Home Equity Loan While In Chapter 13

Home Equity Loan While In Chapter 13 - Web if you have significant equity in your house that is not exempt in bankruptcy, it could increase your chapter 13 plan payment. You will need to have kept your credit clean since the bankruptcy and. Are you in a chapter 13 bankruptcy? Web options for navigating a home loan while in chapter 13 bankruptcy. Web a person who has had a chapter 13 bankruptcy discharged can get a home equity loan. Currently own a home and have equity? Start by checking websites like realtor.com and zillow.com when valuing. Web calculating home equity protection in chapter 13 bankruptcy research your home's value. Web under chapter 13 bankruptcy, you work with an arbitrator to formulate a repayment plan that usually lasts three to five years.

Web a person who has had a chapter 13 bankruptcy discharged can get a home equity loan. Are you in a chapter 13 bankruptcy? Currently own a home and have equity? Web if you have significant equity in your house that is not exempt in bankruptcy, it could increase your chapter 13 plan payment. Web options for navigating a home loan while in chapter 13 bankruptcy. You will need to have kept your credit clean since the bankruptcy and. Web calculating home equity protection in chapter 13 bankruptcy research your home's value. Web under chapter 13 bankruptcy, you work with an arbitrator to formulate a repayment plan that usually lasts three to five years. Start by checking websites like realtor.com and zillow.com when valuing.

Web options for navigating a home loan while in chapter 13 bankruptcy. Start by checking websites like realtor.com and zillow.com when valuing. Web under chapter 13 bankruptcy, you work with an arbitrator to formulate a repayment plan that usually lasts three to five years. Are you in a chapter 13 bankruptcy? Web a person who has had a chapter 13 bankruptcy discharged can get a home equity loan. Web if you have significant equity in your house that is not exempt in bankruptcy, it could increase your chapter 13 plan payment. Currently own a home and have equity? Web calculating home equity protection in chapter 13 bankruptcy research your home's value. You will need to have kept your credit clean since the bankruptcy and.

Fixed Rate Home Equity Line >

Web if you have significant equity in your house that is not exempt in bankruptcy, it could increase your chapter 13 plan payment. Web under chapter 13 bankruptcy, you work with an arbitrator to formulate a repayment plan that usually lasts three to five years. Currently own a home and have equity? Web calculating home equity protection in chapter 13.

Pros And Cons Of A Home Equity Loan FortuneBuilders

Start by checking websites like realtor.com and zillow.com when valuing. Web under chapter 13 bankruptcy, you work with an arbitrator to formulate a repayment plan that usually lasts three to five years. Are you in a chapter 13 bankruptcy? Web options for navigating a home loan while in chapter 13 bankruptcy. You will need to have kept your credit clean.

HELOC Pros and Cons You Need To Know FortuneBuilders

Web options for navigating a home loan while in chapter 13 bankruptcy. Web a person who has had a chapter 13 bankruptcy discharged can get a home equity loan. Currently own a home and have equity? Web under chapter 13 bankruptcy, you work with an arbitrator to formulate a repayment plan that usually lasts three to five years. You will.

Home Equity Loan Interest can still be Deducted (in certain instances

Web if you have significant equity in your house that is not exempt in bankruptcy, it could increase your chapter 13 plan payment. Web under chapter 13 bankruptcy, you work with an arbitrator to formulate a repayment plan that usually lasts three to five years. Web options for navigating a home loan while in chapter 13 bankruptcy. You will need.

Refinancing vs. Home Equity Loans Tribecca

Currently own a home and have equity? Web a person who has had a chapter 13 bankruptcy discharged can get a home equity loan. Are you in a chapter 13 bankruptcy? You will need to have kept your credit clean since the bankruptcy and. Start by checking websites like realtor.com and zillow.com when valuing.

A Complete Guide To Home Equity Loans Revenues & Profits

Web under chapter 13 bankruptcy, you work with an arbitrator to formulate a repayment plan that usually lasts three to five years. Web options for navigating a home loan while in chapter 13 bankruptcy. Web a person who has had a chapter 13 bankruptcy discharged can get a home equity loan. You will need to have kept your credit clean.

Equity Loan Interest Rate >

Currently own a home and have equity? Web a person who has had a chapter 13 bankruptcy discharged can get a home equity loan. Web calculating home equity protection in chapter 13 bankruptcy research your home's value. Web under chapter 13 bankruptcy, you work with an arbitrator to formulate a repayment plan that usually lasts three to five years. Web.

5 Tips For Choosing A Home Equity Loan In 2021 Best Finance Blog

Web options for navigating a home loan while in chapter 13 bankruptcy. Web calculating home equity protection in chapter 13 bankruptcy research your home's value. Start by checking websites like realtor.com and zillow.com when valuing. Are you in a chapter 13 bankruptcy? You will need to have kept your credit clean since the bankruptcy and.

How Does A Home Equity Loan Work And How To Get One?

Start by checking websites like realtor.com and zillow.com when valuing. Are you in a chapter 13 bankruptcy? Web options for navigating a home loan while in chapter 13 bankruptcy. Web calculating home equity protection in chapter 13 bankruptcy research your home's value. Web under chapter 13 bankruptcy, you work with an arbitrator to formulate a repayment plan that usually lasts.

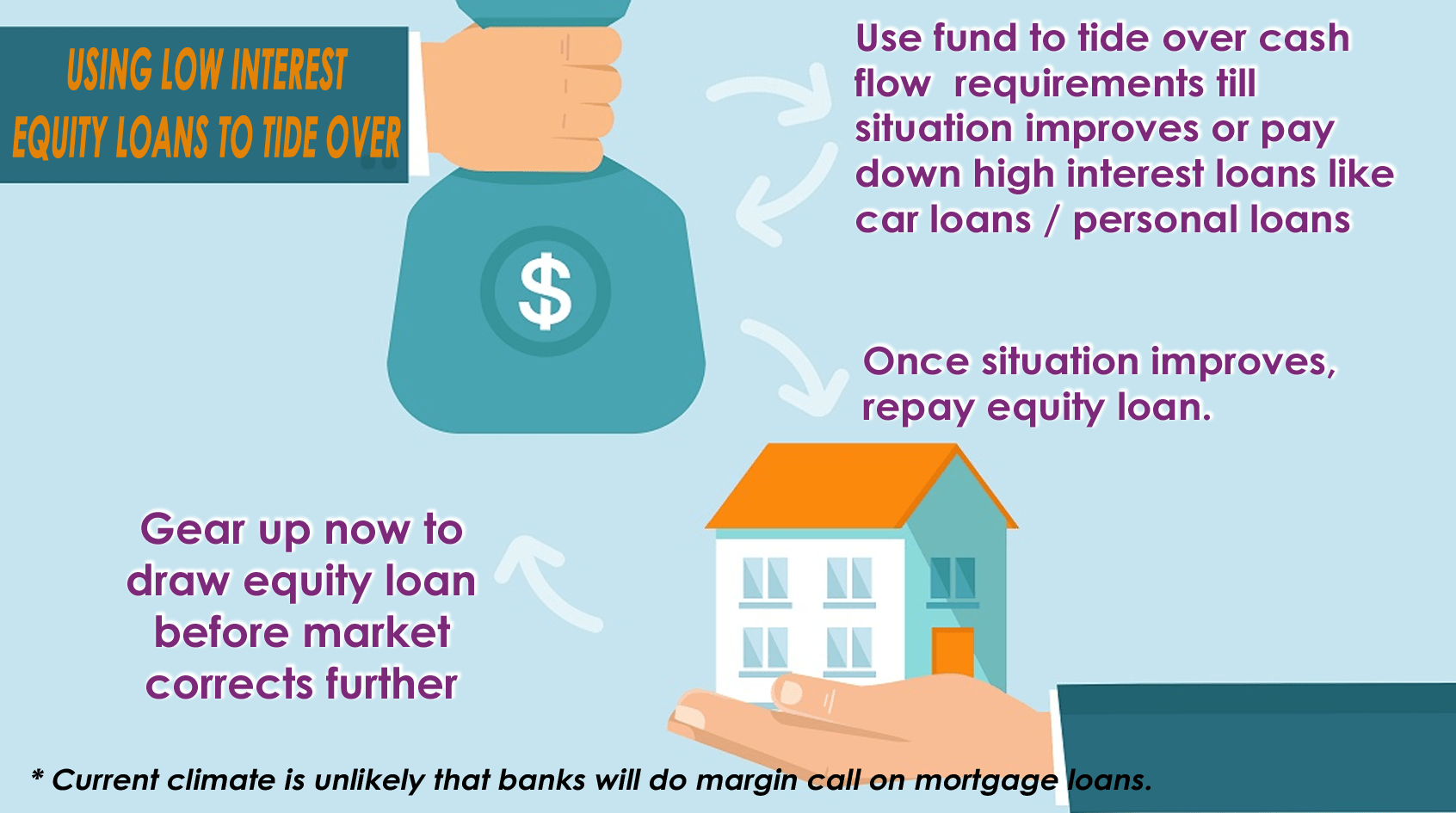

How a home equity term loan might save you from cash flow issue without

Web calculating home equity protection in chapter 13 bankruptcy research your home's value. Are you in a chapter 13 bankruptcy? You will need to have kept your credit clean since the bankruptcy and. Web if you have significant equity in your house that is not exempt in bankruptcy, it could increase your chapter 13 plan payment. Start by checking websites.

Start By Checking Websites Like Realtor.com And Zillow.com When Valuing.

Web options for navigating a home loan while in chapter 13 bankruptcy. Web calculating home equity protection in chapter 13 bankruptcy research your home's value. Web a person who has had a chapter 13 bankruptcy discharged can get a home equity loan. Web if you have significant equity in your house that is not exempt in bankruptcy, it could increase your chapter 13 plan payment.

Are You In A Chapter 13 Bankruptcy?

Web under chapter 13 bankruptcy, you work with an arbitrator to formulate a repayment plan that usually lasts three to five years. You will need to have kept your credit clean since the bankruptcy and. Currently own a home and have equity?