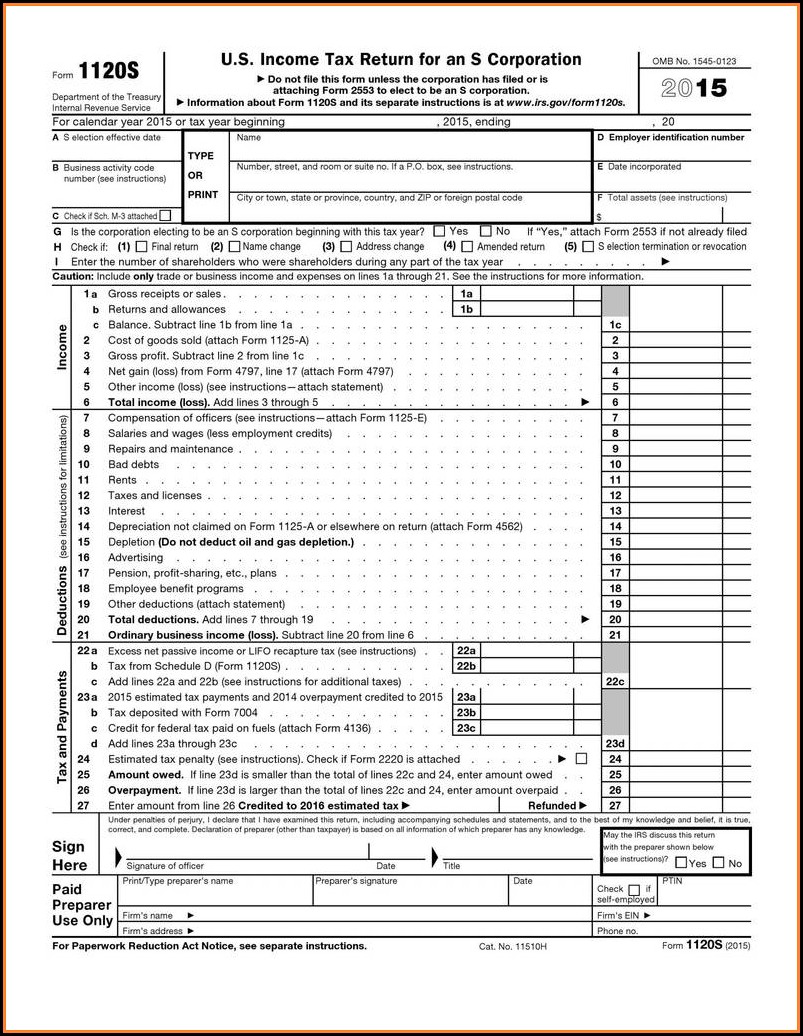

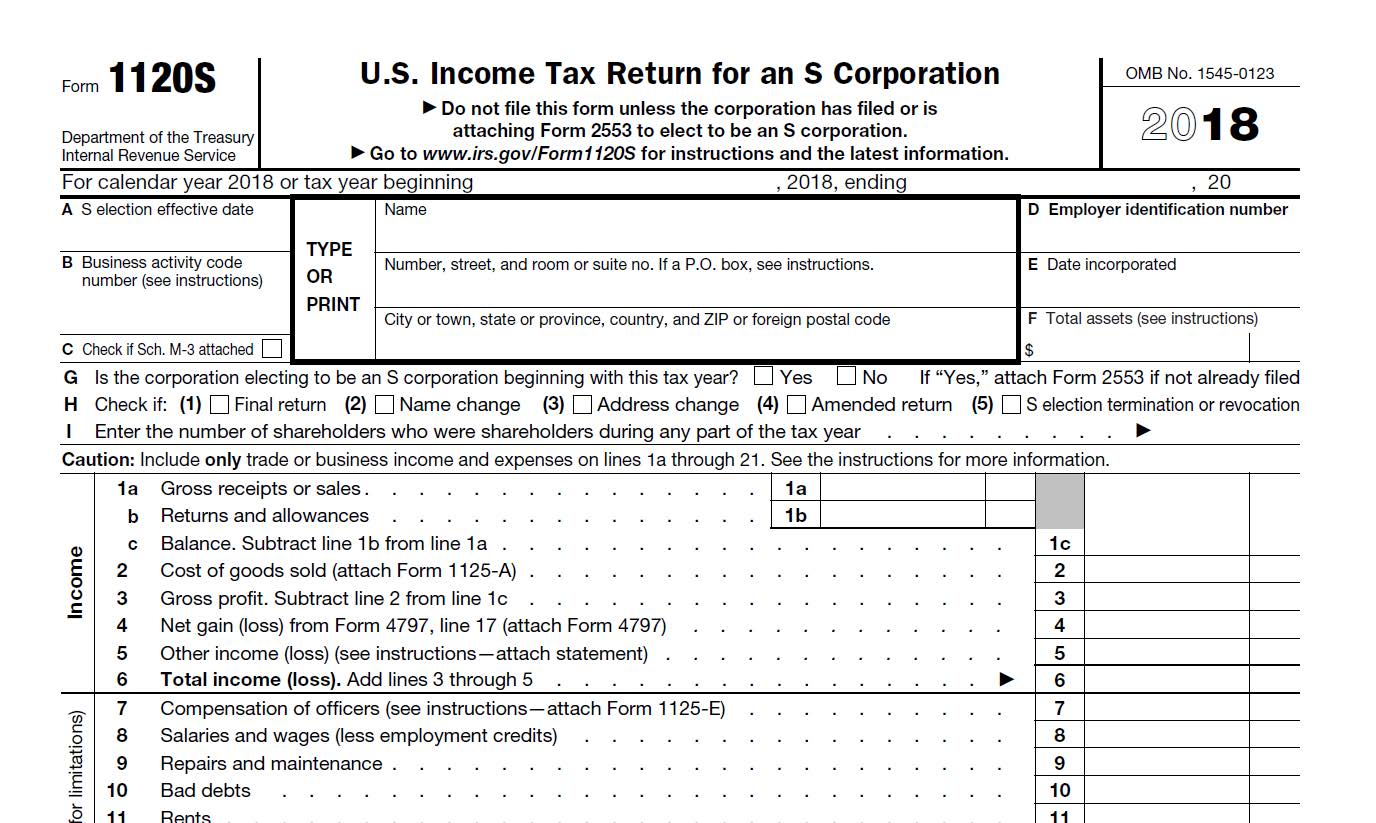

Form To Change Llc To S Corp - Start yours for $0 + filing fees. Kone corporation has assigned a total of 18,485 kone class b shares to two key employees. Ad protect your business from liabilities. Web in order to become an s corporation, the corporation must submit form 2553, election by a small business corporation signed by all the shareholders. Home of the $0 llc. Web antarctic sea ice has usually been able to recover in winter. Start your s corporation now. Choose to be an s corporation by filling out form 2553; Ad 10 minute filing & fast turnaround time with swyft filings®. Web you can change your limited liability company (llc) to an s corporation (s corp) by filing form 2553 with the internal revenue service (irs).

But this time it's different, with levels taking a sharp downward turn at a time of year when sea ice usually. You will be required to obtain a new ein if any of the following statements are true. Incfile can help converting s corp to an llc involves planning out the conversion in detail, gaining. Keep your llc compliant w/ a registered agent, operating agreement, and business licenses. Web a corporation or other entity eligible to be treated as a corporation files this form to make an election under section 1362 (a) to be an s corporation. Web in some states, you must first form your llc and then merge the s corporation into the existing llc. Web change in kone corporation's holding of treasury shares. Web in order to become an s corporation, the corporation must submit form 2553, election by a small business corporation signed by all the shareholders. Start yours for $0 + filing fees. Choose to be an s corporation by filling out form 2553;

Web to have your business treated as an s corporation, you must file form 8832 to inform the irs that you no longer want your llc to be taxed as a partnership or sole. Start your s corporation now. Choose to be an s corporation by filling out form 2553; After all, it is only a filed form. Kone corporation has assigned a total of 18,485 kone class b shares to two key employees. Web change in kone corporation's holding of treasury shares. Keep your llc compliant w/ a registered agent, operating agreement, and business licenses. Web send the irs a letter informing them of the structural change; It may take a few steps, but it is by no means complicated. Web in order to become an s corporation, the corporation must submit form 2553, election by a small business corporation signed by all the shareholders.

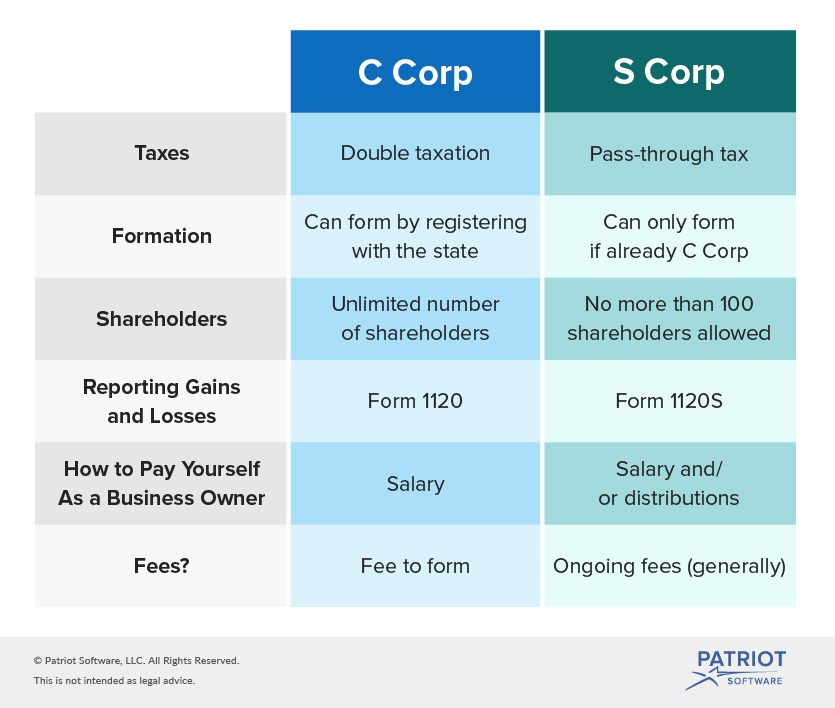

What Is the Difference Between S Corp and C Corp? Business Overview

You need to file a. Web you can change your limited liability company (llc) to an s corporation (s corp) by filing form 2553 with the internal revenue service (irs). Our trusted & experienced business specialists provide personal customer support. Ad protect your business from liabilities. Web thus, an llc that has been treated as a partnership for several years.

30 plantillas profesionales de acuerdos operativos de LLC Mundo

Web as of july 19, the average credit card interest rate is 20.44%, down slightly from the 20.58% recorded the week before, according to bankrate.com. Web up to 25% cash back west virginia law currently only allows for statutory mergers. Ad 10 minute filing & fast turnaround time with swyft filings®. This transaction can be complicated. It may take a.

Limited Liability Company LLC Operating Agreement Fill out

Home of the $0 llc. Keep your llc compliant w/ a registered agent, operating agreement, and business licenses. Web send the irs a letter informing them of the structural change; Ad 10 minute filing & fast turnaround time with swyft filings®. It may take a few steps, but it is by no means complicated.

An SCorp Gift Charitable Solutions, LLC

Web antarctic sea ice has usually been able to recover in winter. Citizen or equivalent, converting to an s corporation is relatively simple. Web dissolving a corporation to form an llc need a new llc? You need to file a. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook.

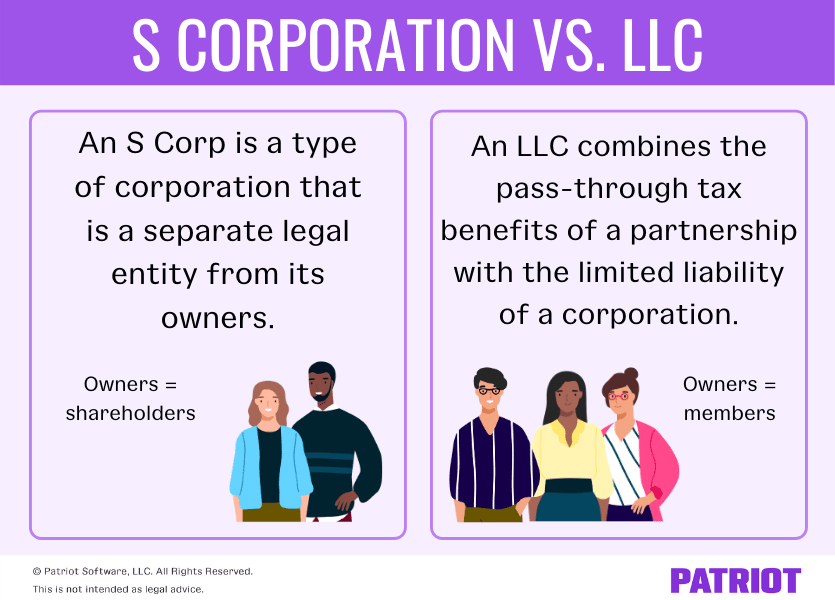

S Corp vs. LLC Q&A, Pros & Cons of Each, & More

Web if your business is operating as a sole proprietorship, and you’re a u.s. Cancel the llc while filing with the state for a new. Web as of july 19, the average credit card interest rate is 20.44%, down slightly from the 20.58% recorded the week before, according to bankrate.com. Web up to 25% cash back west virginia law currently.

Convert Your Tax Status From LLC To S Corp In 7 Steps

Web you can change your limited liability company (llc) to an s corporation (s corp) by filing form 2553 with the internal revenue service (irs). Web send the irs a letter informing them of the structural change; Web in some states, you must first form your llc and then merge the s corporation into the existing llc. Web thus, an.

81 [PDF] FORM 8832 APPROVAL FREE PRINTABLE DOCX 2020 ApprovalForm2

This transaction can be complicated. Web dissolving a corporation to form an llc need a new llc? Choose to be an s corporation by filling out form 2553; Ad 10 minute filing & fast turnaround time with swyft filings®. Cancel the llc while filing with the state for a new.

Printable Irs Forms 1040ez 2017 Form Resume Examples qeYzK8WV8X

This transaction can be complicated. Our trusted & experienced business specialists provide personal customer support. Web change in kone corporation's holding of treasury shares. Web dissolving a corporation to form an llc need a new llc? Home of the $0 llc.

Llc Operating Agreement Pdf Fill Online, Printable, Fillable

This transaction can be complicated. Ad protect your business from liabilities. A corporation receives a new charter from the secretary of state. Web a corporation or other entity eligible to be treated as a corporation files this form to make an election under section 1362 (a) to be an s corporation. Web thus, an llc that has been treated as.

LLC vs. SCorp Which One is Right for You? Filenow

After all, it is only a filed form. Keep your llc compliant w/ a registered agent, operating agreement, and business licenses. It may take a few steps, but it is by no means complicated. Web thus, an llc that has been treated as a partnership for several years may be able to prospectively change its classification to be treated as.

Web Change In Kone Corporation's Holding Of Treasury Shares.

You need to file a. Trusted by over 1,000,000 business owners worldwide since 2004. You will be required to obtain a new ein if any of the following statements are true. Web in order to become an s corporation, the corporation must submit form 2553, election by a small business corporation signed by all the shareholders.

Web If Your Business Is Operating As A Sole Proprietorship, And You’re A U.s.

Web to change an llc to an s corp (s corporation) is a move that intelligent business proprietors looking to reduce tax liability might consider. Web send the irs a letter informing them of the structural change; Web thus, an llc that has been treated as a partnership for several years may be able to prospectively change its classification to be treated as a corporation by filing. Choose to be an s corporation by filling out form 2553;

Citizen Or Equivalent, Converting To An S Corporation Is Relatively Simple.

Web in some states, you must first form your llc and then merge the s corporation into the existing llc. A corporation receives a new charter from the secretary of state. Web antarctic sea ice has usually been able to recover in winter. Web dissolving a corporation to form an llc need a new llc?

Web To Have Your Business Treated As An S Corporation, You Must File Form 8832 To Inform The Irs That You No Longer Want Your Llc To Be Taxed As A Partnership Or Sole.

Web as of july 19, the average credit card interest rate is 20.44%, down slightly from the 20.58% recorded the week before, according to bankrate.com. Home of the $0 llc. Start your s corporation now. Web you can change your limited liability company (llc) to an s corporation (s corp) by filing form 2553 with the internal revenue service (irs).

![81 [PDF] FORM 8832 APPROVAL FREE PRINTABLE DOCX 2020 ApprovalForm2](https://www.llcuniversity.com/wp-content/uploads/IRS-CP277-Form-8832-Approval.jpg)