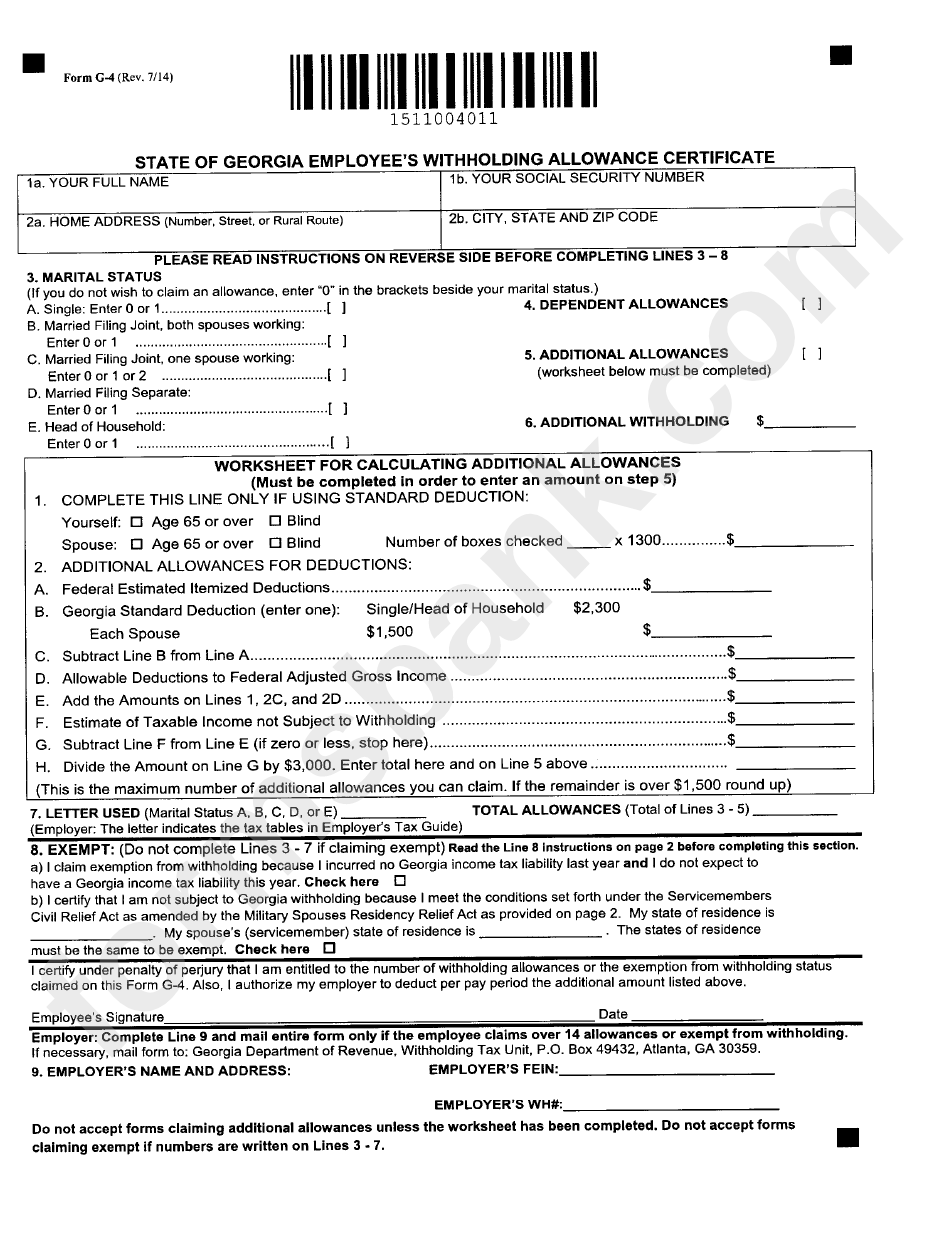

Ga Tax Form G4

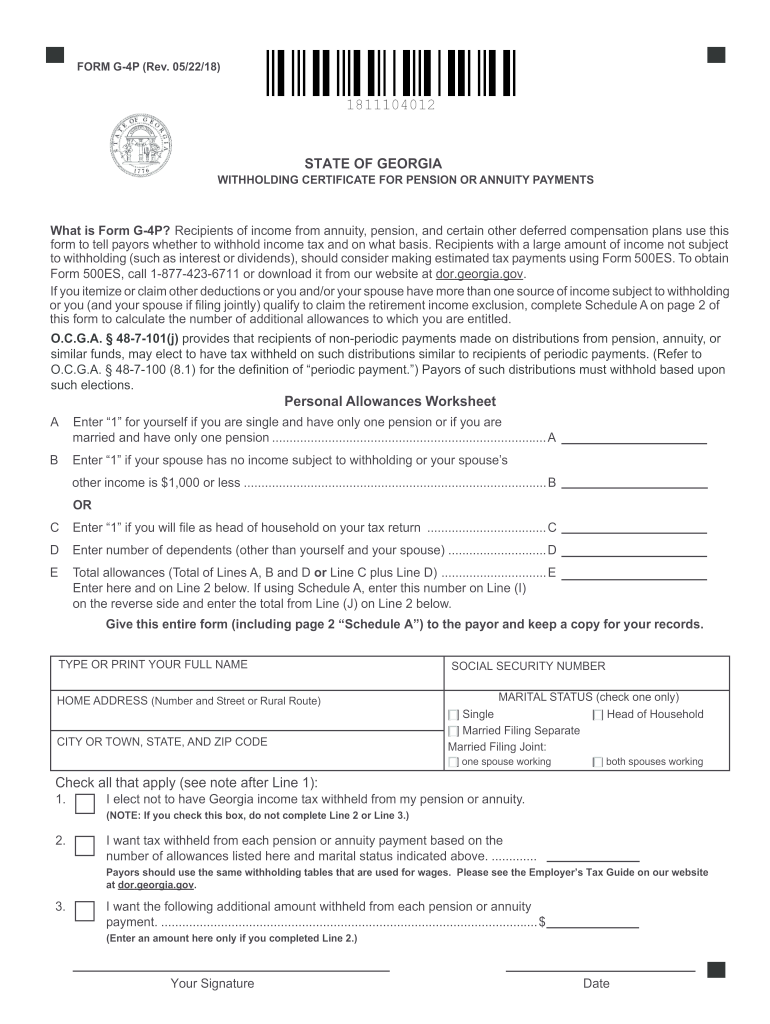

Ga Tax Form G4 - Recipients of income from annuity, pension, and certain other deferred compensation plans use this form to tell payors whether to withhold income tax and on what basis. Video of the day the single filing status is used only by taxpayers who are not legally married. Each choice affects the amount of tax the employer will withhold. Form (g4) is to be completed and submitted to your employer in order to have tax withheld from your wages. The forms will be effective with the first paycheck. Web they can only be printed and completed by hand.

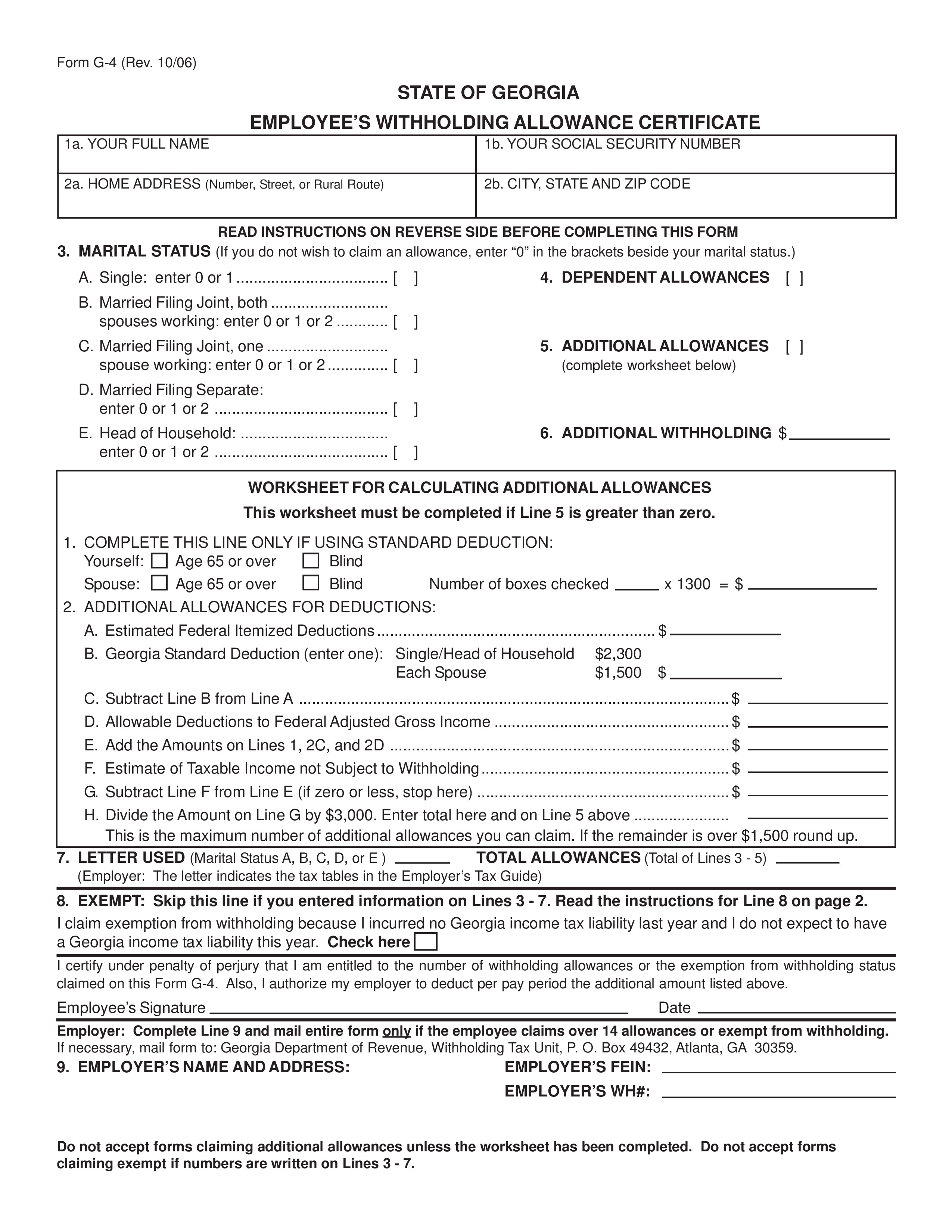

Each choice affects the amount of tax the employer will withhold. Video of the day the single filing status is used only by taxpayers who are not legally married. Web they can only be printed and completed by hand. Recipients of income from annuity, pension, and certain other deferred compensation plans use this form to tell payors whether to withhold income tax and on what basis. The forms will be effective with the first paycheck. Form (g4) is to be completed and submitted to your employer in order to have tax withheld from your wages.

Form (g4) is to be completed and submitted to your employer in order to have tax withheld from your wages. The forms will be effective with the first paycheck. Video of the day the single filing status is used only by taxpayers who are not legally married. Web they can only be printed and completed by hand. Recipients of income from annuity, pension, and certain other deferred compensation plans use this form to tell payors whether to withhold income tax and on what basis. Each choice affects the amount of tax the employer will withhold.

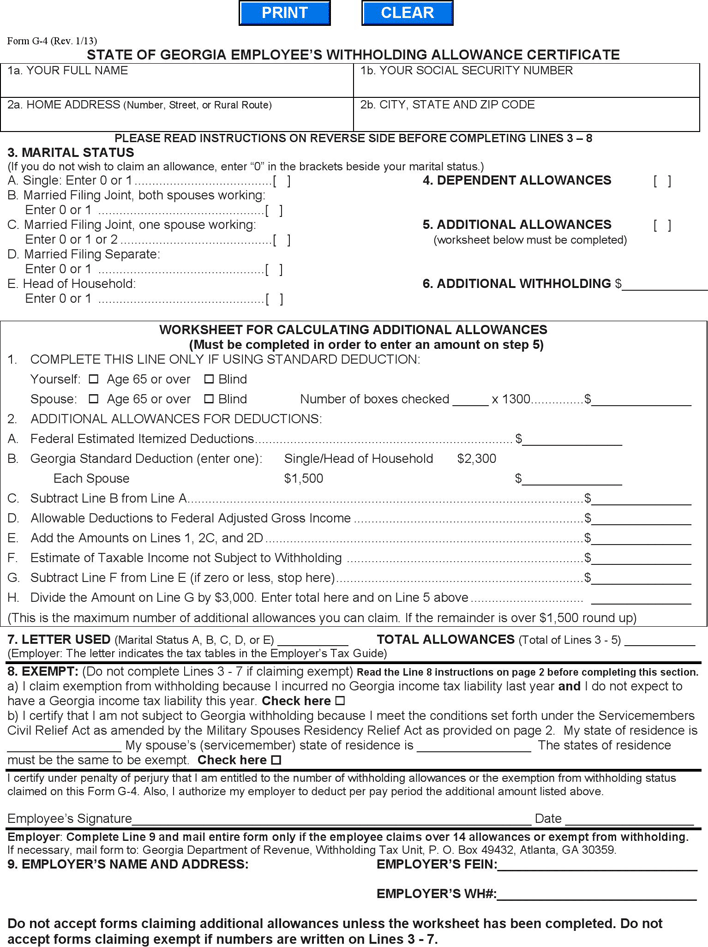

Form G4 State Of Employee'S Withholding Allowance

Each choice affects the amount of tax the employer will withhold. Recipients of income from annuity, pension, and certain other deferred compensation plans use this form to tell payors whether to withhold income tax and on what basis. Web they can only be printed and completed by hand. Form (g4) is to be completed and submitted to your employer in.

Saving PDF as JPG for zoom.it, Camtasia, Articulate, LMS course Geesh

Each choice affects the amount of tax the employer will withhold. Recipients of income from annuity, pension, and certain other deferred compensation plans use this form to tell payors whether to withhold income tax and on what basis. Video of the day the single filing status is used only by taxpayers who are not legally married. Form (g4) is to.

Form G4 State Of Employee'S Withholding Allowance

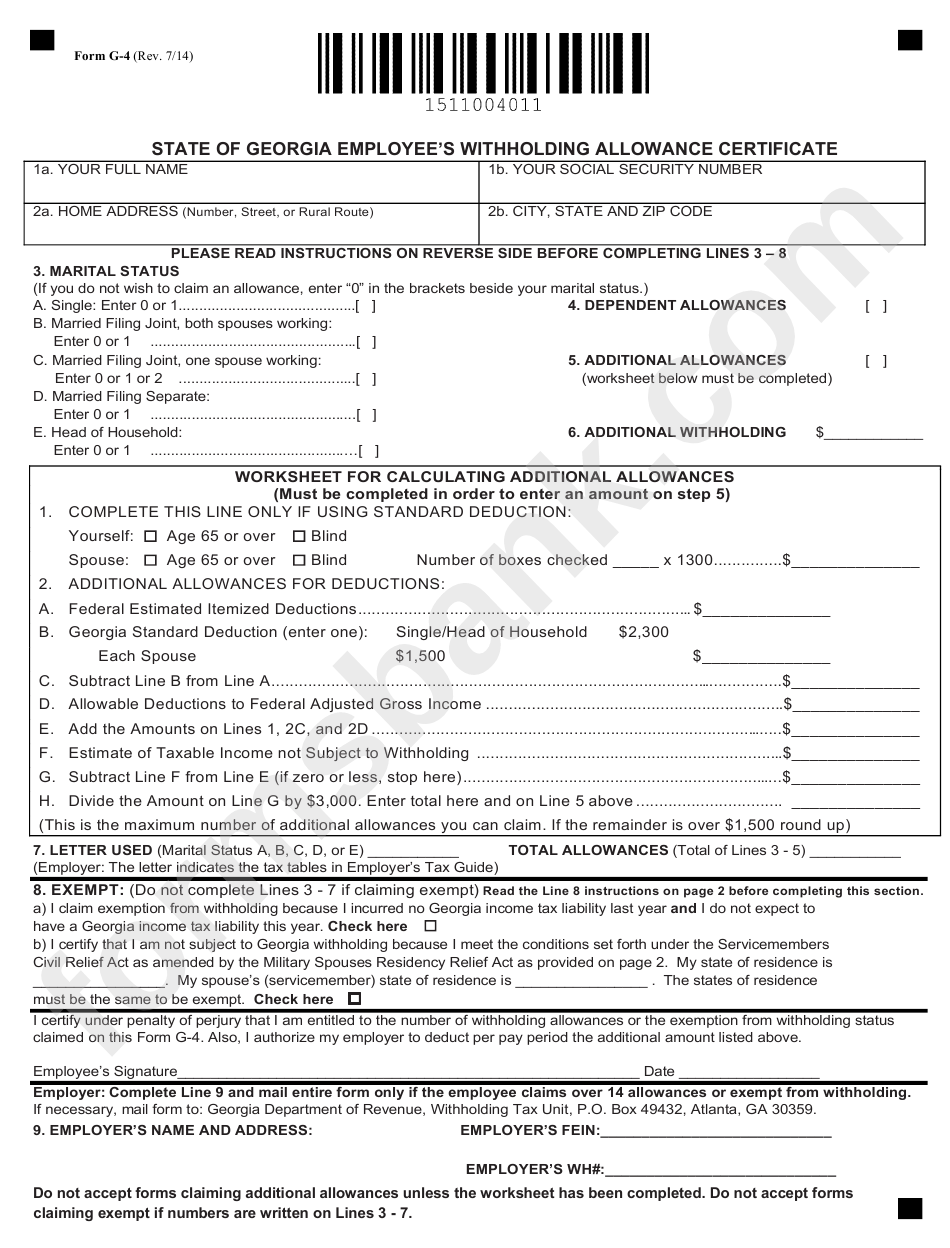

The forms will be effective with the first paycheck. Form (g4) is to be completed and submitted to your employer in order to have tax withheld from your wages. Video of the day the single filing status is used only by taxpayers who are not legally married. Recipients of income from annuity, pension, and certain other deferred compensation plans use.

Fillable Form G4 State Of Employee'S Withholding Allowance

Form (g4) is to be completed and submitted to your employer in order to have tax withheld from your wages. Each choice affects the amount of tax the employer will withhold. Video of the day the single filing status is used only by taxpayers who are not legally married. Web they can only be printed and completed by hand. The.

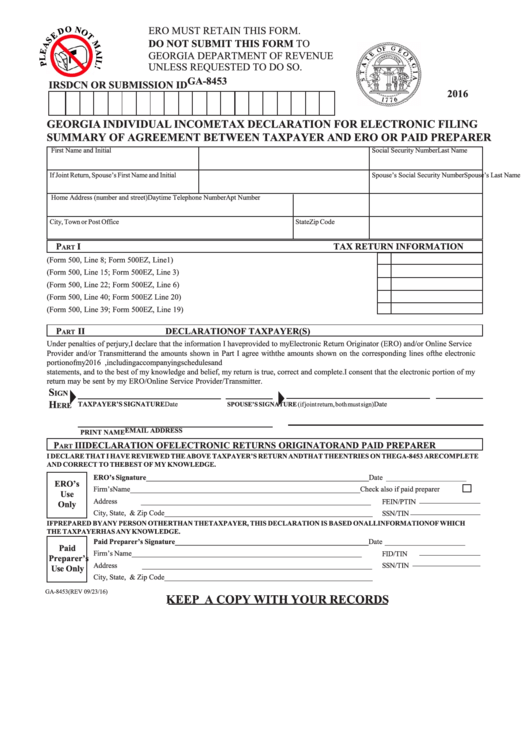

20182020 Form GA DoR G1003 Fill Online, Printable, Fillable, Blank

Recipients of income from annuity, pension, and certain other deferred compensation plans use this form to tell payors whether to withhold income tax and on what basis. Form (g4) is to be completed and submitted to your employer in order to have tax withheld from your wages. Video of the day the single filing status is used only by taxpayers.

G 4P Fill Out and Sign Printable PDF Template signNow

Video of the day the single filing status is used only by taxpayers who are not legally married. Recipients of income from annuity, pension, and certain other deferred compensation plans use this form to tell payors whether to withhold income tax and on what basis. Web they can only be printed and completed by hand. The forms will be effective.

Free Form G PDF 194KB 2 Page(s)

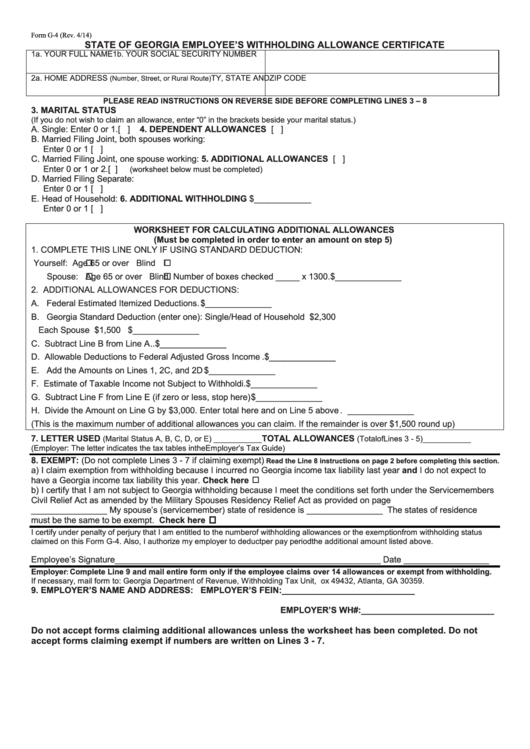

Recipients of income from annuity, pension, and certain other deferred compensation plans use this form to tell payors whether to withhold income tax and on what basis. Form (g4) is to be completed and submitted to your employer in order to have tax withheld from your wages. The forms will be effective with the first paycheck. Web they can only.

Form G 4 PDFSimpli

Video of the day the single filing status is used only by taxpayers who are not legally married. Form (g4) is to be completed and submitted to your employer in order to have tax withheld from your wages. Each choice affects the amount of tax the employer will withhold. The forms will be effective with the first paycheck. Web they.

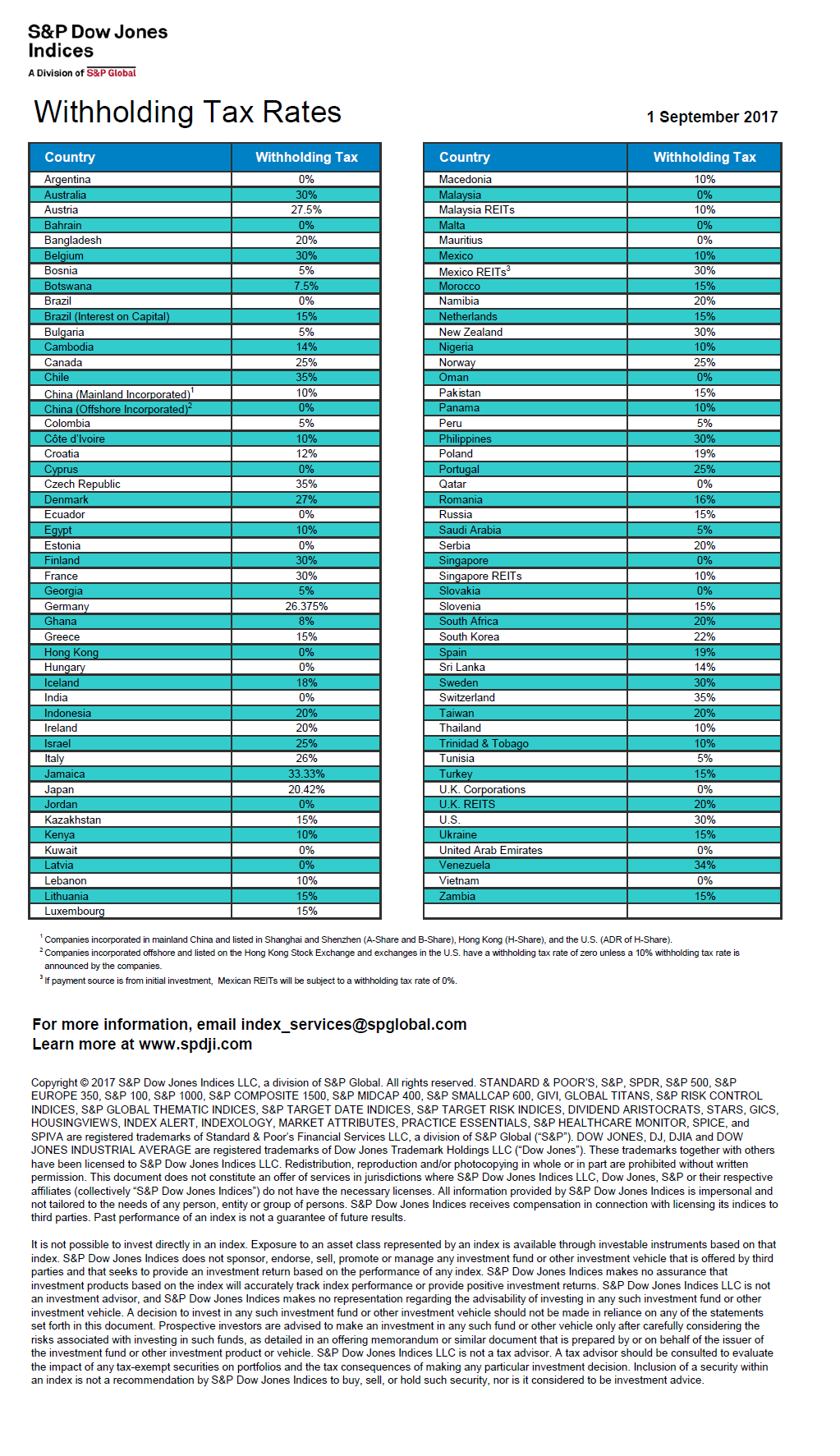

Withholding Tax Tables 2017

Form (g4) is to be completed and submitted to your employer in order to have tax withheld from your wages. Web they can only be printed and completed by hand. Video of the day the single filing status is used only by taxpayers who are not legally married. Each choice affects the amount of tax the employer will withhold. The.

Fillable Form Ga8453 Individual Tax Declaration For

Each choice affects the amount of tax the employer will withhold. Video of the day the single filing status is used only by taxpayers who are not legally married. Recipients of income from annuity, pension, and certain other deferred compensation plans use this form to tell payors whether to withhold income tax and on what basis. Form (g4) is to.

Recipients Of Income From Annuity, Pension, And Certain Other Deferred Compensation Plans Use This Form To Tell Payors Whether To Withhold Income Tax And On What Basis.

Form (g4) is to be completed and submitted to your employer in order to have tax withheld from your wages. The forms will be effective with the first paycheck. Each choice affects the amount of tax the employer will withhold. Web they can only be printed and completed by hand.