How To Fill Out A W9 Form For Onlyfans

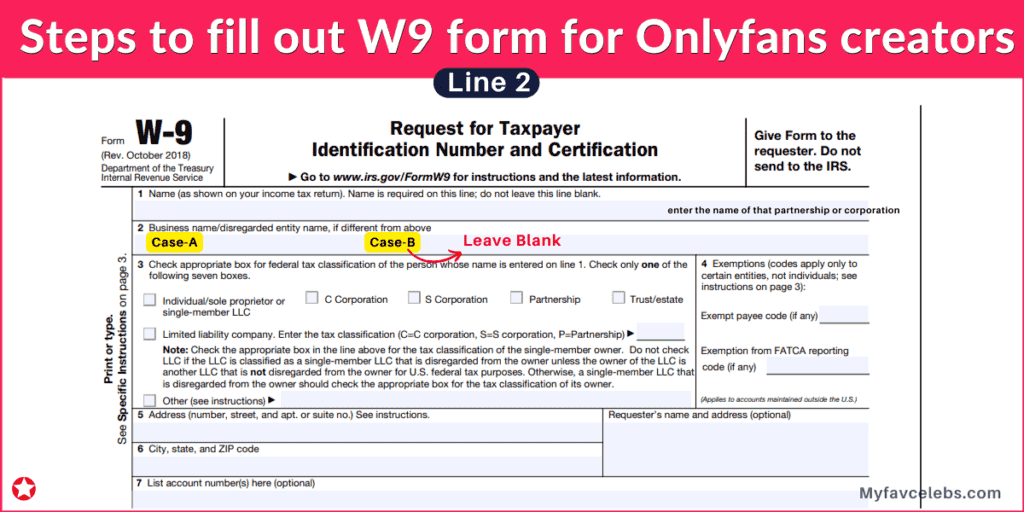

How To Fill Out A W9 Form For Onlyfans - This ensures that the proper taxes are paid. Web this article explains how to fill out the w9 form for onlyfans users. Businesses to request the taxpayer. Web you’ll get a 1099 (self employment tax form) if you make more than $600 per year. Web filling out a w9 form for onlyfans is a straightforward process. It’s especially important for onlyfans. Web a model release for onlyfans is the standard paper for all content monetization platforms. This form is commonly used by u.s. Web to begin filling out your w9 form for onlyfans, follow these simple steps: Web i do this to inform!

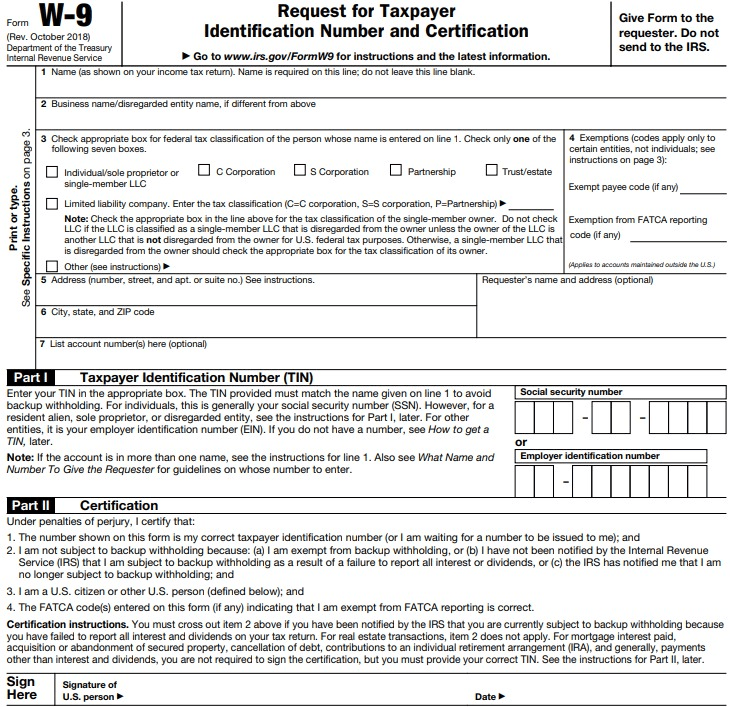

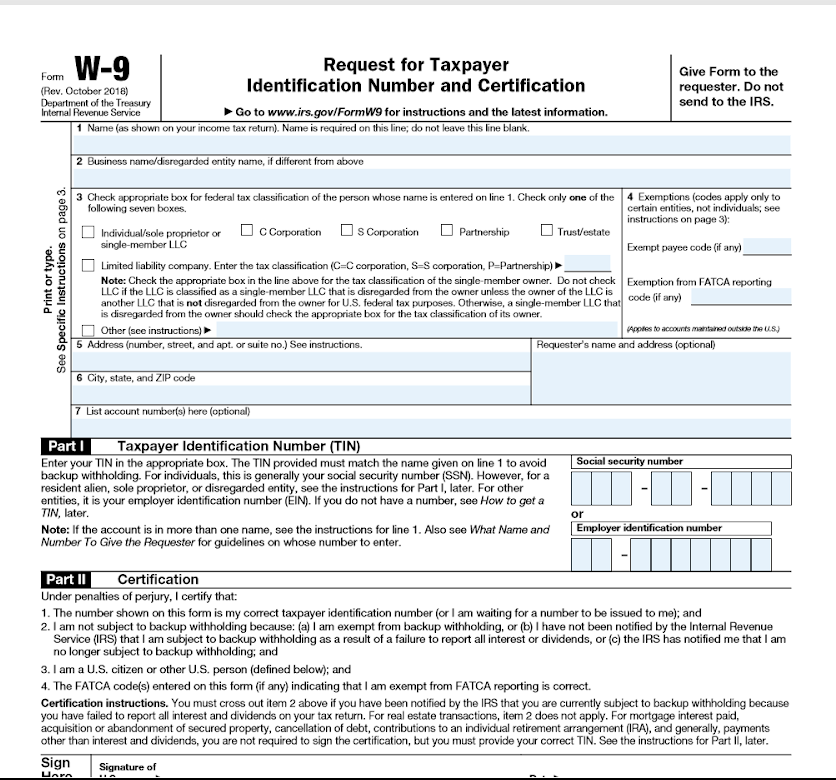

This ensures that the proper taxes are paid. Web estimated taxes are due quarterly on april 15th, june 15th, september 15th and january 15th. You will also need to. You will be required to pay back around 25ish% since 1099/self employment isn’t taxed. Web a model release for onlyfans is the standard paper for all content monetization platforms. Web to fill out the onlyfans w9 form, you will need to provide your legal name, address, and social security number or other taxpayer identification number. When i go to submit it says there is a validation error. The purpose of the document is to prove to the platform that the. Web help with w9 form for onlyfans. Download and print the w9 form you can find the w9 form on the irs website.

I'm currently attempting to fill out a w9 form for an onlyfans account. Web a model release for onlyfans is the standard paper for all content monetization platforms. I want to make sure i’m doing it right you need to fill it out with your full name, address and ssn, sign the certification in part ii. Gather your personal information, including your legal name,. Web i'm currently trying to fill out a w9 form for an onlyfans account. The first step is to download the w9 form. Please check your name/business name and tin. You will be required to pay back around 25ish% since 1099/self employment isn’t taxed. Web estimated taxes are due quarterly on april 15th, june 15th, september 15th and january 15th. When you create an onlyfans or myystar account to become a creator, they are.

how to use onlyfans and fill out the w9 form YouTube

Please check your name/business name and tin. You will also need to. You will be required to pay back around 25ish% since 1099/self employment isn’t taxed. This form is commonly used by u.s. I want to make sure i’m doing it right you need to fill it out with your full name, address and ssn, sign the certification in part.

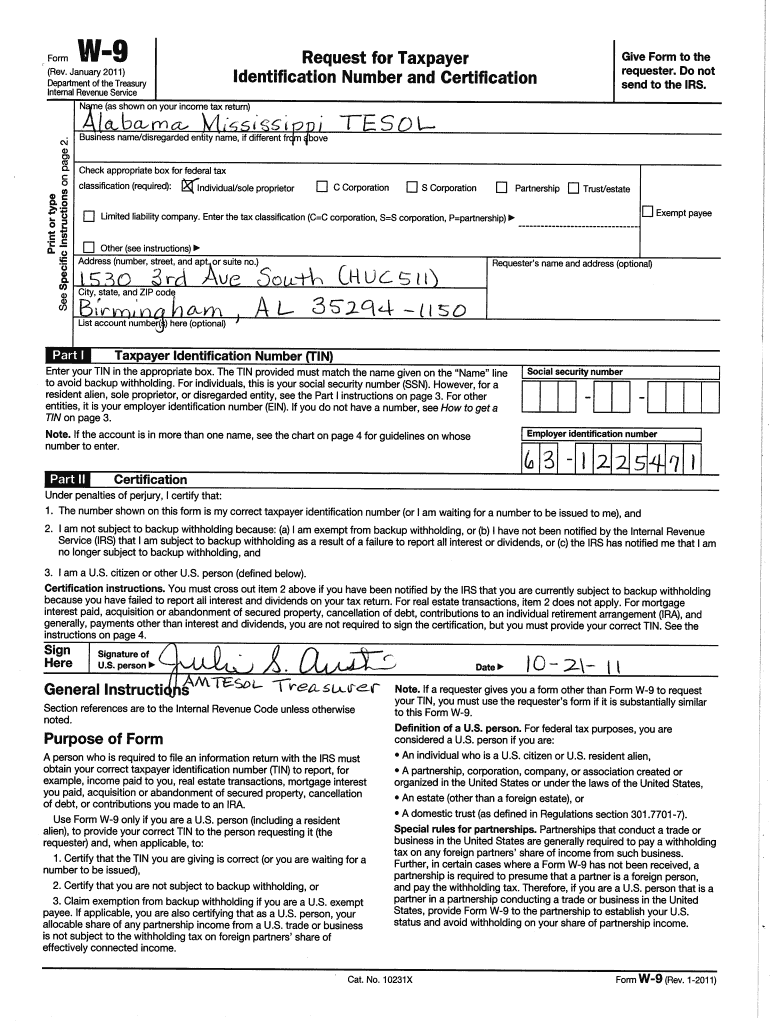

Irs W9 Form 2021 Printable

Please check your name/business name and tin. When i go to submit it says there is a validation error. Web to begin filling out your w9 form for onlyfans, follow these simple steps: Web estimated taxes are due quarterly on april 15th, june 15th, september 15th and january 15th. You will also need to.

16+ VIP How To Fill Out W 9 Form For Onlyfans Leaked Photo

Web i do this to inform! Web as an onlyfans content creator, you’re considered an independent contractor, which means you’ll need to submit a w9 instead of a w4 form that you fill out as an employee. Web help with w9 form for onlyfans. Web filling out a w9 form for onlyfans is a straightforward process. This form is commonly.

Downloadable W9 Tax Form How To Fill Out A W9 Form Line W pertaining

Web estimated taxes are due quarterly on april 15th, june 15th, september 15th and january 15th. Businesses to request the taxpayer. I want to make sure i’m doing it right you need to fill it out with your full name, address and ssn, sign the certification in part ii. You will also need to. Download the w9 form from the.

Pdf Fillable W9 Form Printable Forms Free Online

You will be required to pay back around 25ish% since 1099/self employment isn’t taxed. Web to fill out the onlyfans w9 form, you will need to provide your legal name, address, and social security number or other taxpayer identification number. Web as an onlyfans content creator, you’re considered an independent contractor, which means you’ll need to submit a w9 instead.

Irs W9 Form 2017 Fill Online, Printable, Fillable Blank Pdffiller

Web you’ll get a 1099 (self employment tax form) if you make more than $600 per year. The w9 form is used for hiring independent contractors or freelancers. When i go to submit it says there is a validation error. Web estimated taxes are due quarterly on april 15th, june 15th, september 15th and january 15th. Web any llcs must.

How to file OnlyFans taxes (W9 and 1099 forms explained)

Web filling out a w9 form for onlyfans is a straightforward process. Businesses to request the taxpayer. This ensures that the proper taxes are paid. When i go to submit it says there is a validation error. Web i'm currently trying to fill out a w9 form for an onlyfans account.

Downloadable W 9 Form Example Calendar Printable

Web i'm currently trying to fill out a w9 form for an onlyfans account. Web help with w9 form for onlyfans. This ensures that the proper taxes are paid. Web as an onlyfans content creator, you’re considered an independent contractor, which means you’ll need to submit a w9 instead of a w4 form that you fill out as an employee..

How to fill out W9 for Onlyfans? StepbyStep Guide

Businesses to request the taxpayer. Web estimated taxes are due quarterly on april 15th, june 15th, september 15th and january 15th. I'm currently attempting to fill out a w9 form for an onlyfans account. Web this article explains how to fill out the w9 form for onlyfans users. The w9 form is used for hiring independent contractors or freelancers.

Free Printable W9 Form From Irs

This ensures that the proper taxes are paid. When i go to submit it says there is a validation error. Businesses to request the taxpayer. Download and print the w9 form you can find the w9 form on the irs website. Gather your personal information, including your legal name,.

The W9 Form Is Used For Hiring Independent Contractors Or Freelancers.

This ensures that the proper taxes are paid. You will also need to. Web this article explains how to fill out the w9 form for onlyfans users. Businesses to request the taxpayer.

When I Go To Submit It Says There Is A Validation Error.

Web to begin filling out your w9 form for onlyfans, follow these simple steps: Download the w9 form from the irs website. When i go to submit it says there is a validation error. When you create an onlyfans or myystar account to become a creator, they are.

It’s Especially Important For Onlyfans.

I want to make sure i’m doing it right you need to fill it out with your full name, address and ssn, sign the certification in part ii. The purpose of the document is to prove to the platform that the. Please check your name/business name and tin. Web as an onlyfans content creator, you’re considered an independent contractor, which means you’ll need to submit a w9 instead of a w4 form that you fill out as an employee.

Gather Your Personal Information, Including Your Legal Name,.

Follow these steps to complete it: Web any llcs must fill out a w9 form for their owners in order to report any income received. You will be required to pay back around 25ish% since 1099/self employment isn’t taxed. I'm currently attempting to fill out a w9 form for an onlyfans account.