Heloc After Chapter 13 Discharge

Heloc After Chapter 13 Discharge - Home equity loan after bankruptcy — home.loans home loans blog get the latest info on mortgages, home equity, and refinancing at the home loans blog. There are two basic types of bankruptcy available to consumers — chapter 7 and chapter 13. Web heloc under chapter 13 bankruptcy. You can qualify for a refinance as little as a day after the discharge or dismissal date of your. Chapter 13 bankruptcy may not have the same impact on your. Ad get more from your home equity line of credit. Check out top home equity loan options within minutes. Explore all your options now! With chapter 13 bankruptcy, you create a payment plan that lasts three to five years. During this time, you continue paying on your first.

Web heloc stands for home equity line of credit. Don't overpay on your loan. This means that you have the means to repay your. Check out top home equity loan options within minutes. You can get court approval for a repayment plan over three to five years, after which. Find out how much you could save now! Compare and save with lendingtree. Web those with fha and va loans do not have to wait before they can refinance after chapter 13 bankruptcy. Which debts get paid, and how. Borrow from yourself through a home equity line of credit.

Web in many cases, after 18 months of regular chapter 13 payments, debtors can typically refinance out of a chapter 13, especially if you have any equity in a home. Web the chapter 13 hardship discharge after confirmation of a plan, circumstances may arise that prevent the debtor from completing the plan. Which debts get paid, and how. This post will focus on chapter 7 bankruptcy as this option can, in many cases, allow individuals to obtain. Web if the heloc loan was not shown on the plan as a long term debt and if the charge off occurred after the bankruptcy petition was filed, then the debt was discharged when your chapter 13 discharge. With chapter 13 bankruptcy, you create a payment plan that lasts three to five years. There are two basic types of bankruptcy available to consumers — chapter 7 and chapter 13. Web heloc under chapter 13 bankruptcy. Web heloc/2nd mortgages require a much longer seasoning period from a bk discharge (as well as more strict requirements in practically all categories) than a 1st mortgage due to them being in. Web most lenders want to see the bankruptcy seasoned for at least two years from the date of discharge or four years from the dismissal date.

HELOC Chapter 2 on Vimeo

Web heloc under chapter 13 bankruptcy. This post will focus on chapter 7 bankruptcy as this option can, in many cases, allow individuals to obtain. Explore all your options now! Chapter 13 bankruptcy may not have the same impact on your. Web debt from a home equity line of credit is discharged in bankruptcy, but the lender may foreclose depending.

Home Equity Loan or 401k Loan? Both Have Risks Level Financial Advisors

Ad get more from your home equity line of credit. Ad get more from your home equity line of credit. You can get court approval for a repayment plan over three to five years, after which. Web bad credit series: Home equity loan after bankruptcy — home.loans home loans blog get the latest info on mortgages, home equity, and refinancing.

What Happens After a Chapter 13 Discharge? Husker Law

You can get court approval for a repayment plan over three to five years, after which. Ad get more from your home equity line of credit. There are two basic types of bankruptcy available to consumers — chapter 7 and chapter 13. You can qualify for a refinance as little as a day after the discharge or dismissal date of.

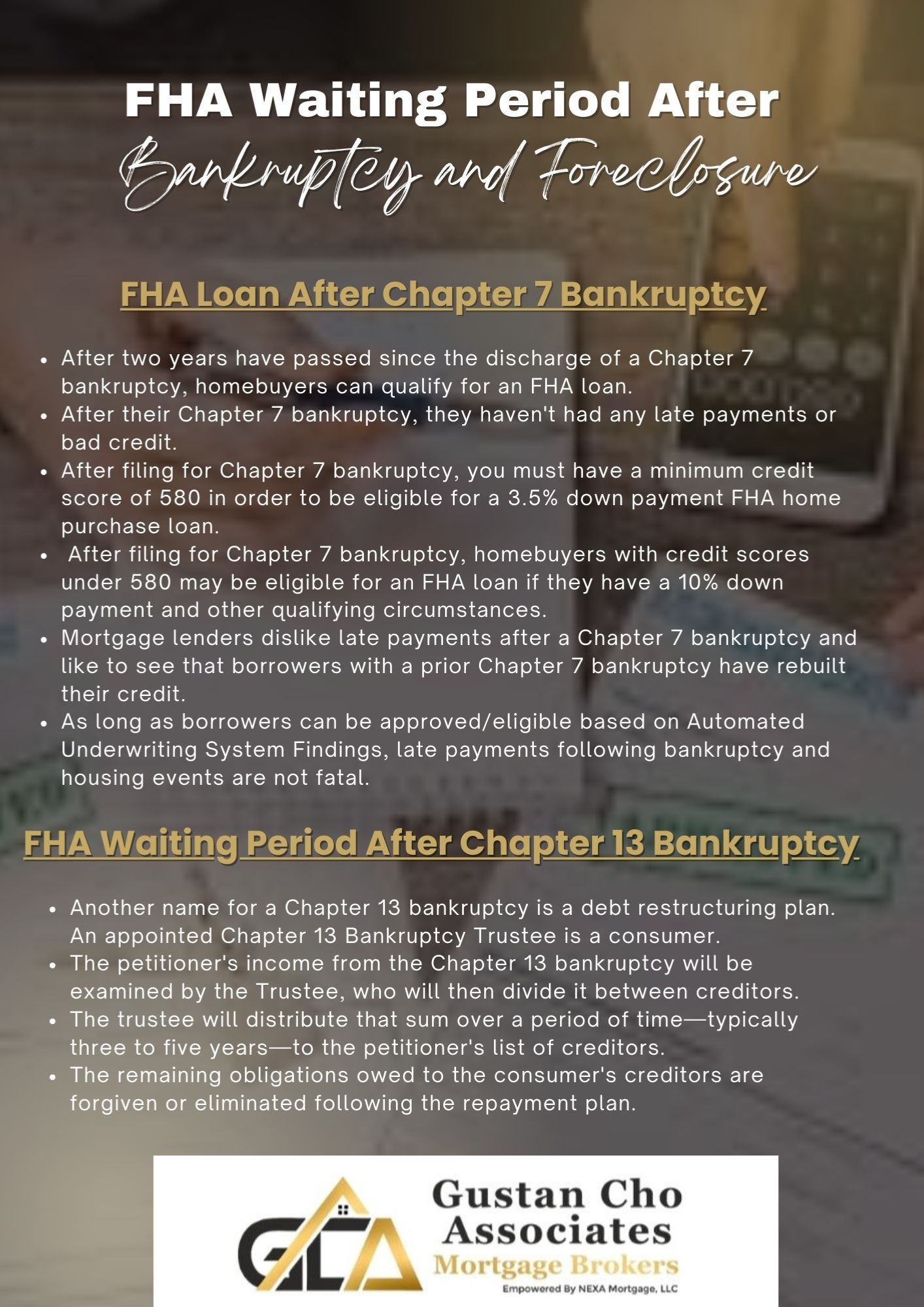

43+ Fha Waiting Period After Chapter 13 Discharge KylaTomilola

How a home equity line of credit (heloc) is treated in bankruptcy depends on what type of bankruptcy. This post will focus on chapter 7 bankruptcy as this option can, in many cases, allow individuals to obtain. Web heloc/2nd mortgages require a much longer seasoning period from a bk discharge (as well as more strict requirements in practically all categories).

The Chapter 13 Discharge Chapter 13 Bankruptcy Attorney

With chapter 13 bankruptcy, you create a payment plan that lasts three to five years. Web the chapter 13 hardship discharge after confirmation of a plan, circumstances may arise that prevent the debtor from completing the plan. Web things may be slightly different in chapter 13 bankruptcy, but being allowed to get a home equity loan in the process is.

The Chapter 13 Discharge Chapter 13 Bankruptcy Attorney

Web if the heloc loan was not shown on the plan as a long term debt and if the charge off occurred after the bankruptcy petition was filed, then the debt was discharged when your chapter 13 discharge. Compare and save with lendingtree. Which debts get paid, and how. Web those with fha and va loans do not have to.

Chapter 13 Bankruptcy Discharge Sasser Law Firm

Check out top home equity loan options within minutes. Web if the heloc loan was not shown on the plan as a long term debt and if the charge off occurred after the bankruptcy petition was filed, then the debt was discharged when your chapter 13 discharge. Borrow from yourself through a home equity line of credit. Web bad credit.

Can I Buy a House in Chapter 13

In some cases, you may even be eligible for a home loan one day after discharge… Web if your first position mortgage balance exceeds the value of your home and the heloc or second mortgage is not supported by any equity in the home, you can file a chapter 13 and reclassify the second. Home equity loan after bankruptcy —.

Will Chapter 7 Bankruptcy Get Rid of a HELOC?

Which debts get paid, and how. Check out top home equity loan options within minutes. Web debt from a home equity line of credit is discharged in bankruptcy, but the lender may foreclose depending on the circumstances. Compare and save with lendingtree. Ad get more from your home equity line of credit.

What Is a Chapter 13 Hardship Discharge? Oaktree Law

Web debt from a home equity line of credit is discharged in bankruptcy, but the lender may foreclose depending on the circumstances. Don't overpay on your loan. A heloc is a secured debt unless the property that secured the loan is sold. You can get court approval for a repayment plan over three to five years, after which. Explore all.

In Such Situations, The Debtor May Ask The Court To Grant A Hardship Discharge. 11 U.s.c.

Explore all your options now! During this time, you continue paying on your first. This post will focus on chapter 7 bankruptcy as this option can, in many cases, allow individuals to obtain. Home equity loan after bankruptcy — home.loans home loans blog get the latest info on mortgages, home equity, and refinancing at the home loans blog.

Web Things May Be Slightly Different In Chapter 13 Bankruptcy, But Being Allowed To Get A Home Equity Loan In The Process Is Still Highly Unlikely.

With chapter 13 bankruptcy, you create a payment plan that lasts three to five years. Web if you can exempt all of your home equity, you won't pay an additional amount in your chapter 13 plan. A heloc is a secured debt unless the property that secured the loan is sold. Don't overpay on your loan.

Unlike Chapter 7, Chapter 13 Bankruptcy Allows For Almost All Personal Property To Be Kept, With Debts Being Repaid Over A Three To Five Year Period.

Compare and save with lendingtree. Web you can actually use chapter 13 bankruptcy to get rid of a heloc. Borrow from yourself through a home equity line of credit. How a home equity line of credit (heloc) is treated in bankruptcy depends on what type of bankruptcy.

Ad Get More From Your Home Equity Line Of Credit.

Check out top home equity loan options within minutes. Find out how much you could save now! Don't overpay on your loan. Compare and save with lendingtree.