Free File Form 7004

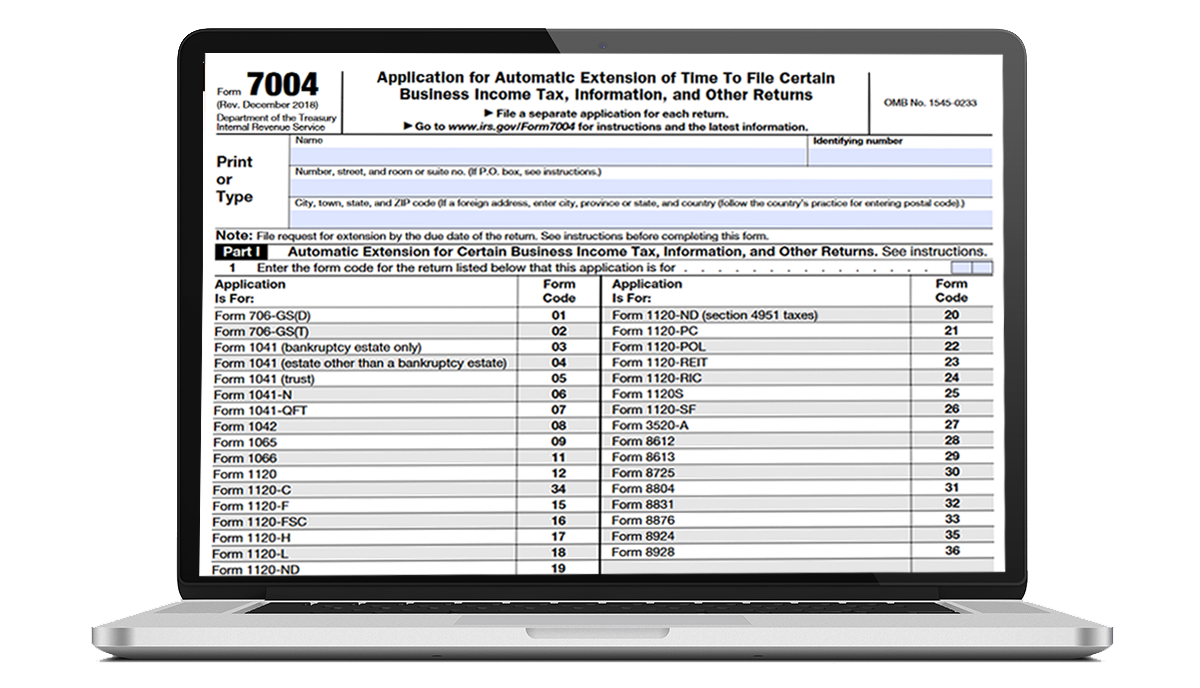

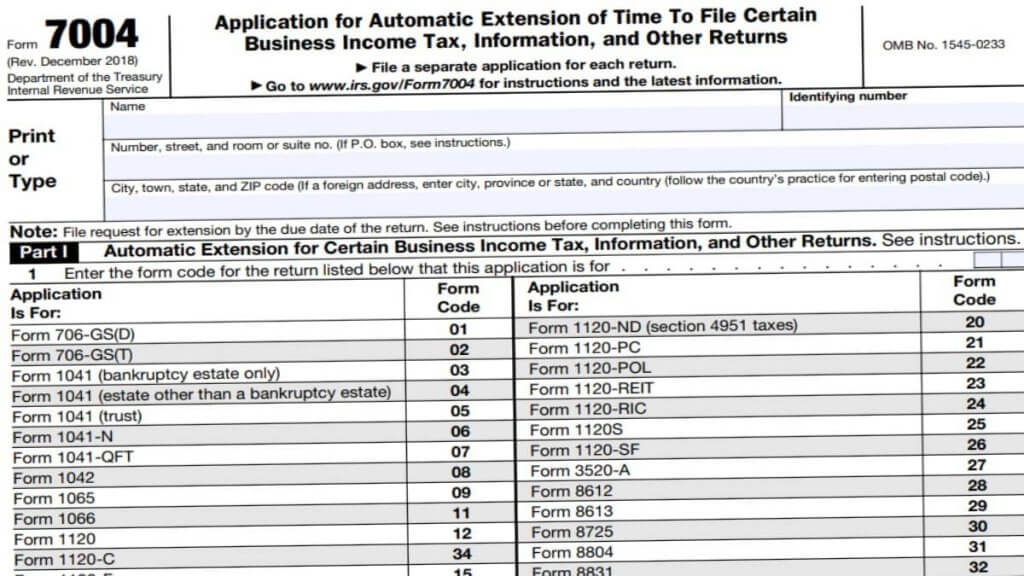

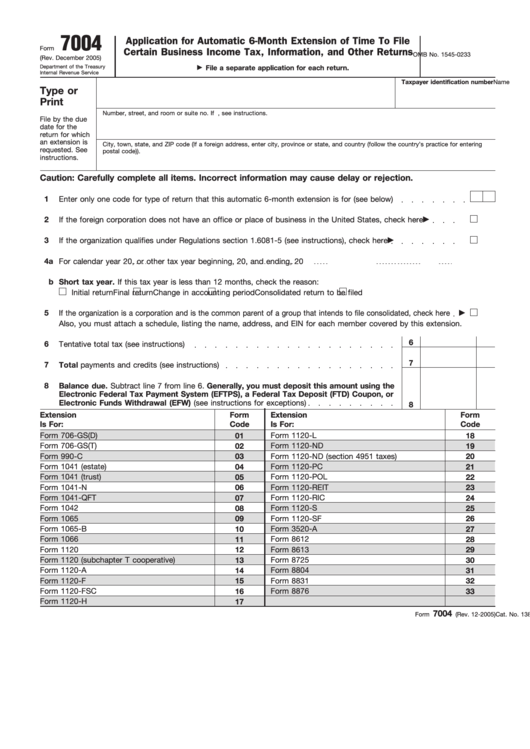

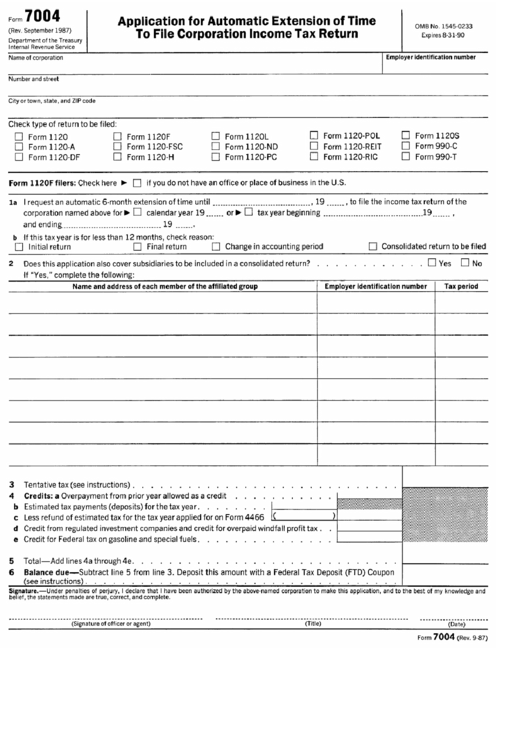

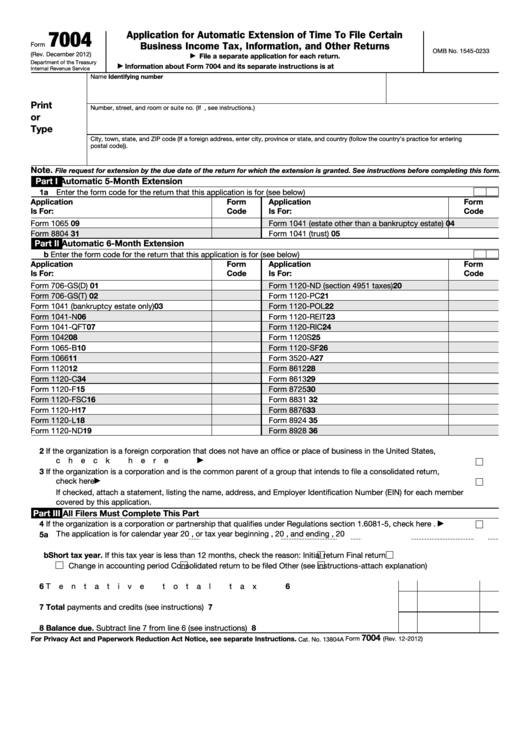

Free File Form 7004 - Enter business details step 2: Enter code 25 in the box on form 7004, line 1. Web how do i file form 7004, application for automatic extension of time to file certain business income tax, information, and other returns? Select business entity & form step 3: Web select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain business. Web 13 rows purpose of form. Filing your taxes just became easier. From within your taxact return ( online or desktop), click filing to expand, then click file extension. The following links provide information on the companies that have passed the internal revenue service (irs). Transmit your form to the irs ready to e.

Ad over 90 million taxes filed with taxact. Web successfully and properly filing form 7004 grants you a six month corporate tax extension to file that tax form. Web to file form 7004 using taxact ®: See instructions before completing this form. By filling irs 7004, you will receive an. Before you start filling out the printable or fillable form. Start basic federal filing for free. Application for automatic extension of time (irs) fillable. Web select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain business. Web file request for extension by the due date of the return for which the extension is granted.

Web file request for extension by the due date of the return for which the extension is granted. Web select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain business. Select business entity & form step 3: Web 1 min read you can extend filing form 1120s when you file form 7004. Try it for free now! Ad over 90 million taxes filed with taxact. Transmit your form to the irs ready to e. On smaller devices, click in the upper. By the tax filing due date (april 15th for most businesses) who needs to file: Application for automatic extension of time (irs) fillable.

EFile 7004 Online 2022 File Business Tax extension Form

Web 1 min read you can extend filing form 1120s when you file form 7004. Select business entity & form step 3: Transmit your form to the irs ready to e. Web the purpose of form 7004: Before you start filling out the printable or fillable form.

Business Tax Extension 7004 Form 2021

Select business entity & form step 3: Upload, modify or create forms. Ad download or email irs 7004 & more fillable forms, register and subscribe now! Web the purpose of form 7004: On smaller devices, click in the upper.

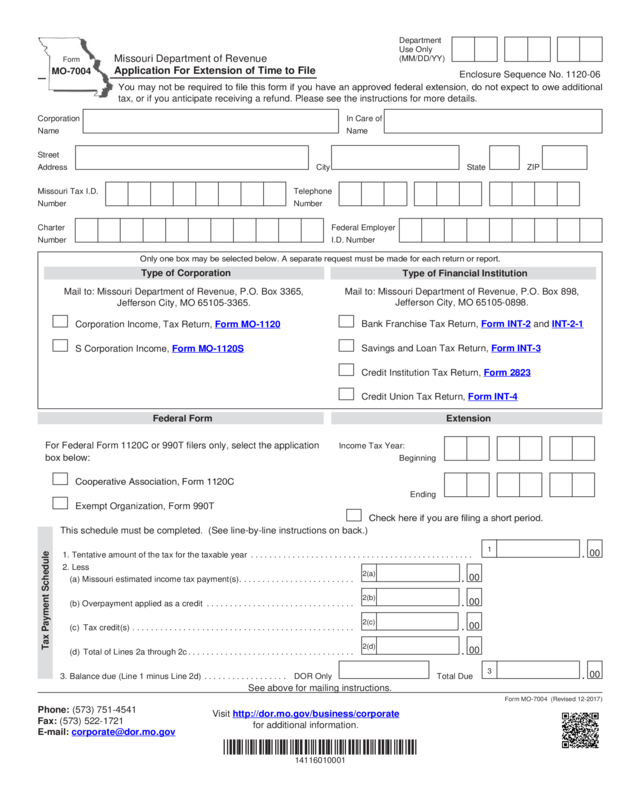

Form Mo7004 Application For Extension Of Time To File Edit, Fill

Application for automatic extension of time (irs) fillable. Start basic federal filing for free. Web file request for extension by the due date of the return for which the extension is granted. See instructions before completing this form. Try it for free now!

Free File Form 1040 Tax Return Yourself to Receive the

Web 13 rows purpose of form. Web irs form 7004 is the form required by the internal revenue service in case your business needs to prolong the date of the tax return. Use form 7004 to request an automatic extension of time to file certain. Try it for free now! Web find the federal tax form either online as a.

Fillable Form 7004 Application For Automatic 6Month Extension Of

Complete, edit or print tax forms instantly. From within your taxact return ( online or desktop), click filing to expand, then click file extension. Web 13 rows purpose of form. Enter code 25 in the box on form 7004, line 1. Enter business details step 2:

E File Form 7004 Online Universal Network

Ad over 90 million taxes filed with taxact. Web file request for extension by the due date of the return for which the extension is granted. Get your extension approved or money back. Web how do i file form 7004, application for automatic extension of time to file certain business income tax, information, and other returns? Use form 7004 to.

Form 7004 Application For Automatic Extension Of Time To File

Enter business details step 2: Complete, edit or print tax forms instantly. Requests for a tax filing extension. Application for automatic extension of time (irs) fillable. Web 13 rows purpose of form.

2016 Form IRS 7004 Fill Online, Printable, Fillable, Blank pdfFiller

Create your account and select form 7004 extension; Web 13 rows purpose of form. Application for automatic extension of time (irs) pdf form form 7004: Web successfully and properly filing form 7004 grants you a six month corporate tax extension to file that tax form. Web select the appropriate form from the table below to determine where to send the.

Irs Form 7004 amulette

By filling irs 7004, you will receive an. Web 1 min read you can extend filing form 1120s when you file form 7004. Enter business details step 2: Requests for a tax filing extension. On smaller devices, click in the upper.

Fillable Form 7004 Application For Automatic Extension Of Time To

Ad download or email irs 7004 & more fillable forms, register and subscribe now! Enter business details step 2: From within your taxact return ( online or desktop), click filing to expand, then click file extension. By the tax filing due date (april 15th for most businesses) who needs to file: Before you start filling out the printable or fillable.

Web How Do I File Form 7004, Application For Automatic Extension Of Time To File Certain Business Income Tax, Information, And Other Returns?

Web form 7004 application for automatic extension of time to file certain business income tax, information, and other returns omb no. Web irs form 7004 is the form required by the internal revenue service in case your business needs to prolong the date of the tax return. Complete, edit or print tax forms instantly. Web successfully and properly filing form 7004 grants you a six month corporate tax extension to file that tax form.

Web 1 Min Read You Can Extend Filing Form 1120S When You File Form 7004.

More about the federal form 7004 extension we last. Requests for a tax filing extension. Ad download or email irs 7004 & more fillable forms, register and subscribe now! Web to file form 7004 using taxact ®:

By Filling Irs 7004, You Will Receive An.

Enter business details step 2: Enter code 25 in the box on form 7004, line 1. Filing your taxes just became easier. Web find the federal tax form either online as a pdf file, or you can request a printable blank template from the irs website.

See Instructions Before Completing This Form.

Start basic federal filing for free. Before you start filling out the printable or fillable form. Create your account and select form 7004 extension; Web file request for extension by the due date of the return for which the extension is granted.