How To Form A 501C4

How To Form A 501C4 - To do this, use the form 8976, electronic notice registration system. The pages in this section of the national council of nonprofits’ website. Request for transcript of tax return. Web organizations file this form to apply for recognition of exemption from federal income tax under section 501 (c) (4). We want to help you too! For information about applying for exemption, see. Web form 8976, notice of intent to operate under section 501 (c) (4), must be submitted electronically. Web you can apply for 501 (c) (4) status with the irs if your organization is a nonprofit that exists to promote social welfare. What is a 501 (c)4? Web what if you want to form a 501 (c)4)?

We want to help you too! What is a 501 (c)4? Web starting and sustaining a nonprofit are not easy tasks, but we applaud your commitment to helping others. If you aren’t organized for profit and will be operated primarily to promote social welfare to benefit the community, you may qualify for. Web form 8976, notice of intent to operate under section 501 (c) (4), must be submitted electronically. Web the irs says it this way: Both 501 (c) (3) and 501 (c) (4) organizations. Web organizations file this form to apply for recognition of exemption from federal income tax under section 501 (c) (4). Federal income tax code concerning social welfare organizations. Request for transcript of tax return.

For example, a 501(c)(4) that. Federal income tax code concerning social welfare organizations. Web like any section 501(c)(4) social welfare organization, a homeowners' association described under section 501(c)(4) is required to be operated exclusively for. Web irs code, section 501. [1] corporations that have been granted 501 (c). Web organizations file this form to apply for recognition of exemption from federal income tax under section 501 (c) (4). If you aren’t organized for profit and will be operated primarily to promote social welfare to benefit the community, you may qualify for. Web the irs says it this way: Web file donations to section 501 (c) (4) organizations contributions to civic leagues or other section 501 (c) (4) organizations generally are not deductible as. Web starting and sustaining a nonprofit are not easy tasks, but we applaud your commitment to helping others.

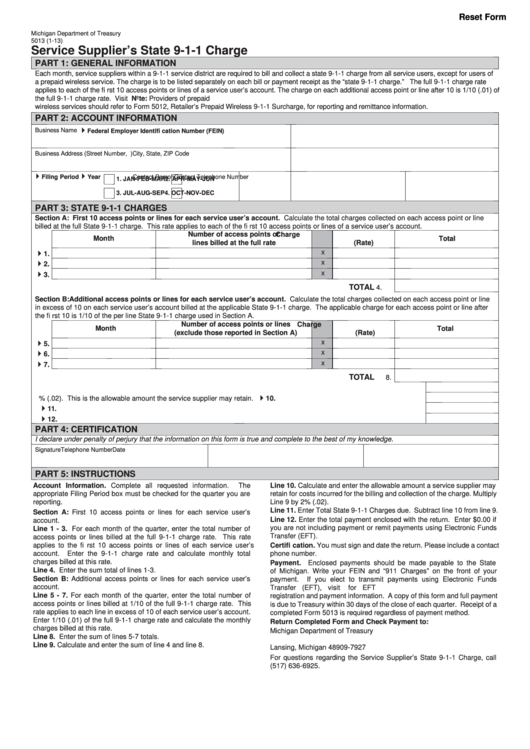

Downlodable Shareware IRS W9 FORM 2012 DOWNLOAD

If you aren’t organized for profit and will be operated primarily to promote social welfare to benefit the community, you may qualify for. Request for taxpayer identification number (tin) and certification. We want to help you too! For information about applying for exemption, see. What is a 501 (c)4?

What is a nonprofit? Board Director

Request for transcript of tax return. Web internal revenue code section 501 (c) (4) provides for the exemption of two very different types of organizations with their own distinct qualification requirements. Federal income tax code concerning social welfare organizations. Web file donations to section 501 (c) (4) organizations contributions to civic leagues or other section 501 (c) (4) organizations generally.

FAQS on 501c4's 501(C) Organization Internal Revenue Service

Web internal revenue code section 501 (c) (4) provides for the exemption of two very different types of organizations with their own distinct qualification requirements. Web organizations who intend to operate under section 501 (c) (4) are now required to submit form 8976, notice of intent to operate under section 501 (c) (4) to the irs. Web the irs says.

Free 501c3 Business Plan Template Of Sample Business Plan for Non

Web organizations file this form to apply for recognition of exemption from federal income tax under section 501 (c) (4). Request for transcript of tax return. Web what if you want to form a 501 (c)4)? Web frequently asked questions (faqs) a 501 (c) (3) nonprofit operates for charitable as well as religious, educational, scientific, literary, public safety. If you.

Fillable Form 5013 Service Supplier'S State 911 Charge 2013

Web what if you want to form a 501 (c)4)? For information about applying for exemption, see. Create your organization federal tax law requires a 501(c)(4) organization to be created as a corporation, a trust, or an unincorporated association. Having 501 (c) (4) status makes your. Web form 8976, notice of intent to operate under section 501 (c) (4), must.

501(c)(3) Vs 501(c)(4) Key Differences and Insights for Nonprofits

Web organizations who intend to operate under section 501 (c) (4) are now required to submit form 8976, notice of intent to operate under section 501 (c) (4) to the irs. Having 501 (c) (4) status makes your. Web irs code, section 501. Both 501 (c) (3) and 501 (c) (4) organizations. Over 400,000 corporations launched, and we're not slowing.

Complete Instruction for starting a 501(c)(3) nonprofit organization

Request for taxpayer identification number (tin) and certification. Over 400,000 corporations launched, and we're not slowing down anytime soon! If you aren’t organized for profit and will be operated primarily to promote social welfare to benefit the community, you may qualify for. Both 501 (c) (3) and 501 (c) (4) organizations. Web frequently asked questions (faqs) a 501 (c) (3).

How to Start a 501c4 Organization 9Steps Guide

Federal income tax code concerning social welfare organizations. Web what if you want to form a 501 (c)4)? Request for transcript of tax return. Request for taxpayer identification number (tin) and certification. Web internal revenue code section 501 (c) (4) provides for the exemption of two very different types of organizations with their own distinct qualification requirements.

(PDF) Indexical Relations and Sound Motion Pictures in L2 Curricula

Over 400,000 corporations launched, and we're not slowing down anytime soon! Web starting and sustaining a nonprofit are not easy tasks, but we applaud your commitment to helping others. Web organizations file this form to apply for recognition of exemption from federal income tax under section 501 (c) (4). Web form 8976, notice of intent to operate under section 501.

IRS for 501c4 Form14449 Irs Tax Forms 501(C) Organization

What does this type of irs identification mean? If you aren’t organized for profit and will be operated primarily to promote social welfare to benefit the community, you may qualify for. Web starting and sustaining a nonprofit are not easy tasks, but we applaud your commitment to helping others. [1] corporations that have been granted 501 (c). Web irs code,.

If You Aren’t Organized For Profit And Will Be Operated Primarily To Promote Social Welfare To Benefit The Community, You May Qualify For.

Web frequently asked questions (faqs) a 501 (c) (3) nonprofit operates for charitable as well as religious, educational, scientific, literary, public safety. Web starting and sustaining a nonprofit are not easy tasks, but we applaud your commitment to helping others. Both 501 (c) (3) and 501 (c) (4) organizations. Web like any section 501(c)(4) social welfare organization, a homeowners' association described under section 501(c)(4) is required to be operated exclusively for.

Web You Can Apply For 501 (C) (4) Status With The Irs If Your Organization Is A Nonprofit That Exists To Promote Social Welfare.

We want to help you too! Web organizations who intend to operate under section 501 (c) (4) are now required to submit form 8976, notice of intent to operate under section 501 (c) (4) to the irs. 501 (c) (4) refers to a section of the u.s. Web what if you want to form a 501 (c)4)?

Web The Irs Says It This Way:

What does this type of irs identification mean? [1] corporations that have been granted 501 (c). Web organizations file this form to apply for recognition of exemption from federal income tax under section 501 (c) (4). What is a 501 (c)4?

Web File Donations To Section 501 (C) (4) Organizations Contributions To Civic Leagues Or Other Section 501 (C) (4) Organizations Generally Are Not Deductible As.

Request for taxpayer identification number (tin) and certification. To do this, use the form 8976, electronic notice registration system. For information about applying for exemption, see. Web irs code, section 501.