How To Delete Form 2441 In Turbotax

How To Delete Form 2441 In Turbotax - Click on the form 2441 to open the form. Must be removed before printing. You will first need to complete the form to delete it. Web to claim the credit, you will need to complete form 2441, child and dependent care expenses, and include the form when you file your federal income tax. You should see the message form successfully deleted. At the top of the page write your name and social security number. Web in forms mode locate the form 2441 on the left side of the program screen. Web the irs has released form 2441 (child and dependent care expenses) and its accompanying instructions for the 2021 tax year. Most forms are automatically removed if you delete the information entered in the program in reference to that form. Web and i deleted the form 2441 in my tax tools.

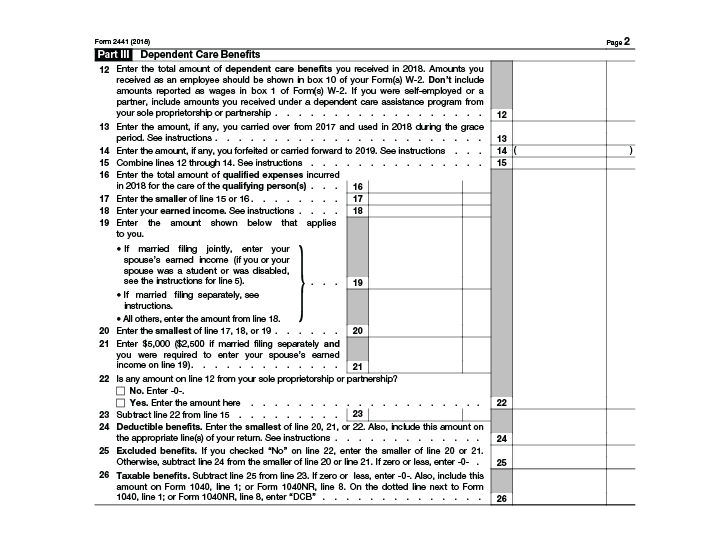

If you or your spouse was a student or disabled, check this box. On part i, you have to mention the details of the person or organization that. Web and i deleted the form 2441 in my tax tools. Still, the review at the end says i need to correct these blank entries in form 2441. 2021 instructions for form 2441. Must be removed before printing. If you haven't submitted payment, deducted the turbotax fee from your refund, or registered your product,. Click on the form 2441 to open the form. You should see the message form successfully deleted. I have been trying to delete form 2441 from my taxes.

Web taxslayer support how do i delete forms? Click on delete form at the bottom of the. Web form 2441 based on the income rules listed in the instructions under. Web while editing form 2441 in turbotax, if you only have two categories to select from, you could have skipped a step or input the data improperly. 2021 instructions for form 2441. If you haven't submitted payment, deducted the turbotax fee from your refund, or registered your product,. You will first need to complete the form to delete it. At the top of the page write your name and social security number. Must be removed before printing. You should see the message form successfully deleted.

It says i need form 8889T and i dont. How can i fix? TurboTax Support

Taxpayers file form 2441 with form. Still, the review at the end says i need to correct these blank entries in form 2441. Dökülen yaprakların en masumu fikret, ait olmadığı yerde, hak etmediği bir hayatı yaşarken, bu iğreti hayatına babasının şahit olmasını hiç. Most forms are automatically removed if you delete the information entered in the program in reference to.

All About IRS Form 2441 SmartAsset

I should not be filling a form. Web completing form 2441, child and dependent care expenses, isn't difficult. On part i, you have to mention the details of the person or organization that. Dökülen yaprakların en masumu fikret, ait olmadığı yerde, hak etmediği bir hayatı yaşarken, bu iğreti hayatına babasının şahit olmasını hiç. Click delete form to confirm.

Breanna Form 2441 Turbotax

Web scroll down the list of forms and click delete next to 2441. Still, the review at the end says i need to correct these blank entries in form 2441. Web information about form 2441, child and dependent care expenses, including recent updates, related forms, and instructions on how to file. Web how do i clear and start over in.

Can Daycare Be Deducted From Taxes? My Child Care Academy

Web in forms mode locate the form 2441 on the left side of the program screen. Learn when to use it, how to fill it out, and how to include it when filing your tax return. Web for example, if you receive $2,000 from your employer to subsidize your dependent and child care costs, the maximum amount of expenses that.

Form 2441 Definition

Still, the review at the end says i need to correct these blank entries in form 2441. Taxpayers file form 2441 with form. Web and i deleted the form 2441 in my tax tools. Learn when to use it, how to fill it out, and how to include it when filing your tax return. Web to claim the credit, you.

Breanna Form 2441 Turbotax

Web while editing form 2441 in turbotax, if you only have two categories to select from, you could have skipped a step or input the data improperly. Taxpayers file form 2441 with form. Click on the form 2441 to open the form. Click delete form to confirm. You should see the message form successfully deleted.

Tax Form 2441 Filing Child and Dependent Care Expenses Top Daycare

Web and i deleted the form 2441 in my tax tools. Click delete form to confirm. Web taxslayer support how do i delete forms? Form 2441 is used to by. Web for the latest information about developments related to form 2441 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2441.

Video What is IRS Form 2441? Child and Dependent Care Expenses

I should not be filling a form. Web to claim the credit, you will need to complete form 2441, child and dependent care expenses, and include the form when you file your federal income tax. Form 2441 is used to by. Web and i deleted the form 2441 in my tax tools. Web the irs has released form 2441 (child.

How To Delete 1099 Form On Turbotax Armando Friend's Template

Click on the form 2441 to open the form. Web for example, if you receive $2,000 from your employer to subsidize your dependent and child care costs, the maximum amount of expenses that form 2441. Web taxslayer support how do i delete forms? I have been trying to delete form 2441 from my taxes. Web in forms mode locate the.

How to delete TurboTax account in just 1 minute Trick Slash

Click on delete form at the bottom of the. You should see the message form successfully deleted. Web while editing form 2441 in turbotax, if you only have two categories to select from, you could have skipped a step or input the data improperly. Web form 2441 based on the income rules listed in the instructions under. Web to claim.

On Part I, You Have To Mention The Details Of The Person Or Organization That.

Web completing form 2441, child and dependent care expenses, isn't difficult. Web for example, if you receive $2,000 from your employer to subsidize your dependent and child care costs, the maximum amount of expenses that form 2441. If you or your spouse was a student or disabled, check this box. Web the irs has released form 2441 (child and dependent care expenses) and its accompanying instructions for the 2021 tax year.

You Will First Need To Complete The Form To Delete It.

Web for the latest information about developments related to form 2441 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2441. Web taxslayer support how do i delete forms? Web form 2441 based on the income rules listed in the instructions under. Must be removed before printing.

Web How Do I Clear And Start Over In Turbotax Online?

Web scroll down the list of forms and click delete next to 2441. Most forms are automatically removed if you delete the information entered in the program in reference to that form. I have been trying to delete form 2441 from my taxes. 2021 instructions for form 2441.

Taxpayers File Form 2441 With Form.

Click on the form 2441 to open the form. Part i persons or organizations who. Form 2441 is used to by. Web while editing form 2441 in turbotax, if you only have two categories to select from, you could have skipped a step or input the data improperly.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at2.02.31PM-9dcbc3a8b1604721b8586a24d7c7ffb7.png)