How To Fill Out Form 1310

How To Fill Out Form 1310 - File a final tax return. Web a return is normally required. Web if a refund is due on the individual income tax return of the deceased, claim the refund by submitting form 1310, statement of a person claiming refund due a. Web 1 best answer paulam expert alumni i am sorry for your loss. Web taxslayer support how to claim a refund due to a deceased taxpayer (form 1310) if you need to file a return on behalf of a deceased taxpayer, go to federal miscellaneous. My answers on this form are: Use form 1310 to claim a refund on behalf of a deceased taxpayer. Complete, edit or print tax forms instantly. Web how do i complete form 1310? Web how to fill out irs form 1310?

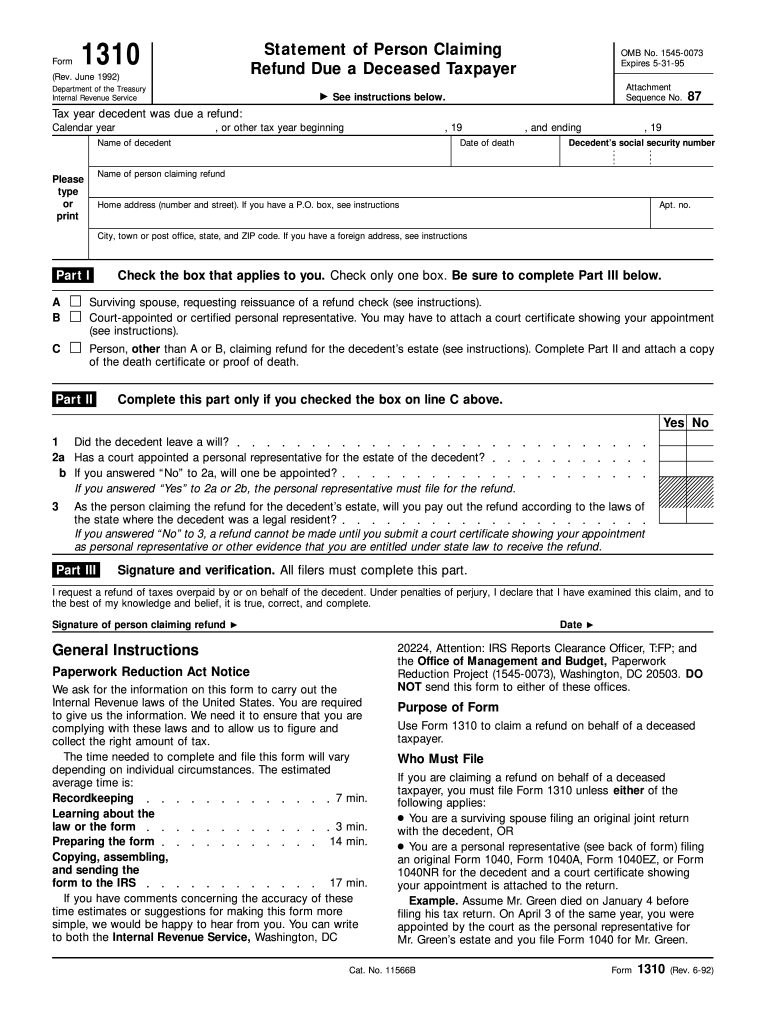

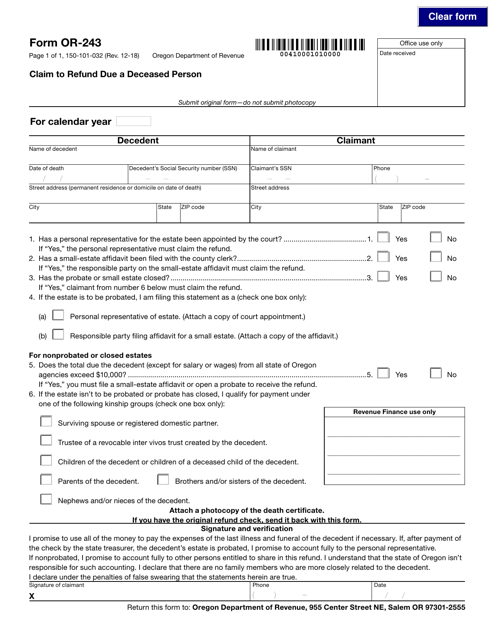

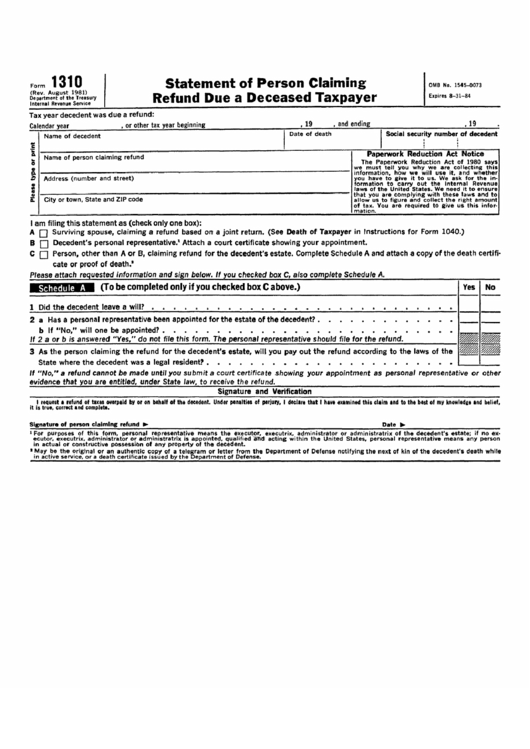

Web if a refund is due on the individual income tax return of the deceased, claim the refund by submitting form 1310, statement of a person claiming refund due a. Fortunately, the form is very simple to complete. In the first step, you have to indicate that the taxpayer is not alive anymore on whose behalf you are claiming the. Try it for free now! Download your fillable irs form 1310 in pdf. Use form 1310 to claim a refund on behalf of a deceased taxpayer. Web a return is normally required. Get the check reissued in the name of the trust. Get ready for tax season deadlines by completing any required tax forms today. Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in charge of the decedent's property in order to claim a refund.

Web according to the tax form, you must file form 1310 both of the following conditions apply: But form 1310 is confusing me. Download your fillable irs form 1310 in pdf. Get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today. Web if a refund is due to the decedent, it may be necessary to file form 1310, statement of person claiming refund due a deceased taxpayer with the return. Ad access irs tax forms. Generally, a person who is filing a return for a decedent and claiming a refund must file form 1310 statement of person claiming. Web irs form 1310 allows you to claim a refund due on behalf of a deceased taxpayer. Complete, edit or print tax forms instantly.

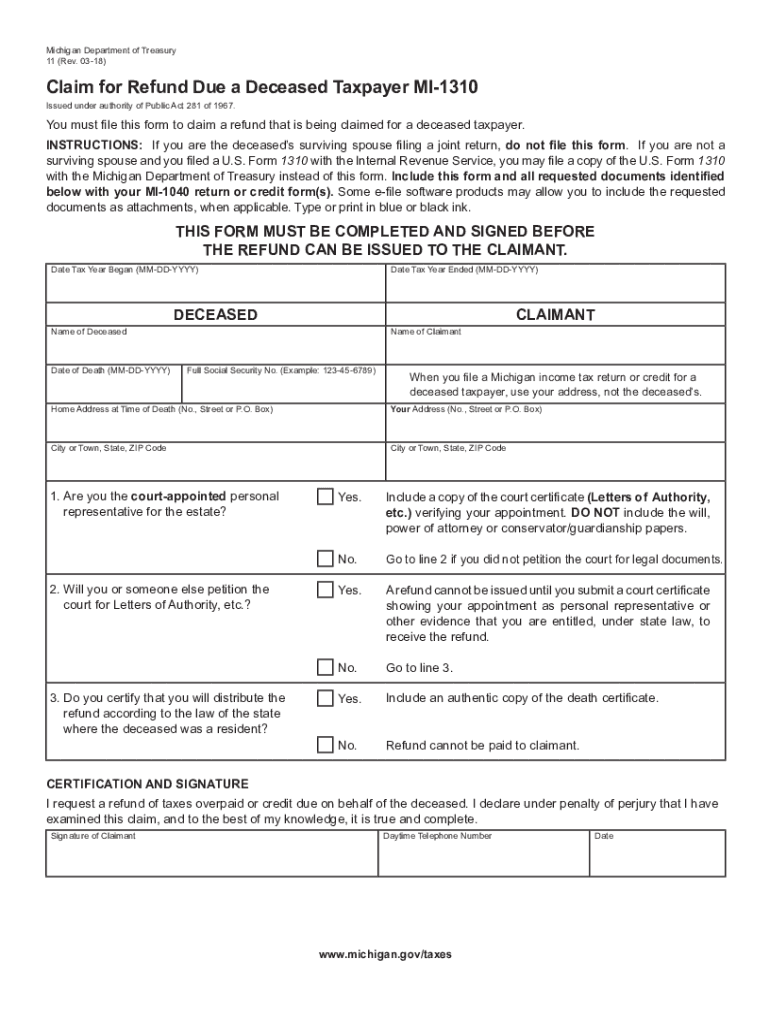

1992 Form IRS 1310 Fill Online, Printable, Fillable, Blank pdfFiller

Ad access irs tax forms. Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in charge of the decedent's property in order to claim a refund. Get the check reissued in the name of the trust. You can prepare the form and then mail it in to the same irs service..

Irs Form 1310 Printable Master of Documents

Web if a refund is due on the individual income tax return of the deceased, claim the refund by submitting form 1310, statement of a person claiming refund due a. Web according to the tax form, you must file form 1310 both of the following conditions apply: Get ready for tax season deadlines by completing any required tax forms today..

IRS Form 1310 How to Fill it with the Best Form Filler

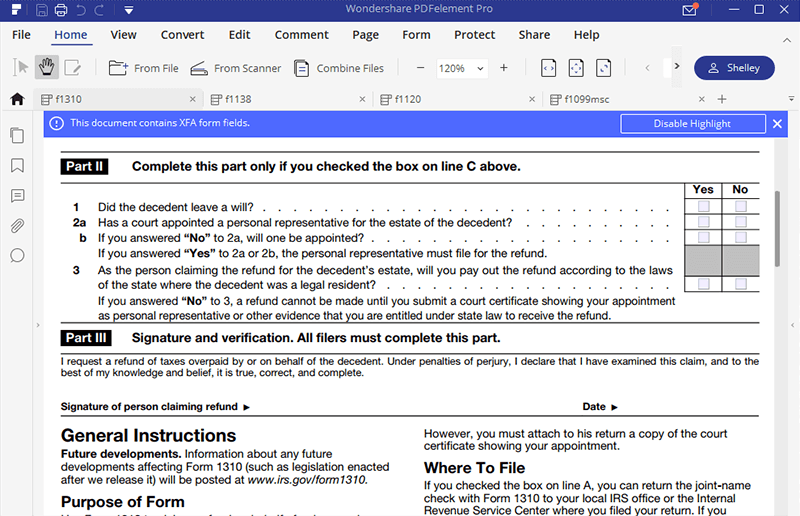

At the top of the form, you’ll provide identifying information such as the tax year,. Web if a refund is due to the decedent, it may be necessary to file form 1310, statement of person claiming refund due a deceased taxpayer with the return. File a final tax return. Fortunately, the form is very simple to complete. Generally, a person.

Irs Form 1310 Printable Master of Documents

Web if a refund is due on the individual income tax return of the deceased, claim the refund by submitting form 1310, statement of a person claiming refund due a. File a final tax return. Complete, edit or print tax forms instantly. Try it for free now! My answers on this form are:

IRS Form 1310 How to Fill it Right

Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. Generally, a person who is filing a return for a decedent and claiming a refund must file form 1310 statement of person claiming. Complete, edit or print tax forms instantly. File a final tax return.

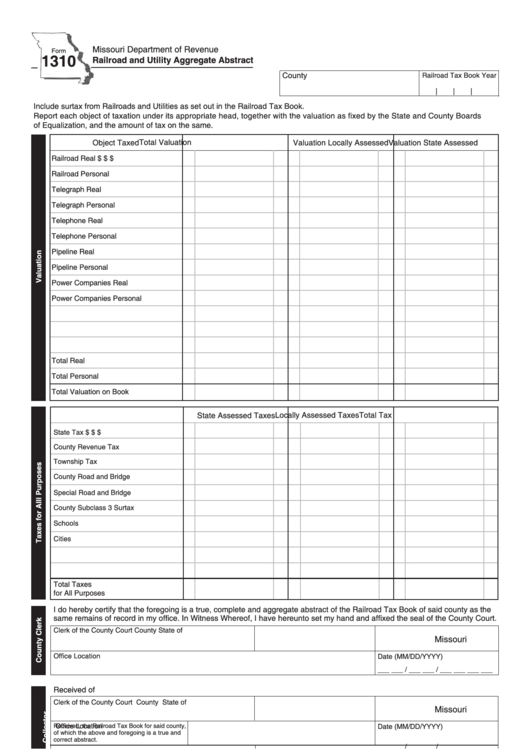

Fillable Form 1310 Railroad And Utility Aggregate Abstract printable

Ad access irs tax forms. Supposedly you don't need the 1310 with proof of appointment but you could. Get the check reissued in the name of the trust. Web a return is normally required. Download your fillable irs form 1310 in pdf.

1019 Fill Out and Sign Printable PDF Template signNow

Web yes, you can file irs form 1310 in turbotax to claim the tax refund for a decedent return (a return filed on the behalf of a deceased taxpayer). Web taxslayer support how to claim a refund due to a deceased taxpayer (form 1310) if you need to file a return on behalf of a deceased taxpayer, go to federal.

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer

Web yes, you can file irs form 1310 in turbotax to claim the tax refund for a decedent return (a return filed on the behalf of a deceased taxpayer). Get the check reissued in the name of the trust. File a final tax return. Web if a refund is due on the individual income tax return of the deceased, claim.

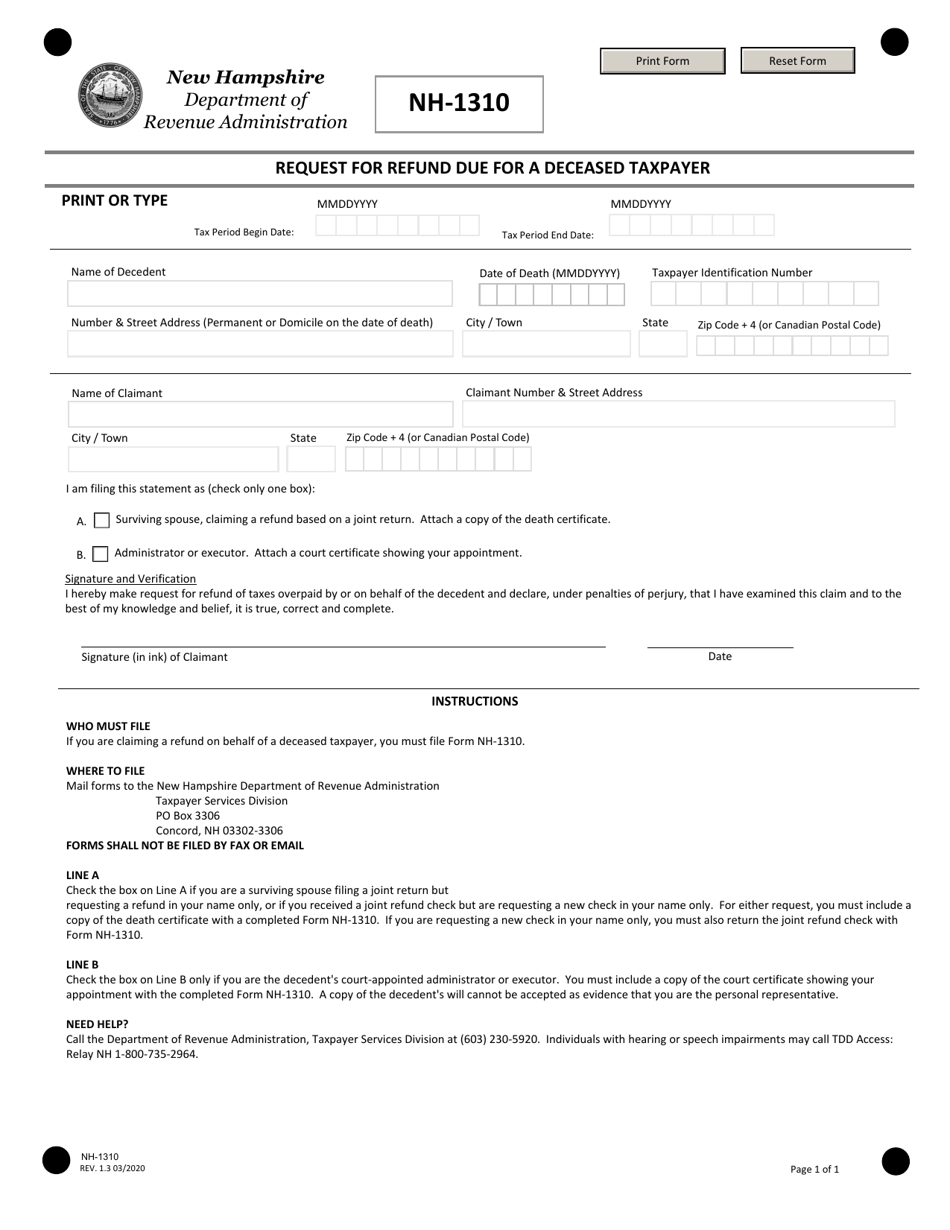

Form NH1310 Download Fillable PDF or Fill Online Request for Refund

In the first step, you have to indicate that the taxpayer is not alive anymore on whose behalf you are claiming the. Web if a refund is due on the individual income tax return of the deceased, claim the refund by submitting form 1310, statement of a person claiming refund due a. Complete, edit or print tax forms instantly. Web.

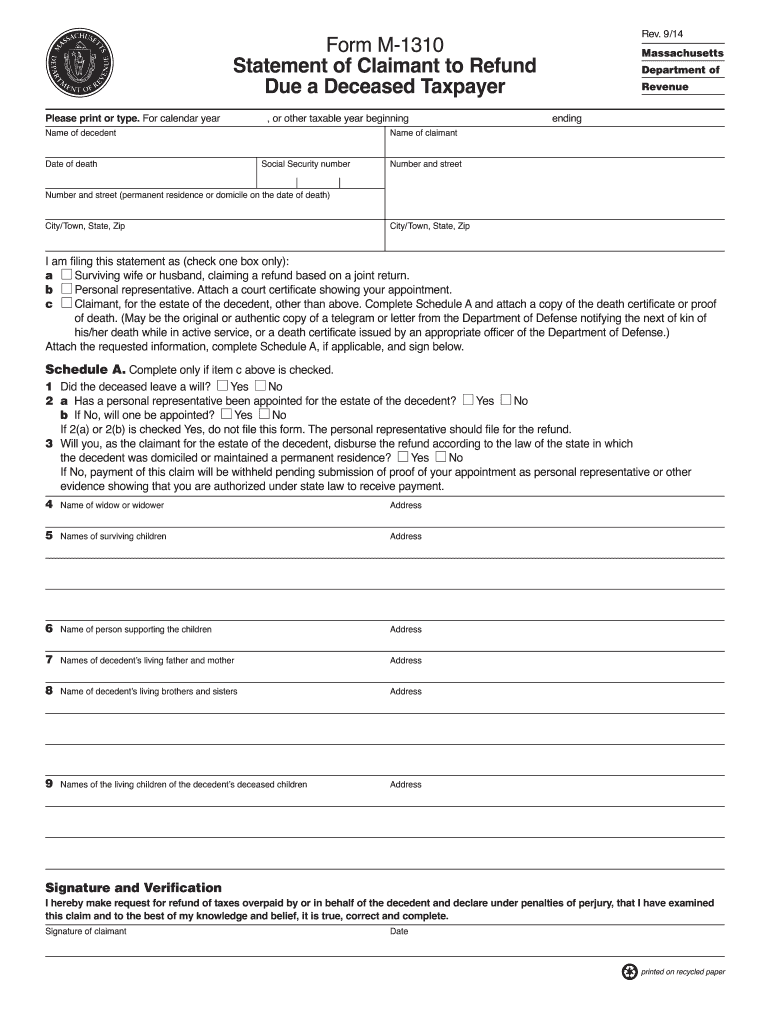

2014 Form MA DoR M1310 Fill Online, Printable, Fillable, Blank pdfFiller

Use form 1310 to claim a refund on behalf of a deceased taxpayer. Download your fillable irs form 1310 in pdf. But form 1310 is confusing me. Get ready for tax season deadlines by completing any required tax forms today. Web taxslayer support how to claim a refund due to a deceased taxpayer (form 1310) if you need to file.

Fortunately, The Form Is Very Simple To Complete.

Web irs form 1310 allows you to claim a refund due on behalf of a deceased taxpayer. In the first step, you have to indicate that the taxpayer is not alive anymore on whose behalf you are claiming the. Ad access irs tax forms. Get the check reissued in the name of the trust.

Complete, Edit Or Print Tax Forms Instantly.

Web a return is normally required. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. At the top of the form, you’ll provide identifying information such as the tax year,.

But Form 1310 Is Confusing Me.

Now you have to provide some personal. Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in charge of the decedent's property in order to claim a refund. Web 1 best answer paulam expert alumni i am sorry for your loss. Ad access irs tax forms.

Irs Form 1310 Is Executed To Support The Application For The Deceased’s Refund For The Tax Year At Issue.

1 did the decedent leave a will? Only certain people related to the decedent are eligible to make this claim. The decedent did not file prior year return (s) the administrator, executor, or beneficiary must: File a final tax return.