Form W-4R 2023

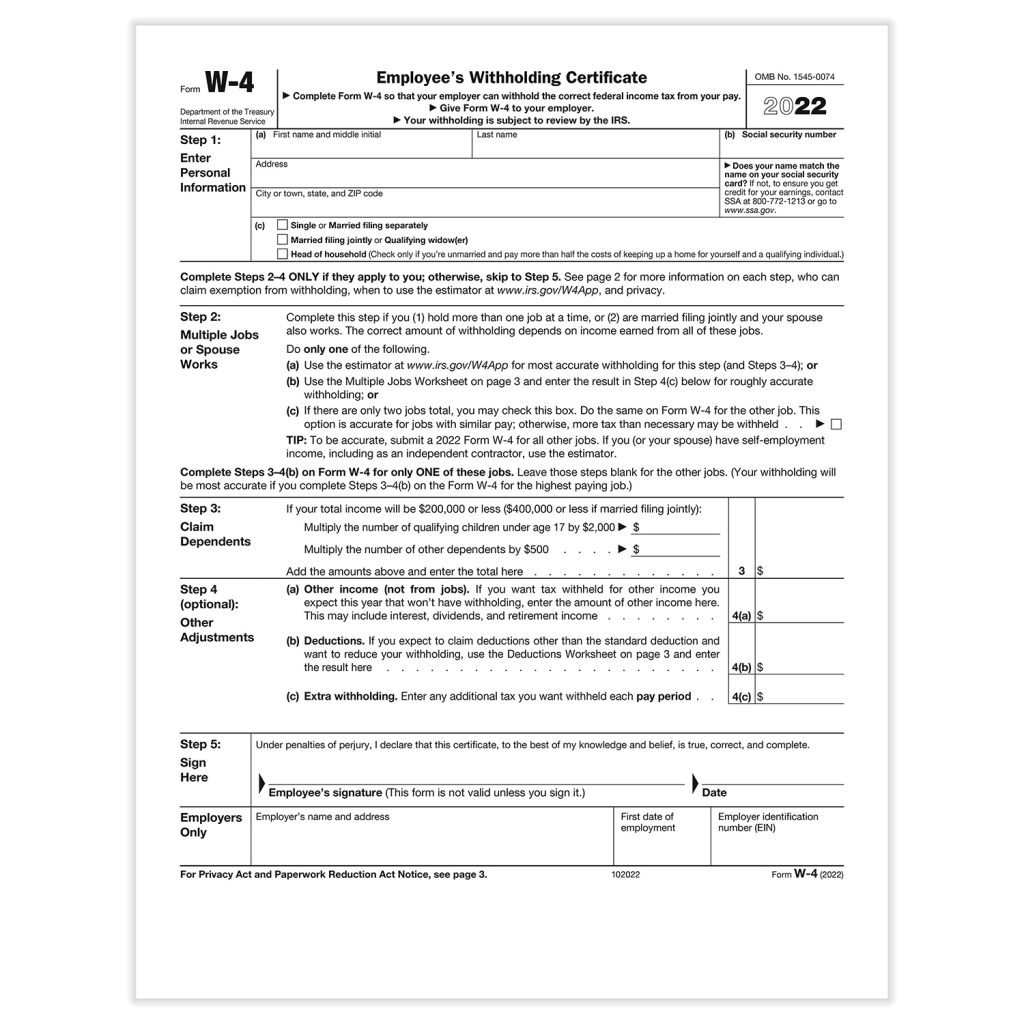

Form W-4R 2023 - Web if your total income will be $200,000 or less ($400,000 or less if married filing jointly): However, if no amount is selected, plan sponsors must withhold at a flat 10%. Trs is required by federal law to implement the new and revised irs forms no later than jan. The form was optional in 2022 but is required to be used starting in 2023. The final 2023 version of the new federal withholding certificate for nonperiodic pension payments was released jan. Multiply the number of qualifying children under age 17 by $2,000 $ multiply the number of other dependents by $500. You may add to this the amount of any other credits. $ add the amounts above for qualifying children and other dependents. 9 by the internal revenue service. Learn more about bloomberg tax or log in to.

However, if no amount is selected, plan sponsors must withhold at a flat 10%. The form was optional in 2022 but is required to be used starting in 2023. Learn more about bloomberg tax or log in to. Web if your total income will be $200,000 or less ($400,000 or less if married filing jointly): Trs is required by federal law to implement the new and revised irs forms no later than jan. You may add to this the amount of any other credits. $ add the amounts above for qualifying children and other dependents. 9 by the internal revenue service. Multiply the number of qualifying children under age 17 by $2,000 $ multiply the number of other dependents by $500. The final 2023 version of the new federal withholding certificate for nonperiodic pension payments was released jan.

However, if no amount is selected, plan sponsors must withhold at a flat 10%. You may add to this the amount of any other credits. The form was optional in 2022 but is required to be used starting in 2023. 9 by the internal revenue service. Learn more about bloomberg tax or log in to. Trs is required by federal law to implement the new and revised irs forms no later than jan. Multiply the number of qualifying children under age 17 by $2,000 $ multiply the number of other dependents by $500. $ add the amounts above for qualifying children and other dependents. The final 2023 version of the new federal withholding certificate for nonperiodic pension payments was released jan. Web if your total income will be $200,000 or less ($400,000 or less if married filing jointly):

Form W4 Allowances 2022 Chevy Trax IMAGESEE

The form was optional in 2022 but is required to be used starting in 2023. Multiply the number of qualifying children under age 17 by $2,000 $ multiply the number of other dependents by $500. Learn more about bloomberg tax or log in to. $ add the amounts above for qualifying children and other dependents. The final 2023 version of.

IRS to Begin Using Updated Form W4P and New Form W4R in 2023 PERA

You may add to this the amount of any other credits. Multiply the number of qualifying children under age 17 by $2,000 $ multiply the number of other dependents by $500. 9 by the internal revenue service. Learn more about bloomberg tax or log in to. $ add the amounts above for qualifying children and other dependents.

W4 Form Fillable 2023 W4 Forms Zrivo

Multiply the number of qualifying children under age 17 by $2,000 $ multiply the number of other dependents by $500. However, if no amount is selected, plan sponsors must withhold at a flat 10%. The final 2023 version of the new federal withholding certificate for nonperiodic pension payments was released jan. Web if your total income will be $200,000 or.

El IRS aplica un poco de “WD40” a su Formulario W4 Café con Labor

Web if your total income will be $200,000 or less ($400,000 or less if married filing jointly): Learn more about bloomberg tax or log in to. Trs is required by federal law to implement the new and revised irs forms no later than jan. Multiply the number of qualifying children under age 17 by $2,000 $ multiply the number of.

2022 W4 Form IRS W4 Form 2022 Printable

However, if no amount is selected, plan sponsors must withhold at a flat 10%. Trs is required by federal law to implement the new and revised irs forms no later than jan. Multiply the number of qualifying children under age 17 by $2,000 $ multiply the number of other dependents by $500. Learn more about bloomberg tax or log in.

Treasury and IRS unveil new Form W4 for 2020 Accounting Today

$ add the amounts above for qualifying children and other dependents. You may add to this the amount of any other credits. The final 2023 version of the new federal withholding certificate for nonperiodic pension payments was released jan. Learn more about bloomberg tax or log in to. Trs is required by federal law to implement the new and revised.

How To Avoid Withholding Tax Economicsprogress5

9 by the internal revenue service. Trs is required by federal law to implement the new and revised irs forms no later than jan. Learn more about bloomberg tax or log in to. Web if your total income will be $200,000 or less ($400,000 or less if married filing jointly): The form was optional in 2022 but is required to.

W4 Form 2023

However, if no amount is selected, plan sponsors must withhold at a flat 10%. Multiply the number of qualifying children under age 17 by $2,000 $ multiply the number of other dependents by $500. The final 2023 version of the new federal withholding certificate for nonperiodic pension payments was released jan. 9 by the internal revenue service. Web if your.

W2 Form 2022 Fillable Form 2023

The final 2023 version of the new federal withholding certificate for nonperiodic pension payments was released jan. However, if no amount is selected, plan sponsors must withhold at a flat 10%. You may add to this the amount of any other credits. Learn more about bloomberg tax or log in to. The form was optional in 2022 but is required.

IRS to Begin Using Updated Form W4P and New Form W4R in 2023 PERA

9 by the internal revenue service. However, if no amount is selected, plan sponsors must withhold at a flat 10%. Multiply the number of qualifying children under age 17 by $2,000 $ multiply the number of other dependents by $500. $ add the amounts above for qualifying children and other dependents. Web if your total income will be $200,000 or.

Web If Your Total Income Will Be $200,000 Or Less ($400,000 Or Less If Married Filing Jointly):

Learn more about bloomberg tax or log in to. Trs is required by federal law to implement the new and revised irs forms no later than jan. Multiply the number of qualifying children under age 17 by $2,000 $ multiply the number of other dependents by $500. The final 2023 version of the new federal withholding certificate for nonperiodic pension payments was released jan.

$ Add The Amounts Above For Qualifying Children And Other Dependents.

However, if no amount is selected, plan sponsors must withhold at a flat 10%. You may add to this the amount of any other credits. The form was optional in 2022 but is required to be used starting in 2023. 9 by the internal revenue service.