Free Printable 1099 Nec Form 2022

Free Printable 1099 Nec Form 2022 - The payment is made to someone who is not an employee. To order these instructions and additional forms, go to www.irs.gov/employerforms. For your state (if you live in a state that requires a copy — most do!) Furnish copy b of this form to the recipient by january 31,. These new “continuous use” forms no longer include the tax year. You might face substantial fines for misclassifying employees as independent contractors. Web in order to record pay, tips, and other compensation received during the tax year, all workers must complete a form w2. Quickbooks will print the year on the forms for you. Easily fill out pdf blank, edit, and sign them. Because paper forms are scanned during processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the irs website.

Web electronically file any form 1099 for tax year 2022 and later with the information returns intake system (iris). Rents ( box 1 ); Because paper forms are scanned during processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the irs website. And depreciation schedules for filling out the form correctly. Form1099online is the most reliable and secure way to file your 1099 nec tax returns online. The payment is made for services in the course of your trade or business. Web 1099s get printed at least three times — sometimes four. For your own records copy 1: Web january 06, 2023 02:27 am. Easily fill out pdf blank, edit, and sign them.

Api client id (a2a filers only) sign in to iris for system availability, check iris status. The payment is made for services in the course of your trade or business. Web 1099s get printed at least three times — sometimes four. For your state (if you live in a state that requires a copy — most do!) Web in order to record pay, tips, and other compensation received during the tax year, all workers must complete a form w2. For the irs copy b: To order these instructions and additional forms, go to www.irs.gov/form1099nec. It is now 2023 and possible to create the 2022 data needed for the 1099 forms. The payment is made to someone who is not an employee. This applies to both federal and state taxes.

Irs Printable 1099 Form Printable Form 2022

Web you have to send the forms out by january of the year after the independent contractor delivered their services. For your own records copy 1: January 2022 on top right and bottom left corners. 1099, 3921, or 5498 that you print from the irs website. Because paper forms are scanned during processing, you cannot file certain forms 1096, 1097,.

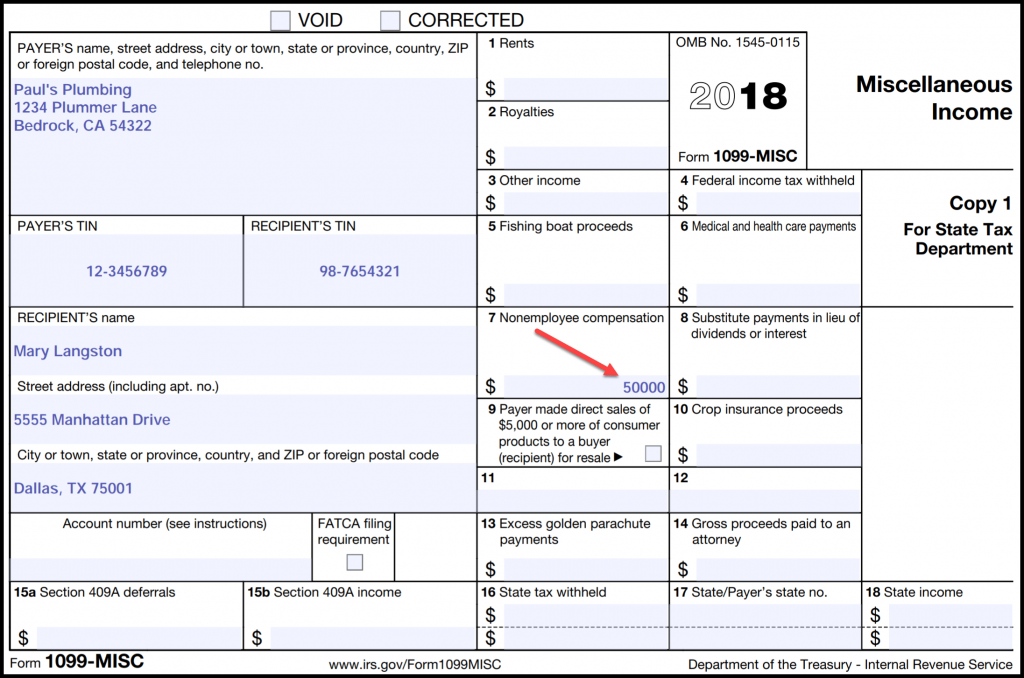

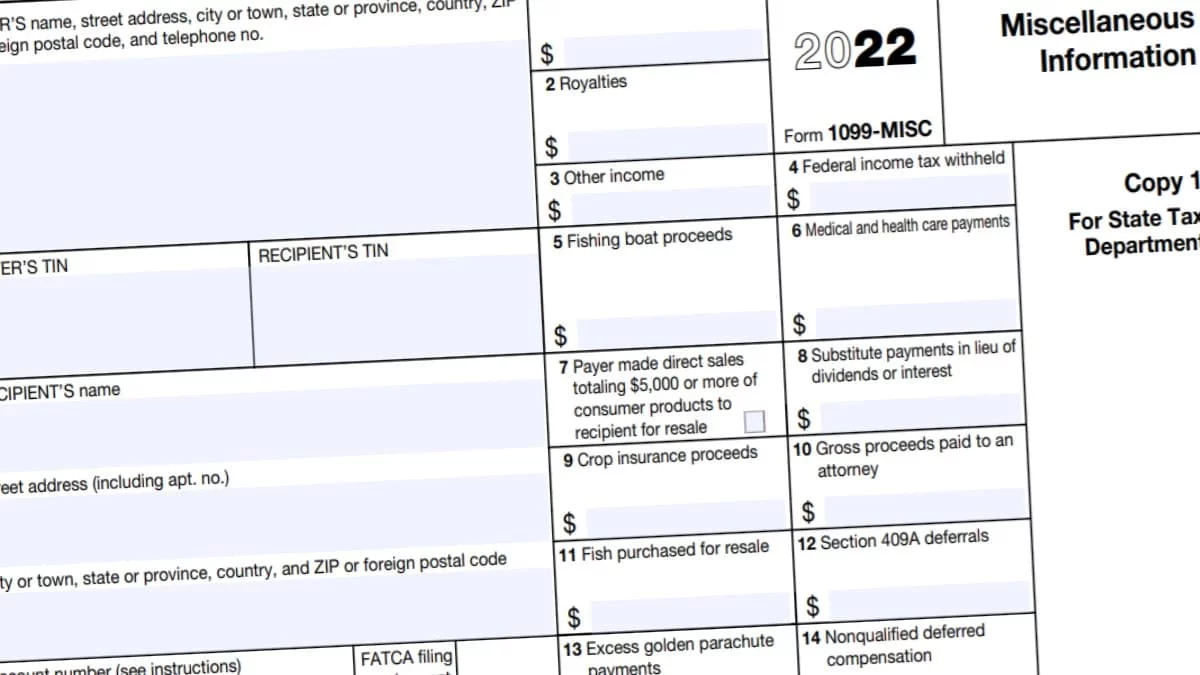

1099 MISC Form 2022 1099 Forms TaxUni

For your state (if you live in a state that requires a copy — most do!) Rents ( box 1 ); And depreciation schedules for filling out the form correctly. These new “continuous use” forms no longer include the tax year. Because paper forms are scanned during processing, you cannot file certain forms 1096, 1097, 1098, 1099, 3921, or 5498.

1099 MISC Form 2022 1099 Forms TaxUni

Web you have to send the forms out by january of the year after the independent contractor delivered their services. Api client id (a2a filers only) sign in to iris for system availability, check iris status. Rents ( box 1 ); What you need employer identification number (ein) iris transmitter control code (tcc). The payment is made to someone who.

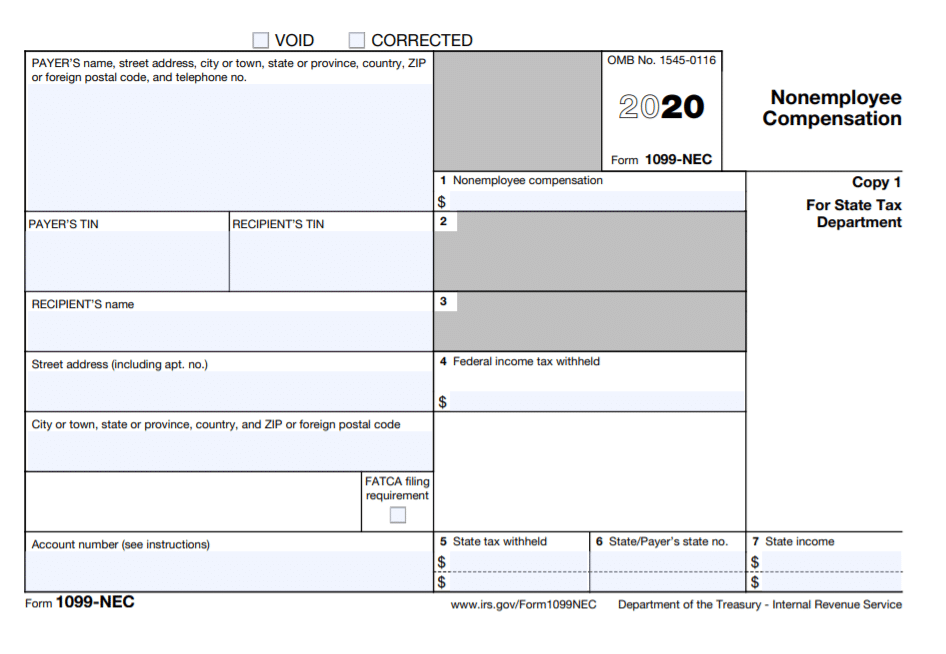

1099 NEC Form 2022

Web in order to record pay, tips, and other compensation received during the tax year, all workers must complete a form w2. To order these instructions and additional forms, go to www.irs.gov/employerforms. Rents ( box 1 ); Save or instantly send your ready documents. Form1099online is the most reliable and secure way to file your 1099 nec tax returns online.

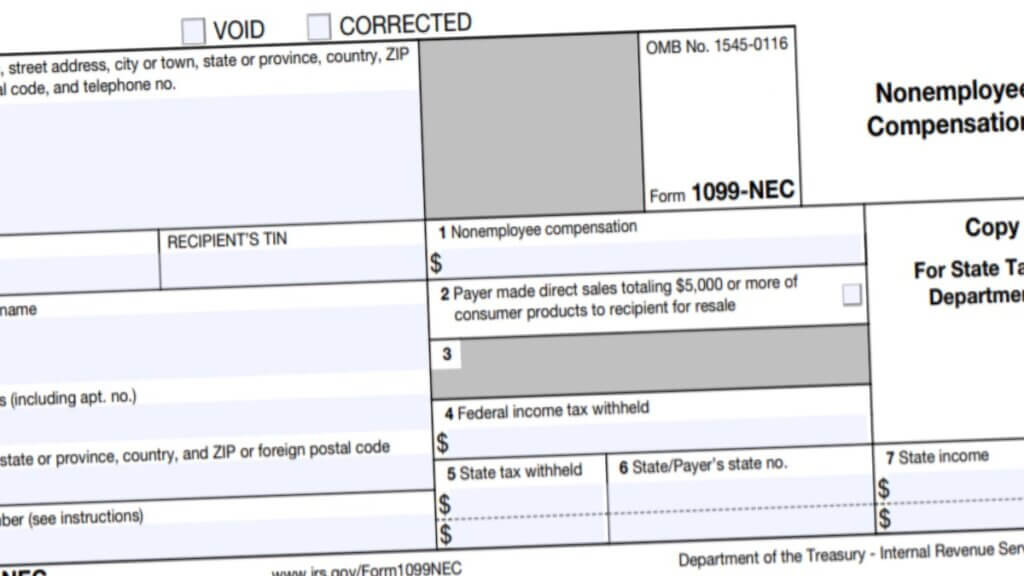

The New 1099NEC IRS Form for Second Shooters & Independent Contractors

Easily fill out pdf blank, edit, and sign them. For the irs copy b: Web january 06, 2023 02:27 am. January 2022 on top right and bottom left corners. Web 1099s get printed at least three times — sometimes four.

What the 1099NEC Coming Back Means for your Business Chortek

To order these instructions and additional forms, go to www.irs.gov/employerforms. To order these instructions and additional forms, go to www.irs.gov/form1099nec. The payment is made for services in the course of your trade or business. What you need employer identification number (ein) iris transmitter control code (tcc). For your own records copy 1:

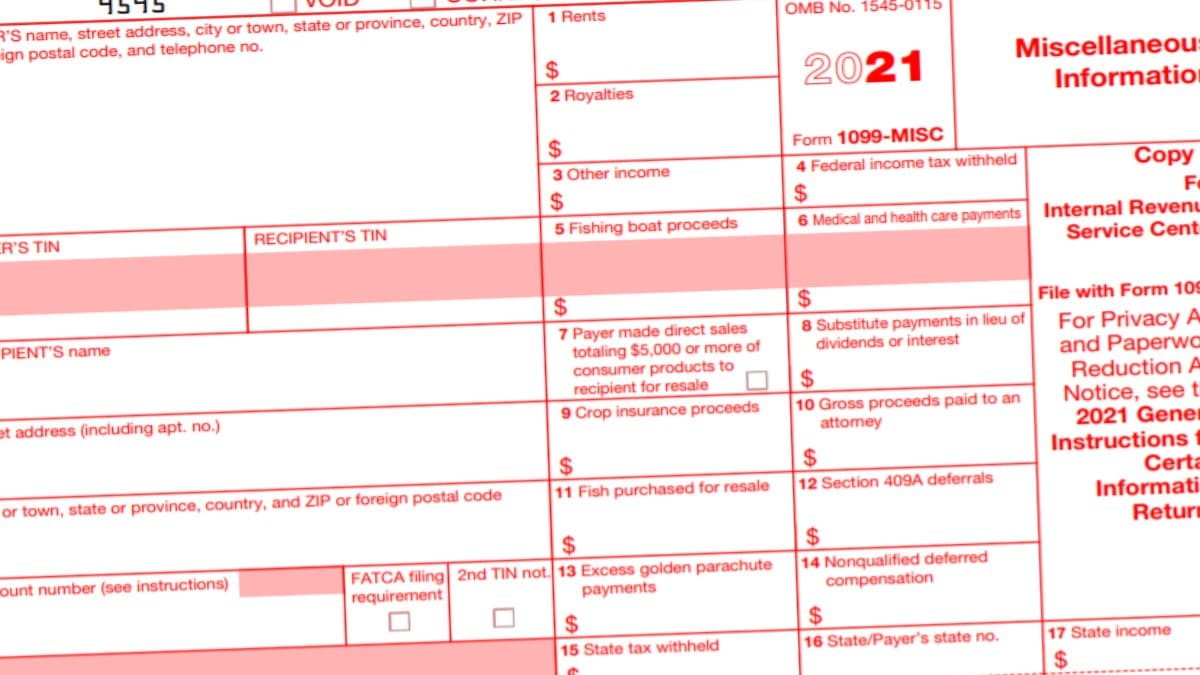

1099 NEC vs 1099 MISC 2021 2022 1099 Forms TaxUni

Web you have to send the forms out by january of the year after the independent contractor delivered their services. Because paper forms are scanned during processing, you cannot file certain forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the irs website. Save or instantly send your ready documents. For the person you paid copy c:.

Understanding 1099 Form Samples

Web you have to send the forms out by january of the year after the independent contractor delivered their services. This applies to both federal and state taxes. Rents ( box 1 ); To order these instructions and additional forms, go to www.irs.gov/employerforms. Web electronically file any form 1099 for tax year 2022 and later with the information returns intake.

For the Love of 1099s! Preparing for JD Edwards YearEnd Circular

You might face substantial fines for misclassifying employees as independent contractors. Save or instantly send your ready documents. Because paper forms are scanned during processing, you cannot file certain forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the irs website. Easily fill out pdf blank, edit, and sign them. This applies to both federal and state.

How to File Your Taxes if You Received a Form 1099NEC

Rents ( box 1 ); For the person you paid copy c: For your state (if you live in a state that requires a copy — most do!) Web you have to send the forms out by january of the year after the independent contractor delivered their services. Easily fill out pdf blank, edit, and sign them.

You Might Face Substantial Fines For Misclassifying Employees As Independent Contractors.

For your state (if you live in a state that requires a copy — most do!) Web january 06, 2023 02:27 am. Web electronically file any form 1099 for tax year 2022 and later with the information returns intake system (iris). And depreciation schedules for filling out the form correctly.

These Are Called Copies A, B, C, And 1, And Here’s Who Gets Them:

The payment is made to someone who is not an employee. Furnish copy b of this form to the recipient by january 31,. Quickbooks will print the year on the forms for you. It is now 2023 and possible to create the 2022 data needed for the 1099 forms.

For Your Own Records Copy 1:

Form1099online is the most reliable and secure way to file your 1099 nec tax returns online. Easily fill out pdf blank, edit, and sign them. For the person you paid copy c: This applies to both federal and state taxes.

1099, 3921, Or 5498 That You Print From The Irs Website.

The payment is made for services in the course of your trade or business. What you need employer identification number (ein) iris transmitter control code (tcc). For the irs copy b: Web 1099s get printed at least three times — sometimes four.