Free Form 1099 Nec

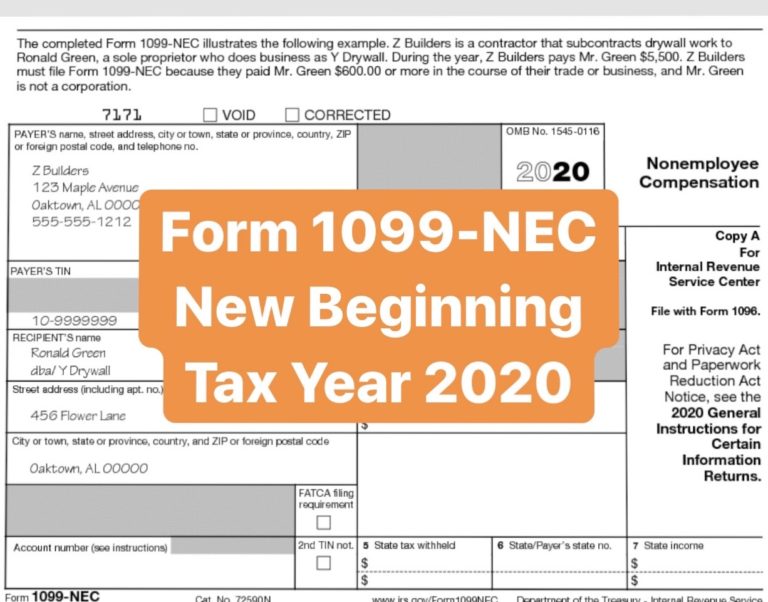

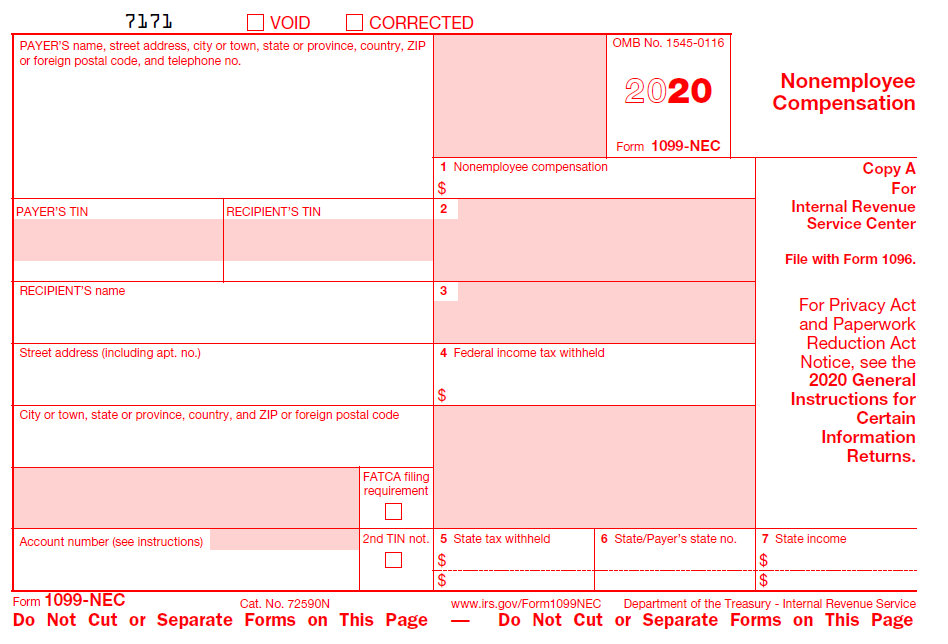

Free Form 1099 Nec - State tax withheld state/payer’s state no. Web nonemployee compensation direct sales totaling $5,000 or more of consumer products for resale. Takes 5 minutes or less to complete. Get ready for tax season deadlines by completing any required tax forms today. Beginning in tax year 2020, payers must. Payer’s information, including name, address and taxpayer. These tax forms can be filled out with our. Web report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services, payments to an attorney, or any amount of. Not used federal income tax withheld. Simply answer a few question to instantly download, print & share your form.

Simply answer a few question to instantly download, print & share your form. Payer’s information, including name, address and taxpayer. Web nonemployee compensation direct sales totaling $5,000 or more of consumer products for resale. Takes 5 minutes or less to complete. These tax forms can be filled out with our. Not used federal income tax withheld. Beginning in tax year 2020, payers must. Do not miss the deadline. Previously reported on box 7 of the. State tax withheld state/payer’s state no.

Get ready for tax season deadlines by completing any required tax forms today. Not used federal income tax withheld. Payer’s information, including name, address and taxpayer. State tax withheld state/payer’s state no. Previously reported on box 7 of the. Simply answer a few question to instantly download, print & share your form. Ad register and subscribe now to work on irs nonemployee compensation & more fillable forms. Do not miss the deadline. These tax forms can be filled out with our. Takes 5 minutes or less to complete.

What is Form 1099NEC for Nonemployee Compensation

Beginning in tax year 2020, payers must. These tax forms can be filled out with our. State tax withheld state/payer’s state no. Not used federal income tax withheld. Get ready for tax season deadlines by completing any required tax forms today.

How to File Your Taxes if You Received a Form 1099NEC

Get ready for tax season deadlines by completing any required tax forms today. Web nonemployee compensation direct sales totaling $5,000 or more of consumer products for resale. Web report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services, payments to an attorney, or any amount of..

Accounts Payable Software for Small Business Accurate Tracking

Simply answer a few question to instantly download, print & share your form. Beginning in tax year 2020, payers must. These tax forms can be filled out with our. State tax withheld state/payer’s state no. Do not miss the deadline.

How To File 1099 Nec Electronically Free Leah Beachum's Template

Ad register and subscribe now to work on irs nonemployee compensation & more fillable forms. These tax forms can be filled out with our. State tax withheld state/payer’s state no. Payer’s information, including name, address and taxpayer. Previously reported on box 7 of the.

1099NEC Software to Create, Print & EFile IRS Form 1099NEC

Payer’s information, including name, address and taxpayer. Not used federal income tax withheld. Do not miss the deadline. Ad register and subscribe now to work on irs nonemployee compensation & more fillable forms. Get ready for tax season deadlines by completing any required tax forms today.

Form 1099NEC Requirements, Deadlines, and Penalties eFile360

Web nonemployee compensation direct sales totaling $5,000 or more of consumer products for resale. Web report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services, payments to an attorney, or any amount of. Not used federal income tax withheld. Beginning in tax year 2020, payers must..

The New 1099NEC IRS Form for Second Shooters & Independent Contractors

These tax forms can be filled out with our. Simply answer a few question to instantly download, print & share your form. Get ready for tax season deadlines by completing any required tax forms today. Beginning in tax year 2020, payers must. Not used federal income tax withheld.

What is Form 1099NEC and Who Needs to File? 123PayStubs Blog

Beginning in tax year 2020, payers must. Takes 5 minutes or less to complete. Web nonemployee compensation direct sales totaling $5,000 or more of consumer products for resale. These tax forms can be filled out with our. Not used federal income tax withheld.

1099NEC Form Print Template for Word or PDF 1096 Transmittal Etsy

Beginning in tax year 2020, payers must. Not used federal income tax withheld. Payer’s information, including name, address and taxpayer. Web report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services, payments to an attorney, or any amount of. Ad register and subscribe now to work.

Form 1099NEC Instructions and Tax Reporting Guide

Get ready for tax season deadlines by completing any required tax forms today. Web nonemployee compensation direct sales totaling $5,000 or more of consumer products for resale. Beginning in tax year 2020, payers must. Not used federal income tax withheld. Web report payments made of at least $600 in the course of a trade or business to a person who's.

Ad Register And Subscribe Now To Work On Irs Nonemployee Compensation & More Fillable Forms.

Do not miss the deadline. Payer’s information, including name, address and taxpayer. Web report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services, payments to an attorney, or any amount of. These tax forms can be filled out with our.

Not Used Federal Income Tax Withheld.

Get ready for tax season deadlines by completing any required tax forms today. Previously reported on box 7 of the. Web nonemployee compensation direct sales totaling $5,000 or more of consumer products for resale. Simply answer a few question to instantly download, print & share your form.

Takes 5 Minutes Or Less To Complete.

Beginning in tax year 2020, payers must. State tax withheld state/payer’s state no.