Georgia Ez Tax Form

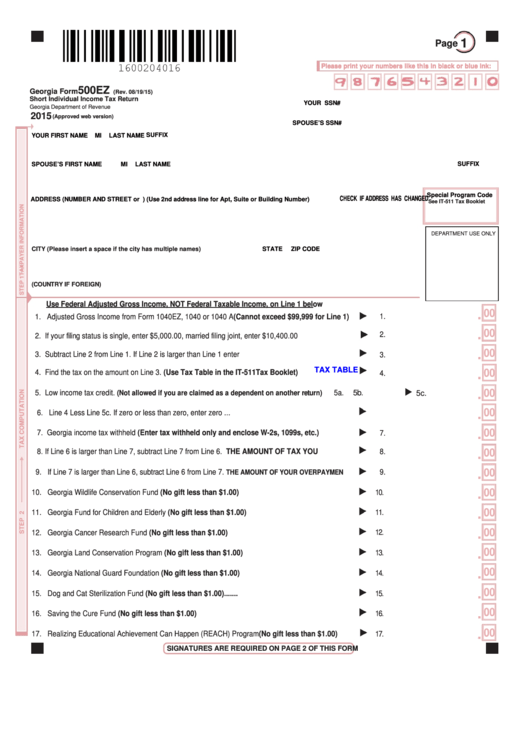

Georgia Ez Tax Form - If your filing status is single, enter $7,300.00, married filing joint, enter $13,400.00. 06/20/20) short individual income tax return georgia department of revenue 2020(approved web version)) pag e1state issued your. We last updated the individual income tax return (short. You may be eligible for the hb 162 surplus tax refund if you: Persons with very simple taxes may file this form. Georgia has a state income tax that ranges between 1% and 5.75%. Short individual income tax return georgia department of revenue. Ad easy, fast, secure & free to try! Web 2021 georgia form 500ez, short individual income tax return (short form) form link: Web print blank form > georgia department of revenue zoom in;

Persons with very simple taxes may file this form. If line 6 is larger. Web 2021 georgia form 500ez, short individual income tax return (short form) form link: 06/20/20) short individual income tax return georgia department of revenue 2020(approved web version)) pag e1state issued your. This form is for income earned in tax year 2022, with tax returns due in april. Web georgia department of revenue save form. Contains 500 and 500ez forms and general instructions. Short individual income tax return georgia department of revenue. Web georgia depreciation and amortization form, includes information on listed property. If your filing status is single, enter $7,300.00, married filing joint, enter $13,400.00.

Web print blank form > georgia department of revenue zoom in; This form is for income earned in tax year 2022, with tax returns due in april. Show details we are not affiliated with any brand or entity on this form. Web georgia depreciation and amortization form, includes information on listed property. Download blank or fill out online in pdf format. Ad easy, fast, secure & free to try! 06/20/20) short individual income tax return georgia department of revenue 2020(approved web version)) pag e1state issued your. You may be eligible for the hb 162 surplus tax refund if you: Please complete income statement details on page 3. Do your 2021, 2020, 2019, 2018 all the way back to 2000.

Do Not Resuscitate (dnr) Form Universal Network

Complete, sign, print and send your tax documents easily with us legal forms. Your social security number (income statement a). Download blank or fill out online in pdf format. Short individual income tax return georgia department of revenue. Do your 2021, 2020, 2019, 2018 all the way back to 2000.

500 Ez Tax Form trueyfil

Do your 2021, 2020, 2019, 2018 all the way back to 2000. Please complete income statement details on page 3. If line 6 is larger. Web georgia department of revenue save form. We last updated the individual income tax return (short.

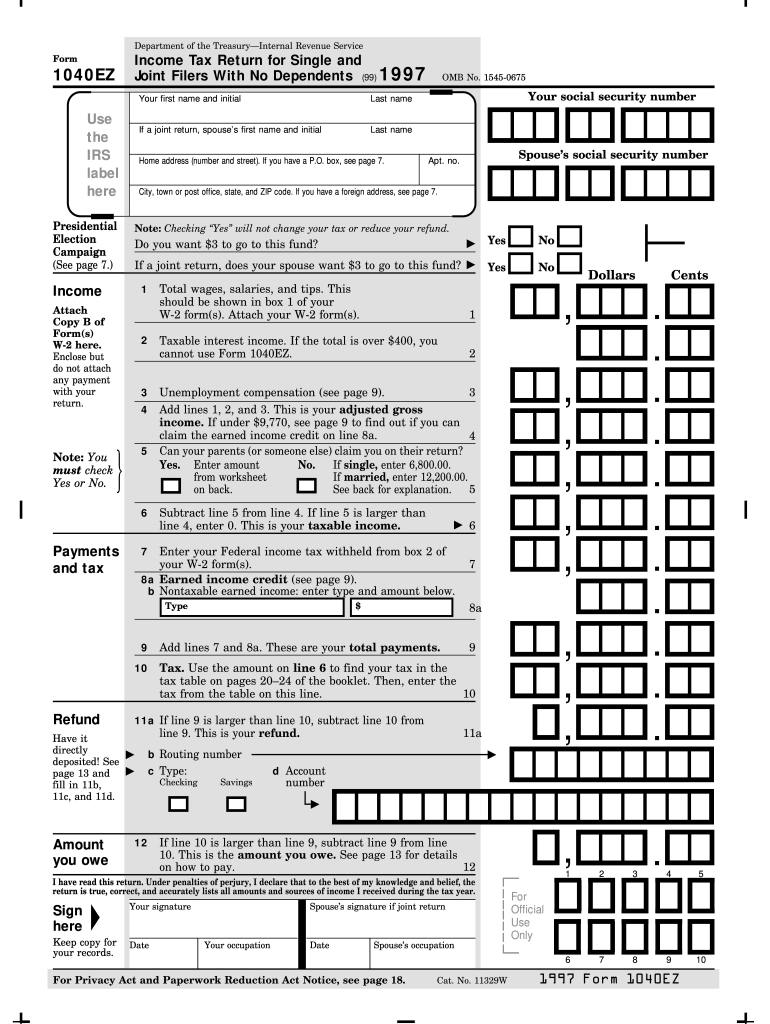

1997 Form IRS 1040EZ Fill Online, Printable, Fillable, Blank pdfFiller

06/20/20) short individual income tax return georgia department of revenue 2020(approved web version)) pag e1state issued your. Web 2021 georgia form 500ez, short individual income tax return (short form) form link: Web 500ez individual income tax return. Do your 2021, 2020, 2019, 2018 all the way back to 2000. If line 6 is larger.

Printable 500 Ez Tax Form Printable Form 2022

Web 2021 georgia form 500ez, short individual income tax return (short form) form link: We last updated the individual income tax return (short. Web 500ez individual income tax return. Web print blank form > georgia department of revenue zoom in; If line 6 is larger.

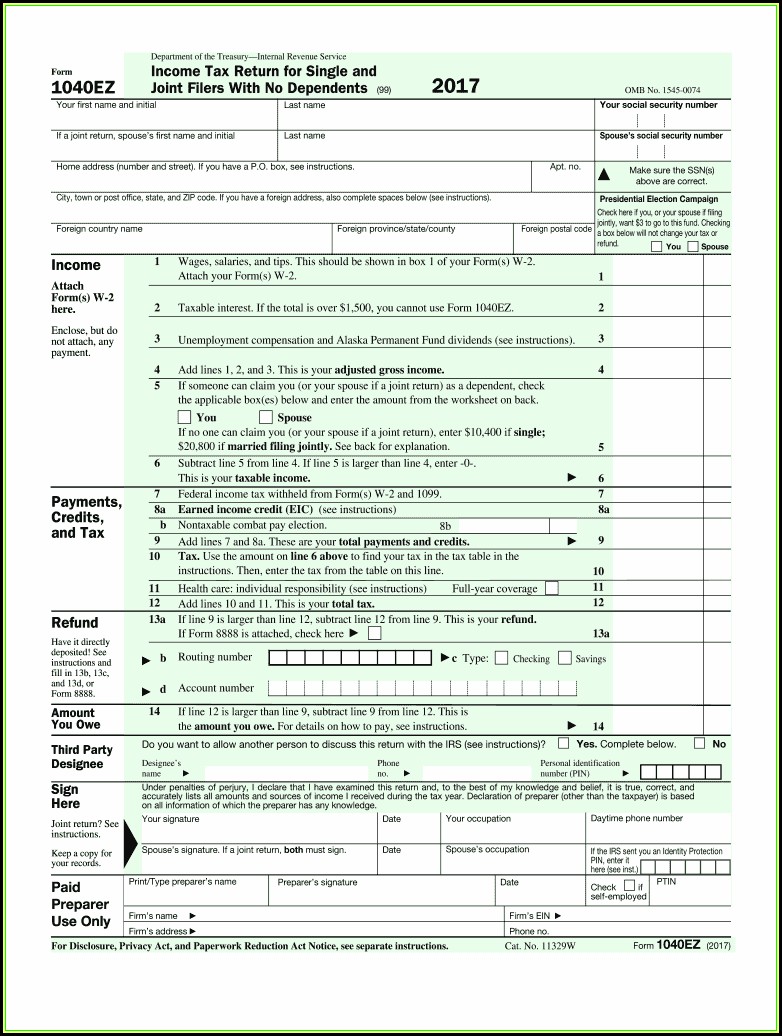

What Is An Ez Tax Form Form Resume Examples

If your filing status is single, enter $7,300.00, married filing joint, enter $13,400.00. For more information about the georgia income tax,. This form is for income earned in tax year 2022, with tax returns due in april. Who gets the extra georgia tax refund? You may be eligible for the hb 162 surplus tax refund if you:

2019 Form GA DoR 500NOL Fill Online, Printable, Fillable, Blank

This form is for income earned in tax year 2022, with tax returns due in april. Persons with very simple taxes may file this form. Complete, sign, print and send your tax documents easily with us legal forms. 500 individual income tax return what's new? Short individual income tax return georgia department of revenue.

Ez Tax Form Online Form Resume Examples l6YNbl7Y3z

Your social security number (income statement a). If line 6 is larger. Do your 2021, 2020, 2019, 2018 all the way back to 2000. Web print blank form > georgia department of revenue zoom in; Who gets the extra georgia tax refund?

Ez tax form instructions

Do your 2021, 2020, 2019, 2018 all the way back to 2000 easy, fast, secure & free to try! Please complete income statement details on page 3. Your social security number (income statement a). You may be eligible for the hb 162 surplus tax refund if you: Short individual income tax return georgia department of revenue.

Do Not Resuscitate (dnr) Form Universal Network

Download blank or fill out online in pdf format. You may be eligible for the hb 162 surplus tax refund if you: Short individual income tax return georgia department of revenue. This form is for income earned in tax year 2022, with tax returns due in april. Georgia has a state income tax that ranges between 1% and 5.75%.

Ez tax form instructions

You may be eligible for the hb 162 surplus tax refund if you: Your social security number (income statement a). This form is for income earned in tax year 2022, with tax returns due in april. Short individual income tax return georgia department of revenue. For more information about the georgia income tax,.

Your Social Security Number (Income Statement A).

For more information about the georgia income tax,. Show details we are not affiliated with any brand or entity on this form. Ad easy, fast, secure & free to try! Who gets the extra georgia tax refund?

Web Georgia Depreciation And Amortization Form, Includes Information On Listed Property.

Web georgia department of revenue save form. Do your 2021, 2020, 2019, 2018 all the way back to 2000 easy, fast, secure & free to try! 06/20/20) short individual income tax return georgia department of revenue 2020(approved web version)) pag e1state issued your. Persons with very simple taxes may file this form.

Short Individual Income Tax Return Georgia Department Of Revenue.

This form is for income earned in tax year 2022, with tax returns due in april. Contains 500 and 500ez forms and general instructions. Print blank form > georgia department of revenue. Web print blank form > georgia department of revenue zoom in;

We Last Updated The Individual Income Tax Return (Short.

Web 500ez individual income tax return. If line 6 is larger. Georgia has a state income tax that ranges between 1% and 5.75%. Web 2021 georgia form 500ez, short individual income tax return (short form) form link: