How Much Does It Cost To File Form 990

How Much Does It Cost To File Form 990 - Intended for private foundations, regardless of gross receipts. Web please note, our audit and review services normally include the preparation of the irs form 990 and state reporting forms. It's free to get started. Web charities and nonprofits annual filing and forms required filing (form 990 series) required filing (form 990 series) see the form 990 filing thresholds page to determine which forms an organization must file. Intended for organizations with gross receipts equal to or above $200,000 and/or assets equal to or above $500,000. Us income tax return for estate and trusts. Any fees will be based upon time spent. For prior year forms, use the prior year search tool on the irs forms, instructions & publications page. You don't pay until you are ready to submit your return to the irs. A qualified state or local political organization must file.

For prior year forms, use the prior year search tool on the irs forms, instructions & publications page. This fee chart is meant as a guide only and is based on our prior client experience. Web charities and nonprofits annual filing and forms required filing (form 990 series) required filing (form 990 series) see the form 990 filing thresholds page to determine which forms an organization must file. Any fees will be based upon time spent. It's free to get started. A qualified state or local political organization must file. Intended for organizations with both gross receipts below $200,000 and assets below $500,000. Web simple form 990 pricing. You don't pay until you are ready to submit your return to the irs. There is no paper form.

Web please note, our audit and review services normally include the preparation of the irs form 990 and state reporting forms. Web simple form 990 pricing. You don't pay until you are ready to submit your return to the irs. A qualified state or local political organization must file. It's free to get started. Intended for private foundations, regardless of gross receipts. Us income tax return for estate and trusts. Intended for organizations with gross receipts equal to or above $200,000 and/or assets equal to or above $500,000. For prior year forms, use the prior year search tool on the irs forms, instructions & publications page. There is no paper form.

Does Your IRA Have to File a Form 990T? New Direction Trust Company

Intended for private foundations, regardless of gross receipts. A qualified state or local political organization must file. Us income tax return for estate and trusts. Any fees will be based upon time spent. Web charities and nonprofits annual filing and forms required filing (form 990 series) required filing (form 990 series) see the form 990 filing thresholds page to determine.

Meet the May 17, 2021 EPostcard Form 990N Deadline In 3 Simple Steps

You don't pay until you are ready to submit your return to the irs. There is no paper form. It's free to get started. Us income tax return for estate and trusts. Intended for organizations with both gross receipts below $200,000 and assets below $500,000.

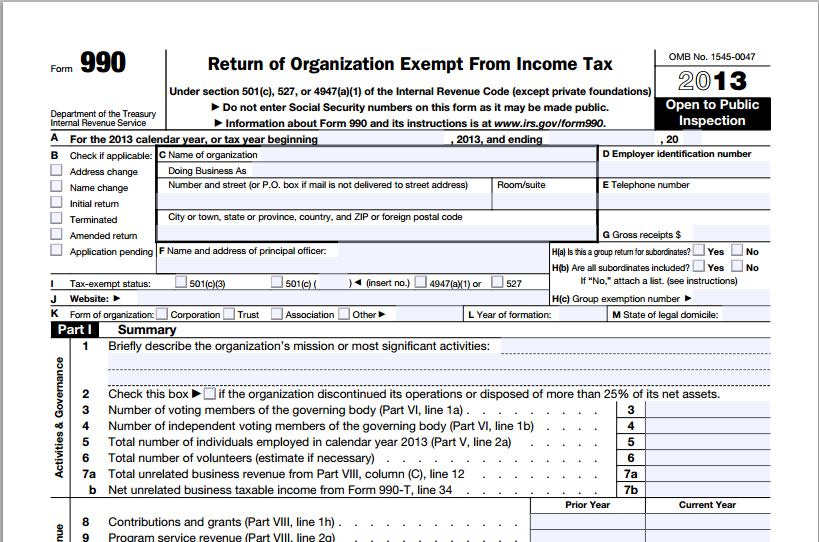

File Form 990 Online Efile 990 990 Filing Deadline 2021

Intended for private foundations, regardless of gross receipts. Intended for organizations with both gross receipts below $200,000 and assets below $500,000. Any fees will be based upon time spent. Web please note, our audit and review services normally include the preparation of the irs form 990 and state reporting forms. Web simple form 990 pricing.

File Form 990 Online Efile 990 990 Filing Deadline 2021

There is no paper form. You don't pay until you are ready to submit your return to the irs. Web charities and nonprofits annual filing and forms required filing (form 990 series) required filing (form 990 series) see the form 990 filing thresholds page to determine which forms an organization must file. Web simple form 990 pricing. Web please note,.

Don’t to File Form 990 Charity Lawyer Blog Nonprofit Law

Intended for private foundations, regardless of gross receipts. Any fees will be based upon time spent. Web charities and nonprofits annual filing and forms required filing (form 990 series) required filing (form 990 series) see the form 990 filing thresholds page to determine which forms an organization must file. For prior year forms, use the prior year search tool on.

The Best Form 990 Software for Tax Professionals What You Need to Know

Intended for private foundations, regardless of gross receipts. Web simple form 990 pricing. Any fees will be based upon time spent. Intended for organizations with both gross receipts below $200,000 and assets below $500,000. There is no paper form.

What is IRS Form 990?

Web please note, our audit and review services normally include the preparation of the irs form 990 and state reporting forms. It's free to get started. For prior year forms, use the prior year search tool on the irs forms, instructions & publications page. You don't pay until you are ready to submit your return to the irs. Web charities.

What is the IRS Form 990N and What Does It Mean for Me? Secure

For prior year forms, use the prior year search tool on the irs forms, instructions & publications page. Web please note, our audit and review services normally include the preparation of the irs form 990 and state reporting forms. Web simple form 990 pricing. Intended for organizations with gross receipts equal to or above $200,000 and/or assets equal to or.

Efile Form 990PF 2021 IRS Form 990PF Online Filing

Any fees will be based upon time spent. Us income tax return for estate and trusts. Intended for private foundations, regardless of gross receipts. Intended for organizations with gross receipts equal to or above $200,000 and/or assets equal to or above $500,000. There is no paper form.

What Is A 990 N E Postcard hassuttelia

Intended for organizations with both gross receipts below $200,000 and assets below $500,000. It's free to get started. There is no paper form. For prior year forms, use the prior year search tool on the irs forms, instructions & publications page. Web charities and nonprofits annual filing and forms required filing (form 990 series) required filing (form 990 series) see.

Web Please Note, Our Audit And Review Services Normally Include The Preparation Of The Irs Form 990 And State Reporting Forms.

Any fees will be based upon time spent. Us income tax return for estate and trusts. Intended for organizations with gross receipts equal to or above $200,000 and/or assets equal to or above $500,000. Web simple form 990 pricing.

Web Charities And Nonprofits Annual Filing And Forms Required Filing (Form 990 Series) Required Filing (Form 990 Series) See The Form 990 Filing Thresholds Page To Determine Which Forms An Organization Must File.

Intended for organizations with both gross receipts below $200,000 and assets below $500,000. You don't pay until you are ready to submit your return to the irs. A qualified state or local political organization must file. There is no paper form.

It's Free To Get Started.

This fee chart is meant as a guide only and is based on our prior client experience. For prior year forms, use the prior year search tool on the irs forms, instructions & publications page. Intended for private foundations, regardless of gross receipts.