How To Fill Out K-4 Form Kentucky

How To Fill Out K-4 Form Kentucky - These 2021 forms and more are available: Web get the kentucky form 4 you require. Edit your ky withholding form online type text, add images, blackout confidential details, add comments, highlights and more. Keep it simple when filling out your kentucky form k 4 and use pdfsimpli. Easily fill out pdf blank, edit, and sign them. Web how to edit and fill out kentucky k 4 online. Sign it in a few clicks draw. Easily fill out pdf blank, edit, and sign them. Sign it in a few clicks draw your signature, type. Easily fill out pdf blank, edit, and sign them.

Easily fill out pdf blank, edit, and sign them. Easily fill out pdf blank, edit, and sign them. Read the following instructions to use cocodoc to start editing and completing your kentucky k 4: Edit your ky withholding form online type text, add images, blackout confidential details, add comments, highlights and more. In the first section, you need to calculate taxable income from activities. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Save or instantly send your ready. Use get form or simply click on the template preview to open it in the editor. Open it up using the online editor and begin altering. Web fill out the kentucky form k 4 form for free!

Web fill out the kentucky form k 4 form for free! Specify the reporting period and enter your local tax id, name, and ssn. Start completing the fillable fields and. Sign it in a few clicks draw your signature, type. Use get form or simply click on the template preview to open it in the editor. Web effective may 5, 2020, kentucky's tax law requires employers filing on a twice monthly and monthly frequency to electronically file and pay the income tax withheld for periods. Open it up using the online editor and begin altering. Save or instantly send your ready documents. Read the following instructions to use cocodoc to start editing and completing your kentucky k 4: Keep it simple when filling out your kentucky form k 4 and use pdfsimpli.

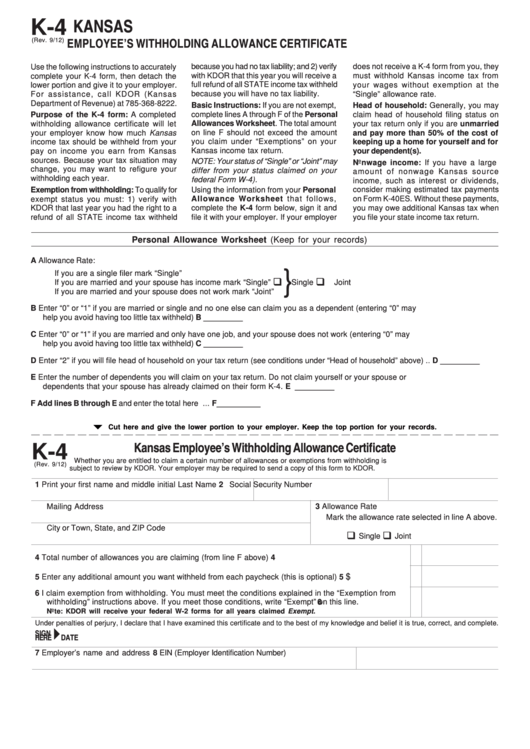

imperialpricedesign K 4 Form Kentucky

Sign it in a few clicks draw your signature, type. Specify the reporting period and enter your local tax id, name, and ssn. Start completing the fillable fields. Use get form or simply click on the template preview to open it in the editor. Easily fill out pdf blank, edit, and sign them.

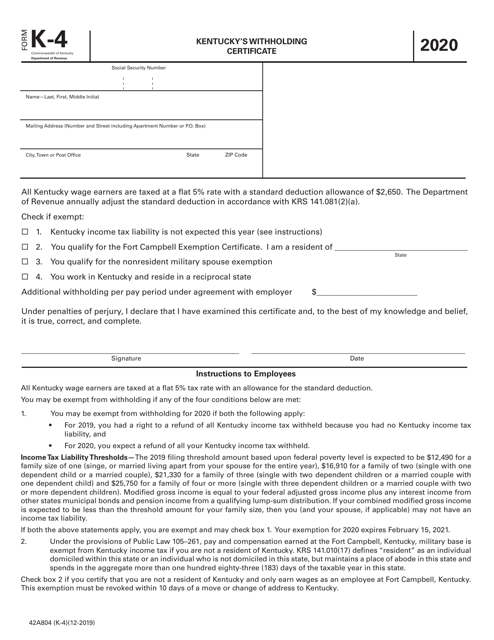

Form K4 (42A804) Download Printable PDF or Fill Online Kentucky's

Save or instantly send your ready documents. Sign it in a few clicks draw. Start completing the fillable fields. Use get form or simply click on the template preview to open it in the editor. These 2021 forms and more are available:

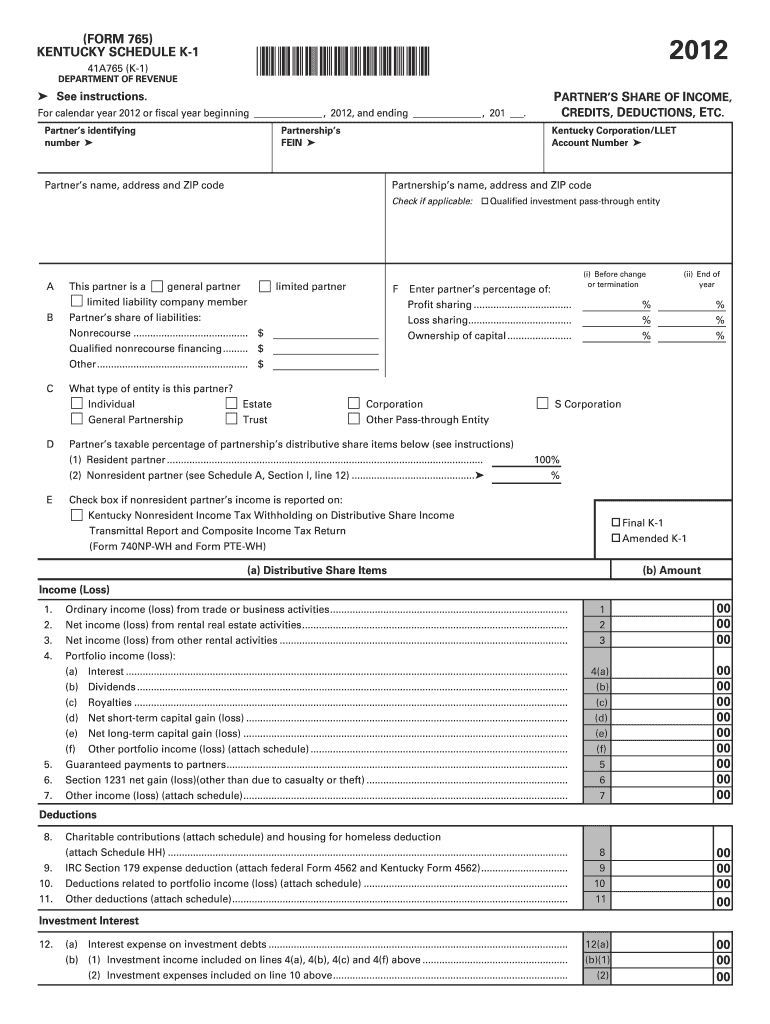

2012 Form KY 765 Schedule K1 Fill Online, Printable, Fillable, Blank

Sign it in a few clicks draw your signature, type. Read the following instructions to use cocodoc to start editing and completing your kentucky k 4: Easily fill out pdf blank, edit, and sign them. Use get form or simply click on the template preview to open it in the editor. Save or instantly send your ready documents.

K 4 Form Fill Out and Sign Printable PDF Template signNow

Edit your kentucky k 4 fillable tax form online type text, add images, blackout confidential details, add comments, highlights and more. Start completing the fillable fields. Read the following instructions to use cocodoc to start editing and completing your kentucky k 4: In the first section, you need to calculate taxable income from activities. Start completing the fillable fields and.

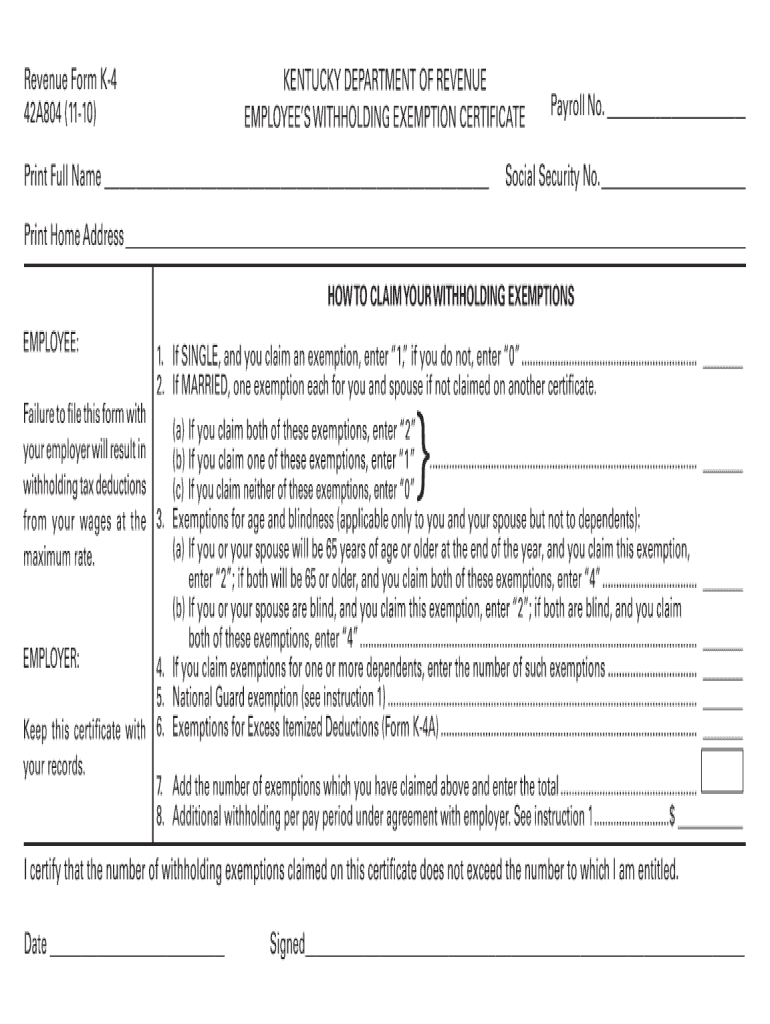

KY DoR 42A804 Form K4 2010 Fill out Tax Template Online US Legal Forms

These 2021 forms and more are available: Sign it in a few clicks draw. Sign it in a few clicks draw your signature, type. At first, seek the “get form” button. Use get form or simply click on the template preview to open it in the editor.

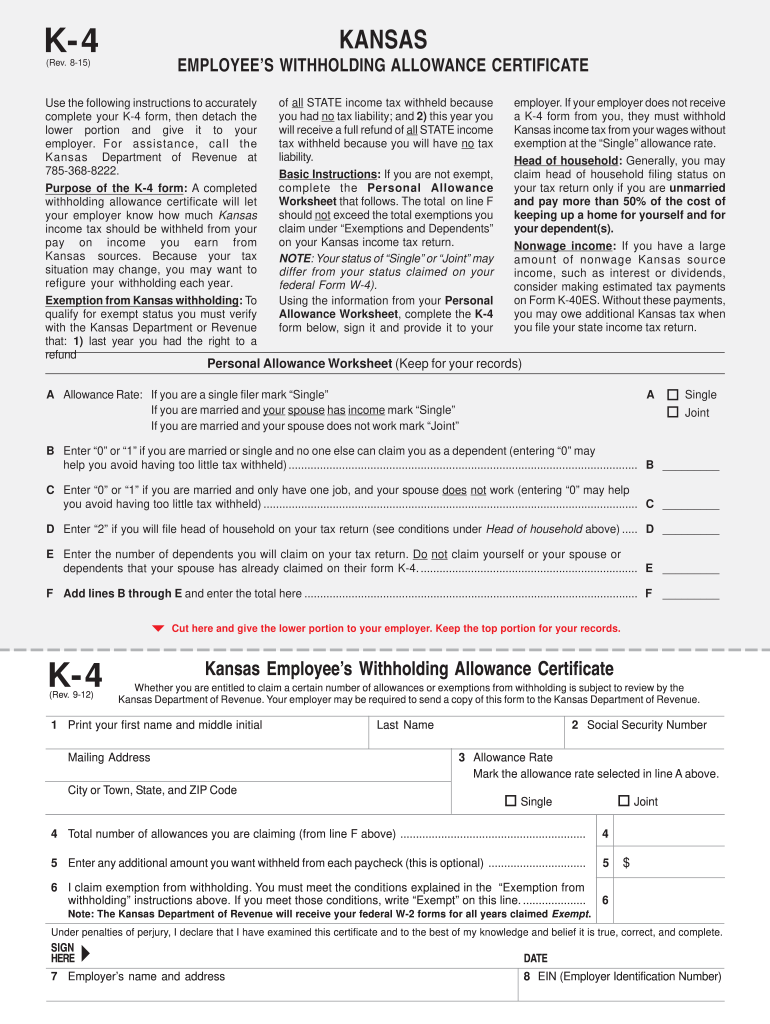

Fillable Form K4 Employee'S Withholding Allowance Certificate

Edit your kentucky k 4 fillable tax form online type text, add images, blackout confidential details, add comments, highlights and more. Sign it in a few clicks draw. At first, seek the “get form” button. Easily fill out pdf blank, edit, and sign them. Read the following instructions to use cocodoc to start editing and completing your kentucky k 4:

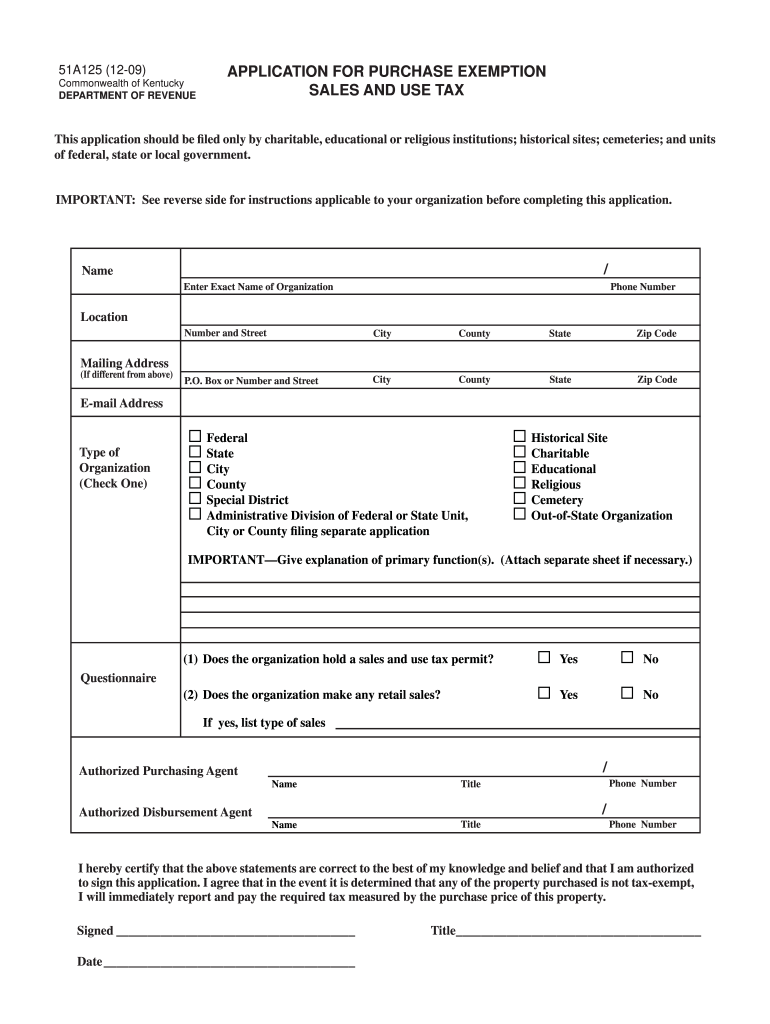

Ky Exemption Tax Form Fill Out and Sign Printable PDF Template signNow

Save or instantly send your ready documents. Web how to edit and fill out kentucky k 4 online. Edit your ky withholding form online type text, add images, blackout confidential details, add comments, highlights and more. Read the following instructions to use cocodoc to start editing and completing your kentucky k 4: Save or instantly send your ready.

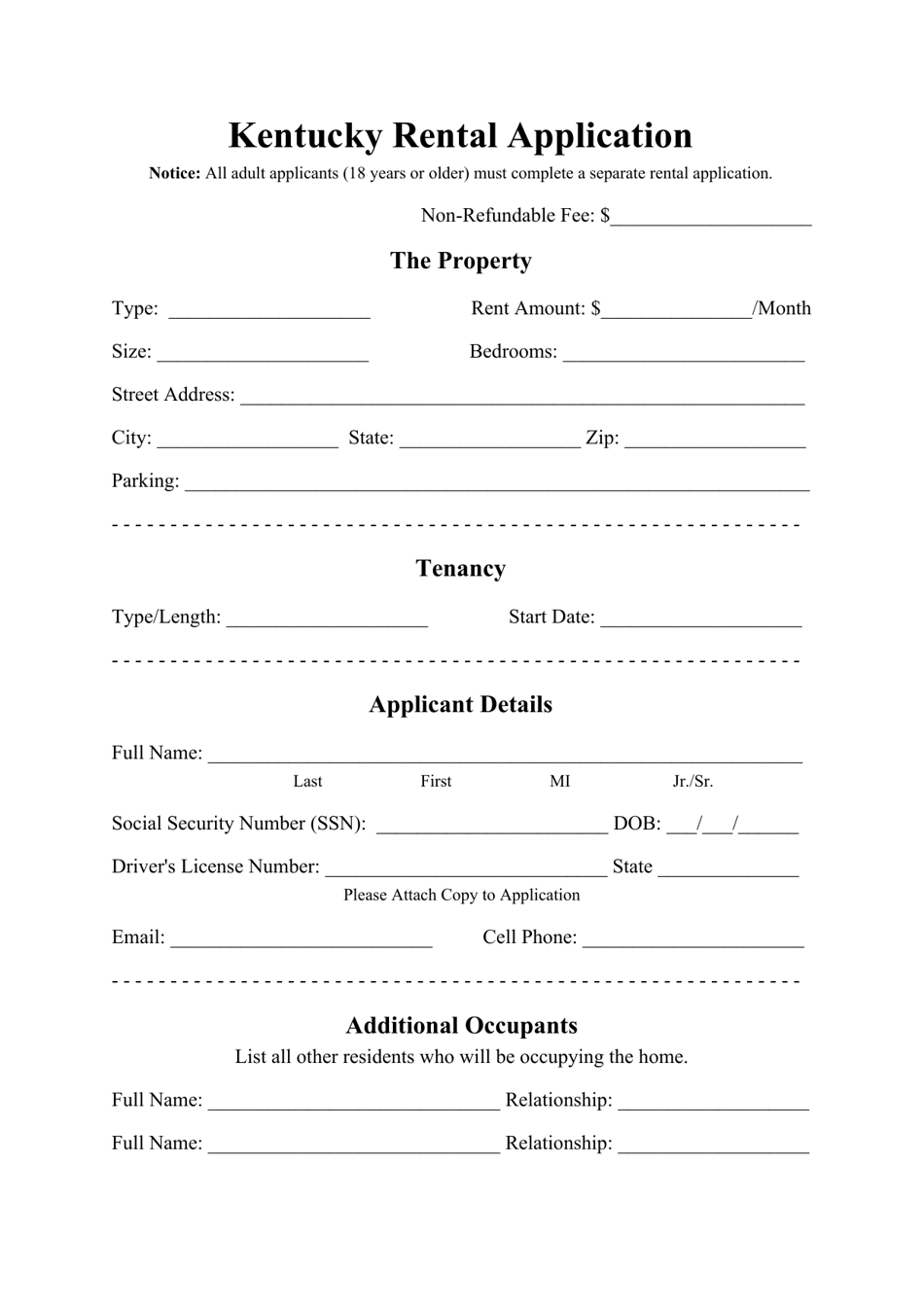

Kentucky Rental Application Form Download Printable PDF Templateroller

Easily fill out pdf blank, edit, and sign them. Edit your kentucky k 4 fillable tax form online type text, add images, blackout confidential details, add comments, highlights and more. Use get form or simply click on the template preview to open it in the editor. Web get the kentucky form 4 you require. Specify the reporting period and enter.

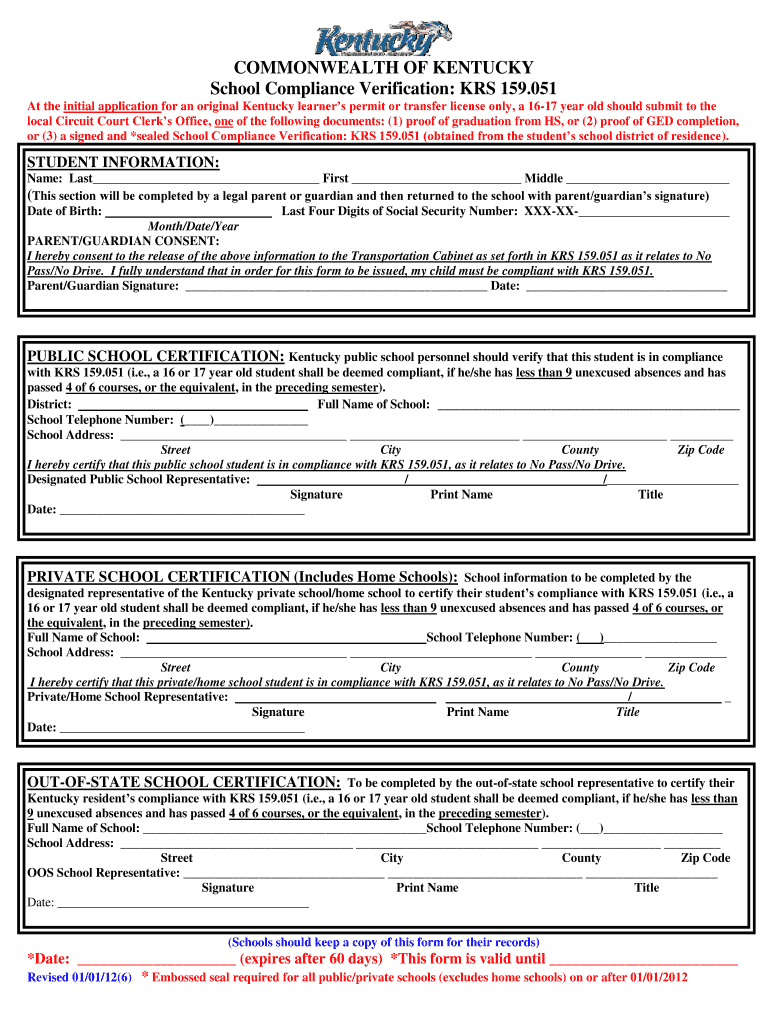

KY KRS 159.051 20122021 Fill and Sign Printable Template Online US

Sign it in a few clicks draw your signature, type. Open it up using the online editor and begin altering. These 2021 forms and more are available: In the first section, you need to calculate taxable income from activities. Easily fill out pdf blank, edit, and sign them.

How Do I Form An Llc In Kentucky Universal Network

Edit your ky withholding form online type text, add images, blackout confidential details, add comments, highlights and more. Save or instantly send your ready documents. Web get the kentucky form 4 you require. Easily fill out pdf blank, edit, and sign them. Sign it in a few clicks draw your signature, type.

Concerned Parties Names, Places Of Residence And Phone Numbers.

Read the following instructions to use cocodoc to start editing and completing your kentucky k 4: Save or instantly send your ready. Save or instantly send your ready documents. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook.

Sign It In A Few Clicks Draw.

In the first section, you need to calculate taxable income from activities. Use get form or simply click on the template preview to open it in the editor. Easily fill out pdf blank, edit, and sign them. Web fill out the kentucky form k 4 form for free!

Start Completing The Fillable Fields.

Start completing the fillable fields and. Specify the reporting period and enter your local tax id, name, and ssn. Sign it in a few clicks draw your signature, type. Open it up using the online editor and begin altering.

Use Get Form Or Simply Click On The Template Preview To Open It In The Editor.

Edit your ky withholding form online type text, add images, blackout confidential details, add comments, highlights and more. Web effective may 5, 2020, kentucky's tax law requires employers filing on a twice monthly and monthly frequency to electronically file and pay the income tax withheld for periods. At first, seek the “get form” button. Easily fill out pdf blank, edit, and sign them.