How To File Form 568

How To File Form 568 - Web to generate form 568, limited liability company return of income, choose file > client properties, click the california tab, and mark the limited liability company option. Click the file menu, and select go to state/city. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. The llc must file the. (m m / d d / y y y y) (m m / d d / y y y y) rp. Web the questions about form 568 appear during california interview. Form 568 must be filed by every llc that is not taxable as a corporation if any of the following. Web california form 568 can be generated from a federal schedule c, schedule e, or schedule f. Follow the interview to the business summary topic and click edit. Ca and unique secretary of state (sos) account number in the state use code statement dialog in federal screen c,.

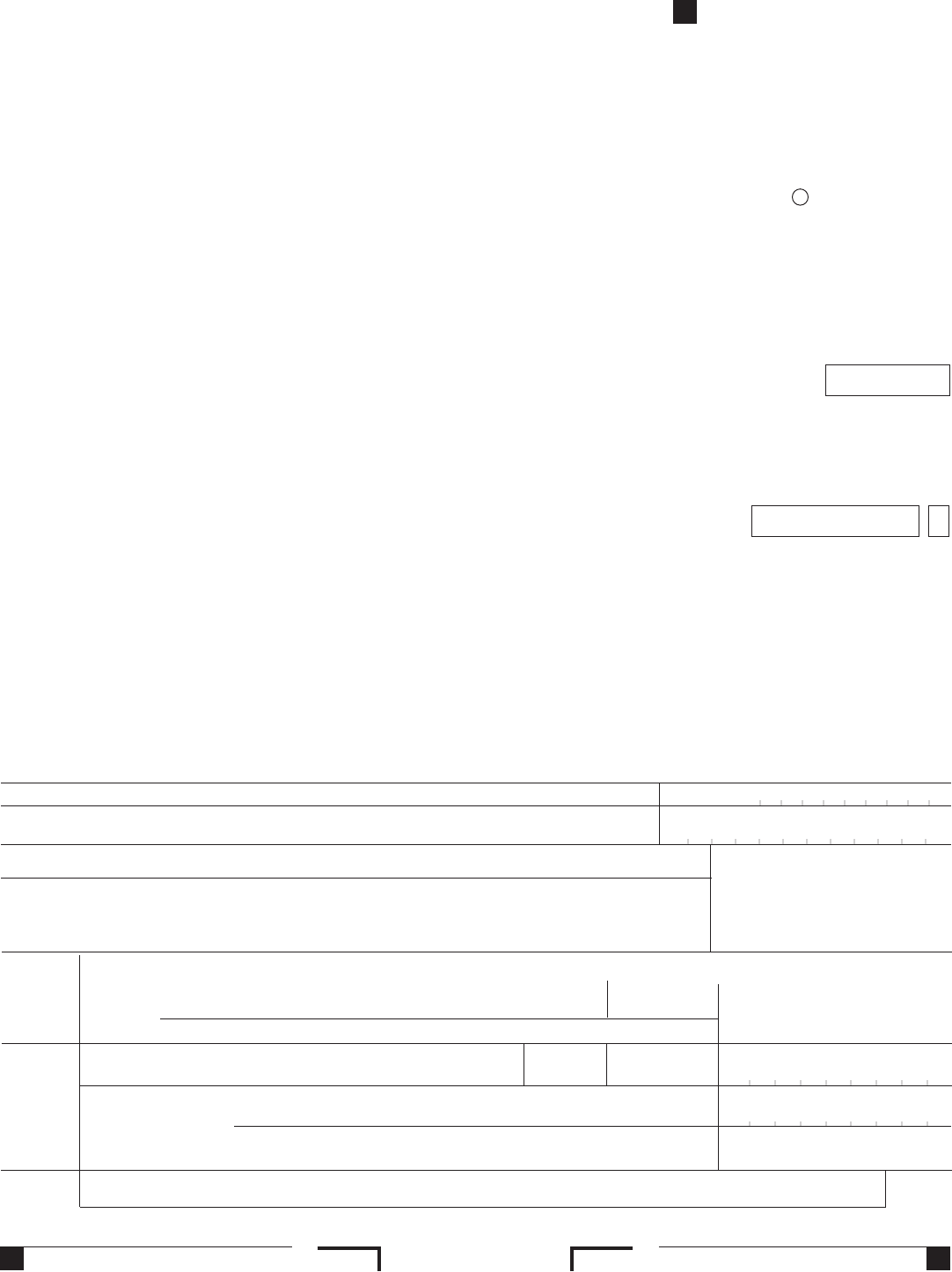

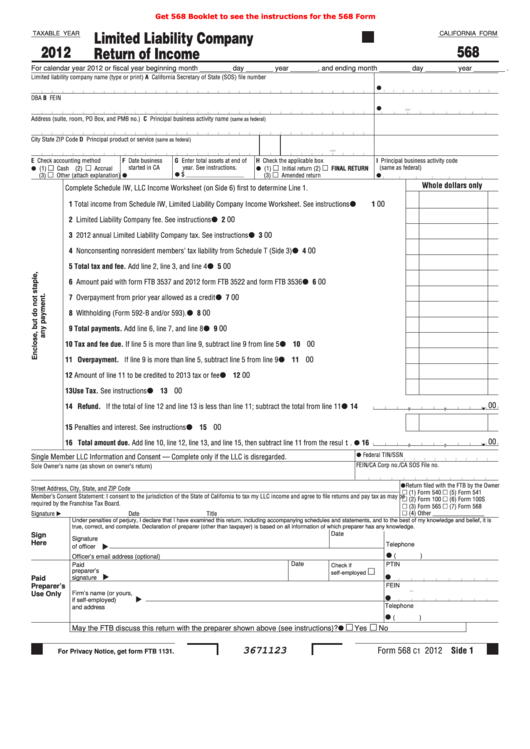

Web to complete california form 568 for a partnership, from the main menu of the california return, select: • form 568, limited liability company return of income • form 565, partnership return of income • form 100, california. Web there are several ways to submit form 4868. Web california form 568 can be generated from a federal schedule c, schedule e, or schedule f. Ad upload, modify or create forms. Web to enter the information for form 568 in the 1040 taxact ® program: (m m / d d / y y y y) (m m / d d / y y y y) rp. Web if you have an llc, here’s how to fill in the california form 568: Line 1—total income from schedule iw. Side 3 (continued from side 2) • federal tin/ssn sole owner’s name (as shown on owner’s return) • fein/ca corp no./ca sos file no.

(m m / d d / y y y y) (m m / d d / y y y y) rp. Follow the interview to the business summary topic and click edit. Line 1—total income from schedule iw. Llcs may be classified for tax purposes as a partnership, a corporation, or a disregarded entity. Ca and unique secretary of state (sos) account number in the state use code statement dialog in federal screen c,. Web california form 568 can be generated from a federal schedule c, schedule e, or schedule f. Form 568 must be filed by every llc that is not taxable as a corporation if any of the following. Web the questions about form 568 appear during california interview. Side 3 (continued from side 2) • federal tin/ssn sole owner’s name (as shown on owner’s return) • fein/ca corp no./ca sos file no. Complete, edit or print tax forms instantly.

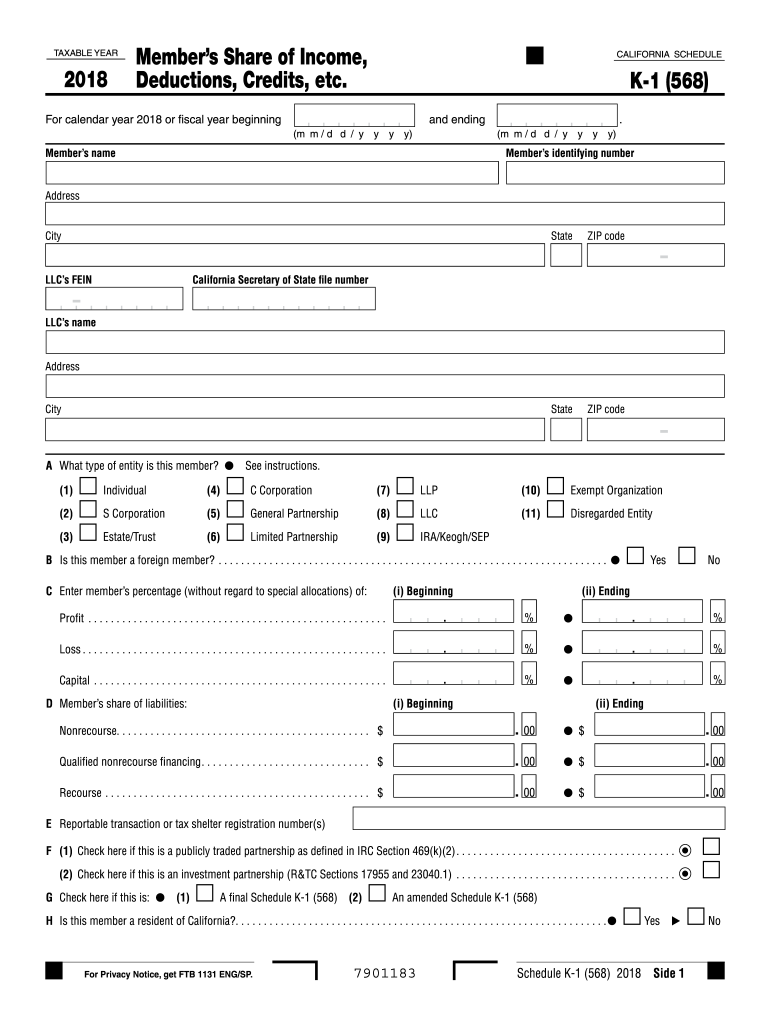

California Schedule K 1 568 Form Fill Out and Sign Printable PDF

Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web to enter the information for form 568 in the 1040 taxact ® program: From within your taxact return ( online or desktop), click state to expand, then click california (or ca ). Business entities that are partnerships, llcs, or corporations.

Form 568 2019 Fill Out, Sign Online and Download Fillable PDF

Side 3 (continued from side 2) • federal tin/ssn sole owner’s name (as shown on owner’s return) • fein/ca corp no./ca sos file no. Web california form 568 can be generated from a federal schedule c, schedule e, or schedule f. Web llcs classified as partnerships file form 568. Web the questions about form 568 appear during california interview. Taxpayers.

2016 Form 568 Limited Liability Company Return Of Edit, Fill

Web if you have an llc, here’s how to fill in the california form 568: Web an llc fee an llc return filing requirement (form 568) generally, a disregarded smllc must file a form 568 by the same deadline applicable to the owner's tax return. Web california where do i enter ca form 568 llc information in an individual return?.

2013 Form 568 Limited Liability Company Return Of Edit, Fill

• form 568, limited liability company return of income • form 565, partnership return of income • form 100, california. Web to create an llc unit, enter a state use code 3 form 568: Business entities that are partnerships, llcs, or corporations in the state of california are required to file form 568. Ad upload, modify or create forms. Web.

2012 Form 568 Limited Liability Company Return Of Edit, Fill

Click the file menu, and select go to state/city. Web to create an llc unit, enter a state use code 3 form 568: Side 3 (continued from side 2) • federal tin/ssn sole owner’s name (as shown on owner’s return) • fein/ca corp no./ca sos file no. Web to complete california form 568 for a partnership, from the main menu.

Ca Form 568 Instructions 2021 Mailing Address To File manyways.top 2021

Web the questions about form 568 appear during california interview. Follow the interview to the business summary topic and click edit. Web adding a limited liability return (form 568) to add limited liability, form 568 to the california return, choose file > client properties > california tab and mark the form 568. Web an llc fee an llc return filing.

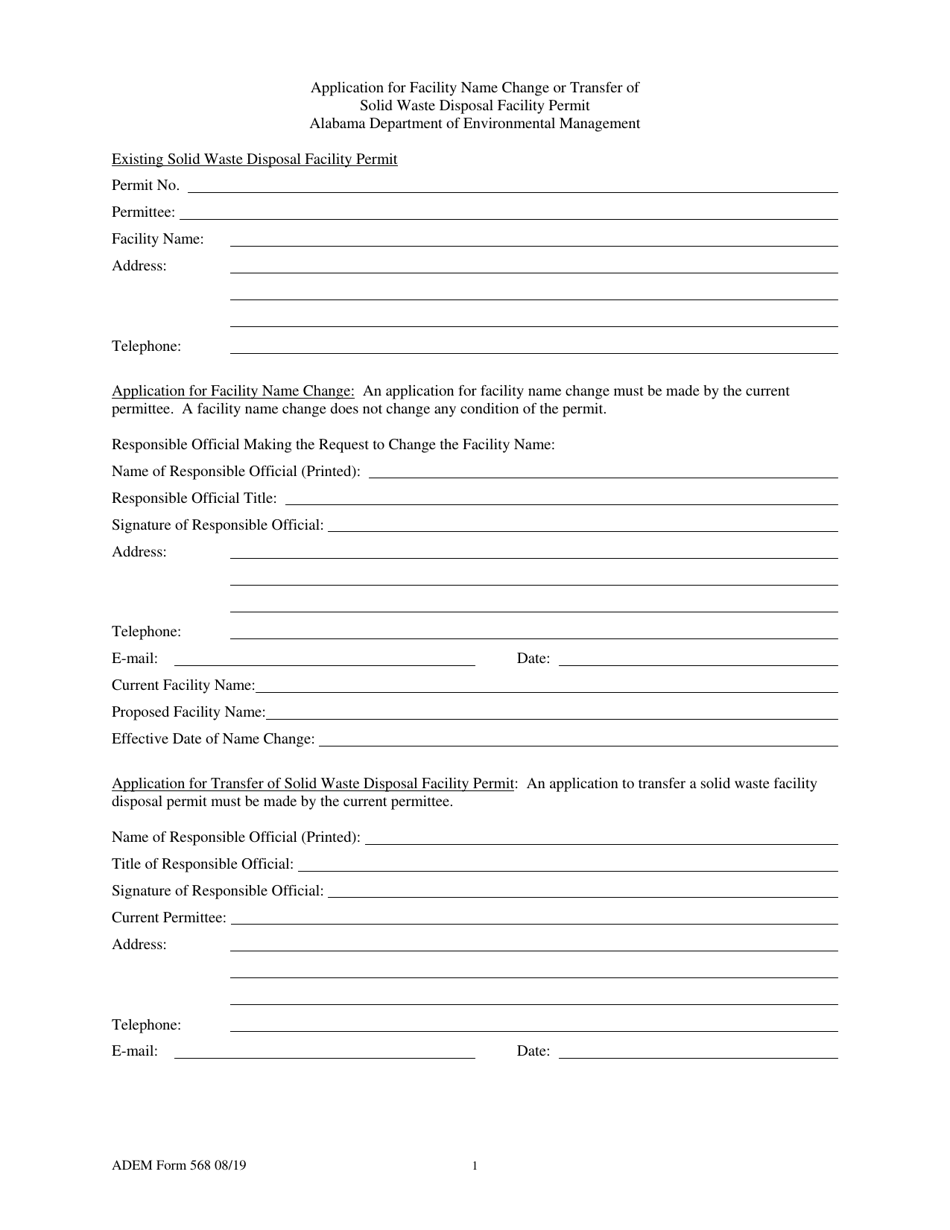

ADEM Form 568 Download Printable PDF or Fill Online Application for

Business entities that are partnerships, llcs, or corporations in the state of california are required to file form 568. Go to the state tax tab. Web california where do i enter ca form 568 llc information in an individual return? Web an llc fee an llc return filing requirement (form 568) generally, a disregarded smllc must file a form 568.

2016 Form 568 Limited Liability Company Return Of Edit, Fill

Web if you have an llc, here’s how to fill in the california form 568: Go to the state tax tab. If you are married, you and your spouse are considered one owner and can. Web to enter the information for form 568 in the 1040 taxact ® program: Web the questions about form 568 appear during california interview.

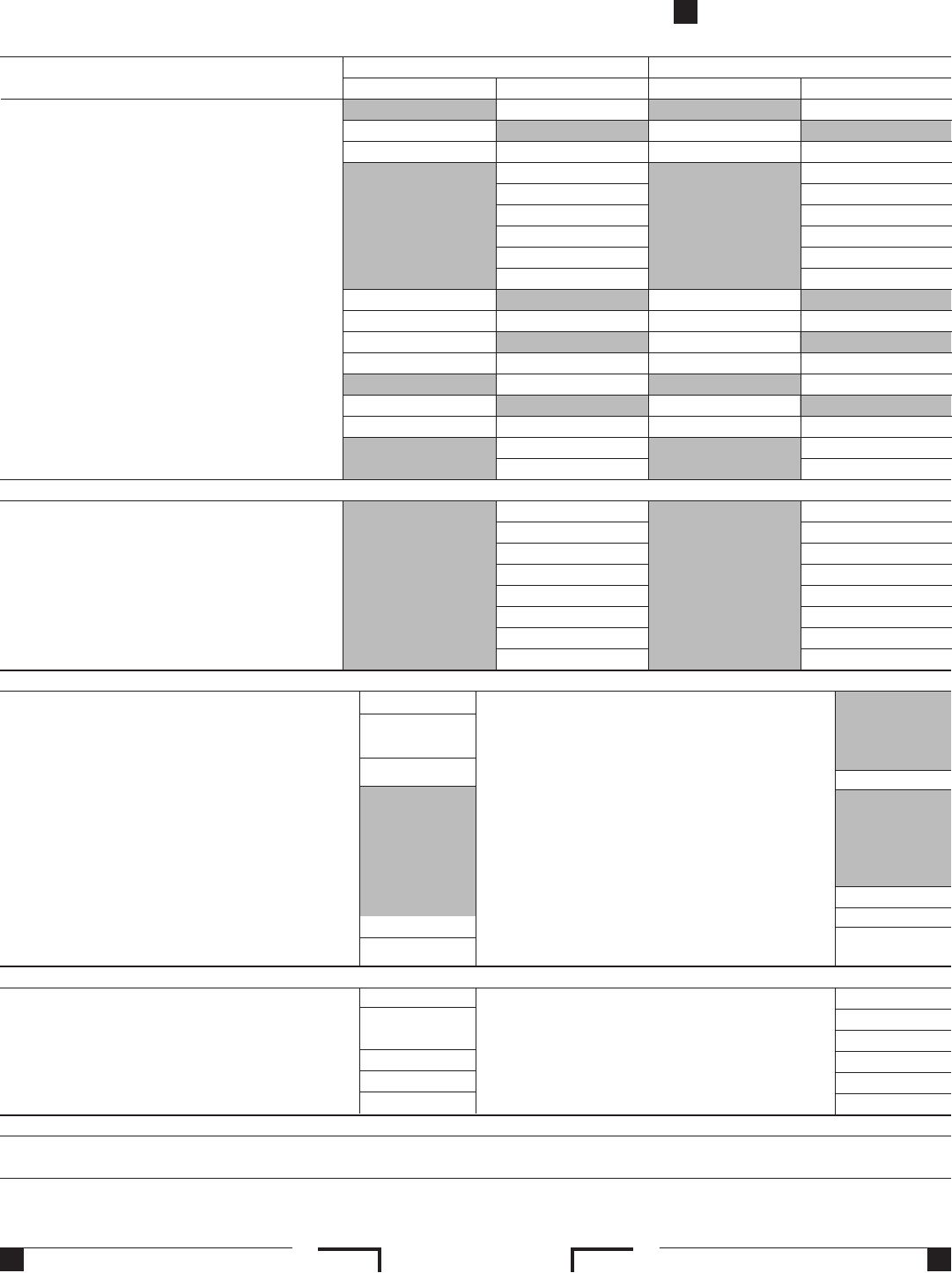

Fillable California Form 568 Limited Liability Company Return Of

Web to create an llc unit, enter a state use code 3 form 568: Thus, you will need to file both if you are running a. Web california form 568 can be generated from a federal schedule c, schedule e, or schedule f. The llc must file the. Web llcs classified as partnerships file form 568.

CA Form 568 Due Dates 2023 State And Local Taxes Zrivo

Thus, you will need to file both if you are running a. Side 3 (continued from side 2) • federal tin/ssn sole owner’s name (as shown on owner’s return) • fein/ca corp no./ca sos file no. If you are married, you and your spouse are considered one owner and can. Business entities that are partnerships, llcs, or corporations in the.

Ad Upload, Modify Or Create Forms.

For calendar year 2020 or fiscal year beginning and ending. Web california form 568 can be generated from a federal schedule c, schedule e, or schedule f. Web up to $40 cash back who needs 2022 form 568: Web llcs classified as partnerships file form 568.

Web An Llc Fee An Llc Return Filing Requirement (Form 568) Generally, A Disregarded Smllc Must File A Form 568 By The Same Deadline Applicable To The Owner's Tax Return.

Web overview if your llc has one owner, you’re a single member limited liability company (smllc). Click the file menu, and select go to state/city. If you are married, you and your spouse are considered one owner and can. Line 1—total income from schedule iw.

Web Along With Form 3522, You Will Have To File Ca Form 568 If Your Llc Tax Status Is Either As A Disregarded Entity Or A Partnership.

Complete, edit or print tax forms instantly. Business entities that are partnerships, llcs, or corporations in the state of california are required to file form 568. (m m / d d / y y y y) (m m / d d / y y y y) rp. From within your taxact return ( online or desktop), click state to expand, then click california (or ca ).

Web California Where Do I Enter Ca Form 568 Llc Information In An Individual Return?

Web to create an llc unit, enter a state use code 3 form 568: Form 568 must be filed by every llc that is not taxable as a corporation if any of the following. • form 568, limited liability company return of income • form 565, partnership return of income • form 100, california. Web the questions about form 568 appear during california interview.